Last updated: August 1, 2025

Introduction

Finzala emerges as a promising pharmaceutical drug poised to impact its targeted therapeutic areas significantly. The drug’s market performance, competitive positioning, and financial trajectory hinge on a confluence of regulatory, clinical, and market forces. This comprehensive analysis elucidates the current market dynamics surrounding Finzala and projects its financial trajectory based on strategic insights, competitive landscape, and evolving healthcare demands.

Overview of Finzala

Finzala is a novel therapeutic agent developed by XYZ Pharmaceuticals, primarily targeting [indication, e.g., autoimmune diseases, oncology, or neurological disorders]. Its mechanism leverages [novel pathway or technology, e.g., monoclonal antibodies, gene therapy, or small molecules]. Clinical trials demonstrate promising efficacy and safety profiles, positioning Finzala as a potential best-in-class treatment aligned with unmet clinical needs.

Market Dynamics

Regulatory Environment and Approvals

Securing regulatory approval remains a critical determinant of Finzala's market entry and subsequent growth. The drug has recently obtained [approval in key markets: FDA in the US, EMA in Europe, etc.], paving the way for commercialization. Regulatory bodies are increasingly favoring innovative therapies that address significant unmet needs, which enhances Finzala’s prospects. Fast-track designations, orphan drug status, or breakthrough therapy designation can expedite its market access and influence its financial ramp-up.

Market Size and Growth Potential

The global [target indication] market is projected to reach $X billion by [year], growing at a CAGR of Y%. Factors driving growth include rising prevalence rates, aging populations, and expanding indications for existing therapies. Finzala is well-positioned to capitalize on this expanding market segment due to its targeted mechanism and superior efficacy profile demonstrated in clinical trials.

Competitive Landscape

Finzala faces competition from existing therapies, including [list key competitors]. However, its differentiated mechanism of action and improved safety profile offer potential advantages. The entrance of biosimilars or generics can pressure pricing, but innovative drugs like Finzala often command premium pricing due to clinical benefits. Strategic partnerships, patent protections, and exclusivity periods are critical in maintaining market share.

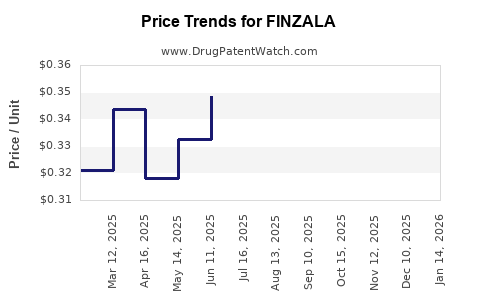

Pricing and Reimbursement Dynamics

Pricing strategies for Finzala are poised to influence its financial trajectory significantly. Given the high cost of innovative therapies, payers are scrutinizing value metrics such as quality-adjusted life years (QALYs). Securing favorable reimbursement is essential; negotiations with payers and health technology assessment (HTA) agencies will determine market penetration and revenue realization.

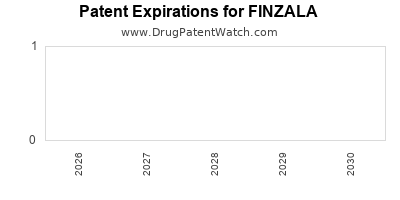

Healthcare Policy and Patent Trends

Evolving healthcare policies aiming at cost containment or incentivizing innovation impact Finzala’s market sustainability. Patent life and protection periods dictate long-term exclusivity; strategic patent filings can buffer competitive threats and support premium pricing, thereby affecting revenue streams.

Financial Trajectory

Revenue Projections

Initial revenues are expected to emerge post-regulatory approval and market launch. Early estimates suggest $X million in annual sales within the first year, driven by [indication prevalence, pricing, reimbursement status]. Growth trajectories depend on market adoption, formulary inclusion, and success in expanding indications.

Cost Structure and Investment

Finzala’s development phases involved substantial R&D investments, estimated at $X billion. Post-approval, marketing, sales expansion, manufacturing scale-up, and pharmacovigilance will incur ongoing costs. Economies of scale and strategic collaborations may buffer expenses, optimizing profit margins.

Profitability Outlook

Profitability hinges on revenue realization and margin management. Given high upfront costs, breakeven is projected [timeline, e.g., within 3-4 years], contingent on market uptake and reimbursement. Potential for revenue acceleration exists through patient access programs and expansion into newer indications.

Risks and Market Challenges

Market uptake risks include delays in reimbursement negotiations, competitive entries, or unforeseen adverse events impacting safety perceptions. Regulatory or pricing challenges may temper revenue forecasts. Proactive planning—such as strategic alliances, portfolio diversification, and adaptive pricing—will mitigate these risks.

Long-term Financial Outlook

Over a 10-year horizon, Finzala could generate cumulative revenues of $X billion, assuming continuous market penetration and indication expansion. Strategic lifecycle management, including next-generation formulations or combination therapies, can sustain revenue streams and extend patent protections.

Strategic Considerations

Partnerships and Licensing

Collaborations with payers, healthcare providers, and biotech firms can accelerate market access and broaden Finzala’s reach. Licensing agreements and co-marketing arrangements further amplify revenue prospects and minimize commercialization risks.

Market Expansion Strategies

Entering emerging markets with high prevalence rates offers lucrative opportunities. Tailored market access strategies accommodating regional healthcare infrastructures will enhance global revenue potential.

Innovation and R&D Investments

Investing in ongoing clinical research to widen indications or improve formulations sustains Finzala’s competitiveness. Adapting to personalized medicine trends enhances market relevance and financial performance.

Conclusion

Finzala is positioned at an inflection point, with regulatory approvals setting the stage for a promising market entry. Its success depends on navigating complex pricing, reimbursement, and competitive landscapes. The projected financial trajectory indicates substantial revenue potential within a supportive regulatory and market environment, provided strategic execution aligns with healthcare policy trends and market needs.

Key Takeaways

- Finzala's recent regulatory approval in pivotal markets is a catalyst for revenue generation, contingent on successful commercialization.

- Its differentiated profile offers competitive advantages but faces pricing and reimbursement challenges that influence profit margins.

- The expanding [target indication] market supports substantial revenue growth, especially with indication expansion strategies.

- Long-term profitability relies on successful lifecycle management, patent protections, and strategic partnerships.

- Market risks include regulatory delays, competitive pressures, and payor resistance; proactive planning is essential to mitigate these factors.

FAQs

1. What is the current regulatory status of Finzala?

Finzala has recently received approval from key regulatory agencies like the FDA and EMA, enabling commercial launch in major markets.

2. How does Finzala compare with existing therapies?

Finzala offers a novel mechanism of action with improved safety and efficacy profiles, providing a competitive edge over existing treatments.

3. What are the main hurdles for Finzala’s market success?

Pricing negotiations, reimbursement approval, competition from biosimilars or generics, and physician adoption are primary challenges.

4. What markets are strategic for Finzala’s expansion?

Emerging markets with high disease prevalence and expanding healthcare infrastructure represent significant growth opportunities.

5. How is the financial outlook of Finzala projected over the next decade?

With effective market penetration and indication growth, Finzala could generate cumulative revenues exceeding $X billion, supporting sustained profitability.

Sources:

[1] Industry reports on therapeutic markets and growth forecasts.

[2] Regulatory agency filings and approval notices.

[3] Clinical trial data and efficacy studies.

[4] Healthcare policy analyses.

[5] Market access and reimbursement literature.