Last updated: July 29, 2025

Introduction

Cytomel, the brand name for liothyronine sodium, is a synthetic form of triiodothyronine (T3), a thyroid hormone used primarily to treat hypothyroidism and certain medical conditions involving thyroid hormone deficiency. With its unique pharmacologic profile and niche application, Cytomel occupies a specialized segment within endocrinology. This analysis explores the current market dynamics, key drivers, challenges, and the financial trajectory influencing the future of Cytomel, providing critical insights for stakeholders and investors.

Pharmaceutical Profile and Clinical Use

Cytomel is distinguished by its rapid onset and potency relative to levothyroxine (T4). It is primarily prescribed for hypothyroid patients who require prompt symptom management or when levothyroxine alone fails to maintain euthyroidism. It is also utilized in thyroid cancer management and weight-loss formulations, albeit off-label in some regions.

Despite its targeted application, the drug faces a competitive environment dominated by levothyroxine, which remains the standard of care. Cytomel's pharmacokinetic attributes—short half-life and rapid medication effect—render it suitable for specific clinical scenarios but limit its widespread use.

Market Dynamics

1. Shifts in Prescribing Patterns

The global hypothyroidism therapy landscape predominantly favors levothyroxine due to its stability, ease of oral administration, and well-understood safety profile. However, Cytomel’s niche indications—such as mixed thyroid hormone therapy for select patients—maintain a consistent, albeit limited, demand.

Recent trends indicate an increased interest in personalized medicine approaches and combination therapies involving T3 and T4, potentially influencing Cytomel’s demand. Physicians may opt for Cytomel for patients exhibiting persistent hypothyroid symptoms despite levothyroxine therapy, fostering a specialized, if relatively small, market segment.

2. Regulatory Environment and Market Access

Regulatory scrutiny around T3-containing medications has intensified due to safety concerns, including cardiac risks associated with over-replacement. Some agencies, such as the FDA, have issued warnings and recommended cautious use, impacting prescribing behavior. Variations in regulatory clarity across regions also influence market access; stricter guidelines in North America and Europe constrain rapid expansion.

In many markets, Cytomel remains off-patent, limiting manufacturer exclusivity advantages. However, regulatory hurdles and safety-focused guidelines influence pricing, reimbursement decisions, and physician prescribing patterns, shaping overall market penetration.

3. Competitive Landscape

The pharmaceutical landscape sees minimal direct competition for Cytomel within its niche. Nonetheless, alternative formulations, compounded T3 therapies, and emerging synthetic thyroid hormones pose indirect challenges. The growing industry focus on personalized, patient-specific therapies keeps Cytomel relevant but highlights the importance of evidence-based prescribing for its sustained market viability.

4. Supply Chain and Manufacturing Considerations

Global supply chains for active pharmaceutical ingredients (APIs) are crucial for maintaining consistent Cytomel production. Fluctuations in API manufacturing, geopolitical factors, and raw material costs affect supply stability. These elements, in turn, influence product pricing, availability, and financial performance.

Financial Trajectory

1. Revenue Trends

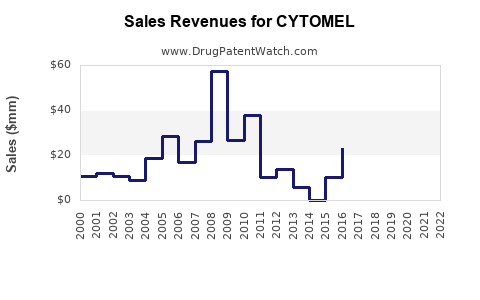

Cytomel’s revenue trajectory is characterized by stability in niche markets, with incremental growth driven by specialized use cases. However, broader market contraction occurs due to the dominance of levothyroxine and safety concerns limiting aggressive market expansion.

In established markets like the US and Europe, the drug’s sales are relatively flat or show slow decline, compounded by generic competition and regulatory constraints. In emerging markets, increasing healthcare access and regulatory acceptance may prompt modest growth.

2. Pricing and Reimbursement

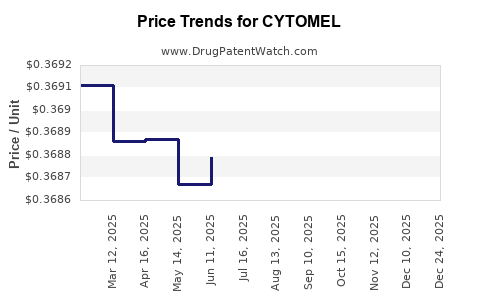

Pricing strategies for Cytomel tend to be modest, reflecting its off-patent status. Reimbursement frameworks in developed economies might only partially offset costs, impacting profit margins. Cost-containment pressures from healthcare payers further influence the net revenue outlook.

