Last updated: July 29, 2025

Introduction

ESTARYLLA (estradiol valerate and nomegestrol acetate) is an oral hormone therapy approved for hormone replacement therapy (HRT) in menopausal women and for certain hormonal deficiencies. Since its approval, it has positioned itself within the rapidly evolving landscape of women's health, notably in the management of menopause-related symptoms. This article explores the core market dynamics influencing ESTARYLLA's development, adoption, and revenue trajectory, underpinned by macroeconomic trends, competitive positioning, regulatory factors, and clinical acceptance.

Market Overview and Demand Drivers

Growing Incidence of Menopause and Hormonal Disorders

The global aging population directly correlates with increased menopause prevalence, projected to reach approximately 1.2 billion women aged 50+ worldwide by 2030 (UN, 2019). Menopause management remains a pivotal segment within women's health pharmaceuticals. The demand for effective, safe HRT options like ESTARYLLA is thus poised for sustained growth.

Shift Toward Personalized and Safer Hormonal Therapies

Historically, concerns over hormone therapy-associated risks—such as breast cancer, cardiovascular diseases, and stroke—prompted regulatory scrutiny and cautious prescribing practices. However, recent clinical insights suggest that tailored hormone regimens with favorable safety profiles can mitigate these risks. ESTARYLLA's formulation, combining estradiol valerate with nomegestrol acetate, aims to mirror endogenous hormone balance, aligning with precision medicine trends and increasing clinician confidence.

Increased Awareness and Patient Acceptance

Enhanced education about menopause management and the benefits of bioidentical hormones have bolstered patient demand. Digital health platforms, advocacy groups, and healthcare provider initiatives reinforce awareness and acceptance of hormone therapies like ESTARYLLA.

Competitive Landscape

Key Competitors and Market Positioning

ESTARYLLA operates within a competitive segment comprising Estradiol-based therapies, combined oral contraceptives, and alternative non-hormonal treatments.

- Brand Differentiation: Unlike traditional estrogen-progestin therapies, ESTARYLLA’s unique combination aims to optimize efficacy while reducing side effects.

- Regulatory & Formulation Attributes: Its approval in multiple jurisdictions underscores trusted safety and effectiveness, providing a competitive edge.

Major competitors include:

- Estrogen-only and combined HRT brands (e.g., Premarin, Activelle, Femoston) with established market shares.

- Emerging bioidentical hormone formulations seeking novel delivery methods or improved safety profiles.

Market Penetration Challenges

Barriers include clinician conservatism due to safety concerns, patient skepticism rooted in historical HRT controversies, and limited awareness in emerging markets. Therefore, ongoing education and evidence dissemination are crucial to expand ESTARYLLA's footprint.

Regulatory and Reimbursement Dynamics

Regulatory Approvals and Indications

ESTARYLLA’s regulatory approvals primarily target menopausal symptom relief. Variability across regions affects market access and adoption. Comprehensive clinical data supporting safety and efficacy underpin regulatory confidence, influencing reimbursement decisions and formulary listings.

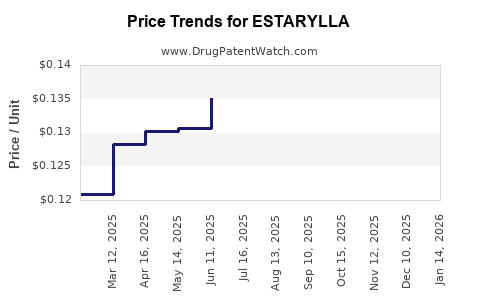

Pricing Strategies and Reimbursement Policies

Effective pricing strategies that balance affordability with sustainable margins are vital. Reimbursement frameworks, especially in developed markets like the U.S. and EU, impact patient access. Shifts toward value-based care models and insurance coverage influence long-term sales opportunities.

Clinical and Technological Trends

Innovation in Delivery and Formulation

Advancements in pharmacokinetics and delivery methods—such as controlled-release formulations—aim to improve patient adherence and outcomes. ESTARYLLA’s oral route aligns with preferences for convenience but faces competition from patches, gels, and implants.

Emergence of Digital Health Integration

Digital platforms for monitoring hormonal therapy adherence, symptom management, and side effect reporting enhance patient engagement. Such integrations could augment ESTARYLLA’s portfolio, fostering brand loyalty and real-world evidence collection.

