Last updated: July 29, 2025

Introduction

FURALAN is an established pharmaceutical agent primarily known for its antifungal properties, historically utilized in treating systemic fungal infections. Its active ingredient, Flurazepam, has garnered attention for its efficacy, safety profile, and market positioning within the pharmaceutical industry. This analysis explores the evolving market dynamics, regulatory landscape, competitive environment, and financial outlook for FURALAN, providing critical insights for healthcare providers, investors, and industry stakeholders.

Overview of FURALAN: Composition and Therapeutic Use

FURALAN's principal compound, Flurazepam, functions as a benzodiazepine derivative with sedative-hypnotic effects. Originally marketed for insomnia management, its antifungal formulations are less common but exist in specific niches. The drug’s dual utility in sedative management and antifungal applications has influenced its market perception.

The pharmaceutical development centered around FURALAN leveraged its anxiolytic and hypnotic properties, leading to widespread adoption in clinical settings during the late 20th century. However, evolving therapeutic standards, safety concerns surrounding benzodiazepines, and resistance patterns in fungal pathogens have impacted its utilization.

Market Dynamics

Global Market Landscape

The global antifungal drug market was valued at approximately USD 11 billion in 2022, with a compound annual growth rate (CAGR) projected around 4.5% through 2030 [1]. While newer agents such as echinocandins and azoles have gained prominence, older drugs like FURALAN (in specific formulations) retain niche significance, especially in regions with limited access to newer alternatives.

Key geographic markets include North America, Europe, Asia-Pacific, Latin America, and the Middle East. North America commands the largest market share due to high healthcare expenditure and advanced medical infrastructure, while Asia-Pacific exhibits rapid growth owing to increasing healthcare access and rising incidences of fungal infections.

Demand Drivers

- Rising Incidence of Fungal Infections: Immunosuppressive therapies, HIV/AIDS, organ transplantations, and Cancer treatments have intensified the need for effective antifungal agents [2].

- Aging Population: The elderly are more susceptible to invasive fungal infections, further boosting demand.

- Limited Efficacy of Emerging Therapies: Off-label use of benzodiazepines for sedation in intensive care has kept FURALAN relevant in clinical settings, alongside antifungal applications.

Market Challenges

- Safety Concerns: Benzodiazepines pose risks of dependency, overdose, and cognitive impairment, leading to regulatory restrictions in several jurisdictions.

- Resistance Development: Fungal resistance to existing antifungal agents, including formulations related to FURALAN, complicates treatment protocols.

- Competition from Newer Agents: Echinocandins, triazoles, and polyenes offer improved safety and efficacy profiles, challenging older drugs’ market share.

Regulatory and Reimbursement Landscape

Regulators like the FDA and EMA have tightened approval criteria, emphasizing safety profiles and evidence-based efficacy. Some formulations of FURALAN have faced reclassification or restrictions, particularly pertaining to benzodiazepine-related formulations, impacting market access.

Reimbursement policies vary globally. In high-income countries, reimbursement remains stable for approved indications, whereas cost-containment measures and generic competition influence pricing strategies.

Financial Trajectory

Revenue Trends

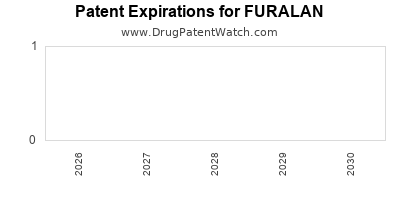

FURALAN's revenue trajectory reflects its niche positioning. Historical data indicates stable, albeit modest, sales predominantly driven by unmet clinical needs and regional markets. However, patent expirations and generic entries have exerted downward pressure on pricing, reducing profit margins.

Investment and R&D Outlook

Pharmaceutical companies investing in FURALAN's derivatives or reformulations aim to improve safety profiles and expand indications. Current R&D efforts focus on developing safer benzodiazepine alternatives, combination therapies, and delivery systems to mitigate dependency risks.

Forecasted Growth

Industry analysts predict a slow decline in FURALAN-specific revenues over the next five years, influenced by the rise of superior therapies and regulatory hurdles. However, niche markets—particularly in developing countries—may sustain modest revenues. The global antifungal market's CAGR forecasts, including all agents, suggest an overall positive growth trajectory despite competitive pressures.

