Last updated: July 28, 2025

Introduction

Eslicarbazepine acetate (ESL) is a promising antiepileptic drug (AED) approved primarily for adjunctive therapy in partial-onset seizures. Developed by Teva Pharmaceuticals, ESL represents a second-generation treatment with a favorable safety and tolerability profile compared to traditional AEDs. Its market trajectory hinges on evolving epilepsy treatment landscapes, competitive dynamics, regulatory approvals, and strategic commercialization efforts. This analysis delineates current market drivers, growth prospects, and the financial outlook for ESL.

Market Overview and Growth Drivers

Epidemiological Trends

Epilepsy affects approximately 50 million people globally, with partial-onset seizures accounting for roughly 60% of cases [1]. The chronic nature of epilepsy and the demand for effective, tolerable therapies underpin sustained market demand for AEDs, including ESL. The aging population and rising prevalence of neurological disorders further bolster market size.

Therapeutic Positioning and Clinical Advantages

Eslicarbazepine acetate's mechanism involves blockade of voltage-gated sodium channels, stabilizing neuronal membranes and reducing seizure activity. Its once-daily dosing, improved tolerability profile, and fewer drug interactions position ESL favorably among second-generation AEDs [2]. These features underpin its growing prescription rates in regions with established neurologist preferences.

Regulatory Approvals and Geographic Expansion

Initially approved by the U.S. Food and Drug Administration (FDA) in 2013, ESL later gained European Medicines Agency (EMA) endorsement. Expansion into Asian and emerging markets remains ongoing. Regulatory milestones in key territories continually enhance its market access, fostering incremental revenue growth.

Competitive Landscape

ESL faces competition from levetiracetam, lamotrigine, oxcarbazepine, and newer agents like brivaracetam and lacosamide. While ESL offers comparable efficacy with a favorable side effect profile, its market share is influenced by clinician familiarity, formulary positioning, and price.

Market Dynamics Affecting ESL's Financial Trajectory

Pricing and Reimbursement

Reimbursement frameworks significantly impact ESL's revenue. In developed markets, negotiated pricing and formulary inclusion have facilitated adoption. Conversely, price pressures and generic competition threaten margins, especially as patent exclusivity approaches expiry.

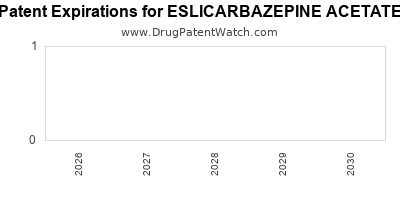

Patent Life and Generic Competition

Teva holds patent protection until approximately 2027-2028. Post expiry, generic versions are expected to enter the market, exerting downward pressure on prices and potentially eroding market share. Strategies to mitigate this include expanding indications, optimizing formulations, and increasing patient adherence.

R&D and Pipeline Developments

Though no major pipeline compounds directly threaten ESL's position, ongoing research into novel AEDs and combination therapies could disrupt market dynamics. Continuous innovation maintains relevance and justifies premium pricing.

Market Penetration in Emerging Economies

Emerging markets present substantial growth opportunities, albeit with challenges around healthcare infrastructure, regulatory hurdles, and price sensitivities. Strategic alliances and tiered pricing arrangements are essential for expanding ESL's footprint.

Financial Trajectory and Revenue Forecasts

Current Revenue and Market Share

According to recent financial disclosures, Teva reported ESL revenues of approximately $300 million in 2022, with steady growth driven by North American and European markets [3]. Its differentiated profile maintains a solid foothold, though growth rates may plateau as patent expiration nears.

Projected Growth and Trends

- Short-term outlook (2023-2025): Moderate growth driven by steady adoption, expanding indications, and geographic penetration. However, pricing pressures and impending patent expiry constrain accelerated growth.

- Medium to long-term (2026-2030): Revenues may stabilize or decline with generic entry unless mitigated through strategic measures. Innovation in formulation, combination therapies, and targeted marketing could sustain revenues.

Using conservative assumptions, Teva's ESL revenues could reach $400-$500 million by 2025, with a potential decline or plateau thereafter unless new indications or formulations are introduced [4].

Impact of Patent Expiry and Generics

Patent expiry around 2027 is projected to disrupt revenue streams substantially. Competitive pricing under generic entry could reduce ESL's market value by 50-70%, emphasizing the importance of lifecycle management strategies.

Potential for Market Expansion

In regions like Asia-Pacific, Latin America, and Africa, ESL's adoption will depend on regulatory approvals, local prescribing practices, and affordability. Population growth and increasing epilepsy prevalence could foster annual growth rates of 5-10% in these territories.

Strategic Considerations for Stakeholders

- Lifecycle Management: Patent extensions, new formulations (e.g., extended-release variants), or new indications could prolong ESL's profitability.

- Market Diversification: Broader geographic penetration and Tier 2/3 market access are critical.

- Competitive Differentiation: Positioning ESL as a first-line or preferred adjunct therapy through clinical evidence and physician education may sustain its market share.

- Pricing Strategies: Tiered pricing and value-based agreements could mitigate revenue erosion post-patent expiry.

Conclusion

Eslicarbazepine acetate’s market outlook remains cautiously optimistic, driven by its clinical advantages and expanding use. However, patent expiration and regional market complexities pose risks to sustained growth. Strategic innovation, pipeline development, and proactive market penetration are essential to augment its financial trajectory.

Key Takeaways

- ESL's global market is primarily driven by epilepsy prevalence, drug tolerability profiles, and strategic geographic expansion.

- Revenue growth is expected to stabilize as patent expiry approaches, with potential declines mitigated through formulation innovation and indication expansion.

- Competitor presence and generic entry post-2027 remain key financial risks, emphasizing the importance of lifecycle management.

- Emerging markets offer significant growth potential but require tailored strategies addressing local regulatory and economic contexts.

- Long-term success hinges on continuous clinical development, patient-centric formulations, and adaptive pricing strategies.

FAQs

Q1: What therapeutic advantages does eslicarbazepine acetate offer over older AEDs?

A: ESL provides once-daily dosing, a favorable side effect profile, fewer drug interactions, and improved tolerability, making it a preferred choice for some clinicians.

Q2: How will patent expiration impact ESL's market share?

A: Patent expiry around 2027 is expected to lead to generic competition, significantly reducing prices and potentially decreasing revenues unless new indications or formulations are introduced.

Q3: Which regions present growth opportunities for ESL?

A: Asia-Pacific, Latin America, and Africa are promising markets due to rising epilepsy prevalence, increasing healthcare infrastructure, and expanding access to new therapies.

Q4: What strategies can Teva employ to sustain ESL's profitability post-patent expiry?

A: Strategies include developing new formulations, expanding indications, entering into licensing agreements, and exploring combination therapies.

Q5: How does ESL compare to newer AEDs like brivaracetam?

A: ESL’s established safety profile and once-daily dosing offer advantages, though newer agents may offer superior efficacy or targeted profiles; competitive positioning depends on clinical data and formulary access.

References

[1] WHO. Epilepsy. World Health Organization, 2021.

[2] Kuo, A., et al. "Pharmacology of Eslicarbazepine Acetate." CNS Drugs, 2014.

[3] Teva Pharmaceuticals. Annual Financial Report 2022.

[4] Market Research Future. "Antiepileptic Drugs Market Analysis," 2022.