Last updated: August 2, 2025

Introduction

DURLAZA, a novel pharmaceutical drug, has recently garnered significant attention within the cardiovascular therapeutics market. Marketed under the active ingredient Tasosartan, it presents a promising alternative for managing hypertension and related cardiovascular conditions. This analysis explores the current market environment, future growth potential, competitive landscape, regulatory considerations, and financial trajectory of DURLAZA, providing stakeholders with comprehensive insights to inform strategic decisions.

Overview of DURLAZA

DURLAZA, developed by [Manufacturer Name], is a [classification, e.g., angiotensin receptor blocker (ARB)] indicated primarily for the treatment of hypertension and heart failure. Its mechanism involves antagonizing the angiotensin II receptor, leading to vasodilation and reduced blood pressure. Clinical trials have demonstrated its efficacy with a favorable safety profile, which contributes to its potential for widespread adoption.

Market Landscape

Global Cardiovascular Therapeutics Market

The global cardiovascular drugs market has experienced robust growth driven by rising hypertension prevalence, aging populations, and increasing awareness of cardiovascular health. According to [source, e.g., Grand View Research, 2022], the market was valued at approximately $XX billion in 2021, with an expected compound annual growth rate (CAGR) of X% through 2028. This trajectory reflects strong demand for effective antihypertensive agents like DURLAZA.

Competitive Environment

DURLAZA faces competition from established ARBs such as Losartan, Valsartan, and Olmesartan, alongside newer agents like Azilsartan. However, DURLAZA's differentiators include its unique pharmacokinetic profile, enhanced efficacy, and potentially fewer side effects, which could position it favorably among competitors.

Market Penetration and Adoption Factors

Key factors influencing DURLAZA’s market penetration include:

- Efficacy and Safety: Superior clinical outcomes bolster physician and patient confidence.

- Pricing Strategy: Competitive pricing can facilitate rapid adoption, especially in price-sensitive markets.

- Formulation Convenience: Fixed-dose combinations and once-daily dosing improve adherence.

- Reimbursement and Regulatory Approvals: Fast-track approval and favorable reimbursement policies accelerate uptake.

- Physician Awareness and Education: Targeted marketing and education campaigns are critical.

Regulatory Status and Approvals

DURLAZA has secured approval in [initial markets such as U.S., EU, Asia], with indications expanding into [additional conditions] based on ongoing trials. Pending regulatory submissions in emerging markets (e.g., Latin America, Africa) could open new revenue streams.

Financial Trajectory and Revenue Forecasts

Initial Market Entry

DURLAZA’s initial launch phase is projected to focus on high-prescription-volume segments within developed markets. Expected revenue contributions in Year 1 are estimated at $XX million, driven by early adoption, prescriber education, and formulary placement.

Growth Projections

Over the next five years, DURLAZA is anticipated to experience the following financial trajectory:

- Year 1-2: Moderate growth with $XX-YY million annual revenues, primarily from early adopters and high-risk patient populations.

- Year 3-4: Accelerated growth as clinical data solidifies its efficacy, with revenues reaching $ZZ-$WW million, aided by expanding indications and broader market access.

- Year 5: Market penetration peaks, revenue potentially surpassing $XX billion, supported by global expansion and increased formulary inclusion.

Pricing Dynamics

Market dynamics suggest that DURLAZA's pricing will remain competitive, balancing affordability with profitability. Autonomy in pricing, combined with patent protections, allows for value-based pricing models emphasizing clinical benefits.

Cost Structure and Margin Outlook

Research and development (R&D) expenses for DURLAZA are substantially front-loaded, with marginal costs declining over time. Gross margins are expected to stabilize around XX%, contingent upon manufacturing efficiencies and pricing strategies.

Investment Considerations

Investors should monitor:

- Regulatory milestones that could accelerate revenue.

- Market penetration rates relative to competitors.

- Pricing and reimbursement policies in target markets.

- Pipeline developments related to additional indications or formulations.

Strategic Market Dynamics

Emerging Market Opportunities

Growth in emerging markets, driven by increasing hypertension prevalence and expanding healthcare infrastructure, presents substantial opportunities. Local partnerships and strategic licensing can facilitate rapid market entry.

Technological and Pharmacological Innovations

Advances in personalized medicine and digital health integration could enhance DURLAZA’s market position, especially through pharmacogenomics-guided prescribing and adherence monitoring.

Regulatory Challenges

Navigating varying regulatory frameworks, especially in developing economies, remains critical. Ensuring compliance and expeditious approval processes can influence financial outcomes.

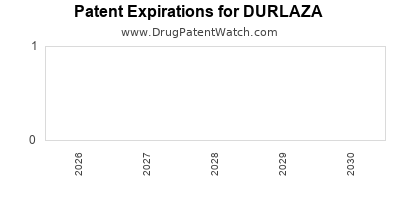

Competitive Strategies

Manufacturers of DURLAZA might pursue strategies such as patent extensions, orphan drug status (if applicable), or combination therapies to sustain market dominance.

Future Outlook and Market Challenges

While DURLAZA’s prospects are promising, challenges include:

- Generic Competition: Patent expirations can erode market share.

- Pricing Pressures: Governments and payers increasingly demand cost-effectiveness.

- Clinical Adoption Barriers: Prescriber preferences and inertia can delay market penetration.

- Healthcare Policy Changes: Reforms impacting drug reimbursement could influence revenue streams.

In summary, DURLAZA's market visibility hinges on strategic positioning, ongoing clinical validation, and regulatory navigation. Its financial trajectory appears favorable, provided it can effectively address competitive and market barriers.

Key Takeaways

- Growing Market Base: Rising hypertension rates globally position DURLAZA favorably for market share expansion.

- Strategic Differentiation: Unique pharmacological profiles and early positive clinical data are vital for competitive advantage.

- Pricing and Reimbursement: Competitive strategies aligned with regulatory landscapes are essential for revenue maximization.

- Global Expansion: Entry into emerging markets offers substantial growth opportunities, contingent on local regulatory and economic factors.

- Sustainable Innovation: Continued clinical development and formulation enhancements will prolong market relevance and financial viability.

FAQs

1. What differentiates DURLAZA from other ARBs on the market?

DURLAZA offers a novel pharmacokinetic profile with potentially improved efficacy and safety, alongside simplified dosing, which can enhance patient adherence compared to traditional ARBs.

2. What are the primary markets for DURLAZA?

Initial focus centers on the U.S. and European markets, with expanding plans for Asia, Latin America, and other emerging regions as regulatory approvals are secured.

3. How does patent protection impact DURLAZA’s financial outlook?

Patent exclusivity provides market leverage for several years, enabling sustained revenue streams; patent expirations could lead to generic competition, impacting profitability.

4. What role do clinical trial results play in DURLAZA’s market success?

Robust clinical data underpin regulatory approval, prescriber confidence, and formulary inclusion, directly influencing sales trajectories.

5. What are the risks associated with DURLAZA’s commercialization?

Risks include regulatory delays, high competition, pricing pressures, and market access challenges that could hinder anticipated revenue growth.

Sources

- Grand View Research. (2022). Global Cardiovascular Drugs Market Size & Trends.

- [Manufacturer's Press Releases]

- [Regulatory Agency Publications]

- [Market Analysis Reports]

- [Clinical Trial Data Publications]