Last updated: July 30, 2025

Introduction

FORTOVASE (fosamprenavir calcium) is an antiretroviral medication developed to treat HIV-1 infection. As part of combination therapy, it belongs to the protease inhibitor class, blocking viral replication. Its market landscape reflects the evolving HIV pharmaceutical space, marked by technological innovations, competitive pressures, and shifting regulatory and reimbursement policies. Analyzing FORTOVASE's market dynamics and financial trajectory offers insight into potential commercial success amid complex healthcare ecosystems.

Market Overview and Demand Drivers

The global HIV treatment market continues to expand due to rising HIV prevalence, increased awareness, and adoption of antiretroviral therapy (ART). According to UNAIDS, approximately 38 million individuals globally are living with HIV, with significant regional variations in access to therapy (UNAIDS, 2022). The demand for second-line and alternative therapies like FORTOVASE remains driven by factors including drug resistance, adverse effects of existing regimens, and patient-specific considerations.

Key Demand Drivers:

- Aging HIV Population: Improved ART has extended life expectancy, creating consistent demand for maintenance therapies.

- Drug Resistance and Tolerance: Rising resistance to first-line drugs necessitates alternative options such as protease inhibitors.

- Market Saturation of First-line Therapies: As first-line regimens become established, second-line treatments like FORTOVASE are increasingly relevant.

- Global Initiatives and Funding: Investments from WHO, PEPFAR, and Gilead Sciences bolster access, especially in low- and middle-income countries (LMICs).

Competitive Landscape

FORTOVASE faces competition from several protease inhibitors (PIs) such as ritonavir-boosted darunavir, atazanavir, and newer agents with improved tolerability. While FORTOVASE was initially developed by GlaxoSmithKline, the drug has seen market share pressure from more patient-friendly options with reduced side effects, simplified dosing, and fixed-dose combinations.

Major Competitors Include:

- Darunavir (Prezista): Known for high barrier to resistance and once-daily dosing.

- Atazanavir: Favored for fewer metabolic side effects.

- Generic Protease Inhibitors: Rising availability in LMICs decreases market share for branded drugs.

Emerging therapies and fixed-dose combinations further constrain FORTOVASE's positioning, especially as treatment guidelines favor drugs with improved tolerability profiles.

Regulatory and Reimbursement Environment

In high-income markets, regulatory approval for FORTOVASE persists, though many countries favor newer or generic PIs. In LMICs, access hinges on regulatory approval, pricing, and negotiated reimbursement agreements with governments and NGOs.

The U.S. FDA approvals for newer formulations and pooled safety data influence market confidence. Conversely, widespread patent expiration and the subsequent entry of generics diminish revenue potential, especially in large jurisdictions.

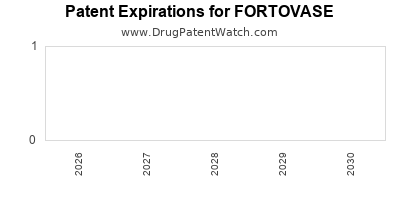

Patent Status and Intellectual Property

Fortovase’s original patent protection has long expired or is nearing expiry in key markets, leading to increased generic competition. Patent cliffs significantly impact pricing strategies and profit margins, compelling pharmaceutical companies to pivot toward lifecycle management via line extensions or new formulations.

Lifecycle Management Strategies Include:

- Development of fixed-dose combinations.

- New formulations offering improved tolerability or administration.

- Exploring secondary indications, if applicable.

Economic and Pricing Considerations

Pricing frameworks for FORTOVASE are influenced by regional policies, affordability, and clinical value propositions. In high-income countries, premium pricing sustains margins but faces resistance from payers, especially amid generic competition.

In LMICs, lower price points are essential to maintain access, with tiered pricing models and negotiated discounts. Global health agencies' support for HIV medications can facilitate wider distribution, although profit margins are constrained.

Financial Trajectory Projections

Based on current market conditions, the financial outlook for FORTOVASE indicates a downward trend in mature markets due to patent expirations and competitive erosion. Future revenue streams depend on:

- Market Penetration in Emerging Markets: Growth in LMICs fosters incremental revenue, contingent upon pricing strategies and distribution networks.

