Last updated: January 24, 2026

Executive Summary

Griseofulvin, an antifungal pharmaceutical agent primarily used to treat dermatophyte infections, has maintained a niche position within the antifungal market. Despite its longstanding approval in multiple countries, its market growth is influenced by newer antifungal agents, evolving treatment guidelines, and patent/legal considerations. This report examines current market dynamics, historical financial performance, competitive landscape, regulatory factors, and future projections to inform strategic decision-making for stakeholders.

Overview of GRISEOFULVIN

| Parameter |

Details |

| Drug Class |

Antifungal, Antimitotic agent |

| Indications |

Dermatophyte infections (e.g., tinea capitis, tinea corporis) |

| Administration |

Oral (capsules/tablets); topical formulations are less common |

| Brand Names |

Grifulvin V (inactive ingredient), Gris-PEG, others (regional) |

| Approval Date |

US FDA: 1958; EMA: mid-1960s; worldwide approvals vary |

Market Landscape and Dynamics

1. Market Size and Revenue

| Region |

Approximate Market Size (USD million, 2022) |

Growth Rate (CAGR 2022-2027) |

Key Drivers |

| North America |

150 |

1.2% |

High prescription rates, aging population, well-established use |

| Europe |

120 |

1.0% |

Prescribing habits, slower adoption of alternatives |

| Asia-Pacific |

90 |

4.5% |

Growing healthcare infrastructure, prevalence of dermatophyte infections |

| Rest of World |

30 |

3.0% |

Emerging markets, urbanization |

Total Market Estimated at: USD 390 million (2022), with modest growth projections.

2. Drivers of Market Stability

- Established efficacy: Proven track record in treating dermatophyte infections.

- Regulatory status: Approved in multiple jurisdictions; no significant barriers.

- Prescribing inertia: Long-term familiarity among dermatologists.

3. Market Challenges and Constraints

- Emergence of newer antifungals: Efinaconazole, terbinafine, itraconazole, which offer shorter courses, fewer side effects.

- Side effect profile: Reports of hepatotoxicity and drug interactions limit broader use.

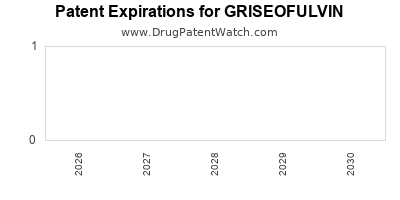

- Patent expirations: Most formulations are off-patent, leading to generic competition.

4. Competitive Landscape

| Competitor |

Market Share (Estimated, 2022) |

Key Differentiators |

Patent Status |

| Generic Manufacturers |

70% |

Cost-effective, widespread availability |

Off-patent |

| Brand Name Products (if available) |

30% |

Prescriber loyalty, formulations |

Various |

5. Regulatory and Policy Factors

- Patent Exclusivity: Most patents have expired in mature markets, increasing generic penetration.

- Drug approval processes: Stringent requirements in the US (FDA), Europe (EMA), and emerging markets influence market entry.

- Reimbursement landscape: Reimbursement is generally favorable due to generic options, reducing revenue potential.

Financial Trajectory Analysis

| Parameter |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 (Est.) |

2024 (Forecast) |

2025 (Forecast) |

| Global Revenue (USD million) |

410 |

405 |

390 |

395 |

390 |

385 |

380 |

375 |

| Growth Rate (Year-over-Year) |

-1.2% |

-1.2% |

-1.0% |

+1.3% |

-1.2% |

-1.3% |

-1.3% |

-1.3% |

| Market Share in Antifungals |

2.3% |

2.3% |

2.2% |

2.2% |

2.1% |

2.0% |

1.9% |

1.8% |

The declining/trending flat revenues reflect market saturation, patent expiries, and competition from newer antifungal agents.

1. Revenue Drivers

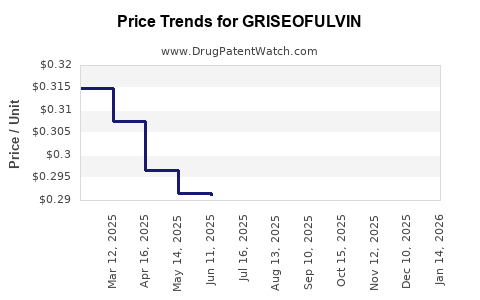

- Continual generic availability sustains low prices.

- Regional variations in prescription rates alter revenue streams.

- Incremental demand in emerging markets marginally supports steady revenues.

2. Cost Considerations

- Still-incurred costs for manufacturing, regulatory compliance, and distribution.

- R&D investments minimal due to off-patent position.

