ESBRIET Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Esbriet, and what generic alternatives are available?

Esbriet is a drug marketed by Genentech Inc and is included in two NDAs. There are twenty patents protecting this drug and two Paragraph IV challenges.

This drug has two hundred and sixty-six patent family members in forty-six countries.

The generic ingredient in ESBRIET is pirfenidone. There are twenty-three drug master file entries for this compound. Twenty-four suppliers are listed for this compound. Additional details are available on the pirfenidone profile page.

DrugPatentWatch® Litigation and Generic Entry Outlook for Esbriet

A generic version of ESBRIET was approved as pirfenidone by AMNEAL on January 3rd, 2022.

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for ESBRIET?

- What are the global sales for ESBRIET?

- What is Average Wholesale Price for ESBRIET?

Summary for ESBRIET

| International Patents: | 266 |

| US Patents: | 20 |

| Applicants: | 1 |

| NDAs: | 2 |

| Finished Product Suppliers / Packagers: | 2 |

| Raw Ingredient (Bulk) Api Vendors: | 103 |

| Clinical Trials: | 19 |

| Patent Applications: | 4,854 |

| Drug Prices: | Drug price information for ESBRIET |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for ESBRIET |

| What excipients (inactive ingredients) are in ESBRIET? | ESBRIET excipients list |

| DailyMed Link: | ESBRIET at DailyMed |

Recent Clinical Trials for ESBRIET

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Excalibur Pharmaceuticals, Inc. | Phase 1 |

| Veterans Medical Research Foundation | Phase 2 |

| National Institute of Diabetes and Digestive and Kidney Diseases (NIDDK) | Phase 2 |

Pharmacology for ESBRIET

| Drug Class | Pyridone |

Paragraph IV (Patent) Challenges for ESBRIET

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| ESBRIET | Capsules | pirfenidone | 267 mg | 022535 | 9 | 2018-10-15 |

| ESBRIET | Tablets | pirfenidone | 534 mg | 208780 | 2 | 2018-10-15 |

US Patents and Regulatory Information for ESBRIET

ESBRIET is protected by sixty-four US patents.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Genentech Inc | ESBRIET | pirfenidone | TABLET;ORAL | 208780-001 | Jan 11, 2017 | AB | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Genentech Inc | ESBRIET | pirfenidone | TABLET;ORAL | 208780-003 | Jan 11, 2017 | AB | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Genentech Inc | ESBRIET | pirfenidone | TABLET;ORAL | 208780-003 | Jan 11, 2017 | AB | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| Genentech Inc | ESBRIET | pirfenidone | TABLET;ORAL | 208780-003 | Jan 11, 2017 | AB | RX | Yes | Yes | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for ESBRIET

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Genentech Inc | ESBRIET | pirfenidone | TABLET;ORAL | 208780-001 | Jan 11, 2017 | ⤷ Get Started Free | ⤷ Get Started Free |

| Genentech Inc | ESBRIET | pirfenidone | TABLET;ORAL | 208780-002 | Jan 11, 2017 | ⤷ Get Started Free | ⤷ Get Started Free |

| Genentech Inc | ESBRIET | pirfenidone | TABLET;ORAL | 208780-003 | Jan 11, 2017 | ⤷ Get Started Free | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

EU/EMA Drug Approvals for ESBRIET

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Roche Registration GmbH | Esbriet | pirfenidone | EMEA/H/C/002154Esbriet is indicated in adults for the treatment of idiopathic pulmonary fibrosis. | Authorised | no | no | no | 2011-02-27 | |

| Axunio Pharma GmbH | Pirfenidone axunio (previously Pirfenidone AET) | pirfenidone | EMEA/H/C/005873Pirfenidone AET is indicated in adults for the treatment of mild to moderate idiopathic pulmonary fibrosis (IPF). | Authorised | yes | no | no | 2022-06-20 | |

| Viatris Limited | Pirfenidone Viatris | pirfenidone | EMEA/H/C/005862Pirfenidone Viatris is indicated in adults for the treatment of mild to moderate idiopathic pulmonary fibrosis (IPF). | Authorised | yes | no | no | 2023-01-10 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for ESBRIET

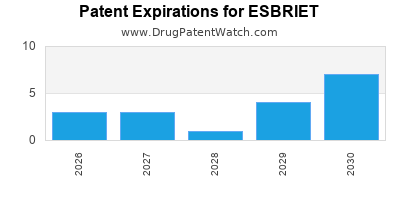

When does loss-of-exclusivity occur for ESBRIET?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

African Regional IP Organization (ARIPO)

Patent: 55

Estimated Expiration: ⤷ Get Started Free

Argentina

Patent: 7990

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 11201520

Estimated Expiration: ⤷ Get Started Free

Patent: 13201986

Estimated Expiration: ⤷ Get Started Free

Patent: 14240300

Estimated Expiration: ⤷ Get Started Free

Patent: 17241530

Estimated Expiration: ⤷ Get Started Free

Patent: 22275529

Patent: Granulate formulation of 5-methyl-1-phenyl-2(1H)-pyridone and method of making the same

