Last updated: August 4, 2025

Introduction

Eprosartan mesylate, an angiotensin II receptor blocker (ARB), gained regulatory approval in the early 2000s as an antihypertensive agent. Designed for managing primary hypertension, it was part of a broader shift toward ARBs as alternatives to ACE inhibitors. Over the past decade, market dynamics surrounding eprosartan mesylate have evolved significantly, driven by regulatory, clinical, and competitive factors. A comprehensive analysis of its market trajectory underscores broader industry trends and provides key insights for stakeholders.

Regulatory Landscape and Market Entry

Eprosartan mesylate was approved in several jurisdictions, including Europe and parts of Asia, with its initial launch expected to garner substantial market share owing to its favorable side effect profile compared to older classes like beta-blockers and diuretics. However, regulatory hurdles in the United States, where the drug was not approved by the FDA, limited its market penetration. Regulatory agencies assessed its safety and efficacy data against competing agents, often favoring drugs with more extensive longitudinal studies.

Market Competition and Therapeutic Positioning

The global antihypertensive market is highly competitive. Eprosartan faced challenges from established ARBs like losartan, valsartan, and newer agents such as azilsartan. These competitors benefited from aggressive marketing, expanded clinical indications, and broader physician familiarity. Additionally, the concomitant rise of fixed-dose combination therapies shifted attention toward drugs that could more effectively improve adherence, further constricting eprosartan’s share.

Despite these challenges, eprosartan retained a niche appeal in specific markets, particularly in regions where physicians valued its tolerability profile or where regulatory barriers limited competition. Its unique molecular structure and pharmacokinetic profile, which conferred longer half-life and selectivity, also contributed to sustained albeit modest demand.

Market Size and Revenue Trends

Estimates suggest that the global antihypertensive market surpassed USD 20 billion in 2022, with ARBs constituting a significant segment. However, eprosartan's contribution remains comparatively small. Its revenue trajectory has shown a declining trend post-2010, attributable to:

- Market saturation in key regions

- The emergence of branded fixed-dose combinations

- Patent expirations of competing ARBs, leading to generic proliferation

- Limited additional indications beyond primary hypertension

Specifically, sales peaked in the mid-2000s, with annual revenues in the hundreds of millions of dollars in select markets, before experiencing steady declines. In markets like Japan, where eprosartan maintained a presence, revenues were sustained longer due to formulary preferences and regional clinical guidelines.

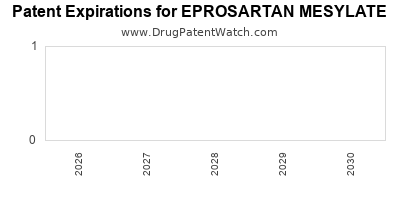

Patent and Generic Landscape

Patent protections for eprosartan mesylate began expiring in various jurisdictions starting around 2013-2015, opening doors for generic manufacturers. The subsequent influx of generics caused price reductions and further erosion of branded sales. This environment pressed the original patent holder or licensee to reconsider market strategies, including price competition, niche marketing, or withdrawal from certain markets.

Emerging Trends and Future Outlook

The future of eprosartan mesylate appears subdued absent significant new clinical data or expanded indications. The pharmaceutical industry is increasingly focusing on personalized medicine, combination therapies, and novel mechanisms of action, positioning eprosartan as less competitive. Nonetheless, its legacy presence persists in select markets, especially where healthcare systems favor cost-effective antihypertensives.

Emerging generics continue to capture substantial market share where patent barriers have dissolved. Strategic opportunities include positioning eprosartan for use in resistant hypertension or leveraging combination formulations, although these avenues remain underexplored.

Market Drivers and Barriers

Key Drivers:

- Established efficacy in hypertension management

- Favorable tolerability profile

- Cost-effectiveness in certain healthcare systems

- Increasing global hypertensive population

Barriers:

- High competition from newer, more convenient fixed-dose combinations

- Limited brand differentiation

- Patent expirations leading to commoditization

- Lack of expanded indications or adjunctive therapies

Financial Trajectory Assessment

Analyzing available financial data, eprosartan's revenue generation has declined markedly since its peak. Growth prospects are constrained; the drug now functions primarily as a low-cost generic option in specific regions. Companies holding the rights are likely to pursue niche markets or pivot toward development of combination therapies or biosimilars in related therapeutic classes to sustain revenue streams.

The decline reflects broader industry trends—market consolidation, the need for innovation, and regulatory pressures—rather than intrinsic drug inadequacy. Its financial trajectory underscores the importance of continual innovation and strategic diversification in pharmaceutical portfolios.

Conclusion

Eprosartan mesylate exemplifies the complex interplay of regulatory, clinical, and competitive factors shaping a pharmaceutical product’s market lifecycle. Its initial promise as a selective ARB was tempered by intense competition, patent expiration, and evolving treatment paradigms. While it remains a viable antihypertensive in certain contexts, its future financial prospects hinge on strategic repositioning, such as integration into combination therapies or indication expansion.

Stakeholders must monitor regional market developments, patent landscapes, and emerging clinical data to achieve optimal positioning. For investors and pharmaceutical companies, eprosartan’s trajectory underscores the necessity of active lifecycle management, ongoing research, and market adaptation.

Key Takeaways

- Market entry for eprosartan mesylate was limited by regional regulatory hurdles; lack of FDA approval curtailed broader U.S. market penetration.

- Competition from established ARBs and fixed-dose combinations significantly limited eprosartan’s market share.

- Patent expirations and the rise of generic versions have driven revenue declines, emphasizing the importance of lifecycle management.

- The drug’s future hinges on strategic repositioning, potential combination formulations, or niche market focus.

- The case underscores broader industry trends of intense competition, patent cliffs, and the need for continuous innovation for sustained growth.

FAQs

1. Why did eprosartan mesylate not achieve widespread adoption compared to other ARBs?

Limited by regulatory approvals, notably the absence of FDA approval in the U.S., along with stiff competition from more established ARBs like losartan and valsartan, hampered its global adoption. Its relatively late entry and lack of additional clinical indications further constrained uptake.

2. How have patent expirations affected eprosartan’s market presence?

Patent expirations around 2013-2015 allowed generic manufacturers to enter the market, leading to significant price reductions and diminished revenues for the branded drug. This commoditization reduced profitability and market share.

3. What are the main factors limiting eprosartan’s growth today?

Face stiff competition from fixed-dose combination therapies, minimal differentiation from generic options, lack of new indications, and region-specific regulatory challenges restrict further growth.

4. Are there prospects for eprosartan mesylate in the treatment of resistant hypertension?

While theoretically plausible, there is limited clinical evidence or regulatory approval supporting its use beyond primary hypertension. Its future in resistant hypertension remains uncertain without dedicated trials.

5. Can eprosartan mesylate be repositioned as part of combination therapies?

Potentially, yes. Combining eprosartan with other antihypertensives could improve adherence and efficacy. However, such strategies require clinical validation and regulatory approval, which are currently lacking.

Sources

- European Medicines Agency. (2002). Eprosartan: Summary of Product Characteristics.

- MarketWatch. (2022). Global antihypertensive drug markets - Industry analysis.

- U.S. Food and Drug Administration. (Date). Drug Approvals and Denials.

- IMS Health. (2018). Cardiovascular drug sales data.

- PhRMA. (2021). Industry Trends - Oncology and Chronic Disease Treatments.