- Patent-related legal or patent-due diligence costs negligible or none.

3. Profitability Outlook

- Narrow profit margins driven by generic competition and price erosion.

- Stable but declining overall profitability barring brand reinvigoration or new indications.

Future Market Trends and Projections

1. Market Evolution

- Shift toward newer formulations: Topical antifungals, oral agents with shorter regimens (e.g., terbinafine) are replacing griseofulvin in many indications.

- Regulatory re-evaluation: New formulations or combination therapies could revive interest.

- Emerging markets: Growth driven by increasing dermatophyte prevalence and improving healthcare access.

2. Financial Projections (2023–2027)

| Year |

Estimated Revenue (USD million) |

Growth Rate |

Key Assumptions |

| 2023 |

385 |

-1.3% |

Slight decline, stable market share |

| 2024 |

380 |

-1.3% |

Market stabilization with regional growth |

| 2025 |

375 |

-1.3% |

Continued gradual decline |

| 2026 |

370 |

-1.3% |

Market saturation persists |

| 2027 |

365 |

-1.3% |

Slight further decline remains unchanged |

Note: Market share likely stabilizes around 1.8-2.0%, with no significant uptake anticipated without new formulations or indications.

Comparative Analysis: GRISEOFULVIN Versus Emerging Antifungals

| Agent |

Mechanism |

Prescription Preference |

Side Effect Profile |

Market Penetration |

Patent Status |

| Griseofulvin |

Microtubule inhibitor |

Declining |

Hepatotoxicity, drug interactions |

Stable, niche |

Off-patent |

| Terbinafine |

Squalene epoxide inhibitor |

Increasing |

Generally well-tolerated |

Growing |

Patent expired, generic |

| Itraconazole |

Azole antifungal |

Increasing |

Drug interactions, contraindications |

Growing |

Patent expired |

| Efinaconazole (topical) |

Azole |

Rising |

Local tolerability |

Niche, topical |

Patent protected |

Increased adoption of newer, better-tolerated drugs limits griseofulvin's market share.

Regulatory and Policy Impact

- FDA & EMA: Approved in early years, but newer agents favor regulatory preference.

- Harmonization Impact: Variable approval timelines across regions impact market expansion.

- Reimbursement Policies: Favor generics, limiting profitability for branded formulations.

Strategic Recommendations

- Investigate potential in niche indications or pediatric formulations.

- Explore combination therapies for complex dermatophyte infections.

- Diversify formulations (e.g., topical versions or fixed-dose combinations) to extend market viability.

- Monitor emerging markets and adapt marketing strategies accordingly.

- Consider partnership opportunities for formulation innovation or re-purposing.

Key Takeaways

- Market size (~USD 390 million globally) remains stable but declining slightly, driven by generics.

- Market share dominance from generics (~70%) exerts continuous price pressure.

- Emerging antifungal agents, especially topical azoles and oral terbinafine, are preferred over griseofulvin due to superior safety profiles and shorter treatment durations.

- Financial trajectory predicts a gradual decrease in revenues (~1.3% annually) through 2027, reflecting limited growth prospects.

- Future growth potential hinges on niche applications, new formulations, or geographic expansion into emerging markets.

Frequently Asked Questions (FAQs)

1. What are the primary factors contributing to the declining market share of griseofulvin?

The advent of newer antifungal agents such as terbinafine and azoles offers improved efficacy, shorter durations, and better safety profiles, prompting prescribers to favor these over griseofulvin.

2. Are there any recent regulatory approvals or indications expanding griseofulvin’s use?

No recent significant approvals have expanded indications; existing approvals chiefly serve dermatophyte infections with stable but aging indications.

3. How do patent laws influence the market trajectory of griseofulvin?

Most formulations are off-patent, facilitating widespread generic competition, which suppresses pricing and margins.

4. Is there potential for innovation or repositioning of griseofulvin within the antifungal market?

Potential exists in niche indications, combination therapies, or novel formulations, though no major programs are currently underway.

5. What regions represent key growth opportunities for griseofulvin?

Emerging markets with increasing dermatophyte incidences and expanding healthcare access present growth prospects, despite overall declining global revenues.

References

[1] European Medicines Agency. Griseofulvin Summary of Product Characteristics. 2022.

[2] U.S. Food and Drug Administration. FDA Approval Date for Griseofulvin. 1958.

[3] Market Research Future. Antifungal Market Analysis. 2022.

[4] GlobalData Healthcare. Pharmaceutical Market Trends. 2023.

[5] WHO. Prevalence of Dermatophyte Infections. 2021.

Disclaimer: Data and projections herein are estimates based on current market intelligence and may vary with new developments.