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 0616324

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 20380

Estimated Expiration: ⤷ Get Started Free

Patent: 37365

Patent: FORMULATION EN GRANULES DE 5-METHYL-1-PHENYL-2-(1H)-PYRIDONE ET METHODE DE FABRICATION ASSOCIEE (GRANULATE FORMULATION OF 5-METHYL-1-PHENYL-2-(1H)-PYRIDONE AND METHOD OF MAKING THE SAME)

Estimated Expiration: ⤷ Get Started Free

China

Patent: 1267810

Estimated Expiration: ⤷ Get Started Free

Patent: 3393607

Estimated Expiration: ⤷ Get Started Free

Patent: 3735530

Estimated Expiration: ⤷ Get Started Free

Patent: 8883072

Patent: 5-甲基-1-苯基-2-(1H)-吡啶酮颗粒制剂和其制备方法 (GRANULATE FORMULATION OF 5-METHY-1-PHENY-2(1H)-PYRIDONE AND METHOD OF MAKING THE SAME)

Estimated Expiration: ⤷ Get Started Free

Patent: 4533688

Patent: 5-甲基-1-苯基-2-(1H)-吡啶酮颗粒制剂和其制备方法 (5-methyl-1-phenyl-2-(1H)-pyridone granular formulations and processes for their preparation)

Estimated Expiration: ⤷ Get Started Free

Cuba

Patent: 080043

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 15544

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 40364

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 088394

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 0800881

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 40364

Estimated Expiration: ⤷ Get Started Free

Patent: 31025

Estimated Expiration: ⤷ Get Started Free

Patent: 35985

Patent: PRÉPARATION DE GRANULÉS DE 5-MÉTHYL-1-PHÉNYL-2(1H)-PYRIDONE ET SON PROCÉDÉ DE FABRICATION (GRANULATE FORMULATION OF 5-METHY!-1-PHENY!-2(1H)-PYRIDONE AND METHOD OF MAKING THE SAME)

Estimated Expiration: ⤷ Get Started Free

Patent: 95696

Patent: PRÉPARATION DE GRANULÉS DE 5-MÉTHYL-1-PHÉNYL-2(1H)-PYRIDONE ET SON PROCÉDÉ DE FABRICATION (GRANULATE FORMULATION OF 5-METHYL-1-PHENYL-2(1H)-PYRIDONE AND METHOD OF MAKING THE SAME)

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 17762

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 9273

Estimated Expiration: ⤷ Get Started Free

Patent: 1745

Patent: פורמולציית גרגירים של 5-מתיל-1-פניל-2(h1)-פירידון ושיטה להכנתה (Granulate formulation of 5-methyl-1-phenyl-2(1h)-pyridone and method of making the same)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 15101

Estimated Expiration: ⤷ Get Started Free

Patent: 37732

Estimated Expiration: ⤷ Get Started Free

Patent: 56721

Estimated Expiration: ⤷ Get Started Free

Patent: 09509962

Estimated Expiration: ⤷ Get Started Free

Patent: 19513145

Patent: 5−メチル−1−フェニル−2−(1H)−ピリドンの顆粒製剤及びその製造方法

Estimated Expiration: ⤷ Get Started Free

Patent: 22087115

Patent: 5-メチル-1-フェニル-2-(1H)-ピリドンの顆粒製剤及びその製造方法

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 3177

Patent: FORMULACION GRANULADA DE 5-METIL-1-FENIL-2-(1H)-PIRIDONA Y METODO PARA ELABORARLA. (GRANULATE FORMULATION OF 5-METHY|-1-PHENY|-2(1H)-PYRIDONE AND METHOD OF MAKING THE SAME)

Estimated Expiration: ⤷ Get Started Free

Patent: 08003882

Estimated Expiration: ⤷ Get Started Free

Patent: 18011819

Patent: FORMULACION GRANULADA DE 5-METIL-1-FENIL-2-(1H)-PIRIDONA Y METODO PARA ELABORARLA. (GRANULATE FORMULATION OF 5-METHY|-1-PHENY|-2(1H)-PYRIDONE AND METHOD OF MAKING THE SAME.)

Estimated Expiration: ⤷ Get Started Free

Morocco

Patent: 875

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 5957

Estimated Expiration: ⤷ Get Started Free

Patent: 0129

Estimated Expiration: ⤷ Get Started Free

Norway

Patent: 5131

Estimated Expiration: ⤷ Get Started Free

Patent: 080759

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 40364

Estimated Expiration: ⤷ Get Started Free

Patent: 35985

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 40364

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 0802237

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1675651

Estimated Expiration: ⤷ Get Started Free

Patent: 2552615

Estimated Expiration: ⤷ Get Started Free

Patent: 130100381

Estimated Expiration: ⤷ Get Started Free

Patent: 180123067

Patent: 5-메틸-1-페닐-2-(1H)-피리돈의 과립화 제형 및 이의 제조 방법

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 83595

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 5861

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering ESBRIET around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| World Intellectual Property Organization (WIPO) | 2008077068 | ⤷ Get Started Free | |

| Israel | 260196 | ⤷ Get Started Free | |

| Portugal | 2124945 | ⤷ Get Started Free | |

| Hong Kong | 1217903 | ⤷ Get Started Free | |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Market Dynamics and Financial Trajectory for ESBRIET (Esbrerit)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.