Last updated: July 31, 2025

Introduction

FML FORTE, an ophthalmic pharmacy product combining fluorometholone and nedocromil, is positioned within the therapeutic landscape for ocular inflammatory and allergic conditions. As a corticosteroid with anti-inflammatory properties paired with an anti-allergic agent, it targets a niche with robust clinical demand. This analysis explores the market dynamics influencing FML FORTE’s positioning, alongside its projected financial trajectory within the evolving pharmaceutical landscape.

Market Overview

The global ophthalmic drugs market stood at approximately USD 19.2 billion in 2022, with a compound annual growth rate (CAGR) of 4.8% from 2018 to 2022 [1]. The increasing prevalence of ocular allergies, infectious keratitis, and inflammatory diseases underpin sustained demand for targeted therapies. Products like FML FORTE address this need by offering potent anti-inflammatory and anti-allergic action, positioning it within a competitive but expanding sector.

Market Drivers

1. Rising Prevalence of Ocular Allergies and Inflammatory Disorders

The World Health Organization (WHO) estimates that allergic conjunctivitis affects up to 20% of the global population, driven by environmental changes, urbanization, and lifestyle factors [2]. The escalation in ocular inflammatory conditions correlates with rising demand for effective ophthalmic treatments, including FML FORTE.

2. Advancements in Ophthalmic Formulations

Enhanced delivery mechanisms, including preservative-free formulations and targeted dosing, improve patient adherence and treatment outcomes. FML FORTE benefits from such advancements, increasing its desirability among clinicians.

3. Growing Aging Population

Elderly patients are more susceptible to ocular inflammatory conditions, cataracts, and glaucoma. The aging demographic propels the need for potent anti-inflammatory solutions, including corticosteroid combinations like FML FORTE.

4. Increasing Healthcare Expenditure

Growing healthcare budgets, particularly in emerging economies, support broader access to ophthalmic pharmacotherapies, thus expanding the potential market.

Market Challenges

1. Competition

FML FORTE faces competition from generic corticosteroids, anti-allergic agents, and combination pharmaceuticals. Notable rivals include prednisolone acetate, dexamethasone, and other fluorometholone-based formulations with similar profiles.

2. Safety & Side Effect Profile

Corticosteroids carry risks such as increased intraocular pressure, glaucoma, and cataract formation. Regulatory agencies mandate careful labeling and monitoring, which could influence prescribing habits.

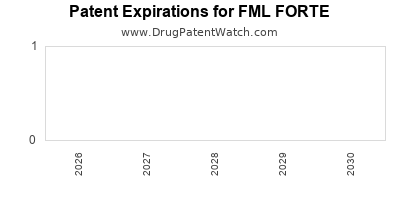

3. Patent and Regulatory Considerations

While the original formulations might be protected temporarily, patent expirations open the market to generics, exerting price pressures and affecting revenue streams.

Financial Trajectory Analysis

1. Revenue Forecasts

Based on current market penetration rates and rising prevalence, projections estimate that FML FORTE could achieve a compound annual growth rate (CAGR) of 6-8% over the next five years. This estimate considers increased adoption in developed markets and potential expansion into emerging markets where ophthalmic disease burden is rising.

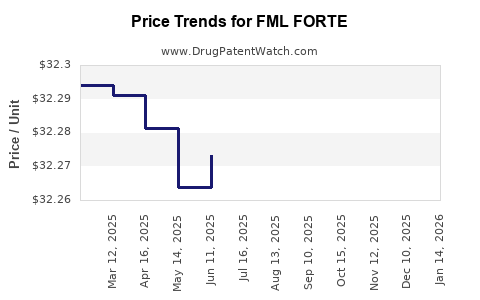

2. Pricing Strategy and Market Penetration

Premium formulations with higher safety profiles and novel delivery systems command higher pricing. Strategic alliances and licensing agreements could facilitate broader distribution, bolstering revenues.

3. Cost Structure and Profitability

Manufacturing costs remain relatively stable given the mature synthesis processes for corticosteroids. Margins could improve through scale, operational efficiencies, and patent protection extensions.

4. Market Expansion Opportunities

Entry into new geographical regions—particularly Asia-Pacific, Latin America, and the Middle East—could significantly bolster revenue streams. Additionally, positioning FML FORTE within combination therapy regimens enhances its clinical value proposition.

5. Regulatory and Reimbursement Landscape

Securing approval from authorities such as the FDA and EMA, alongside favorable reimbursement policies, will critically influence financial outcomes. An evident shift towards value-based care emphasizes clinical efficacy and safety profiles, which FML FORTE’s unique formulation could leverage.

Regulatory Status & Patent Outlook

FML FORTE's strategic value hinges on patent protection, which prevents generic competition and sustains premium pricing. The expiration timeline of primary patents will significantly influence revenue trajectories. Companies may seek patent extensions through formulation innovations or licensing arrangements.

Key Market Dynamics Summary

| Aspect |

Impact on FML FORTE |

| Disease prevalence |

Drives sustained demand |

| Competition |

Pressures pricing and market share |

| Regulatory environment |

Influences market entry and expansion |

| Innovation and formulation improvements |

Enhance competitiveness and adherence |

| Demographic trends |

Expand target patient base |

Conclusion and Outlook

FML FORTE is positioned to capitalize on the expanding ophthalmic drug market driven by increasing ocular disease prevalence, demographic shifts, and a focus on targeted, safe therapies. The product’s financial trajectory appears promising, provided it navigates patent landscapes, competitive pressures, and regulatory hurdles effectively. Strategic expansion and differentiation through formulation innovation will be critical in maintaining a competitive edge and realizing its revenue potential over the next five years.

Key Takeaways

- Market growth potential for FML FORTE hinges on rising prevalence and demographic shifts favoring ocular therapies, with projected CAGR of 6-8%.

- Competitive positioning remains crucial as generic corticosteroids threaten market share, emphasizing the importance of patent protection and formulation differentiation.

- Expanded geographical reach into emerging markets offers significant revenue opportunities amidst growing healthcare investments.

- Safety and efficacy profile serve as key factors influencing market acceptance and pricing strategies.

- Regulatory and reimbursement frameworks will critically shape FML FORTE’s financial trajectory, necessitating proactive engagement with health authorities.

FAQs

1. What are the primary therapeutic indications for FML FORTE?

FML FORTE is indicated for ocular inflammatory conditions such as allergic conjunctivitis, uveitis, and postoperative inflammation, benefiting from its corticosteroid and anti-allergic properties.

2. How does FML FORTE differentiate itself from other ophthalmic corticosteroids?

Its combination of fluorometholone—known for a favorable safety profile—and nedocromil provides targeted anti-inflammatory and anti-allergic effects, potentially reducing side effects associated with long-term corticosteroid use.

3. What factors could influence FML FORTE’s market share in the coming years?

Emerging generic competition, regulatory approvals, clinical adoption, safety perceptions, and pricing strategies will influence its market share.

4. Are there any recent regulatory developments affecting FML FORTE?

Regulatory bodies focus on safety profiles of corticosteroids; approvals depend on local safety data and efficacy. Patent expirations could reopen the market to generics, impacting exclusivity.

5. What strategies can pharmaceutical companies adopt to maximize FML FORTE’s financial performance?

Investing in clinical education, expanding geographical access, innovating formulations, securing robust patent protections, and engaging with reimbursement agencies are key strategies.

Sources

- Grand View Research, 2023. "Ophthalmic Drugs Market Size & Trends."

- WHO, 2019. "Allergic Conjunctivitis Prevalence Data."