Last updated: August 3, 2025

Introduction

CYSTAGON (cysteamine bitartrate) is a critical pharmaceutical agent approved by the U.S. Food and Drug Administration (FDA) for the treatment of nephropathic cystinosis, a rare autosomal recessive disorder characterized by abnormal accumulation of cystine within lysosomes. Given its specialized indication, CYSTAGON operates within a niche market with unique dynamics shaped by clinical needs, regulatory pathways, and competitive landscape. This analysis explores the current market environment, growth drivers, challenges, and the financial trajectory of CYSTAGON.

Market Overview

Disease Profile and Demand Drivers

Nephropathic cystinosis affects approximately 1 in 100,000 to 200,000 live births globally, with higher prevalence in certain populations such as those of Northern European descent [1]. The condition leads to renal failure if untreated, necessitating lifelong management with cystine-depleting agents like CYSTAGON. Its rarity classifies it as a orphan disease, which influences regulatory, pricing, and market dynamics.

The demand for CYSTAGON hinges on early diagnosis, treatment adherence, and the availability of alternative therapies. Currently, CYSTAGON remains the first-line therapy, supported by clinical guidelines and extensive usage due to its proven efficacy in reducing cystine levels and delaying disease progression.

Regulatory Status and Market Access

As an FDA-approved orphan drug, CYSTAGON benefits from incentives such as market exclusivity (7 years post-approval), tax credits, and potential for priority review depending on the application and clinical needs. Its status facilitates market penetration but also limits competition in the immediate term.

Market access in different regions depends on local regulatory pathways and reimbursement policies. In Europe, orphan designation aligns with incentives under the European Medicines Agency (EMA), supporting commercialization efforts.

Market Dynamics

Competitive Landscape

CYSTAGON's primary competitor is the generic formulation of cysteamine, which emerged following patent expirations and manufacturing approvals. A notable alternative is Procysmá (cysteamine bitartrate), a delayed-release formulation from Horizon Pharmaceuticals, offering improved dosing schedules to improve compliance [2].

Emerging pipeline agents, such as novel cystine-depleting therapies with improved pharmacokinetics or gene therapies, may pose future competitive threats. Currently, however, the global standard remains CYSTAGON.

Pricing and Reimbursement

Pricing strategies for CYSTAGON are influenced by its orphan status, high treatment costs, and value delivered through disease management. List prices vary across markets but typically range from $50,000 to $70,000 annually per patient. Reimbursement policies are critical, with payers often requiring robust clinical and economic evidence due to the high cost.

Manufacturers frequently engage in negotiations emphasizing the drug’s role in preventing severe renal complications, thereby justifying premium pricing within rare disease frameworks.

Market Penetration and Adoption

Physician awareness, early diagnosis, and adherence remain critical for optimizing market penetration. Given the rarity of cystinosis, patient registries, advocacy groups, and specialist centers serve as pivotal channels for education and distribution.

Digital health tools and patient support programs further enhance adherence, improving clinical outcomes and reinforcing long-term demand.

Supply Chain and Manufacturing

Manufacturing CYSTAGON requires specialized facilities complying with Good Manufacturing Practices (GMP). Supply stability hinges on raw material availability (notably cysteamine) and manufacturing capacity adjustments. Disruptions, as seen during global crises, can impact availability and sales.

Financial Trajectory

Revenue Trends

Since its initial approval, CYSTAGON's revenue trajectory has steadily increased, driven by heightened awareness and diagnosis rates. In established markets like the U.S., revenues have grown in the two-digit percentages annually, with some fluctuations owing to formulary negotiations and market entry of competitors.

Market Expansion Opportunities

Potential expansion into emerging markets and increased adoption in adult patients with cystinosis represent growth avenues. Regulatory approvals for pediatric use and off-label extensions can further broaden the target population.

Pricing and Payer Negotiations

High pricing remains both an enabler and barrier. The introduction of biosimilar or generic cysteamine formulations may pressure pricing and margins but could also expand access and patient uptake.

