DUZALLO Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Duzallo, and what generic alternatives are available?

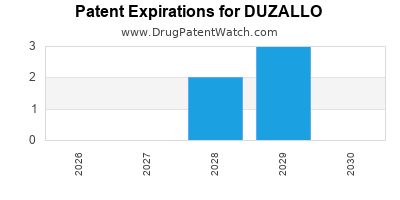

Duzallo is a drug marketed by Ironwood Pharms Inc and is included in one NDA. There are nine patents protecting this drug.

This drug has two hundred and one patent family members in forty-three countries.

The generic ingredient in DUZALLO is allopurinol; lesinurad. There are twenty-two drug master file entries for this compound. Additional details are available on the allopurinol; lesinurad profile page.

DrugPatentWatch® Generic Entry Outlook for Duzallo

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be February 29, 2032. This may change due to patent challenges or generic licensing.

There have been five patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for DUZALLO?

- What are the global sales for DUZALLO?

- What is Average Wholesale Price for DUZALLO?

Summary for DUZALLO

| International Patents: | 201 |

| US Patents: | 9 |

| Applicants: | 1 |

| NDAs: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 1 |

| Drug Prices: | Drug price information for DUZALLO |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for DUZALLO |

| DailyMed Link: | DUZALLO at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for DUZALLO

Generic Entry Date for DUZALLO*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

US Patents and Regulatory Information for DUZALLO

DUZALLO is protected by nine US patents.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of DUZALLO is ⤷ Get Started Free.

This potential generic entry date is based on patent 8,546,436.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Ironwood Pharms Inc | DUZALLO | allopurinol; lesinurad | TABLET;ORAL | 209203-001 | Aug 18, 2017 | DISCN | Yes | No | 9,216,179 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Ironwood Pharms Inc | DUZALLO | allopurinol; lesinurad | TABLET;ORAL | 209203-002 | Aug 18, 2017 | DISCN | Yes | No | 8,546,436 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| Ironwood Pharms Inc | DUZALLO | allopurinol; lesinurad | TABLET;ORAL | 209203-001 | Aug 18, 2017 | DISCN | Yes | No | 10,183,012 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Ironwood Pharms Inc | DUZALLO | allopurinol; lesinurad | TABLET;ORAL | 209203-001 | Aug 18, 2017 | DISCN | Yes | No | 8,283,369 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

Expired US Patents for DUZALLO

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Ironwood Pharms Inc | DUZALLO | allopurinol; lesinurad | TABLET;ORAL | 209203-002 | Aug 18, 2017 | 8,003,681 | ⤷ Get Started Free |

| Ironwood Pharms Inc | DUZALLO | allopurinol; lesinurad | TABLET;ORAL | 209203-001 | Aug 18, 2017 | 8,003,681 | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

EU/EMA Drug Approvals for DUZALLO

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Grunenthal GmbH | Duzallo | allopurinol, lesinurad | EMEA/H/C/004412Duzallo is indicated in adults for the treatment of hyperuricaemia in gout patients who have not achieved target serum uric acid levels with an adequate dose of allopurinol alone. | Withdrawn | no | no | no | 2018-08-23 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for DUZALLO

When does loss-of-exclusivity occur for DUZALLO?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 4639

Patent: FORMAS POLIMORFICAS DE ACIDO 2-(5-BROMO-4-(4-CICLOPROPILNAFTALEN-1-IL)-4H-1,2,4-TRIAZOL-3-ILTIO)ACETICO Y USOS DEL MISMO

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 11352129

Patent: Polymorphic forms of 2-(5-bromo-4-(4-cyclopropylnaphthalen-1-yl)-4H-1,2,4-triazol-3-3ylthio)acetic acid and uses thereof

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2013016982

Patent: formas polimórficas de ácido 2-(5-bromo-4-(4-ciclopropilnaftalen-1-il)-4h-1,2,4-triazol-3-iltio)acético e usos destes

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 17249

Patent: FORMES POLYMORPHES DE L'ACIDE 2-(5-BROMO-4-(4-CYCLOPROPYLNAPHTALEN-1-YL)-4H-1,2,4-TRIAZOL-3-YLTHIO) ACETIQUE ET LEURS UTILISATIONS (POLYMORPHIC FORMS OF 2-(5-BROMO-4-(4-CYCLOPROPYLNAPHTHALEN-1-YL)-4H-1,2,4-TRIAZOL-3-YLTHIO) ACETIC ACID AND USES THEREOF)

Estimated Expiration: ⤷ Get Started Free

China

Patent: 3298796

Patent: Polymorphic forms of 2-(5-bromo-4-(4-cyclopropylnaphthalen-1-yl)-4H-1,2,4-triazol-3-ylthio) acetic acid and uses thereof

