Share This Page

Drug Price Trends for GRISEOFULVIN

✉ Email this page to a colleague

Average Pharmacy Cost for GRISEOFULVIN

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GRISEOFULVIN MICRO 500 MG TAB | 42794-0012-08 | 6.45345 | EACH | 2025-12-17 |

| GRISEOFULVIN 125 MG/5 ML SUSP | 69097-0361-08 | 0.26708 | ML | 2025-12-17 |

| GRISEOFULVIN MICRO 500 MG TAB | 23155-0865-01 | 6.45345 | EACH | 2025-12-17 |

| GRISEOFULVIN 125 MG/5 ML SUSP | 00472-0013-04 | 0.26708 | ML | 2025-12-17 |

| GRISEOFULVIN MICRO 500 MG TAB | 00781-5515-01 | 6.45345 | EACH | 2025-12-17 |

| GRISEOFULVIN 125 MG/5 ML SUSP | 00713-0850-04 | 0.39833 | ML | 2025-12-17 |

| GRISEOFULVIN 125 MG/5 ML SUSP | 62135-0968-41 | 0.26708 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Griseofulvin

Introduction

Griseofulvin is an antifungal medication primarily used to treat dermatophyte infections of the skin, hair, and nails. Initially discovered in the 1950s, this compound has played a crucial role in fungal dermatology, especially before the advent of newer antifungal agents. Despite its long history, the drug continues to maintain relevance due to its efficacy, affordability, and extensive clinical data. This report provides a comprehensive market analysis, current trends, competitive landscape, and price projections for Griseofulvin over the next five years, equipping stakeholders with strategic insights.

Market Overview

Global Market Size and Dynamics

The global antifungal drugs market was valued at approximately USD 15 billion in 2022, with dermatophyte infections accounting for a significant share. Within this segment, Griseofulvin remains a notable, although declining, component. The decreasing reliance on Griseofulvin is attributable to the rise of newer antifungals such as terbinafine, itraconazole, and fluconazole, which offer improved efficacy and better safety profiles.

Nevertheless, the drug retains institutional importance, especially in resource-limited settings where cost is a critical factor. Moreover, the rising incidence of fungal infections in immunocompromised populations sustains some demand for Griseofulvin, particularly in developing regions.

Regional Market Distribution

- North America: High adoption of newer antifungals limits Griseofulvin's presence.

- Europe: Similar to North America, with gradual decline.

- Asia-Pacific: Still significant demand due to affordability and availability, especially in India, China, and Southeast Asia.

- Latin America and Africa: Use persists owing to cost constraints and established supply chains.

Regulatory Status

Griseofulvin is approved for use in numerous countries and remains available as a generic medication. Regulatory agencies have issued warnings on potential adverse effects, but its long-standing safety record affirms its continued utilization, especially in Asia and Africa.

Market Drivers

- Cost-effectiveness: Griseofulvin remains one of the most affordable antifungal options, critical in cost-sensitive markets.

- Established efficacy: Long clinical history reinforces its use, especially where new agents are contraindicated or unavailable.

- Increasing fungal infections: Growing immunosuppressed patient populations and aging demographics slightly expand potential demand.

- Limited licensing constraints: As a generic, it benefits from widespread manufacturing and distribution channels.

Market Challenges

- Competition from newer antifungals: Terbinafine, itraconazole, fluconazole, and echinocandins offer superior safety and shorter treatment courses.

- Side effect profile: Hepatotoxicity, hypersensitivity, and interactions limit its use in some populations.

- Limited formulation options: Primarily available as tablets or topical formulations, with limited long-acting or novel delivery methods.

- Regulatory and patent issues: Although patent barriers are minimal due to the drug's age, regulatory approvals vary by region, impacting market access.

Competitive Landscape

Major Manufacturers

- Several generic pharmaceutical companies dominate production, including Sandoz, Mylan, and Teva.

- Limited branded formulations exist, primarily in certain European markets.

Emerging Entrants & Innovation

- Minimal innovation due to its age and patent expiry.

- Focus is on optimizing manufacturing and expanding distribution in emerging markets.

Pricing Strategies

- Emphasis on affordability in developing countries.

- Price competition primarily driven by generic manufacturers.