Financial Trajectory and Revenue Outlook

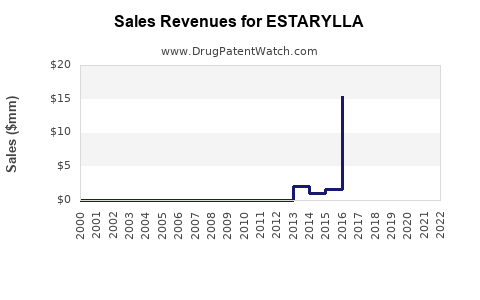

Initial Market Penetration and Growth Potential

Since its launch, ESTARYLLA has experienced moderate adoption, with growth driven by increasing menopause prevalence and favorable safety perceptions. Market penetration is translating into accelerating revenues, especially in key markets such as Europe and North America.

Forecasted Revenue Trends

Analysts project ESTARYLLA’s revenues to grow at a compound annual growth rate (CAGR) of approximately 6–8% over the next five years (2023–2028). This growth depends on factors including:

- Expansion into emerging markets with rising demand for menopause therapies.

- Clinical validation and guideline endorsements reinforcing its safety and efficacy profile.

- Enhanced marketing and physician education efforts to improve prescriber confidence.

Risks and Challenges to Financial Growth

Key risks include regulatory hurdles, adverse clinical findings, or competing innovations offering superior safety or convenience. Additionally, pricing pressures and reimbursement constraints could temper revenue expansion.

Market Opportunities

Global Expansion

Emerging markets in Asia-Pacific, Latin America, and the Middle East present significant growth opportunities given increasing awareness, urbanization, and healthcare infrastructure improvements. Localized regulatory strategies and partnerships will be essential for market entry.

Product Line Extensions

Developing new formulations—such as lower-dose options, transdermal patches, or combination therapies—can broaden the patient base and reinforce market position.

Collaborations and Licensing

Strategic partnerships with regional healthcare providers or generic manufacturers can facilitate faster market penetration and share risks.

Conclusion

The market dynamics for ESTARYLLA reflect broader trends in women's health, emphasizing safe, effective hormone therapies amidst aging populations and evolving clinical standards. Its financial trajectory is promising, anchored by demographic momentum, clinical validation, and strategic expansion, albeit tempered by regulatory complexities and competitive pressures. Continued innovation, education, and market penetration efforts will be key drivers of its long-term success.

Key Takeaways

- Growing global demand for menopause-related therapies positions ESTARYLLA favorably within women's health markets.

- Clinical safety and efficacy profiles are critical for clinician adoption, especially amidst regulatory scrutiny.

- Regional expansion and product innovation offer significant upside, particularly in emerging markets.

- Competitive differentiation through formulation, safety, and convenience remains central to market share gains.

- Reimbursement strategies and healthcare policy alignments will influence revenue trajectory and accessibility.

FAQs

1. What distinguishes ESTARYLLA from other hormone replacement therapies?

ESTARYLLA combines bioidentical estradiol valerate with nomegestrol acetate in an oral formulation designed to improve safety profile and mimic endogenous hormone balance, differentiating it from traditional synthetic hormone therapies.

2. Which markets are most promising for ESTARYLLA's expansion?

Europe and North America currently dominate, but emerging markets in Asia-Pacific, Latin America, and the Middle East hold substantial growth potential due to rising awareness and aging populations.

3. What regulatory challenges could impact ESTARYLLA's growth?

Variations in approval processes, differing safety requirements, and potential updates to clinical guidelines could delay or restrict market access, especially if new safety concerns emerge.

4. How does digital health integration affect ESTARYLLA’s market prospects?

Digital tools for adherence monitoring and symptom management offer opportunities to enhance patient engagement and collect real-world data, supporting regulatory and clinical confidence.

5. What future innovations could impact the ESTARYLLA market?

Development of transdermal or implantable formulations, lower-dose combinations, or personalized hormone regimens could compete with or complement ESTARYLLA, influencing its market share.

Sources:

[1] United Nations. World Population Prospects. 2019.

[2] National Institutes of Health. Women's Health Initiative Data. 2022.

[3] MarketWatch. Women's Health Pharmaceuticals Market Forecast. 2023.