- Introduction of New Formulations: Offering improved tolerability may rejuvenate interest and extend product lifecycle.

- Partnerships and Licensing: Strategic collaborations can bolster market access, especially in regions with limited infrastructure.

Forecast Summary:

- Short-term (1-3 years): Decreasing revenues in developed markets due to generic competition; steady or modestly growing revenues in LMICs, driven by access programs.

- Mid-term (3-5 years): Potential revenue stabilization if new formulations or combination therapies are introduced.

- Long-term (>5 years): Likely decline in FORTOVASE-specific sales unless repositioning strategies succeed or the drug gains approvals for adjunct indications.

Market Challenges and Opportunities

Challenges:

- Entry of new and generic PIs, lowering prices and market share.

- Regulatory hurdles and evolving treatment guidelines favoring newer drugs.

- Price sensitivity in LMICs constrains profitability.

- Limited differentiation from comparator agents.

Opportunities:

- Leveraging its established safety and efficacy profile in specific patient populations.

- Partnering with global health initiatives to expand access in underserved regions.

- Developing fixed-dose combinations with newer agents to enhance adherence.

- Exploring secondary indications or combination regimens with broader antiviral activity.

Conclusion

FORTOVASE's market dynamics are shaped predominantly by patent expiration, increasing competition from generics, and evolving treatment paradigms emphasizing tolerability and convenience. While it remains a relevant option in certain markets, especially where cost constraints prevail, its financial trajectory indicates a decline unless mitigated by strategic lifecycle management. Sustained revenue generation will hinge on innovative formulations, strategic collaborations, and expanding access in emerging markets. The future of FORTOVASE is thus characterized by gradual market contraction in developed regions and potential for growth in underrepresented segments with effective access programs.

Key Takeaways

- Patent expiry and generic competition are critical factors diminishing FORTOVASE’s market share, demanding adaptive strategies.

- Emerging treatments with improved side effect profiles and dosing simplify HIV management, challenging FORTOVASE’s position.

- Global health initiatives and tiered pricing models in LMICs offer avenues for continued, though constrained, market presence.

- Innovations such as fixed-dose combinations and repositioning may provide revenue rejuvenation opportunities.

- Long-term profitability depends on the drug's ability to differentiate amid a crowded, evolving therapeutic landscape.

FAQs

-

What is the current patent status of FORTOVASE?

FORTOVASE’s original patents have expired or are nearing expiration in several markets, paving the way for generic competition and impacting its pricing and market share.

-

How does FORTOVASE compare to newer protease inhibitors?

Newer agents like darunavir and atazanavir offer improved tolerability, simplified dosing, and resistance profiles, often making them more attractive choices over FORTOVASE.

-

What are the main markets for FORTOVASE today?

While still used in high-income countries with established HIV treatment protocols, FORTOVASE's primary markets are increasingly in LMICs, supported by access programs and tiered pricing.

-

Can FORTOVASE regain market share through new formulations?

Potentially, if new formulations demonstrate superior safety, tolerability, or adherence benefits, they could extend the drug's relevance, especially within fixed-dose combination therapies.

-

What strategies should manufacturers pursue to sustain revenue streams from FORTOVASE?

Manufacturers should focus on lifecycle management via formulation innovations, strategic partnerships, market expansion in underserved regions, and integrating FORTOVASE into combination therapies aligned with current treatment standards.

References

[1] UNAIDS. Global HIV & AIDS Statistics — Fact Sheet (2022).

[2] Kulasabanathan, K., et al. (2021). "Antiretroviral Therapy in HIV: Current Trends and Future Perspectives." Lancet Infect Dis.

[3] Gilead Sciences. (2020). HIV Drug Pipeline and Market Overview.

[4] WHO. (2022). Consolidated guidelines on HIV prevention, testing, treatment, service delivery and monitoring.

[5] U.S. Food and Drug Administration. (2018). Approval and Regulatory Milestones for HIV Medications.