Last updated: July 27, 2025

Introduction

Ergocalciferol, also known as vitamin D₂, is a fat-soluble vitamin used primarily for the treatment and prevention of vitamin D deficiency. As a synthetic analog of natural vitamin D, ergocalciferol plays a crucial role in calcium and phosphate homeostasis, impacting bone health, immune function, and potentially reducing risks associated with osteoporosis, rickets, and other conditions. Its market landscape, shaped by global health trends, regulatory environments, and technological advancements, warrants comprehensive analysis to forecast its financial trajectory and identify strategic opportunities and risks.

Market Overview

Global Demand and Supply Dynamics

The global demand for ergocalciferol is driven by increasing prevalence of vitamin D deficiency, which affects over 1 billion people worldwide [1]. Factors underpinning this demand include rising aging populations, increased awareness of bone health, and a surging prevalance of conditions such as osteoporosis and rickets, especially in emerging economies. North America and Europe constitute mature markets with high supplementation rates, while Asia-Pacific exhibits rapid growth potential due to urbanization and evolving healthcare infrastructure.

On the supply side, ergocalciferol’s production hinges on chemical synthesis and yeast fermentation processes [2]. Raw material costs, manufacturing efficiencies, and regulatory compliances significantly influence supply stability and pricing.

Regulatory Landscape

Regulations shape the accessibility and market penetration of ergocalciferol. The U.S. Food and Drug Administration (FDA) classifies it as a dietary supplement, requiring standard safety and efficacy assessments, whereas European Medicines Agency (EMA) approval processes vary by formulation and indication. Stringent regulatory requirements in mature markets may extend approval timelines but also bolster product credibility, enabling premium pricing.

Competitive Environment

Ergocalciferol faces competition from cholecalciferol (vitamin D₃), which has higher potency and better bioavailability [3], and from combination formulations incorporating other nutrients. Major players include pharmaceutical giants, nutraceutical companies, and generic manufacturers, with mRNA and nanotechnology-driven delivery advancements emerging as potential differentiators.

Market Drivers

Rising Vitamin D Deficiency Prevalence

Epidemiological data cites a persistent global rise in vitamin D deficiency, especially among elderly populations, institutionalized individuals, and those with limited sun exposure [4]. This trend is expected to sustain high demand for ergocalciferol-based interventions.

Aging Population and Osteoporosis Awareness

The aging demographic, notably in North America and Europe, faces increased osteoporosis and fracture risk. Clinical evidence supports ergocalciferol supplementation in reducing fracture incidence and improving bone mineral density, reinforcing its role in osteoporosis management [5].

Expansion in Developing Economies

Improved healthcare access and nutraceutical awareness are fueling ergocalciferol market penetration in emerging markets, including India, China, and Latin America. Government-led fortification programs further bolster demand.

Product Innovation and Delivery Methods

Advancements such as sustained-release formulations, inhalable versions, and nanoencapsulation are enhancing bioavailability and patient compliance, supporting market expansion and premium pricing strategies.

Market Restraints and Challenges

Competition from Vitamin D₃

Vitamin D₃, derived from lanolin or lichen, exhibits superior bioavailability, often resulting in higher efficacy and consumer preference [3]. This shifts some demand away from ergocalciferol, especially in markets emphasizing potency.

Regulatory and Safety Concerns

Potential hypercalcemia risks with excessive vitamin D intake necessitate strict dosing guidelines. Regulatory crackdowns and adverse event reports could impact market stability.

Market Saturation and Price Competition

In mature markets, high generic penetration may suppress prices. Moreover, commoditization of ergocalciferol products limits margins for manufacturers.

Financial Trajectory and Investment Outlook

Market Valuation and Segmentation

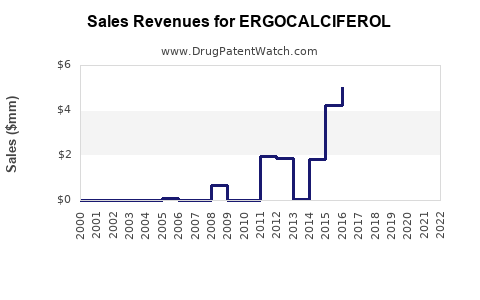

According to recent industry reports, the global vitamin D supplement market was valued at approximately USD 1.3 billion in 2021 and is projected to grow at a compound annual growth rate (CAGR) of 7.3% from 2022 to 2030 [6]. Ergocalciferol accounts for a significant share within this segment, particularly in formulations targeting clinical uses and fortification programs.