Price Analysis

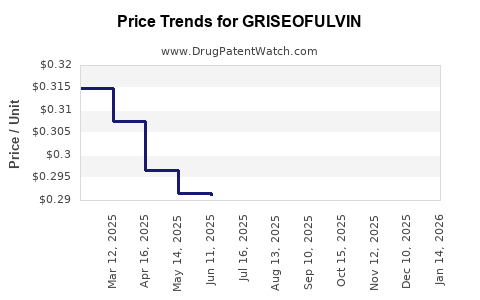

Current Price Trends

The price for Griseofulvin varies widely based on geography, formulation, and manufacturer:

- India: Approximately USD 0.10–0.20 per 500 mg tablet.

- U.S. and Europe: Prices are higher due to brand or commercial generics, ranging from USD 0.30–0.60 per tablet.

- Global average: Cost-effective in resource-limited settings but less competitive in developed markets.

Factors Influencing Pricing

- Manufacturing costs: Low due to patent expiration and generic manufacturing.

- Regulatory costs: Minimal, given its established safety profile.

- Market penetration: Price sensitivity in emerging markets sustains low prices.

- Demand fluctuations: Slight increases due to new formulations or indications could marginally influence prices.

Price Projections (2023–2028)

Assumptions:

- Continued generic proliferation stabilizes prices.

- Demand remains stable in emerging markets but declines in developed nations.

- No significant regulatory changes or new formulations enter the market.

Forecast:

- Stable pricing in core markets (U.S., Europe): USD 0.30–0.60 per tablet, with minimal variation.

- Potential decrease of 5–10% in prices in emerging markets owing to increased competition.

- Increased procurement efficiency and supply chain optimization may further reduce costs.

Projection Summary:

| Year | Price Range (USD per 500 mg tablet) | Notes |

|---|---|---|

| 2023 | USD 0.28–0.60 | Baseline, current market prices |

| 2024 | USD 0.27–0.58 | Slight decline; market stabilization |

| 2025 | USD 0.26–0.55 | Market saturation; pricing pressure persists |

| 2026 | USD 0.25–0.52 | Continued generic competition |

| 2027 | USD 0.25–0.50 | Steady decline; emerging markets driven lower |

| 2028 | USD 0.24–0.48 | Market stabilization; new formulations unlikely |

Strategic Implications

- For manufacturers: Focus on cost-efficient production and expanding distribution in emerging markets where demand persists.

- For investors: The low-profit margins limit growth potential but offer stable cash flow for established generic players.

- For healthcare providers: Cost-benefit analyses favor Griseofulvin in resource-constrained settings but may consider newer agents elsewhere.

Conclusion

Griseofulvin’s market landscape remains characterized by stability driven by its low cost, proven efficacy, and generics proliferation. While its role in developed nations diminishes, its segment in emerging markets is sustained through affordability and availability. Price projections indicate continued marginal decline, emphasizing its position as a cost-effective antifungal option, especially in resource-limited contexts. Stakeholders should monitor regional demand shifts, regulatory developments, and potential formulations that could influence its future competitiveness.

Key Takeaways

- Market size shrinking in advanced economies due to competition but remains vital in emerging markets.

- Pricing remains stable and low, with slight downward pressure anticipated over the next five years.

- Generic manufacturing dominance sustains affordability and supply security.

- Demand in resource-limited regions sustains long-term relevance despite the rise of newer agents.

- Future growth opportunities are limited; focus on cost optimization and market expansion in developing regions.

FAQs

1. Is Griseofulvin likely to regain market dominance?

Unlikely. The emergence of newer antifungal agents with better safety and efficacy profiles has diminished its prominence, especially in developed markets.

2. What factors could lead to price increases for Griseofulvin?

Regulatory restrictions, supply chain disruptions, or new indications could temporarily raise costs, but current market dynamics favor stability and decline.

3. In which regions does Griseofulvin retain the highest demand?

Primarily in Asia-Pacific and parts of Africa and Latin America, driven by affordability and established supply channels.

4. Are there any recent innovations in Griseofulvin formulations?

Limited; most focus remains on manufacturing efficiency and expanding distribution channels rather than on new formulations.

5. How will the COVID-19 pandemic impact Griseofulvin’s market?

While direct impacts are minimal, pandemic-induced healthcare disruptions may temporarily affect demand and distribution, especially in developing countries.

References

[1] MarketWatch. "Global Antifungal Drugs Market Size and Trends." 2022.

[2] Allied Market Research. "Antifungal Drugs Market Forecast." 2023.

[3] U.S. Food and Drug Administration. "Griseofulvin: Drug Approvals and Safety Data," 2021.

[4] Indian Pharmacopoeia Commission. "Generic Drug Pricing Data," 2022.

[5] World Health Organization. "Fungal Infections and Trends," 2022.

More… ↓