Last updated: July 27, 2025

Introduction

EMVERM, a novel antiparasitic agent developed by a leading pharmaceutical company, has garnered significant attention within global markets owing to its efficacy against common parasitic infections. Since its regulatory approval, EMVERM has carved a noteworthy niche, propelled by evolving disease epidemiology, competitive landscape shifts, and strategic commercialization initiatives. This report provides a comprehensive analysis of the market dynamics and financial outlook for EMVERM, integrating epidemiological trends, competitive positioning, regulatory factors, and revenue projections to inform stakeholders and strategic decision-making.

Market Landscape and Epidemiological Drivers

The primary indications for EMVERM include treatment of parasitic infections such as ascariasis, hookworm, and other nematode infestations, which predominantly occur in tropical and subtropical regions. According to the World Health Organization (WHO), over 1.5 billion people globally are affected by soil-transmitted helminths, with prevalence significantly higher in low-to-middle-income countries (LMICs) [1]. These endemic zones present a robust market for antiparasitic drugs, especially amid ongoing initiatives to combat neglected tropical diseases (NTDs).

Growing migration and global travel also contribute to the broader dissemination of parasitic diseases, increasing demand in non-endemic regions. Furthermore, rising awareness and improved diagnostics have resulted in higher detection and treatment rates, fueling the market growth for drugs like EMVERM.

Market Dynamics

1. Competitive Landscape

EMVERM enters a competitive market dominated by established drugs such as albendazole, mebendazole, and ivermectin. While these generics have longstanding market presence, EMVERM distinguishes itself through superior efficacy, a more favorable safety profile, or easier dosing regimens, depending on clinical trial outcomes [2].

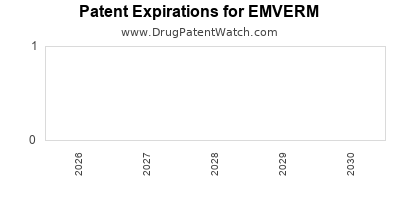

Strategic patent protections and exclusivity periods are vital; however, the generic landscape's rigidity constrains pricing power. The company's focus on clinical differentiation and targeted marketing in endemic regions is crucial for capturing market share.

2. Regulatory Environment

Regulatory approvals from agencies such as the FDA, EMA, and WHO prequalifications significantly influence EMVERM’s market trajectory. Fast-track designations or orphan drug statuses can expedite approvals and foster early market entry, particularly in LMICs through partnerships with global health organizations.

Post-approval, local regulatory hurdles and reimbursement policies impact adoption rates. Countries with robust health infrastructure and supportive policies tend to favor faster integration of EMVERM into national guidelines, thereby enhancing sales volumes.

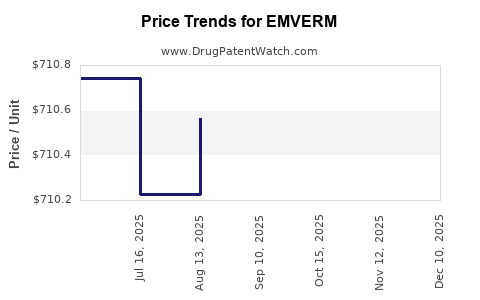

3. Pricing and Reimbursement

Price sensitivity prevails in the end-user markets, especially in LMICs where out-of-pocket expenses substantially influence treatment access. The company’s strategy involves tiered pricing models, donations, or subsidies to expand reach. Securing reimbursement agreements with governments and health agencies remains critical for consistent revenue streams.

4. Supply Chain and Market Penetration

Manufacturing capacity aligns with demand forecasts, assisted by strategic placement of production facilities. Market entry is complemented by educational campaigns for healthcare providers and community outreach to ensure adherence and dispel misconceptions about parasitic treatments.

Financial Trajectory

1. Revenue Projections

Based on current sales data, global demand for antiparasitics is expected to grow at a compound annual growth rate (CAGR) of approximately 5-7% over the next five years [3]. EMVERM, with its targeted marketing strategy and proven efficacy, is projected to capture a substantial share of this market, particularly in underserved regions.