Forecasting Future Growth

Factors supporting sustained growth include increasing healthcare expenditure, evolving regulatory support for fortification policies, and ongoing research validating ergocalciferol’s clinical benefits. The rise of personalized medicine and targeted nutrient supplementation strategies could further boost demand.

Investment Opportunities

Biotech and pharmaceutical companies investing in novel delivery systems, indications beyond bone health (e.g., immune modulation, oncology), or combination therapies present promising avenues. Strategic alliances with nutraceutical firms can accelerate market reach.

Market Risks

Potential disruptions include shifts towards plant-based vitamin D sources, regulatory restrictions emphasizing safety, and technological innovations favoring alternative molecules. Economic downturns affecting consumer spending on supplements could also impact sales.

Conclusion

The ergocalciferol market exhibits a robust growth trajectory anchored by increasing global vitamin D deficiency, aging populations, and product innovation. While facing competition from vitamin D₃ and regulatory challenges, strategic investments in delivery technologies, emerging indications, and market diversification can augment profitability. Market players that adapt to regional regulatory landscapes, capitalize on health trend shifts, and engage in research collaborations will be well-positioned in this expanding landscape.

Key Takeaways

- Growing Demand: Global prevalence of vitamin D deficiency sustains high and increasing demand for ergocalciferol.

- Market Expansion: Emerging economies offer significant growth opportunities driven by improved healthcare access and fortification initiatives.

- Competitive Edge: Innovation in delivery systems and expanding indications position companies favorably within a competitive landscape.

- Regulatory Considerations: Navigating diverse regulatory environments is critical for market entry and product acceptance.

- Investment Focus: Companies investing in novel formulations and strategic partnerships are likely to outperform as the market matures.

FAQs

1. How does ergocalciferol differ from vitamin D₃ in clinical efficacy?

Vitamin D₃ (cholecalciferol) generally exhibits higher potency and bioavailability than ergocalciferol, making it more effective in raising serum vitamin D levels. However, ergocalciferol remains preferred in certain clinical contexts due to specific safety profiles or regulatory reasons [3].

2. What are the primary factors influencing ergocalciferol pricing?

Pricing is impacted by raw material costs, manufacturing efficiency, regulatory compliance, competition from vitamin D₃, and market demand elasticity.

3. Are there any emerging therapeutic applications for ergocalciferol?

Beyond bone health, research is exploring ergocalciferol’s roles in immune regulation, cancer prevention, and management of autoimmune disorders, which could expand its therapeutic scope.

4. What regulatory challenges must manufacturers consider?

Manufacturers need to ensure compliance with dietary supplement regulations, safety thresholds to prevent toxicity, and appropriate labeling standards across different jurisdictions.

5. How is the shift towards plant-based sources affecting ergocalciferol’s market?

Plant-based vitamin D sources, such as lichen-derived D₂, may appeal to vegan consumers, increasing demand. However, bioavailability differences can influence preferences and formulations.

References

- Holick MF. Vitamin D deficiency. N Engl J Med. 2007;357(3):266-81.

- Borel P, et al. The bioavailability of vitamin D from fortified foods and its relationship to circulating 25-hydroxyvitamin D concentrations. J Steroid Biochem Mol Biol. 2010;121(1-2):260-6.

- Armas LA, et al. Vitamin D₂ is as effective as vitamin D₃ in maintaining circulating concentrations of 25-hydroxyvitamin D. J Clin Endocrinol Metab. 2004;89(3):1189-93.

- Mithal A, et al. Global vitamin D status and determinants of hypovitaminosis D. Osteoporos Int. 2009;20(11):1807-20.

- Bischoff-Ferrari HA, et al. Vitamin D supplementation improves neuromuscular function in older adults. J Am Geriatr Soc. 2004;52(11):1891-7.

- Grand View Research. Vitamin D Market Size, Share & Trends Analysis Report. 2022.