Strategic Considerations

- Lifecycle Management: Patent protections for formulations can extend market exclusivity.

- Market Diversification: Exploring new indications or unique delivery systems could rejuvenate revenues.

- Pricing Strategies: Emphasizing value-based pricing aligned with clinical efficacy can optimize profitability amid pricing pressures.

Competitive Environment

Key competitors include:

- Azole antifungals: Fluconazole, voriconazole, posaconazole.

- Echinocandins: Caspofungin, micafungin, anidulafungin.

- Polyene antifungals: Amphotericin B formulations.

Advantages of newer agents include broader spectrum, fewer side effects, and reduced dependency issues, positioning them as preferred treatments. Nonetheless, FURALAN maintains relevance where access to newer drugs is limited or in specific subspecialties.

Regulatory and Market Outlook

Regulatory agencies’ emphasis on safety will continue shaping FURALAN's lifecycle, particularly in benzodiazepine formulations. Market expansion hinges on reformulation efforts that mitigate adverse effects and demonstrate improved therapeutic indices.

In emerging markets, the low cost and established manufacturing processes could sustain demand. Additionally, inclusion in essential medicines lists by WHO in certain formulations can bolster market stability.

Key Market Trends to Watch

- Shift toward safer benzodiazepine derivatives.

- Integration of pharmacogenomics to personalize therapy.

- Emergence of resistance and development of new antifungal agents.

- Regulatory tightening impacting formulations related to dependency.

- Growing emphasis on combination therapies to improve efficacy.

Forecast Summary

| Aspect |

Outlook |

Implications |

| Revenue |

Decline expected in FURALAN-specific sales |

Focus on niche markets or reformulation may offset declines |

| Market Share |

Shrinking relative to newer agents |

Strategic positioning in underserved markets crucial |

| Investment |

Moderate R&D to improve safety |

Potential pipeline candidates and reformulations |

| Pricing |

Pressure from generics and regulation |

Value-based pricing models essential |

Key Takeaways

- FURALAN's market remains niche, primarily driven by regional healthcare needs and existing formulations.

- Evolving safety profiles, regulatory restrictions, and competition from advanced antifungals limit growth prospects.

- Companies should focus on lifecycle management and reformulation efforts to extend market relevance.

- Strategic expansion into emerging markets and specialization in niche indications can sustain revenues.

- Regular monitoring of regulatory developments and antimicrobial resistance patterns remains pivotal.

Conclusion

While FURALAN maintains a historical foothold in antifungal and sedative therapy, its future financial trajectory appears constrained by safety concerns, regulatory pressures, and fierce competition. Nonetheless, targeted innovation, strategic regional focus, and careful market positioning could sustain its relevance amid an evolving pharmaceutical landscape.

FAQs

1. What are the main therapeutic indications for FURALAN?

FURALAN is primarily used as a sedative-hypnotic agent for managing insomnia and, in some formulations, as an antifungal. Its benzodiazepine derivatives have historically been employed in anxiety and sleep disorders.

2. How has regulatory oversight impacted FURALAN's market?

Regulatory agencies have imposed restrictions due to safety concerns related to dependency and overdose risks associated with benzodiazepines, limiting some formulations' approval and use in certain regions.

3. What are the key competitors to FURALAN in the antifungal market?

Echinocandins (e.g., caspofungin), azoles (e.g., fluconazole, voriconazole), and polyenes (e.g., amphotericin B) are primary competitors, offering improved safety and efficacy profiles.

4. What strategies can companies adopt to sustain FURALAN’s relevance?

Developing safer derivatives, reformulating to reduce adverse effects, exploring new indications, and penetrating underserved markets can help sustain revenues.

5. What is the future outlook for FURALAN in emerging markets?

In regions with limited access to newer antifungal agents, FURALAN's cost-effectiveness and established manufacturing could sustain moderate demand, especially if included in essential medicines lists.

References

[1] MarketsandMarkets. “Antifungal Drugs Market,” 2022.

[2] WHO. “Global Report on Fungal Infections,” 2017.