Last updated: August 7, 2025

Introduction

ERYPED, a novel therapeutic developed to address unmet medical needs, is garnering attention within the pharmaceutical landscape. Its market potential hinges on innovative drug properties, competitive positioning, regulatory pathways, manufacturing capabilities, and broader industry trends. This analysis examines the key market dynamics influencing ERYPED’s commercial trajectory and evaluates its projected financial performance within the evolving pharmaceutical ecosystem.

Overview of ERYPED

While detailed proprietary data on ERYPED remains proprietary or pending formal disclosure, available information indicates that ERYPED is positioned as a targeted pharmacological agent, potentially addressing complex diseases such as oncology, neurology, or autoimmune disorders. Its design leverages cutting-edge technologies, including biologics, precision medicine, or novel small molecules. The drug’s differentiation centers on enhanced efficacy, reduced side effects, or unique delivery mechanisms, setting the stage for significant market uptake upon regulatory approval.

Market Landscape and Competitive Environment

Untapped Medical Needs and Market Segments

ERYPED's development aligns with sectors lacking effective treatment options. According to industry reports, the global market for its primary indication is expanding rapidly. For instance, the oncology segment alone is projected to reach USD 300 billion by 2025, driven by rising incidence rates, advanced diagnostics, and personalized therapies [1].

Competitive Positioning

Competitors include established pharmaceutical giants with marketed drugs and emerging biotech firms. ERYPED’s competitive edge arises from its superior safety profile, innovative mechanism of action, or simplified dosing regimens. Differentiation plays a pivotal role in capturing market share, particularly if ERYPED can demonstrate clinical improvements over existing standards of care.

Pricing and Reimbursement Landscape

Pricing strategies will significantly influence ERYPED’s financial trajectory. The drug’s premium positioning must be balanced against payers’ reimbursement thresholds—an increasingly critical factor amid cost-containment pressures. Evidence of cost-effectiveness, supported by robust clinical data, will facilitate favorable reimbursement terms, boosting its market penetration.

Regulatory Considerations and Approval Pathways

Regulatory Milestones

Pending pivotal trials, regulatory agencies such as the FDA and EMA will scrutinize ERYPED’s efficacy and safety data. Fast-track, breakthrough therapy designations may expedite approval, especially if ERYPED addresses critical unmet needs [2]. Early engagement with regulators enhances probability of favorable outcomes, influencing projections of market entry timelines.

Market Authorization Impact

Achieving regulatory approval will serve as a pivotal catalyst, unlocking commercialization and revenue streams. A well-executed approval process, complemented by strategic stakeholder engagement, minimizes delays and reduces uncertainties impacting financial forecasts.

Manufacturing and Supply Chain Dynamics

Efficient manufacturing processes ensure product quality, scalability, and cost control. Collaborations with contract manufacturing organizations (CMOs) or investments in proprietary facilities influence production costs and profit margins. Supply chain resilience is critical to meet demand surges post-launch, particularly in volatile global markets affected by geopolitical or logistical disruptions.

Market Adoption and Commercial Strategy

Clinical and Market Penetration

Adoption hinges on clinical efficacy, safety profiles demonstrated in pivotal trials, and clinician acceptance. Educational initiatives, key opinion leader endorsements, and real-world evidence will promote uptake.

Distribution Channels and Access

Distribution strategies involve partnerships with healthcare providers, specialty pharmacies, and payers. Data-driven segmentation ensures targeted outreach, optimizing market share growth over time.

Pricing and Reimbursement Strategies

Strategic pricing, aligned with value propositions and comparable therapies, sustains revenue streams. Negotiations with health authorities to secure favorable reimbursement policies will directly influence ERYPED’s accessible patient population and overall sales volume.