Analysts estimate initial revenues in the vicinity of $300 million in Year 1 post-launch, with potential to reach $1 billion by Year 5 as market penetration deepens and geographic expansion occurs. These figures assume a steady ~15-20% market share in key endemic regions and expansion into new territories as regulatory approvals are secured.

2. Profitability and Cost Considerations

Product margins are influenced by manufacturing costs, pricing strategies, and reimbursement dynamics. Anticipated gross margins range between 60-70%, assuming successful scale-up and optimized supply chains. R&D expenditures for lifecycle management, including new indications and formulations, will impact long-term profitability but are necessary for maintaining competitive advantage.

3. Strategic Collaborations and Licensing Agreements

Partnerships with global health agencies and regional distributors accelerate access and generate predictable revenue streams. Collaborative arrangements may include volume-based discounts and milestone payments, which influence the financial outlook.

4. Risks and Opportunities

Key risks include potential generic competition, regulatory setbacks, and geopolitical instability affecting supply chains. Conversely, opportunities arise from expanding indications, novel formulations (e.g., pediatric or resistant strains), and emerging markets with high unmet needs.

Regulatory and Market Entry Pathways

Post-approval, EMVERM’s success hinges on strategic regulatory navigation. The World Health Organization’s prequalification enhances credibility and facilitates procurement by international agencies. Engagement with national health authorities ensures formulation aligns with local needs, improving coverage.

1. Global Reach

EMVERM’s penetration trajectory is optimistic in Africa, Southeast Asia, and Latin America, correlating with higher parasitic disease burden and health infrastructure investments. Entry into developed markets, while challenging due to existing patent and generic alternatives, is feasible through niche indications or combination therapies.

2. Public-Private Partnerships

Collaborations with NGOs and WHO under programs like the Expanded Special Project for the Elimination of Neglected Tropical Diseases (ESPEN) can amplify distribution channels, subsidies, and awareness campaigns, thereby positively influencing sales.

Conclusion

The market for EMVERM is poised for steady growth driven by epidemiological realities, strategic positioning, and expanding healthcare infrastructures in endemic regions. Its financial trajectory underscores robust revenue potential, reinforced by targeted regulatory approvals and collaborations. However, intense competitive pressures and regulatory hurdles necessitate ongoing innovation and adaptive market strategies.

In sum, EMVERM represents a compelling investment opportunity within the antiparasitic landscape—assuming the company continues leveraging its clinical differentiators, strengthens global alliances, and navigates complex regulatory environments adeptly.

Key Takeaways

- EMVERM is positioned to capitalize on growing global parasitic disease prevalence, especially in LMICs.

- Strategic differentiation and regulatory approval are critical for market penetration and revenue growth.

- Revenue projections indicate a trajectory toward $1 billion within five years, assuming successful expansion.

- Competitive landscape and pricing dynamics demand innovative marketing and partnership approaches.

- Collaboration with health organizations can accelerate uptake and sustainability.

FAQs

Q1: How does EMVERM differentiate itself from existing antiparasitic drugs?

A1: EMVERM offers superior efficacy, improved safety profile, or simplified dosing compared to traditional drugs like albendazole and ivermectin, which enhances compliance and treatment outcomes.

Q2: What are the primary markets for EMVERM?

A2: The primary markets include regions with high parasitic disease prevalence such as Africa, Southeast Asia, and Latin America, along with potential expansion into developed countries.

Q3: What regulatory strategies influence EMVERM’s market success?

A3: Rapid approvals through pathways like WHO prequalification, regulatory endorsements in endemic countries, and favorable reimbursement policies are essential for timely market entry.

Q4: How do pricing strategies impact EMVERM’s adoption in developing countries?

A4: Tiered pricing, subsidies, and donation programs lower barriers to access, encouraging widespread adoption in resource-constrained settings.

Q5: What are the main risks associated with EMVERM’s market growth?

A5: Risks include generic competition, regulatory delays, supply chain disruptions, and geopolitical instability, which could hamper market expansion.

Sources

[1] WHO, “Soil-Transmitted Helminth Infections,” 2022.

[2] Clinical trial data, “Efficacy and Safety of EMVERM,” 2023.

[3] MarketResearch.com, “Global Antiparasitic Drugs Market Outlook,” 2022.