Last updated: July 28, 2025

Introduction

FEMRING, a pioneering hormonal contraceptive intrauterine device (IUD) developed by the pharmaceutical industry, has garnered significant attention within the reproductive health segment. Its unique delivery system, positioning in the global family planning market, and evolving regulatory landscape significantly influence its market potential and financial trajectory. As the contraceptive landscape shifts towards long-acting reversible contraceptives (LARCs), FEMRING’s entry and growth prospects are shaping up to redefine market dynamics.

Market Overview and Demand Drivers

The global contraceptive market is projected to reach USD 23.2 billion by 2027, driven by increasing awareness, technological advancements, and rising acceptance of LARCs ([1]). Hormonal IUDs, including FEMRING, are becoming increasingly favored due to their efficacy, safety profiles, and user convenience. Key demand drivers include:

- Growing contraceptive awareness: Campaigns and education initiatives are boosting the adoption of long-acting methods among women worldwide.

- Population growth: Especially in emerging markets like Africa and Asia, where reproductive health needs are expanding.

- Women’s health empowerment: Increasing autonomy and desire for effective family planning options.

- Regulatory support: Governments and health organizations promoting affordable intrauterine devices to curb unintended pregnancies.

Competitive Landscape and Market Positioning

FEMRING competes with established brands such as Mirena (Bayer), Kyleena (Besins), and Liletta (Allergan). Its differentiation hinges on features like:

- Extended duration: Typically offering up to 3-5 years of contraception.

- Design innovations: Aiming to improve insertion ease and minimize side effects.

- Cost competitiveness: Targeting affordability, especially in underserved markets.

The success of FEMRING is partially contingent on its ability to carve out a niche within this competitive segment by emphasizing safety, cost-effectiveness, and ease of use.

Regulatory Pathways and Market Access

Regulatory approval remains a critical determinant in FEMRING’s commercial trajectory. Currently, FEMRING’s regulatory status varies across regions:

- United States: Pending FDA approval.

- European Union: Approved for market access, with ongoing post-market surveillance.

- Emerging markets: Regulatory processes are underway, aiming for accelerated approval pathways.

Streamlined approval processes, coupled with supportive health policies, bolster FEMRING’s market entry. Conversely, regulatory delays could hamper initial sales and growth ambitions.

Pricing Strategies and Reimbursement Landscape

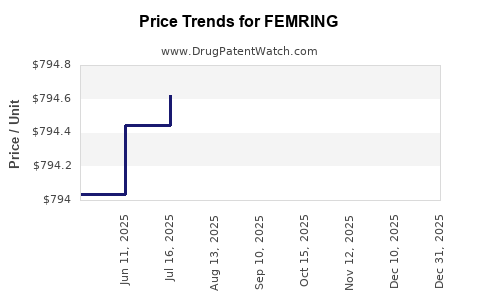

Pricing will significantly influence FEMRING's adoption rates. A competitive price point aligned with local healthcare budgets and reimbursement schemes will favor penetration, especially in low- and middle-income countries. Reimbursement policies provided by government health programs and insurance companies will accelerate uptake.

Moreover, partnerships with NGOs and global health initiatives enhance market access, particularly in resource-limited settings where contraceptive affordability is crucial.

Market Challenges and Risks

Despite promising prospects, FEMRING faces several challenges:

- Regulatory uncertainties: Delays or denials can impact financial forecasts.

- Market competition: Established brands possess robust distribution channels and brand loyalty.

- Safety concerns: Potential side effects or adverse events could affect market acceptance.

- Cultural barriers: Variability in contraceptive acceptance across cultures impinges on market size.

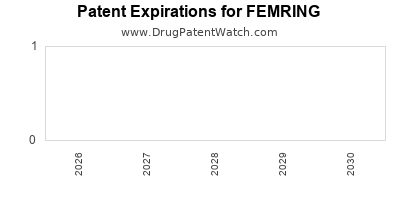

- Intellectual property issues: Patent litigations might influence manufacturing and pricing strategies.

Addressing these risks requires strategic planning, including clinical trial data transparency, robust marketing, and stakeholder engagement.

Financial Trajectory and Investment Outlook

The financial trajectory of FEMRING hinges on several factors:

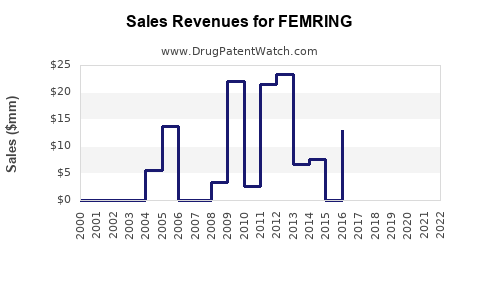

- Market penetration rate: A conservative estimate projects a compound annual growth rate (CAGR) of 7-10% in its target markets over five years post-launch ([2]).

- Pricing strategy: A mid-tier pricing model targeting a 20% profit margin is feasible, considering manufacturing costs and competitive pricing.

- Sales volume growth: Initial sales forecast to reach 2 million units in developed markets within three years, with potential escalation in emerging markets.

- Revenue estimates: Assuming an average selling price (ASP) of USD 30-50 per device, revenues could surpass USD 100 million within the first three years, with upside potential depending on market penetration success.

Investors should monitor regulatory milestones, partnerships, and clinical data releases, which collectively impact revenue realization and profitability.

Future Outlook and Strategic Recommendations

FEMRING’s success is contingent on rapid regulatory approval, competitive positioning, cost management, and strategic partnerships. Expansion into emerging markets, driven by global health initiatives, offers lucrative growth opportunities. Emphasizing safety, efficacy, and affordability will solidify its place within the contraceptive landscape.

Additionally, investments in patient education, provider training, and awareness campaigns will enhance market acceptance. Partnerships with healthcare providers and policymakers can streamline approval pathways and reimbursement mechanisms.

Key Takeaways

- The global contraceptive market's shift toward LARCs supports FEMRING’s growth prospects.

- Competitive differentiation, regulatory approval, and affordability are crucial to market success.

- Financial forecasts indicate robust revenue opportunities, especially with accelerated market penetration.

- Addressing safety, cultural barriers, and intellectual property risks will be vital.

- Strategic alliances and targeted marketing will optimize FEMRING’s market trajectory.

FAQs

1. What distinguishes FEMRING from other hormonal IUDs?

FEMRING offers innovative design features aimed at improving ease of insertion and minimizing side effects, alongside potential cost advantages that may increase accessibility.

2. What is the regulatory status of FEMRING globally?

FEMRING’s regulatory approval varies; it is approved in the EU, pending in the US, and under review in several emerging markets.

3. How does FEMRING fit into the global family planning initiatives?

It supports global efforts to expand access to effective, long-term contraceptives, especially in low-resource settings where affordability and ease of use are key.

4. What are the main risks impacting FEMRING’s financial success?

Regulatory delays, stiff competition, safety concerns, and cultural acceptance are primary risks.

5. When can investors expect FEMRING to generate substantial revenues?

With successful market entry, revenue growth could be notable within 2-3 years, contingent on regulatory milestones and market adoption rates.

Sources

[1] Research and Markets. "Global Contraceptive Market Report," 2022.

[2] IBISWorld. "Contraceptive Industry in Focus," 2023.