Research and Development Impact

Investment in clinical trials for new formulations (e.g., extended-release versions) or combination therapies could influence financial risk profiles. While these hold promise, current revenue streams depend primarily on existing formulations’ performance.

Long-term Financial Outlook

Given the orphan status, expected steady demand, and minimal direct competition, CYSTAGON's revenue is projected to maintain moderate growth over the next five years. Market dynamics will depend on regulatory changes, comparator developments, and healthcare policy shifts.

Challenges and Opportunities

Market Challenges

- Limited Patient Pool: The rarity of cystinosis constrains market growth potential.

- Pricing Pressures: Rising concerns over drug affordability could lead to reimbursement hurdles.

- Competition from Generics: Post-patent expiry, generics threaten market share.

- Treatment Adherence: Pediatric and adolescent adherence remains challenging, affecting outcomes and perception.

Strategic Opportunities

- Market Expansion: Targeting adult cystinosis patients and international markets.

- Formulation Innovation: Developing more convenient dosing or delivery systems.

- Regulatory Developments: Leveraging orphan drug incentives for additional indications.

- Partnerships: Collaborations with patient advocacy groups and specialty care centers.

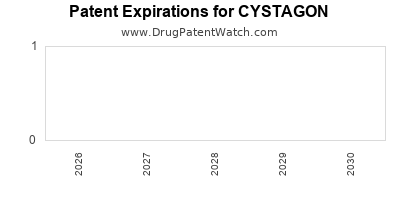

Regulatory and Patent Outlook

Currently, CYSTAGON's patent life extends into the late 2020s, with exclusivity periods protecting market share. Patent extensions are feasible through new formulations or methods of use. Ongoing patent litigation concerning formulations and manufacturing processes influences competitive entry.

Conclusion

CYSTAGON operates within a specialized, underserved niche with stable but modest growth prospects. Its market dynamics are shaped by highly targeted demand, regulatory protections, and evolving competitive landscapes. While pricing and reimbursement remain pivotal, strategic enhancements—such as expanding patient access and investing in formulation improvements—are essential to maximizing its financial trajectory.

Key Takeaways

- Stable Niche Market: CYSTAGON benefits from orphan drug designation, ensuring exclusivity and steady demand among cystinosis patients.

- Growth Drivers: Increased awareness, international market expansion, and formulation innovations present growth opportunities.

- Competitive Pressures: The introduction of generic cysteamine formulations could impact margins, emphasizing the need for differentiation.

- Pricing Strategies: High drug prices are justified by rarity; however, payer negotiations and biosimilar threats may influence future revenue.

- Long-term Outlook: Assuming continued clinical demand and regulatory stability, CYSTAGON's revenue trajectory should remain positive but modest, with strategic positioning critical for sustained growth.

FAQs

1. What is the main therapeutic advantage of CYSTAGON in cystinosis management?

CYSTAGON effectively depletes cystine levels within lysosomes, delaying renal deterioration and improving patient quality of life, making it the standard first-line therapy for nephropathic cystinosis [1].

2. How does orphan drug status impact CYSTAGON’s market and pricing?

Orphan designation grants market exclusivity, tax incentives, and sometimes faster regulatory review, allowing premium pricing justified by limited patient populations and high treatment costs.

3. What are the prospects of biosimilar cysteamine formulations affecting CYSTAGON’s market share?

Generic formulations post-patent expiry could lead to price erosion and decreased market share. Manufacturers need to innovate or differentiate their products to maintain competitiveness.

4. How do international regulatory environments influence CYSTAGON's market trajectory?

Regions with supportive orphan drug policies and reimbursement frameworks facilitate market entry and expansion, while regulatory hurdles can delay commercialization.

5. What future developments could influence CYSTAGON’s financial performance?

Advances in gene therapy, new formulations offering better compliance, and expanded indications could enhance long-term revenue; conversely, increased competition and pricing pressures pose risks.

Sources:

[1] “Cystinosis.” Genetic and Rare Diseases Information Center, 2022.

[2] Horizon Pharmaceuticals. “Procysmá.” Product Information, 2021.