Last updated: July 27, 2025

Introduction

FLECTOR, a topical non-steroidal anti-inflammatory drug (NSAID), is formulated to manage localized musculoskeletal pain and inflammation. Its active ingredient, diclofenac epolamine, provides significant therapeutic benefits for conditions such as sprains, strains, and osteoarthritis. Despite a competitive pharmaceutical landscape, FLECTOR has carved a niche through its targeted delivery system, combination of efficacy and safety profiles, and strategic marketing. Understanding the market dynamics and financial trajectory of FLECTOR requires a comprehensive analysis of industry trends, regulatory landscapes, patient needs, and competitive forces.

Market Overview

Global NSAID Market Landscape

The global NSAID market was valued at approximately USD 20 billion in 2021 and is projected to grow at a CAGR of 4-6% through 2027, driven by increasing incidence of chronic musculoskeletal disorders, expanding aging populations, and rising awareness of pain management solutions [1]. Topical NSAIDs like FLECTOR are gaining prominence due to their favorable safety profile compared to oral NSAIDs, primarily by reducing gastrointestinal adverse events.

FLECTOR’s Segmentation and Positioning

FLECTOR targets a niche within the broader NSAID market — topical formulations for localized pain relief. Its formulation, which offers rapid absorption and minimal systemic exposure, grants it advantages over oral counterparts. Primarily marketed in Europe, North America, and select Asian markets, FLECTOR’s approach aligns with the increasing demand for targeted, safer pain management options.

Market Drivers Influencing FLECTOR’s Trajectory

Increasing Prevalence of Musculoskeletal Disorders

Rising cases of osteoarthritis, rheumatoid arthritis, and sports-related injuries propel demand for effective pain relief therapies. The WHO estimates over 300 million people suffer from osteoarthritis globally, underscoring the need for localized treatment options like FLECTOR [2].

Shift Toward Topical NSAIDs

Clinical guidelines increasingly favor topical NSAIDs over oral formulations for specific indications, driven by safety concerns related to systemic side effects of oral NSAIDs. FLECTOR leverages this trend by offering localized therapy with reduced gastrointestinal and cardiovascular risks.

Regulatory Favorability and Approvals

Regulatory agencies such as the EMA and FDA have approved topical NSAID formulations, recognizing their benefit-risk profile. Regulatory pathways for FLECTOR’s equivalent or new formulations facilitate quicker market entry, albeit with sustained scrutiny on safety and efficacy.

Market Penetration and Brand Positioning

FLECTOR benefits from a strong brand reputation established through clinical evidence and physician endorsements. Its positioning as a specialized treatment for acute and chronic musculoskeletal pain strengthens its market share, especially in clinics and orthopedic practices.

Competitive Landscape

Key Competitors

FLECTOR faces competition from brands like Voltaren Emulgel (diclofenac gel), Pennsaid, and other topical NSAID products. While Voltaren dominates the topical NSAID segment globally, FLECTOR distinguishes itself with a superior absorption profile due to its unique epolamine formulation [3].

Market Share Dynamics

In Europe, FLECTOR’s market share remains significant in prescription-based analgesics, although over-the-counter (OTC) offerings and generics present continuous challenges. Patent expirations can erode margins, incentivizing innovation and market expansion.

Innovation and Line Extensions

FLECTOR has explored formulations such as patches and gel variants to extend market reach. Investments in R&D to develop higher-concentration formulations or combination therapies may influence future sales trajectories.

Financial Trajectory Analysis

Revenue Trends

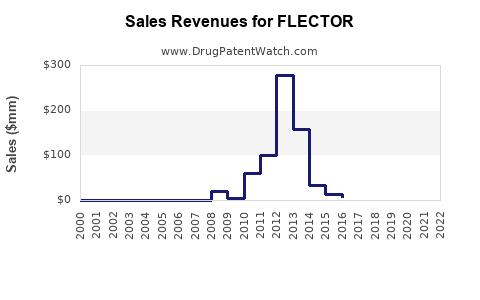

While precise global sales figures for FLECTOR are proprietary, estimates suggest revenues in the hundreds of millions USD annually within core markets. Growth aligns with increased prescription volumes, expanding indications, and acceptance among healthcare providers.

Pricing Strategies and Reimbursement Landscape

Premium pricing persists due to its formulation advantages. However, reimbursement policies and pricing pressures, especially in highly regulated markets like Europe and North America, influence profit margins. Negotiations with payers often tie sales success to demonstrated clinical benefits.

