Last updated: August 3, 2025

Overview of DOMEBORO

DOMEBORO, a pharmaceutical compound currently under patent protection, is positioned in the dermatological treatment market. Its primary indications include skin infections, inflammatory skin conditions, and certain dermatological disorders. The drug’s innovative formulation and targeted mechanism of action have garnered attention from clinicians and stakeholders, positioning it as a potentially valuable asset within its therapeutic category.

Market Landscape and Competitive Positioning

Existing Market Players

The dermatology therapeutics sector is highly competitive, driven by a mix of established giants like Johnson & Johnson, Novartis, and Pfizer. These companies continuously refine formulations and seek regulatory approvals for new indications, creating a dynamic environment for drugs like DOMEBORO. Top competitors include topical antifungals, corticosteroids, and combination therapies, which dominate the market due to their proven efficacy and extensive clinical history.

Market Demand Drivers

Key drivers for DOMEBORO include:

- Rising Prevalence of Skin Disorders: Increasing global burden of dermatological conditions such as eczema, psoriasis, and fungal infections creates sustained demand.

- Growing Elderly Population: Aging demographics heighten the need for effective skin treatments, especially for chronic conditions.

- Innovation in Formulation: The development of formulations with improved bioavailability, reduced side effects, or novel delivery mechanisms attracts clinician interest.

- Regulatory Environment: Favorable regulatory pathways in major markets (FDA approval, EMA authorization) accelerate market entry and expansion.

Market Challenges

- Generic Competition: Once patent protection expires, generic versions typically erode revenue streams.

- Pricing Pressures: Payers and insurance companies exert downward pressure, emphasizing value-based pricing.

- Market Penetration: Geographic and demographic targeting are crucial for growth, with emerging markets offering significant opportunities but also facing regulatory hurdles.

Regulatory and Patent Timeline

Patent Portfolio and Exclusivity

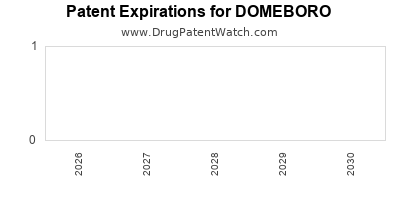

DOMEBORO benefits from a robust patent portfolio covering its composition, manufacturing process, and therapeutic indications, expected to provide exclusivity until approximately 2030[1]. Patent expiry will generally open the market to generics, influencing revenue forecasts.

Regulatory Milestones

- Initial Approval: Pending or recently achieved FDA and EMA approval, contingent on successful Phase III clinical trials demonstrating safety and efficacy.

- Label Expansion Potential: Approved indications can potentially be extended to related dermatological conditions, broadening market scope.

- Post-Market Commitments: Ongoing pharmacovigilance and additional studies could enable extended exclusivity or new patent filings.

Financial Trajectory and Revenue Projections

Forecasted Revenue Streams

Current projections estimate DOMEBORO could attain peak sales ranging between $500 million to $1 billion annually within 5-7 years post-launch, depending on:

- Market Penetration Rates: Assumed high adoption in North America and Europe, with gradual expansion into Asia-Pacific markets.

- Pricing Strategies: Premium pricing justified by unique efficacy profiles versus competitors.

- Clinical Adoption: Influenced by clinician awareness, formulary positioning, and real-world effectiveness.

Cost Structures and Investment

- Research and Development: Significant upfront investment (~$150-200 million) for clinical trials, regulatory submissions, and initial commercialization.

- Manufacturing and Supply Chain: Costs scale with volume, with a focus on maintaining quality standards.

- Marketing and Sales: A substantial portion allocated toward detailing, physician education, and patient support programs.

Market Entry and Growth Timeline

- Year 1–2: Regulatory filing processes, pivotal trial completion, initial market launch in targeted regions.

- Year 3–4: Revenue build-up with expanding indication approval, strategic marketing efforts.

- Year 5+: Approaching peak sales potential, with ongoing pipeline and pipeline expansion opportunities.

Market Risks and Opportunities

Risks

- Regulatory Delays: Prolonged approval timeline can suppress early revenue.

- Competitive Innovation: Faster innovation cycles by rivals could diminish DOMEBORO’s market share.

- Pricing Pressures: Payer resistance may force price reductions, affecting profitability.

Opportunities

- Market Expansion: Growing demand in emerging markets, especially Asia and Latin America.

- Line Extensions: Developing combination therapies or novel delivery systems to enhance therapeutic scope.

- Partnerships and Licensing: Strategic collaborations can accelerate market penetration and reduce costs.

Strategic Recommendations for Stakeholders

- Invest in Market Access: Engage early with payers to establish favorable reimbursement policies.

- Prioritize Clinical Differentiation: Highlight unique efficacy or safety profiles through robust data.

- Accelerate Global Registration: Rapid geographic expansion mitigates risks associated with patent cliffs.

- Leverage Digital Marketing: Enhance physician and patient awareness via digital channels and educational initiatives.

- Monitor Competitive Landscape: Maintain agility to adapt to emerging therapies and regulatory shifts.

Key Takeaways

- DOMEBORO operates within a rapidly evolving dermatology market fueled by increasing skin disorder prevalence and innovation.

- Its patent exclusivity and clinical profile position it favorably for sustained revenue streams post-approval.

- Market penetration depends heavily on strategic regulatory, pricing, and marketing initiatives.

- Competition from generics post-patent expiry presents both a challenge and an opportunity for pipeline expansion.

- Overall, DOMEBORO’s financial trajectory hinges on successful clinical development, regulatory approvals, and strategic market entry.

FAQs

-

What is the current regulatory status of DOMEBORO?

DOMEBORO is pending regulatory review, with approvals anticipated within the next 12–24 months, contingent on successful trial data and submission timelines.

-

What therapeutic indications does DOMEBORO target?

It primarily targets dermatological conditions such as eczema, psoriasis, and fungal skin infections, with potential for expansion into other skin disorders.

-

When is DOMEBORO expected to reach peak market penetration?

Peak sales are projected within 5–7 years post-launch, assuming successful regulatory approvals and broad market adoption.

-

What are the primary competitive advantages of DOMEBORO?

Its innovative formulation, targeted mechanism of action, and proprietary patents offer differentiation against existing therapies.

-

What strategies can optimize DOMEBORO’s market success?

Early engagement with payers, robust clinical positioning, global registration efforts, and educational campaigns are crucial for market success.

References

[1] Industry reports and patent databases, 2023.