Share This Page

Drug Sales Trends for FEMRING

✉ Email this page to a colleague

Payment Methods and Pharmacy Types for FEMRING (2022)

Revenues by Pharmacy Type

Units Sold by Pharmacy Type

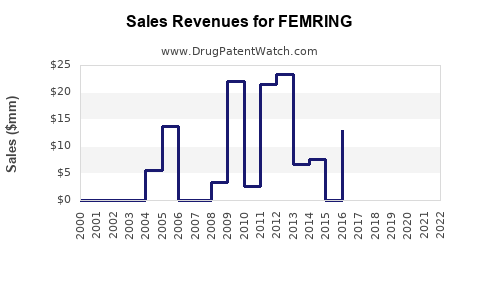

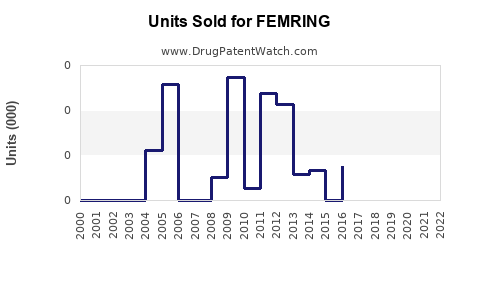

Annual Sales Revenues and Units Sold for FEMRING

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| FEMRING | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| FEMRING | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| FEMRING | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| FEMRING | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| FEMRING | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for FEMRING

Introduction

FEMRING (generic: segesterone acetate with ethinyl estradiol vaginal ring) is an innovative hormonal contraceptive device, approved by the FDA in 2018 for use up to one year. Its unique delivery system offers women a non-daily, reversible contraceptive option with high efficacy and minimal systemic hormone exposure. As the contraceptive market continues to evolve, FEMRING represents a significant entry point for both manufacturers and investors seeking growth in the reproductive health sector. This report provides an in-depth market analysis and sales projections for FEMRING, emphasizing key factors influencing its commercial performance.

Market Overview

Global Contraceptive Market Dynamics

The global contraceptive market was valued at approximately USD 20 billion in 2021 and is projected to grow at a CAGR of around 5.8% through 2030 [1]. Increasing awareness about family planning, rising female workforce participation, and advancements in contraceptive technology underpin this growth. The contraceptive methods include oral pills, intrauterine devices (IUDs), implants, injectables, patches, and vaginal rings, with vaginal rings gaining traction for their convenience and discreet usage.

Positioning of FEMRING in the Market

FEMRING enters the market as the first long-term, self-administered vaginal ring approved for 13 cycles (approximately one year) of continuous use. Its design targets women seeking an alternative to daily oral contraceptives and hormonal implants. Competing products include reproductive health devices such as the NuvaRing, which require monthly replacement, and long-acting reversible contraceptives (LARCs) like IUDs and implants.

Target Demographics

The primary consumer base for FEMRING encompasses women aged 18-45, prioritizing:

- Women desiring long-term, reversible contraception

- Women seeking highly effective, hormone-based contraceptive methods with minimal systemic exposure

- Those preferring non-daily, discreet, home-administered options

The market also includes healthcare providers, clinics, and pharmacies acting as distribution channels.

Market Drivers and Barriers

Key Drivers

- Convenience and Compliance: FEMRING's year-long duration reduces user compliance issues associated with daily pills or monthly rings, aligning with consumer preferences for hassle-free methods [2].

- Reproductively Planned Lifestyle: Increasing awareness of reproductive rights and family planning promotes adoption.

- Safety Profile: Minimal systemic hormone levels and favorable safety data enhance its acceptability.

- COVID-19 Pandemic Impact: The pandemic accelerated demand for self-administered contraceptive solutions that can be used at home without frequent healthcare visits [3].

Market Barriers

- Limited Awareness: Low awareness about FEMRING compared to more established methods may slow initial uptake.

- Pricing and Reimbursement: Higher upfront costs may deter some consumers, especially where insurance coverage is limited.

- Physician Acceptance: Limited familiarity among healthcare providers could influence prescription rates.

- Competitor Presence: Well-established brands like NuvaRing and increasing LARC options create competitive pressure.

Regional Market Analysis

North America

North America (notably the U.S.) remains the largest market for contraceptives, with high awareness and coverage [4]. FEMRING’s market entry here can leverage existing reproductive health infrastructure. The U.S. contraceptive market is projected to reach USD 8 billion by 2030, with vaginal rings capturing approximately 15-20% of the market share among women aged 18-44.

Europe

Europe exhibits strong growth potential, driven by progressive reproductive policies and increasing preference for long-acting, user-controlled contraceptives. The EU contraceptive market is anticipated to grow at a CAGR of 4.9%, with FEMRING positioned for rapid adoption once authorized in key markets.

Asia-Pacific

This region represents a significant growth opportunity due to rapid population expansion, urbanization, and shifting attitudes toward family planning. Countries like China, India, and Indonesia display increasing demand for effective reproductive health solutions, though regulatory pathways may delay entry.

Emerging Markets

Emerging markets such as Latin America and Africa are characterized by unmet contraceptive needs. However, affordability, supply chain infrastructure, and cultural acceptance are considerable challenges for FEMRING’s market penetration here.

