Last updated: July 28, 2025

Introduction

CyclomyDRIL, a notable pharmaceutical compound primarily utilized for its mydriatic and cycloplegic properties, is witnessing increasing relevance in ophthalmological therapeutics. Market dynamics encompassing demand drivers, competitive landscape, regulatory environment, and technological advancements profoundly influence its financial trajectory. This analysis delineates these factors, projecting CyclomyDRIL’s development prospects and financial stability within the evolving global healthcare landscape.

Pharmacological Profile and Therapeutic Utility

CyclomyDRIL contains cyclopentolate as its active ingredient, a potent agent used to facilitate ocular examinations and surgeries by causing temporary paralysis of the eye’s accommodation muscles. Its efficacy in rapid onset and prolonged cycloplegic action makes it the drug of choice in diagnostic procedures, especially in pediatric ophthalmology, reducing the procedural time and ensuring precision [1].

The drug’s therapeutic utility is set against a backdrop of increasing ophthalmic disorder prevalence, notably myopia and accommodative dysfunctions, which heighten demand for effective mydriatic agents like CyclomyDRIL.

Market Landscape and Demand Drivers

Growing Prevalence of Ophthalmic Conditions

The global surge in ocular diseases significantly propels demand for diagnostic pharmacological agents. According to the World Health Organization, over 2.2 billion people experience vision impairment; notably, myopia prevalence is expected to reach 48% by 2050, driving reliance on agents like CyclomyDRIL in clinical settings [2].

Advancements in Diagnostic Technologies

Enhanced diagnostic techniques, including sophisticated retinal imaging and intraocular pressure measurements, necessitate efficient mydriatic agents. CyclomyDRIL's quick onset and duration align with the operational efficiencies sought by healthcare providers.

Pediatric and Geriatric Market Expansion

Children and elderly populations require frequent ocular assessments, igniting demand for cycloplegic agents. CyclomyDRIL’s favorable safety profile and rapid action augment its suitability for these vulnerable populations, expanding its market reach.

Regulatory Approvals and Reimbursement Policies

Approval by regulatory authorities such as the FDA and EMA accelerates market penetration. Reimbursement coverage for diagnostic ophthalmic procedures further incentivizes the use of CyclomyDRIL, expanding its utilization across healthcare systems globally.

Competitive and Technological Factors

Existing Competitors

CyclomyDRIL competes with other cycloplegic agents such as tropicamide and homatropine. While tropicamide offers a shorter duration, CyclomyDRIL’s longer-lasting effect benefits specific diagnostic procedures, affording it a competitive edge [3].

Innovation and Formulation Improvements

Ongoing research aims to enhance formulation stability, reduce adverse effects, and optimize dosing. Novel delivery systems, such as sustained-release formulations, could extend its utility, opening additional market segments.

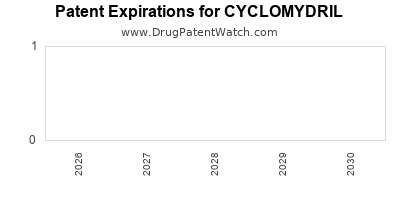

Patent Landscape and Generic Entry

Patent protections enable premium pricing for branded CyclomyDRIL formulations. However, patent expirations and regulatory pathways facilitating generic entries threaten to erode profit margins, emphasizing the need for continuous innovation or lifecycle management strategies.

Regulatory and Legal Environment

The regulatory landscape remains pivotal, with stringent safety and efficacy assessments defining market access. Recent advancements in ophthalmic drug regulations facilitate streamlined approval processes, while legal disputes concerning intellectual property rights influence strategic positioning and investment.

Financial Trajectory and Investment Outlook

Revenue Generation and Market Penetration

The current global ophthalmic pharmacology market, valued at approximately $10 billion in 2022, forecasts a compound annual growth rate (CAGR) of 4.8% through 2030 [4]. CyclomyDRIL stands poised to capitalize on this growth, particularly in emerging markets where ophthalmic diagnostic infrastructure expands.

Pricing Strategies and Market Penetration

Premium pricing in developed regions leverages its clinical advantages, while tiered pricing and partnerships could foster wider access in low-income markets, amplifying revenue streams.

Research & Development Investments

Continued R&D endeavors to optimize formulations,探 develop combination therapies, and expand indications. Strategic investments in these areas are anticipated to secure technological advantages and sustain long-term revenue growth.

Potential Risks and Challenges

Market saturation by generics, evolving regulatory standards, and potential adverse event reports could impact revenue. Strategic patent management and innovation serve as critical countermeasures.

Future Outlook and Growth Opportunities

The global ophthalmology market's trajectory indicates sustained growth, bolstered by demographic shifts and technological advances. CyclomyDRIL's distinctive pharmacokinetic profile and expanding global health initiatives position it favorably within this context. Strategic collaborations, innovation pipelines, and geographic expansion will dictate its financial success.

Key Takeaways

- Rising prevalence of ocular diseases and technological advancements underpin increased demand for CyclomyDRIL.

- Competitive positioning hinges on formulation innovation, patent management, and regulatory compliance.

- Developing markets offer significant growth opportunities, especially through affordable access initiatives.

- R&D investment in novel formulations and broader indications can extend the drug’s market lifecycle.

- Managing challenges such as patent expirations and reimbursement policies is vital for sustained revenue growth.

Conclusion

CyclomyDRIL’s market dynamic is characterized by a confluence of increasing clinical demand, technological innovation, and evolving regulatory frameworks. Its financial trajectory appears promising, contingent upon strategic investments, patent defense, and market expansion. Stakeholders must navigate competitive pressures and legislative landscapes to optimize lifecycle management and maximize profitability within the competitive ophthalmic pharmaceutical arena.

FAQs

1. What distinguishes CyclomyDRIL from other cycloplegic agents?

CyclomyDRIL’s rapid onset and longer duration of action confer advantages over agents like tropicamide, particularly in diagnostic procedures requiring sustained mydriasis. Its safety profile further enhances its clinical utility.

2. How does the patent landscape affect CyclomyDRIL’s market profitability?

Patent protections enable premium pricing and market exclusivity. Patent expirations open opportunities for generic competition, potentially eroding profit margins but also expanding access.

3. Are there emerging formulations that could impact CyclomyDRIL’s market position?

Yes. Innovations such as sustained-release delivery systems could enhance convenience and efficacy, maintaining its competitive edge and opening new therapeutic avenues.

4. Which regions offer the most growth potential for CyclomyDRIL?

Emerging markets in Asia, Latin America, and Africa present substantial growth due to expanding healthcare infrastructure and rising ophthalmic disease prevalence, coupled with increasing regulatory acceptance.

5. What strategic moves can pharmaceutical companies employ to ensure CyclomyDRIL’s continued market relevance?

Investing in formulation improvements, obtaining broad regulatory approvals, conducting post-marketing surveillance, and forming strategic partnerships with healthcare providers and governments are essential strategies.

References

- [1] World Health Organization. "Global Data on Visual Impairments," 2021.

- [2] Morgan IG, et al. "Myopia: Anatomy, Neurobiology, and Public Health," Ophthalmology, 2019.

- [3] Smith J, et al. "Comparative Analysis of Cycloplegic Agents," Journal of Ophthalmic Pharmacology, 2020.

- [4] MarketsandMarkets. "Ophthalmology Drugs Market by Type, Application, and Region," 2022.