Estimated Expiration: ⤷ Get Started Free

Croatia

Patent: 0170187

Estimated Expiration: ⤷ Get Started Free

Cyprus

Patent: 18621

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 58846

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 2301

Patent: ПОЛИМОРФНЫЕ ФОРМЫ 2-(5-БРОМ-4-(4-ЦИКЛОПРОПИЛНАФТАЛИН-1-ИЛ)-4H-1,2,4-ТРИАЗОЛ-3-ИЛТИО)УКСУСНОЙ КИСЛОТЫ И ИХ ПРИМЕНЕНИЕ (POLYMORPHIC FORMS OF 2-(5-BROMO-4-(4-CYCLOPROPYLNAPHTHALEN-1-YL)-4H-1,2,4-TRIAZOL-3-YLTHIO)ACETIC ACID AND USES THEREOF)

Estimated Expiration: ⤷ Get Started Free

Patent: 1370150

Patent: ПОЛИМОРФНЫЕ ФОРМЫ 2-(5-БРОМ-4-(4-ЦИКЛОПРОПИЛНАФТАЛИН-1-ИЛ)-4H-1,2,4-ТРИАЗОЛ-3-ИЛТИО)УКСУСНОЙ КИСЛОТЫ И ИХ ПРИМЕНЕНИЕ

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 58846

Patent: FORMES POLYMORPHES DE L'ACIDE 2-(5-BROMO-4-(4-CYCLOPROPYLNAPHTALEN-1-YL)-4H-1,2,4-TRIAZOL-3-YLTHIO) ACÉTIQUE ET LEURS UTILISATIONS (POLYMORPHIC FORMS OF 2-(5-BROMO-4-(4-CYCLOPROPYLNAPHTHALEN-1-YL)-4H-1,2,4-TRIAZOL-3-YLTHIO) ACETIC ACID AND USES THEREOF)

Estimated Expiration: ⤷ Get Started Free

Hungary

Patent: 31766

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 6367

Patent: צורות פולימורפיות גבישיות של 2-(5-ברומו-4-(4-ציקלופרופילנפתלן -1-איל)-4h-4,2,1-טריאזול-3-אילתיאו) חומצה אצטית, תכשירי רוקחות מוצקים המכילים אותן ושיטות להכנתן (Polymorphic forms of crystalline polymorph of 2-(5-bromo-4-(4-cyclopropylnaphthalen-1-yl)4h-1,2,4-triazol-3-ylthio) acetic acid, solid pharmaceutical compositions comprising them and a process for their preparation)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 81627

Estimated Expiration: ⤷ Get Started Free

Patent: 14501282

Estimated Expiration: ⤷ Get Started Free

Patent: 15172053

Patent: 2−(5−ブロモ−4−(4−シクロプロピルナフタレン−1−イル)−4H−1,2,4−トリアゾル−3−イルチオ)酢酸の多形形態およびその使用 (POLYMORPHIC FORMS OF 2-(5-BROMO-4-(4-CYCLOPROPYLNAPHTHALEN-1-YL)-4H-1,2,4-TRIAZOL-3-YLTHIO)ACETIC ACID AND USES THEREOF)

Estimated Expiration: ⤷ Get Started Free

Lithuania

Patent: 58846

Estimated Expiration: ⤷ Get Started Free

Malaysia

Patent: 2534

Patent: POLYMORPHIC FORMS OF 2-(5-BROMO-4-(4-CYCLOPROPYLNAPHTHALEN-1-YL)-4H-1,2,4-TRIAZOL-3-YLTHIO)ACETIC ACID AND USES THEREOF

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 13007505

Patent: FORMAS POLIMORFICAS DE ACIDO 2-(5-BROMO-4-(4-CICLOPROPILNAFTALEN-1 -IL)-4H-1,2,4-TRIAZOL-3-ILTIO)ACETICO Y USOS DE LOS MISMOS. (POLYMORPHIC FORMS OF 2-(5-BROMO-4-(4-CYCLOPROPYLNAPHTHALEN-1-YL)- 4H-1,2,4-TRIAZOL-3-YLTHIO) ACETIC ACID AND USES THEREOF.)