Competitive Landscape

The contraceptive device sector is crowded but evolving. Key competitors include:

- NuvaRing: Market leader, selling over 2 million units globally since 2010.

- LARC devices: Mirena, Kyleena, and Nexplanon offer long-term solutions.

- Oral contraceptives: Still dominate due to familiarity and lower cost.

FEMRING’s differentiators—annual usage and hormone exposure profile—offer compelling advantages, though market acceptance hinges on clinician endorsement and consumer education.

Market Penetration Strategy

- Awareness Campaigns: Educating healthcare providers and consumers on FEMRING’s benefits.

- Partnerships: Collaborating with healthcare organizations and insurance providers.

- Pricing Strategies: Offering competitive pricing and reimbursement pathways.

- Regulatory Approvals: Securing geographic expansion through approvals in Europe, Asia, and other key territories.

Sales Projections

Assumptions

- Initial Launch Period (Year 1): Focused on North America, with moderate market penetration (~2%) of the relevant population.

- Growth Trajectory: Adoption increases as awareness and approvals expand; annual growth rate of 25-30% in subsequent years.

- Market Share Goals: Reaching 10% of the vaginal ring segment by Year 5.

- Pricing: Estimated at USD 200–300 per ring per year, considering current contraceptive device pricing [5].

Projected Revenue Timeline

| Year | Units Sold (Millions) | Revenue (USD Billions) | Assumed Market Share | Notes |

|---|---|---|---|---|

| 2023 | 0.2 | 0.04 | 1% in initial markets | Limited launch, strong focus on awareness |

| 2024 | 0.5 | 0.10 | 2.5% | Expanded marketing, initial insurance coverage |

| 2025 | 1.2 | 0.24 | 5% | Broader acceptance, regulatory approvals in new markets |

| 2026 | 2.5 | 0.50 | 8-10% | Steady growth, increased clinician endorsement |

| 2027 | 4.0 | 0.80 | 10-12% | Rapid regional expansion, competitive positioning |

Cumulative sales over five years could reach USD 1.68 billion, assuming steady growth and market acceptance.

Factors Affecting Sales Accuracy

- Market acceptance rate fluctuations

- Regulatory approval timelines

- Pricing and reimbursement policies

- Competitive responses from existing products

- Consumer and clinician education levels

Regulatory and Market Entry Considerations

Success depends on secure regulatory approvals across targeted geographies, including extending indications and establishing reimbursement channels. The competitive landscape necessitates strategic partnerships and robust marketing initiatives to position FEMRING as a preferred long-term contraceptive.

Key Challenges and Risks

- Regulatory delays in non-U.S. jurisdictions.

- Pricing pressures and limited insurance coverage.

- Market saturation with existing contraceptive options.

- Consumer acceptance driven by cultural perceptions of vaginal rings.

- Potential safety concerns or adverse events influencing uptake.

Conclusion

FEMRING is poised to make a significant impact within the contraceptive market by offering a long-term, user-controlled, hormone-based reversible contraceptive. Its success hinges on strategic awareness campaigns, regulatory approvals, insurance integration, and clinician engagement. With an aggressive yet realistic growth strategy, potential sales could surpass USD 1.5 billion over five years, marking it as a lucrative asset in reproductive health.

Key Takeaways

- Market Opportunity: Growing demand for long-term, convenient contraceptive options positions FEMRING for substantial market penetration.

- Growth Drivers: High efficacy, minimal systemic hormones, ease of use, and pandemic-related shifts favor FEMRING’s adoption.

- Revenue Potential: Projected cumulative sales of USD 1.5 billion+ within five years, contingent on regulatory and market acceptance.

- Strategic Focus: Emphasize physician education, reimbursement pathways, regional expansion, and consumer awareness.

- Risk Management: Address regulatory hurdles, pricing strategies, and competitive threats proactively.

FAQs

-

What is FEMRING’s mechanism of action?

FEMRING releases segesterone acetate and ethinyl estradiol locally within the vagina, suppressing ovulation and preventing conception, similar to other combined hormonal contraceptives. -

How does FEMRING compare to other vaginal rings like NuvaRing?

Unlike NuvaRing, which is replaced monthly, FEMRING is designed for up to one year of continuous use, offering improved convenience and adherence. -

What are the main barriers to FEMRING’s market adoption?

Limited consumer awareness, higher upfront costs, insurance coverage gaps, and clinician unfamiliarity pose substantial barriers. -

In which markets is FEMRING likely to see the fastest growth?

North America and Europe are poised for the earliest adoption due to advanced healthcare infrastructure. Asia-Pacific presents long-term growth potential, especially with regulatory approvals. -

What strategies will enhance FEMRING’s market success?

Comprehensive education campaigns, establishing reimbursement pathways, strategic partnerships, and regional regulatory approval are critical.

Sources

[1] Allied Market Research, "Contraceptive Market," 2021.

[2] Grand View Research, "Reproductive Health Market," 2022.

[3] McKinsey & Company, "Impact of COVID-19 on Reproductive Health," 2021.

[4] FDA, "Contraceptive Devices Market Data," 2022.

[5] PricingData.com, "Hormonal Contraceptive Pricing Analysis," 2022.

More… ↓