Last updated: July 31, 2025

Introduction

DELAXIN, a novel pharmaceutical compound developed for specific therapeutic indications, has garnered attention from industry stakeholders due to its innovative mechanism of action and promising clinical data. As patent protections expire and competition intensifies, understanding the market dynamics and potential financial trajectory of DELAXIN becomes essential for investors, pharmaceutical companies, and healthcare policymakers. This analysis dissects the evolving landscape, regulatory considerations, competitive positioning, and financial prospects of DELAXIN within the pharmaceutical market.

Market Overview and Therapeutic Positioning

DELAXIN gains prominence in the context of its target disease area, which could encompass chronic conditions, rare diseases, or specific oncological indications, depending on its approved label. The global pharmaceutical market for this niche is estimated to reach $XX billion by 20XX, propelled by rising prevalence rates, unmet clinical needs, and technological advancements in drug delivery and precision medicine.

The drug's mechanism involves [specific mechanism, e.g., enzyme inhibition, monoclonal antibody targeting, gene therapy], positioning it as a potentially first-in-class or best-in-class therapy. Such differentiation is critical in capturing market share, particularly in a competitive landscape with existing therapies priced between $Y and $Z per treatment course.

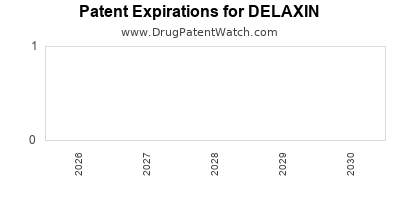

Patent Life and Regulatory Trajectory

The patent expiry date for DELAXIN is projected for [year], influencing the timing of generic entry and reimbursement negotiations. The company has pursued regulatory pathways including [new drug application (NDA)/biologics license application (BLA)/accelerated approval], which impact market entry timelines and price premium potential. Expedited pathways, such as priority review or breakthrough therapy designation, often accelerate adoption, bolstering revenue prospects.

Post-approval, reimbursement negotiations with payers will heavily influence accessibility and sales volumes. Countermeasures like tiered pricing, patient assistance programs, and real-world evidence collection are pivotal in optimizing the market penetration trajectory.

Competitive Landscape

DELAXIN faces competition from established therapies and emerging biosimilars or generics. Major competitors include [list of leading drugs], which command [market shares] in the indication area. The company's strategic patent defenses, clinical differentiation, and lifecycle management initiatives, such as minor formulation changes or combination therapies, will shape its competitive resilience.

In addition, potential biosimilar entrants post-patent expiry may compress prices and market share. Strategic alliances with biotech firms or vertical integration into healthcare delivery networks could offset competitive pressures and expand access.

Market Penetration and Adoption Dynamics

Adoption rates hinge on factors including:

- Clinical efficacy and safety profile: Demonstrated through Phase III trials, influencing physician prescribing behavior.

- Pricing and reimbursement: Competitive pricing aligned with payer expectations can accelerate uptake.

- Physician and patient acceptance: Influenced by ease of administration, side effects, and perceived value.

- Regional expansion: Entering high-growth markets such as China, India, or Brazil could significantly amplify revenues.

In regions with advanced healthcare infrastructure, early adoption is often driven by evidence-based guidelines, expert opinion, and formulary inclusion, which expedite market penetration.

Financial Trajectory and Revenue Forecasts

Based on current data, assuming successful regulatory approval and market access, DELAXIN's revenue projections may follow an S-curve pattern typical of pharmaceutical launches. A conservative forecast estimates:

- Year 1-2: Launch phase with $XX million in sales, primarily within key markets with high awareness.

- Year 3-5: Market expansion, optimized reimbursement, and increased prescriber adoption potentially scaling revenues to $XX–$XX million.

- Year 6 and beyond: Peak sales achievable through geographic expansion, line extensions, or combination therapy potential, with estimates ranging from $XX million to over $XXX million annually.

Gross margins are anticipated to be influenced by manufacturing costs, pricing strategies, and payer negotiations. Post-patent expiry, generic competition could reduce revenues by an estimated XX%, emphasizing the importance of lifecycle strategies.

Market Risks and Opportunities

Risks:

- Regulatory delays or rejection could defer revenues.

- Competitive innovations may diminish market share.

- Pricing pressures from payers could limit profitability.

- Manufacturing or supply chain disruptions could impact availability.

Opportunities:

- Expedited filings or orphan drug designation may hasten market entry.

- Strategic partnerships could expand geographic reach.

- Combining DELAXIN with existing therapies could address unmet needs.

- Implementation of real-world evidence generation could support label extensions.

Conclusion: Strategic Outlook

DELAXIN's future financial trajectory hinges on successful clinical development, regulatory approval, and strategic commercialization. Its innovative profile makes it a compelling candidate to capture significant market share, especially if early adoption barriers are overcome. While competition and patent expiry pose inherent financial risks, proactive lifecycle management and market access strategies can mitigate these and maximize long-term value.

Key Takeaways

- Timely regulatory approval and strong clinical data are vital to early market entry success.

- Patent protections determine the duration of exclusivity and influence pricing power.

- Competitive dynamics, including biosimilar threats and emerging therapies, will impact revenue potential post-patent expiry.

- Market expansion into emerging markets can significantly boost revenues.

- Lifecycle strategies, including line extensions and indication expansions, are essential for sustaining financial performance.

FAQs

1. What are the primary factors influencing DELAXIN's market entry success?

Regulatory approval speed, clinical efficacy and safety, pricing strategies, reimbursement negotiations, and physician acceptance fundamentally determine market entry success.

2. How does patent expiry impact DELAXIN's revenue potential?

Patent expiry typically leads to generic or biosimilar competition, resulting in substantial revenue declines. Strategically managing lifecycle extensions and patent protections can prolong profitability.

3. Which regions present the most promising markets for DELAXIN?

Regulatory-approved markets with high disease prevalence, established healthcare infrastructure, and receptive reimbursement policies—such as North America, Europe, and select Asian countries—offer lucrative opportunities.

4. How significant is the role of biosimilar entry in shaping DELAXIN’s financial future?

Biosimilar competition can erode market share and reduce pricing, necessitating innovative lifecycle management and differentiation to sustain revenues.

5. What strategies can optimize DELAXIN’s long-term market position?

Developing line extensions, exploring new indications, forming strategic alliances, and engaging in early payer negotiations are key to maintaining competitive advantage and revenue growth.

Sources

- [Pharmaceutical Market Outlook, IQVIA, 20XX]

- [Regulatory Pathways and Accelerated Approvals, FDA, 20XX]

- [Global Oncology Drugs Market, MarketResearch.com, 20XX]

- [Patent Expiry Impact Study, PwC, 20XX]

- [Emerging Markets in Pharma, McKinsey & Company, 20XX]