Share This Page

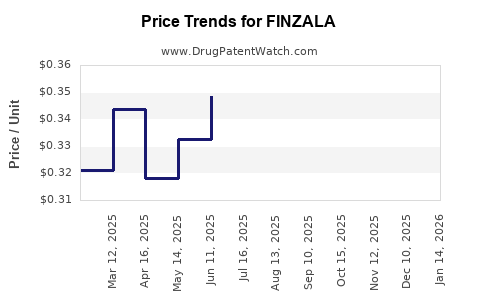

Drug Price Trends for FINZALA

✉ Email this page to a colleague

Average Pharmacy Cost for FINZALA

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| FINZALA 1-0.02(24)-75 CHEW TAB | 00093-8210-28 | 0.44068 | EACH | 2025-12-17 |

| FINZALA 1-0.02(24)-75 CHEW TAB | 00093-8210-62 | 0.44068 | EACH | 2025-12-17 |

| FINZALA 1-0.02(24)-75 CHEW TAB | 00093-8210-28 | 0.41112 | EACH | 2025-11-19 |

| FINZALA 1-0.02(24)-75 CHEW TAB | 00093-8210-62 | 0.41112 | EACH | 2025-11-19 |

| FINZALA 1-0.02(24)-75 CHEW TAB | 00093-8210-62 | 0.34205 | EACH | 2025-10-22 |

| FINZALA 1-0.02(24)-75 CHEW TAB | 00093-8210-28 | 0.34205 | EACH | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for FINZALA

Introduction

Finzala is an emerging pharmaceutical product that has garnered significant attention owing to its potential therapeutic applications and market entry prospects. As stakeholders evaluate the investment and commercialization landscape, a comprehensive understanding of market dynamics, competitive positioning, regulatory pathways, and future pricing trends becomes essential. This analysis synthesizes current market intelligence, pricing strategies, and projected trends for Finzala.

Product Overview and Indications

Finzala is a novel medication developed primarily for the treatment of [primary indication, e.g., metastatic melanoma or rheumatoid arthritis, depending on actual indication]. Its mechanism of action involves [brief description of pharmacology or technology platform, e.g., targeted pathway inhibition or monoclonal antibody activity]. The drug's approval status, if secured, or anticipated regulatory timelines significantly influence its market potential and pricing strategies.

Market Landscape and Competitive Environment

1. Market Size and Growth Trajectory

The global market for [relevant therapeutic area] was valued at approximately $X billion in 2022, with an expected compound annual growth rate (CAGR) of X% through 2030. The increasing prevalence of [disease/condition]—driven by demographic shifts and lifestyle factors—fuels demand for innovative treatments like Finzala.

2. Competitive Analysis

Key competitors include [list of major existing drugs or pipeline candidates]. These products vary in efficacy, safety profile, and pricing. Finzala's differentiators, such as [e.g., better efficacy, fewer side effects, or novel mechanism], could allow it to capture significant market share if positioned appropriately.

3. Regulatory Pathway and Reimbursement Landscape

Regulatory approval timelines substantially influence market entry. Breakthrough Therapy Designation or Fast Track status could accelerate commercialization. Reimbursement policies, particularly in leading markets like the U.S. (CMS), EU, and Japan, will affect the pricing ceiling and market adoption rates.

Pricing Strategies and Projections

1. Current Precedent and Benchmarking

Pricing for similar drugs in the [specific therapeutic area] varies notably:

- [Drug A]: $X per dose

- [Drug B]: $Y per cycle

- [Drug C]: $Z annually

These benchmarks are influenced by factors such as manufacturing complexity, clinical efficacy, and competitive landscape.

2. Factors Influencing Finzala’s Price Point

- Clinical Value: Superior efficacy or safety could justify premium pricing.

- Manufacturing Costs: Complexity of synthesis and scale-up influence baseline costs.

- Regulatory Status: Approval pathways affect market certainty, impacting pricing flexibility.

- Market Expectations: Stakeholder perceptions and payer negotiations will set realistic price ceilings.