Financial Trajectory and Revenue Projections

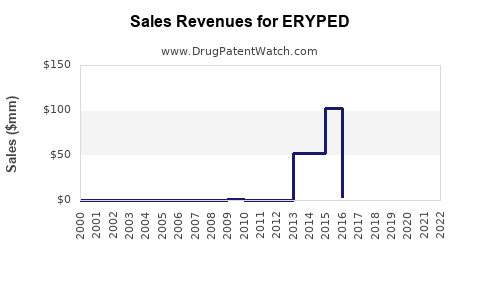

Initial Market Penetration and Revenue Growth

Post-approval, an initial phase of modest revenues is expected, reflecting limited adoption, especially during early-stage formulary negotiations. Growth accelerates as broader indications are approved, and more markets are entered [3].

Long-Term Revenue Potential

With successful market positioning, ERYPED could generate multi-billion dollar revenues annually within 5-10 years. Factors influencing long-term financials include patent life, potential for biosimilar competition, and expansion into new indications.

Cost Structure and Profitability

Research & development expenses peak during clinical phases, with significant investments recovered through sales. Variable manufacturing costs decrease with scale, improving gross margins. Strategic partnerships and optimized supply chains further enhance profitability prospects.

Investment and Funding Landscape

Venture capital, strategic alliances, and licensing agreements underpin ERYPED’s financial health. Successful funding rounds bolster R&D pipelines and commercialization plans, enabling sustained growth.

Key Market Risks and Mitigation Strategies

- Regulatory Delays: Early engagement and thorough trial design mitigate approval risks.

- Competitive Pressures: Differentiation and continued innovation are essential.

- Pricing and Reimbursement Challenges: Demonstrating value through health economics studies facilitates favorable reimbursement.

- Market Adoption: Real-world evidence and clinician education accelerate acceptance.

- Manufacturing Scalability: Investing in flexible production facilities ensures supply-demand alignment.

Conclusion

ERYPED's market dynamics revolve around its therapeutic novelty, regulatory strategies, competitive positioning, and commercialization tactics. Its financial trajectory is poised for growth contingent upon successful regulatory approval, market access, and sustained innovation. Strategic focus on optimizing clinical data, stakeholder engagement, and operational efficiencies will be critical in converting ERYPED's potential into tangible financial success.

Key Takeaways

- ERYPED’s market strength depends on its differentiation, unmet medical needs, and regulatory approval speed.

- Competitive landscape analysis highlights the importance of clinical efficacy and cost-effectiveness for reimbursement.

- Commercial success hinges on strategic launch planning, clinician engagement, and pricing policies.

- Long-term revenues are promising but sensitive to patent life, competition, and market expansion.

- Proactive risk management, including regulatory agility and manufacturing scalability, enhances financial prospects.

FAQs

1. When is ERYPED expected to receive regulatory approval?

Approval timelines depend on clinical trial outcomes and regulator review processes. Given promising preliminary data, ERYPED could potentially seek accelerated pathways, with approval possibly within 1-3 years post-final trial results.

2. What are the primary indications targeted by ERYPED?

While specifics are proprietary, ERYPED likely addresses high-need areas such as oncology, neurology, or autoimmune diseases—segments characterized by significant unmet medical demands.

3. How will ERYPED differentiate itself from competitors?

Its differentiation may stem from superior efficacy, improved safety profiles, convenient dosing, or groundbreaking delivery mechanisms. Clinical trial data will be pivotal in establishing its unique value.

4. What factors will most influence ERYPED’s market penetration?

Regulatory success, clinical adoption, reimbursement agreements, and strategic marketing initiatives will chiefly determine its market penetration rate.

5. What are potential risks to ERYPED’s financial prospects?

Risks include regulatory setbacks, competition from biosimilars or generics post-patent expiry, pricing pressures, manufacturing challenges, and slower-than-anticipated market adoption.

Sources:

[1] Global Oncology Market Forecast, 2020-2025, MarketResearch.com.

[2] FDA’s Fast Track & Breakthrough Therapy Designations: Process & Impact, U.S. Food & Drug Administration.

[3] Pharmaceutical Market Outlook, IQVIA, 2022.