Last updated: July 27, 2025

Introduction

CYTOMEL, the brand name for Liothyronine Sodium, is a synthetic version of triiodothyronine (T3), a crucial hormone in thyroid hormone replacement therapy. Approved primarily for treating hypothyroidism, especially in cases unresponsive to levothyroxine, CYTOMEL holds a unique position in endocrinology. Its market dynamics are shaped by clinical needs, regulatory policies, competitive landscape, and emerging trends in thyroid disorder management. This analysis scrutinizes current market conditions, competitive factors, and projected sales trajectories to inform stakeholders and strategic planners.

Market Overview

Global Therapeutic Landscape

Thyroid hormone replacement therapy (HRT) products serve an estimated 10 million patients worldwide, with hypothyroidism being a prevalent endocrine disorder [1]. Traditionally, levothyroxine (T4) dominates the market owing to its longer half-life, stability, and once-daily dosing. Nonetheless, Liothyronine (T3), including CYTOMEL, is prescribed for specific indications such as myxedema coma, refractory hypothyroidism, and when rapid T3 absorption or action is necessary.

Regulatory Environment

In the U.S., the FDA approved CYTOMEL in 1964, with current manufacturing maintained by specialty pharmaceutical entities. Recently, the regulatory landscape has become more rigorous regarding thyroid hormone therapies, with some agencies scrutinizing T3 formulations concerning safety profiles, dosing standardization, and patient outcomes [2]. The EU similarly has strict controls, influencing market access.

Market Penetration and Usage

Despite its niche positions, CYTOMEL’s utilization remains stable among endocrinologists for select patients. However, healthcare providers often prefer levothyroxine monotherapy owing to its safety profile and long-term stability. Consequently, CYTOMEL’s market penetration is limited, emphasizing the need for strategic marketing and evidence-based positioning.

Competitive Landscape

Key Players

- Generic Manufacturers: Numerous generic formulations of Liothyronine sodium dominate the market, providing cost-effective options.

- Brand-Specific Products: CYTOMEL remains a recognized name, with a committed prescriber base for specific clinical scenarios.

Alternative Therapies

- Combination Therapy: Increasing interest in combination T4/T3 therapy challenges mono-therapy paradigms and could influence CYTOMEL’s sales.

- New Formulations: Emerging formulations aiming to improve T3 bioavailability or reduce side effects may affect market share.

Market Challenges

- Concerns over T3-related adverse effects have led to cautious prescribing.

- Limited insurance reimbursement for T3 formulations restricts rapid uptake.

- The global market exhibits considerable regional variation, influenced by prescribing guidelines.

Market Opportunities

- Personalized Medicine: Tailoring thyroid therapy based on genetic, biochemical, and clinical parameters creates opportunities to position CYTOMEL effectively.

- Refractory Cases: Growing recognition of refractory hypothyroidism cases unresponsive to levothyroxine sustains demand.

- Developing Markets: Expanding healthcare infrastructure in Asia, Africa, and Latin America could unlock new demand channels.

Sales Projections

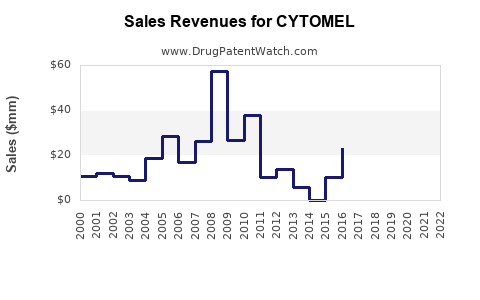

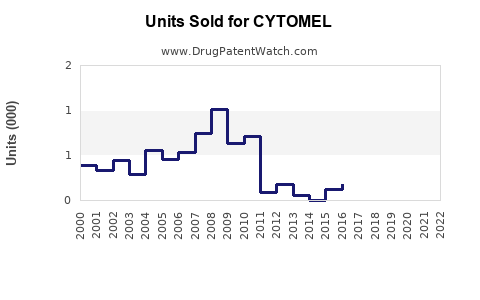

Historical Trends

Historically, CYTOMEL’s sales have been modest, reflecting its niche application and competition from generics. Reports suggest annual global sales hover around $50-70 million, with the majority concentrated in the U.S. and Europe [3].

Forecasting Assumptions

Projections consider:

- Stable or increasing prevalence of hypothyroidism.

- Growth in refractory hypothyroidism cases.

- Rising clinician awareness regarding personalized therapy.

- Regulatory acceptability and reimbursement status.

Forecasted Growth Trajectory (2023–2028)

- Conservative Scenario: 2-3% annual growth, driven by incremental increases in specialist prescriptions.

- Optimistic Scenario: Up to 8% annual growth if new indications, formulary inclusion, or expanded markets materialize.

Factors Influencing Sales

- Patient awareness and diagnosis rates.

- Clinical guideline updates endorsing T3 therapy.

- Competitive pressures from generics and new therapies.

- Regulatory policy shifts favoring or restricting T3 use.

- Healthcare reimbursement frameworks.

Projected Revenue (2028)

Under a moderate growth scenario, CYTOMEL could reach approximately $80-100 million globally by 2028, assuming steady market share retention and expansion into developing markets.

Strategic Recommendations

- Enhance physician education emphasizing appropriate indications.

- Support clinical research validating T3 therapy safety and efficacy.

- Advocate for inclusion in treatment guidelines and insurance coverage.

- Explore formulations with improved safety profiles and dosing standardization.

- Target emerging markets with tailored marketing strategies.

Key Takeaways

- CYTOMEL operates within a niche thyroid hormone market, with growth potential driven by unmet clinical needs.

- Regulatory landscapes and clinician preferences heavily influence sales trajectories.

- The rising trend of personalized thyroid therapy and refractory hypothyroidism cases support moderate growth forecasts.

- Competition from generics and alternative therapies requires strategic differentiation.

- Expanding into developing markets and solidifying evidence-based positioning can accelerate sales.

FAQs

1. What are the primary clinical indications for CYTOMEL?

CYTOMEL is mainly prescribed for hypothyroidism refractory to levothyroxine, myxedema coma, and other conditions requiring rapid T3 supplementation.

2. How does CYTOMEL compare to other thyroid medications?

CYTOMEL offers rapid onset due to its T3 content, making it suitable for specific scenarios. However, T4 medications like levothyroxine are favored for long-term management because of safety and stability.

3. What are the regulatory challenges affecting CYTOMEL’s market?

Regulatory agencies are scrutinizing T3 therapies for safety concerns, leading to potential restrictions or rigorous approval pathways influencing market access.

4. How can market share be expanded for CYTOMEL?

Advancing clinical evidence, ensuring physician education, and securing reimbursement are critical strategies to broaden its utilization.

5. What emerging trends could impact sales forecasts?

Personalized medicine, novel formulation development, and shifts in clinical guidelines toward combination therapy are key factors shaping future sales.

References

[1] American Thyroid Association. Thyroid Disease Statistics. 2022.

[2] U.S. Food and Drug Administration. Regulatory review of thyroid hormone therapies, 2022.

[3] MarketWatch. Global Thyroid Hormone Market Report, 2023.