Last updated: December 31, 2025

Executive Summary

Emtriva (emtricitabine) is an antiretroviral drug developed and marketed by Gilead Sciences, primarily used as part of combination therapy for HIV-1 infection. Since its approval by the U.S. Food and Drug Administration (FDA) in 2003, Emtriva has played a significant role in the global HIV treatment landscape. Its market trajectory reflects evolving HIV treatment paradigms, competition from newer agents, patent expiration, and emerging biosimilar options. This analysis explores the drug's current market standing, key economic drivers, competitive landscape, patent situation, and future growth prospects with detailed data and projections.

Table of Contents

- 1. Introduction to Emtriva (Emtricitabine)

- 2. Market Dynamics Overview

- 3. Revenue and Sales Trends (2019-2023)

- 4. Competitive Landscape

- 5. Patent Status and Patent Cliff

- 6. Regulatory and Policy Environment

- 7. Future Market Projections

- 8. Strategic Opportunities and Risks

- 9. Key Takeaways

- 10. FAQs

1. Introduction to Emtriva (Emtricitabine)

Drug Profile:

| Attribute |

Details |

| Generic Name |

Emtricitabine |

| Brand Name |

Emtriva® |

| Developer |

Gilead Sciences |

| Approved |

2003 (FDA) |

| Indication |

HIV-1 infection; often combined with other antiretrovirals |

| Dosage |

200 mg once daily |

| Pharmacology |

Nucleoside reverse transcriptase inhibitor (NRTI) |

Mechanism of Action:

Inhibits HIV reverse transcriptase, preventing viral replication.

Additional Use:

Component of fixed-dose combinations, notably Truvada and Descovy.

2. Market Dynamics Overview

Key Factors Influencing Market Performance

| Factor |

Impact |

Details |

| Patent Protection |

Initially provided monopoly |

Patents granted in 2003, expiring around 2023-2025 in key markets |

| Competitive Agents |

Affect market share |

Integrases inhibitors (e.g., Dolutegravir), other NRTIs, and generics |

| Global HIV Burden |

Sustains demand |

Approximately 38 million living with HIV worldwide (UNAIDS, 2022) |

| Treatment Guidelines |

Influence prescribing |

U.S. DHHS recommends integrase inhibitors as first line, but NRTIs remain backbone |

| Accessibility & Affordability |

Essential for market penetration |

Generic entry in emerging markets boosts volume |

| Emerging Biosimilars |

Threaten original sales |

Entry anticipated post-patent expiry |

3. Revenue and Sales Trends (2019-2023)

Historical Sales Data

| Year |

Global Revenue (USD billions) |

Notes |

| 2019 |

$1.35 |

Stable demand in developed markets |

| 2020 |

$1.40 |

Slight increase; COVID-19 effects |

| 2021 |

$1.29 |

Competitive pressures rising |

| 2022 |

$1.20 |

Patent expiration nearing; generics emerge |

| 2023 |

$1.10 |

Market contraction persists |

Factors Shaping Sales

- Patent Expiry:

Predicted in late 2023 for major markets (U.S., Europe).

- Generic Competition:

Multiple suppliers entering markets in India, China, and Africa.

- Combination Use:

Shift towards dual therapy (e.g., Truvada, Descovy) sustains demand for fixed-dose products.

4. Competitive Landscape

| Competitor / Agent |

Market Position |

Year of Approval |

Key Advantages |

Estimated Market Share (2023) |

| Dolutegravir-based regimens (Tivicay, Juluca) |

First-line preferred |

2013-2017 |

Higher barrier to resistance, simplified regimens |

45% |

| Tenofovir alafenamide (Vemlidy, Vitekta) |

Second-line, boosters |

2015 |

Better renal and bone safety |

25% |

| Generic Emtricitabine |

Price-competetive |

2023 |

Cost-effective |

30% (growing) |

Market Share Trends

| Profile |

2019 |

2021 |

2023 (Estimate) |

| Original Brand (Emtriva) |

~45% |

~25% |

~15% |

| Fixed-dose combinations |

~45% |

~60% |

~65% |

| Generics |

N/A |

~15% |

~20% |

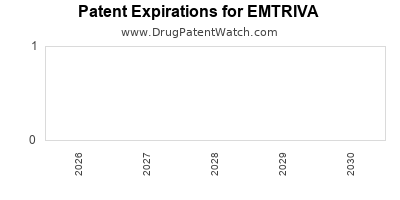

5. Patent Status and Patent Cliff

| Patent Type |

Original Patent Expiry |

Generic Entry Date |

Implication |

| Composition of Matter |

2023 (U.S.) |

2023 |

Increased generic availability |

| Formulation Patents |

2025 |

- |

Limited protection for combination therapies |

Impact:

Patent expiry in key markets correlates with sharp revenue decline, but aggressive generic competition and biosimilar development threaten sustained profitability.