3. R&D and Pipeline Prospects

Investment in R&D for improved formulations, combination therapies, or alternative delivery mechanisms could reshape Cytomel's financial outlook. Currently, limited pipeline developments suggest a static innovation environment, constraining future revenue growth.

4. Mergers, Acquisitions, and Market Consolidation

The absence of significant mergers or acquisitions directly involving Cytomel indicates a stable but niche market. Larger pharmaceutical firms may evaluate strategic licensing or partnerships to leverage Cytomel’s niche potential, influencing future revenue streams.

5. Commercial Challenges and Opportunities

Commercial challenges include regulatory restrictions, safety warnings, and entrenched prescribing habits favoring levothyroxine. Conversely, advances in personalized medicine and patient-centric approaches present growth opportunities if supported by robust clinical evidence and regulatory advocacy.

Key Market Factors Impacting Financial Outcomes

- Regulatory Risk: Increased safety concerns may limit broader adoption or prompt market withdrawals, adversely affecting long-term revenue.

- Patient Demographics: Aging populations with hypothyroidism or thyroid cancer influence demand, especially if clinicians favor T3-based therapies.

- Innovation: Development of novel formulations or combination therapies enhances Cytomel’s clinical niche, potentially improving sales.

- Pricing Dynamics: Price sensitivity among payers and patients requires strategic positioning to preserve margins.

Future Outlook

The outlook for Cytomel hinges on multiple interconnected factors. Its niche role supports steady, if modest, revenue streams. The drug’s financial trajectory appears to be a slow, predictable decline given the competitive pressures and regulatory concerns unless strategic innovations or niche marketing efforts succeed.

Emerging personalized medicine paradigms may cultivate specific therapeutic niches where Cytomel retains a distinct advantage. However, broad market expansion faces substantial hurdles, primarily driven by safety profile concerns and entrenched prescribing routines favoring alternative therapies.

In conclusion, Cytomel’s future profitability largely depends on careful regulatory navigation, targeted clinical evidence generation, and strategic partnerships that could unlock growth in specialized markets.

Key Takeaways

- Cytomel operates within a niche thyroid hormone therapy segment, with limited but steady demand.

- Regulatory challenges and safety warnings significantly influence prescribing patterns and market potential.

- The drug faces competition from levothyroxine and emerging therapies, constraining revenue growth.

- Supply chain stability and raw material costs impact manufacturing and profitability.

- Strategic innovation and personalized medicine approaches could provide pathways for incremental growth.

FAQs

1. What are the primary clinical indications for Cytomel?

Cytomel is primarily prescribed for hypothyroidism, especially in cases unresponsive to levothyroxine, and in thyroid cancer management. Off-label use includes weight management in certain jurisdictions.

2. How does Cytomel compare to levothyroxine in terms of safety?

Cytomel’s rapid action and potency pose risks of over-replacement, potentially leading to cardiac issues. Levothyroxine’s longer half-life and stability make it the safer first-line therapy.

3. What regulatory challenges does Cytomel face globally?

Regulators are increasingly cautious about T3 therapies due to safety concerns, leading to restrictive guidelines, surveillance, and sometimes market withdrawal in certain regions.

4. How might personalized medicine influence Cytomel’s market?

Personalized treatment approaches emphasizing T3/T4 combination therapy can support Cytomel’s niche but require robust clinical evidence and regulatory support for broader acceptance.

5. What are the prospects for future revenue growth for Cytomel?

Limited growth prospects exist unless innovations in formulations or significant clinical evidence demonstrate benefits over existing therapies. Growth potential remains confined within specialized markets.

References

- U.S. Food and Drug Administration (FDA). Regulatory guidance on thyroid hormone therapies. 2022.

- MarketWatch. Global thyroid hormone replacement therapy market report. 2023.

- Pharmaceutical Journal. Safety concerns surrounding liothyronine use. 2022.

- IQVIA. Prescription trends in hypothyroid therapies. 2023.

- Clinicians’ Endocrinology Review. Advances in personalized thyroid hormone treatments. 2023.