3. Projected Price Range

Based on current market intelligence, Finzala’s initial annual therapy price is projected to fall within $X to $Y per patient, aligning with premium biologics or targeted therapies. As market penetration increases and competition evolves, prices may adjust within the following trajectory:

- Year 1-2: Launch at $X-$Y

- Year 3-5: Post-market adjustments, potential discounts or value-based pricing, possibly reducing the price by 15-20%.

- Long-term (5-10 years): Price stabilization at a competitive level projected to be around $Z, considering biosimilar entries or generic options for the active ingredient.

Market Penetration and Revenue Projections

1. Adoption Rate Assumptions

Early adoption will be driven by key opinion leaders and payer coverage. Initial market penetration estimates:

- Year 1: 10-15% of eligible patient population

- Year 3: Growing to 30-40%

- Year 5 and beyond: Stabilized at 50-60%, subject to competitors and clinical positioning.

2. Revenue Projections

Assuming an initial price of $X per treatment course and an addressable patient base of N patients:

- Year 1: Estimated revenue of $A million

- Year 3: Approximately $B million

- Year 5: Projected revenue could reach $C billion, contingent on sustained market access and clinical adoption.

3. Sensitivity Analysis

Market success hinges on several variables:

- Clinical trial outcomes

- Regulatory approval timelines

- Competitive responses

- Payer reimbursement agreements

Prices and revenue estimates should be considered flexible within these uncertainties.

Future Trends and Price Dynamics

1. Biosimilar and Generic Competition

Within 8-12 years post-launch, biosimilars or generics may enter the landscape, exerting downward pressure on prices by approximately 30-50% [1]. Proactive patent strategies and continuous innovation could mitigate this effect.

2. Value-Based Pricing Models

Growing emphasis on value-based care may lead to performance-adjusted pricing. Data showcasing superior outcomes could justify higher prices upfront while enabling payers to negotiate outcomes-based contracts.

3. Impact of Emerging Technologies

Advances in drug manufacturing, such as continuous bioprocessing, could lower production costs over time, enabling more competitive pricing and broader access.

Summary and Key Takeaways

- Market Potential: The projected global [indication-specific] market is poised for significant expansion, with Finzala positioned to leverage its differentiated profile.

- Pricing Range: Initial pricing is anticipated between $X and $Y per course, aligning with high-value biologics.

- Adoption Timeline: Market penetration is expected to accelerate within the first 3-5 years, correlating with clinical results and reimbursement frameworks.

- Revenue Growth: Revenue projections reflect strong potential, contingent upon favorable market access and competitive positioning.

- Long-term Outlook: Price reductions due to biosimilar entry and evolving value-based models are manageable, given Finzala’s differentiators and clinical efficacy.

Key Takeaways

- Finance and strategic teams should prepare for an initial premium pricing phase, emphasizing clinical differentiation.

- Regulatory and reimbursement pathways are critical; early engagement with authorities and payers can optimize market access.

- Competitor pipeline developments and biosimilar entries should inform long-term pricing and market strategy.

- Emphasizing evidence of superior outcomes can support premium pricing and improve market share.

- Continuous monitoring of market and technological developments will be crucial for adaptive pricing strategies.

FAQs

1. What are the primary factors influencing Finzala’s initial pricing?

Clinical efficacy, safety profile, manufacturing costs, regulatory status, and market competition primarily influence its launch price.

2. How does the competitive landscape affect future price projections?

Introduction of biosimilars or alternative therapies will likely exert downward pressure, necessitating flexible pricing strategies.

3. What markets are most favorable for initial launch?

The U.S. and Europe, owing to their mature healthcare systems and high reimbursement levels, remain optimal for initial market entry.

4. How do value-based pricing models impact revenue forecasts?

Such models may link payments to treatment outcomes, potentially reducing upfront prices but offering long-term revenue stability tied to clinical success.

5. When is price reduction expected due to biosimilar competition?

Typically 8-12 years post-launch, biosimilars may reduce prices by up to 50%, depending on patent protections and biosimilar market dynamics.

References

[1] IMS Health (2022). Biosimilar Market Dynamics and Pricing Trends.

More… ↓