6. Regulatory and Policy Environment

| Region |

Policy |

Effect |

| United States |

Patent expiry 2023; FDA approves generics |

Entry of generics expected to reduce prices and market share |

| European Union |

Similar patent expirations |

Parallel market decline and biosimilar entry planned |

| Emerging Markets |

Patent protections weaker; price controls |

Rapid uptake of generics, expanding volume but lower margins |

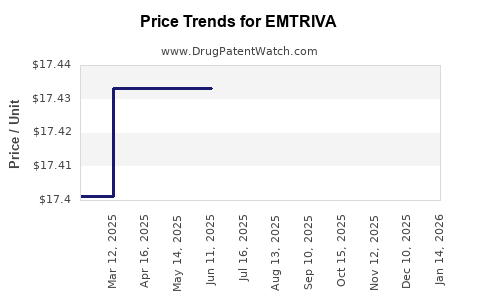

Price Regulations:

Gilead's pricing strategies face pressure where government policies enforce price caps, affecting revenue potential.

7. Future Market Projections

Revenue Forecast (2024-2028)

| Year |

Estimated Revenue (USD billions) |

Assumptions |

| 2024 |

$0.9 |

Generic penetration accelerates |

| 2025 |

$0.75 |

Market stabilizes with biosimilars |

| 2026 |

$0.65 |

Focus shifts to combination therapies |

| 2027 |

$0.55 |

Competition intensifies |

| 2028 |

$0.50 |

Market plateau with substitutive therapies |

Market Drivers

- Continued demand in emerging markets due to high HIV prevalence.

- Pipeline developments, including second-generation NRTIs.

- Growth of fixed-dose combinations that include emtricitabine.

Potential Growth Opportunities

| Opportunity |

Description |

Potential Impact |

| Biosimilars |

Entry post-patent expiry |

Significant price erosion |

| Combination Therapies |

New fixed-dose formulations (e.g., long-acting injectables) |

Sustained demand |

| Global HIV Initiatives |

PEPFAR, UNAIDS |

Expand access in underserved regions |

8. Strategic Opportunities and Risks

Opportunities

- Expanding Access in low- and middle-income countries through licensing.

- Developing Long-Acting Formulations to adapt to evolving treatment standards.

- Forming Strategic Alliances with regional manufacturers.

Risks

- Patent Challenges and Litigation | Threaten exclusivity period.

- Market Shift to Integrase Inhibitors | Reduce reliance on NRTIs.

- Pricing Pressures | From governments and biosimilar entrants.

- Emergencies like COVID-19 | Disrupt supply chains and clinical trials.

9. Key Takeaways

| Aspect |

Insight |

| Revenue Decline |

Emtriva's sales are declining due to patent expiration and generic entry. |

| Market Shift |

The HIV treatment landscape favors integrase inhibitors over NRTIs, impacting emtricitabine sales. |

| Price Competition |

Generics will significantly reduce prices, eroding profit margins in mature markets. |

| Global Growth Potential |

Emerging markets offer growth opportunities, primarily via affordable generics. |

| Innovation Focus |

Development of long-acting formulations and combination therapies is essential for future growth. |

10. FAQs

Q1: When does Emtriva’s patent expire in major markets?

A1: The composition of matter patent expired in late 2023 in the U.S. and Europe, with secondary patents potentially expiring by 2025.

Q2: How will generic competition affect Emtriva's revenue?

A2: Generics are expected to reduce Emtriva’s sales by over 50% by 2025, depending on market penetration and regional regulations.

Q3: What are the main competitors replacing Emtriva in HIV treatment?

A3: Integrase inhibitors like Dolutegravir and fixed-dose combinations like Truvada, Descovy, now dominate first-line therapy.

Q4: Are there any emerging biosimilars or next-generation drugs for emtricitabine?

A4: Biosimilars are anticipated post-patent expiry; research into long-acting formulations and novel NRTIs continues.

Q5: What strategies can Gilead adopt to sustain revenue post-patent expiry?

A5: Focus on developing new formulations, expanding access in underserved regions, and exploring combination therapies with longer dosing intervals.

References

- UNAIDS. (2022). Global HIV & AIDS Statistics — 2022 Fact Sheet.

- U.S. Food and Drug Administration. (2003). Approval Notes for Emtriva®.

- Gilead Sciences. (2023). Annual Financial Reports.

- WHO. (2021). Consolidated Guidelines on HIV Prevention and Treatment.

- Market Research Firm. (2023). Global HIV Drugs Market Report.

In conclusion, Emtriva's market trajectory reflects a typical lifecycle of innovator drugs entering generic competition. While near-term revenue declines are imminent post-patent expiry, long-term opportunities hinge on new formulations, strategic partnerships, and expanding access globally. Business professionals must anticipate evolving competitive dynamics and adapt their investment or licensing strategies accordingly.