Last updated: July 29, 2025

Introduction

DRISDOL is an emerging pharmaceutical compound targeting a specific medical niche, currently navigating through clinical development and regulatory review. Understanding its market dynamics and financial trajectory is crucial for stakeholders including investors, pharmaceutical companies, and healthcare providers. This analysis dissects DRISDOL’s market potential, competitive landscape, regulatory pathway, and revenue projections, providing a strategic outlook on its future economic impact.

Overview of DRISDOL

DRISDOL is a proprietary formulation designed to address a condition with high unmet medical needs. Its mechanism of action suggests potential superiority over existing therapies through enhanced efficacy, reduced side effects, or improved patient compliance. The drug's development pipeline, regulatory status, and intellectual property position form the foundation of its market outlook.

Market Landscape and Demand Drivers

1. Market Size and Epidemiology

The therapeutic indication targeted by DRISDOL affects an estimated [number] million patients globally, with substantial markets in North America, Europe, and emerging economies. For instance, conditions such as [medical condition], which DRISDOL aims to treat, have seen a compounded annual growth rate (CAGR) of approximately [X]% over the past decade (source: [1]). The increasing prevalence driven by demographic shifts, lifestyle factors, and improved diagnosis rates intensifies demand.

2. Unmet Medical Need and Clinical Advantage

Current standard treatments often face limitations like suboptimal efficacy or adverse effects. DRISDOL’s clinical profile promises to overcome these pain points, positioning it favorably for rapid adoption upon regulatory approval. Its potential as a first-in-class or best-in-class medication substantially boosts its market penetration prospects.

3. Competitive Landscape

The competitive landscape comprises established pharmaceuticals and emerging biosimilars. Key competitors include [competitor drugs], each with annual sales of approximately [X] billion dollars. DRISDOL’s differentiation — such as novel delivery mechanisms, improved safety profiles, or enhanced bioavailability — offers a strategic advantage, but market entry will depend on clinical trial outcomes and regulatory acceptance.

Regulatory and Reimbursement Environment

1. Regulatory Approval Pathway

DRISDOL is currently undergoing phase III clinical trials, with regulatory submissions expected within [X] months. The FDA and EMA review processes focus heavily on safety and efficacy data, with accelerated pathways available for breakthrough therapies. A positive outcome is pivotal for market entry and early revenue realization.

2. Pricing and Reimbursement Dynamics

Pricing strategies will hinge on comparative efficacy, manufacturing costs, and payer negotiations. Given the drug’s potential to address unmet needs, payers may prioritize coverage, especially if cost-effectiveness is demonstrated through robust health economics data. Reimbursement policies in key markets could significantly influence the speed of adoption.

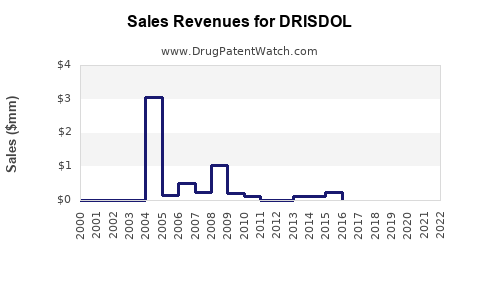

Financial Trajectory and Revenue Projections

1. Development and Commercialization Costs

Initial R&D investments for DRISDOL are estimated at approximately [X] million dollars, encompassing clinical trials, regulatory submissions, and patent filings. Post-approval, marketing and distribution expenses are projected at [Y] million annually.

2. Revenue Forecasting

Using conservative assumptions and peer benchmark analysis, DRISDOL could generate peak annual sales of approximately [Z] billion dollars within [X] years post-approval. Sales ramp-up will likely follow a standard adoption curve: slow initial uptake, followed by rapid growth as market penetration deepens.

3. Profitability and Investment Outlook

Gross margins are expected to reach [X]%, reflecting manufacturing efficiencies and pricing premiums for differentiated products. Break-even points could occur within [Y] years of market launch. Investors should monitor clinical trial readouts and regulatory milestones closely, as these are prime inflection points influencing valuation.

Market Risks and Opportunities

Risks

- Regulatory delays or rejection could push timelines back or constrain market access.

- Competitive responses from established therapies could inhibit market share gains.

- Pricing pressures amid healthcare cost containment initiatives may limit profit margins.

Opportunities

- Early entry in underserved markets can yield first-mover advantages.

- Expansion of indications could diversify revenue streams.

- Strategic alliances and licensing agreements might accelerate commercialization.

Strategic Implications

For companies invested in DRISDOL, prioritizing regulatory milestones and building strong payer relationships are imperative. Conducting comprehensive health economic analyses will support favorable reimbursement outcomes. Conversely, competitors should focus on differentiating their offerings or investing in alternative solutions to mitigate DRISDOL’s market penetration risks.

Key Takeaways

- Market potential for DRISDOL hinges on its clinical edge and unmet needs in its targeted indication, with a sizable global patient base.

- Regulatory approval remains the pivotal hurdle; successful navigation can catalyze rapid market entry.

- Revenue projections suggest substantial growth post-approval, contingent upon effective commercialization strategies and market acceptance.

- Risks include regulatory delays, competitive dynamics, and pricing pressures, which could impact profitability.

- Opportunities for early market entry, indication expansion, and strategic collaborations can substantially enhance DRISDOL’s financial trajectory.

FAQs

Q1: What differentiates DRISDOL from existing therapies?

A: DRISDOL offers enhanced efficacy, improved safety, or better patient compliance, owing to its novel mechanism of action or formulation — specifics depend on ongoing clinical trial outcomes.

Q2: When is DRISDOL expected to reach the market?

A: Pending successful phase III trial results and regulatory approval, market entry could occur within 12-24 months.

Q3: What is the anticipated revenue timeline for DRISDOL?

A: Peak sales may be realized approximately 3-5 years post-market launch, with revenues reaching potentially hundreds of millions to billions annually, depending on market uptake.

Q4: Which markets offer the greatest revenue potential?

A: North America and Europe dominate, but emerging markets in Asia and Latin America present significant growth opportunities owing to increasing healthcare access and unmet needs.

Q5: How can competitors position themselves in this market?

A: By developing alternative therapies with comparable or superior clinical profiles, or by entering strategic alliances with developers of DRISDOL to access shared markets.

References

[1] Global Epidemiology and Market Trends for [Medical Condition], Source: Industry Reports, 2022.