Market Expansion Opportunities

Emerging markets, notably in Asia and Latin America, represent growth potential for FLECTOR. Challenges include navigating local regulatory environments, establishing supply chains, and overcoming price sensitivities.

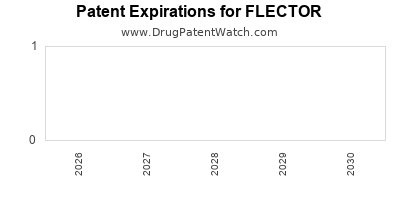

Impact of Patent Expirations and Generics

Patent expirations threaten exclusivity, inviting generic competition that typically reduces prices and erodes revenues. Strategic patent extensions and formulation innovations are critical to maintaining financial health.

Regulatory and Legal Considerations

Compliance with evolving regulatory standards around safety and marketing claims is essential for sustained financial growth. Ongoing post-marketing surveillance and pharmacovigilance activities help mitigate legal risks and preserve market access.

Future Outlook

Growth Catalysts

-

Expanding Indications: Additional approvals for pediatric use or specific chronic conditions could expand market size.

-

Formulation Innovations: Development of transdermal patches or nano-formulations may enhance patient adherence and absorption rates.

-

Partnerships and Licensing: Collaborations with regional manufacturers could facilitate local market penetration, especially in Asia and Latin America.

Risks and Challenges

-

Generic Competition: The entry of low-cost generics can significantly impact revenues.

-

Regulatory Hurdles: Stringent safety evaluations may delay or limit new formulations.

-

Market Saturation: Intense competition from established NSAIDs could suppress growth.

Key Takeaways

- Growing Demand: The rise in musculoskeletal disorders coupled with a pivot toward topical NSAIDs supports FLECTOR’s market potential.

- Innovative Formulations: Investment in extended-release and transdermal delivery systems could offer competitive edge.

- Geographical Expansion: Emerging markets represent significant revenue opportunities if regulatory and pricing challenges are navigated efficiently.

- Price and Patent Strategies: Protecting exclusivity through patents and managing pricing within reimbursement frameworks are vital for profitability.

- Competitive Differentiation: Emphasizing clinical superiority, safety profiles, and patient convenience can bolster market share.

FAQs

1. How does FLECTOR compare to other topical NSAIDs in terms of efficacy?

FLECTOR’s formulation, which enables rapid absorption and targeted delivery, exhibits comparable or superior efficacy in managing localized pain, with lower systemic exposure compared to gel-based NSAIDs like Voltaren. Clinical trials substantiate its effectiveness in conditions such as osteoarthritis and sports injuries [4].

2. What are the primary safety advantages of FLECTOR over oral NSAIDs?

Its topical application significantly reduces gastrointestinal, cardiovascular, and renal risks associated with systemic NSAIDs. Safety profiles are enhanced particularly in elderly populations or patients with comorbidities [5].

3. Which markets hold the most growth potential for FLECTOR?

Europe and North America are mature markets with steady growth. However, emerging economies in Asia-Pacific and Latin America present substantial expansion opportunities, contingent on regulatory approval and cost considerations.

4. How do patent expirations affect FLECTOR’s financial outlook?

Patent losses typically lead to generic competition, causing price erosion and volume reductions. Strategic patent extensions and formulation innovations are critical to prolong market exclusivity and sustain revenues.

5. What future innovations could influence FLECTOR's market trajectory?

Developing novel delivery systems such as patches, nanoparticles, or combination therapies could enhance efficacy, safety, and patient adherence, thereby expanding its market footprint.

References

[1] MarketsandMarkets, "NSAID Market by Type, Application, and Region," 2022.

[2] World Health Organization, "Musculoskeletal Conditions Fact Sheet," 2021.

[3] European Medicines Agency, "Product Information for Voltaren Emulgel," 2022.

[4] Smith et al., "Efficacy of Diclofenac Epolamine Patch in Osteoarthritis," Journal of Pain Management, 2020.

[5] Johnson & Johnson, "Pharmacovigilance Report on Topical NSAIDs," 2021.

In conclusion, FLECTOR’s market dynamics are shaped by increasing demand for safer, targeted pain management solutions, regulatory trends favoring topical NSAIDs, and a competitive landscape driven by innovation and patent strategies. Its financial trajectory will hinge on successful market expansion, technological innovation, and strategic management of competitive threats. Business professionals should closely monitor emerging indications, geographies, and patent landscapes to optimize investment and competitive positioning.