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 0104

Patent: Polymorphic forms of 2-(5-bromo-4-(4-cyclopropylnaphthalen-1-yl)-4h-1,2,4-triazol-3-ylthio) acetic acid and uses thereof

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 58846

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 58846

Estimated Expiration: ⤷ Get Started Free

Serbia

Patent: 667

Patent: POLIMORFNE FORME 2-(5-BROMO-4-(4-CILKOPROPILNAFTALEN-1-IL)-4H-1,2,4-TRIAZOL-3-ILTIO) SIRĆETNE KISELINE I NJIHOVA UPOTREBA (POLYMORPHIC FORMS OF 2-(5-BROMO-4-(4-CYCLOPROPYLNAPHTHALEN-1-YL)-4H-1,2,4-TRIAZOL-3-YLTHIO) ACETIC ACID AND USES THEREOF)

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 0902

Patent: POLYMORPHIC FORMS OF 2-(5-BROMO-4-(4-CYCLOPROPYLNAPHTHALEN-1-YL)-4H-1,2,4-TRIAZOL-3-YLTHIO) ACETIC ACID AND USES THEREOF

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 58846

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1303253

Patent: POLYMORPHIC FORMS OF 2-(5-BROMO-4-(4-CYCLOPROPYLNAPHTHALEN-1-YL)-4H-1,2,4-TRIAZOL-3-YL-THIO)ACETIC ACID AND USES THEREOF

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1541629

Estimated Expiration: ⤷ Get Started Free

Patent: 130105902

Patent: POLYMORPHIC FORMS OF 2-(5-BROMO-4-(4-CYCLOPROPYLNAPHTHALEN-1-YL)-4H-1,2,4-TRIAZOL-3-YLTHIO)ACETIC ACID AND USES THEREOF

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 14914

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 52037

Estimated Expiration: ⤷ Get Started Free

Patent: 1302718

Patent: Polymorphic forms of 2-(5-bromo-4-(4-cyclopropylnaphthalen-1-yl)-4H-1,2,4-triazol-3-ylthio)acetic acid and uses thereof

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 9172

Patent: ПОЛІМОРФНА ФОРМА 2-(5-БРОМ-4-(4-ЦИКЛОПРОПІЛНАФТАЛІН-1-ІЛ)-4H-1,2,4-ТРИАЗОЛ-3-ІЛТІО)ОЦТОВОЇ КИСЛОТИ (ВАРІАНТИ) ТА ЇЇ ЗАСТОСУВАННЯ

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering DUZALLO around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Israel | 201546 | 2-(5-ברומו-4-(4-ציקלופרופילנפתלן-1-איל)-h4- 1, 2, 4-טריאזול-3-תיאו) חומצה אצטית ומתיל האסטר (2-(5-bromo-4-(4-cyclopropylnaphthalen-1-yl)-4h-1,2,4-triazol-3-ylthio)acetic acid and methyl ester thereof) | ⤷ Get Started Free |

| Japan | 2015172053 | ⤷ Get Started Free | |

| Canada | 2736117 | ⤷ Get Started Free | |

| South Korea | 20090111357 | S-TRIAZOLYL ?-MERCAPTOACETANILIDES AS INHIBITORS OF HIV REVERSE TRANSCRIPTASE | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for DUZALLO

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2135608 | C 2016 027 | Romania | ⤷ Get Started Free | PRODUCT NAME: LESINURAD SAU O SARE ACCEPTABILA FARMACEUTIC AACESTUIA; NATIONAL AUTHORISATION NUMBER: EU/1/15/1080; DATE OF NATIONAL AUTHORISATION: 20160218; NUMBER OF FIRST AUTHORISATION IN EUROPEAN ECONOMIC AREA (EEA): EU/1/15/1080; DATE OF FIRST AUTHORISATION IN EEA: 20160218 |

| 2217577 | LUC00103 | Luxembourg | ⤷ Get Started Free | PRODUCT NAME: DUZALLO - ALLOPURINOL/LESINURAD OU UN/DES SEL(S) PHARMACEUTIQUEMENT ACCEPTABLE(S) DE CELUI-CI; AUTHORISATION NUMBER AND DATE: EU/1/18/1300 20180827 |

| 2217577 | 122019000008 | Germany | ⤷ Get Started Free | PRODUCT NAME: DUZALLO - ALLOPURINOL / LESINURAD ODER EIN PHARMAZEUTISCH VERTRAEGLICHES SALZ ODER VERTRAEGLICHE SALZE DAVON; REGISTRATION NO/DATE: EU/1/18/1300 20180823 |

| 2217577 | 2019C/502 | Belgium | ⤷ Get Started Free | PRODUCT NAME: DUZALLO - ALLOPURINOL / LESINURAD OU UN SEL PHARMACEUTIQUEMENT ACCEPTABLE OU UN DE SES SELS; AUTHORISATION NUMBER AND DATE: EU/1/18/1300 20180827 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for DUZALLO

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.