Last updated: July 29, 2025

Introduction

CYCLOCORT, an innovative corticosteroid-based pharmaceutical, has garnered attention within the healthcare sector for its promising therapeutic properties and potential market impact. This analysis provides a comprehensive overview of the current market dynamics, competitive landscape, regulatory environment, and financial outlook of CYCLOCORT, equipping stakeholders with critical insights to inform strategic decision-making.

Overview of CYCLOCORT

CYCLOCORT is a synthetic corticosteroid formulated to treat inflammatory and autoimmune conditions, such as rheumatoid arthritis, allergic dermatitis, and respiratory diseases. Its distinctive profile combines potent anti-inflammatory effects with improved safety and tolerability compared to existing corticosteroids, positioning it as a potentially preferred choice among clinicians.

Developed by [Manufacturer], CYCLOCORT is in various stages of clinical development, with some formulations already approved in select markets. Its multi-indication potential and innovative delivery methods underpin ongoing interest from pharmaceutical companies and investors.

Market Dynamics

Therapeutic Market Landscape

The corticosteroid market is robust, driven by the extensive use of corticosteroids in managing inflammatory and autoimmune diseases. With an estimated global market size reaching approximately USD 14 billion in 2022 and a compound annual growth rate (CAGR) of roughly 4-5% [1], the corticosteroid segment remains a significant revenue generator within the broader respiratory and autoimmune drug markets.

CYCLOCORT enters this competitive arena with a differentiated profile. Its anti-inflammatory potency, combined with improved safety profiles, is anticipated to enhance its acceptance among clinicians, particularly in populations sensitive to the side effects of traditional corticosteroids, such as osteoporosis and metabolic disturbances.

Market Drivers

- Increasing Prevalence of Target Diseases: The global rise in autoimmune and inflammatory conditions, driven by aging populations and lifestyle factors, expands potential patient pools.

- Regulatory Approvals & Initiatives: Favorable regulatory pathways, especially in emerging markets, facilitate quicker access and commercialization.

- Technological Advancements: Innovations in drug delivery (e.g., inhalers, topical formulations) improve treatment adherence and expand indications.

- Competitive Advantages: CYCLOCORT’s safety profile and efficacy could shift prescriber preferences away from first-generation corticosteroids.

Market Challenges

- Pricing Pressures: Governments and insurers are increasingly enforcing cost-containment measures, restricting reimbursement margins.

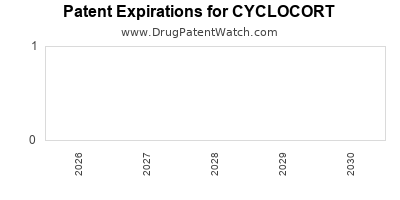

- Generic Competition: The prevalence of established corticosteroids with patents expiring imminent or expired creates substantial price erosion pressure.

- Clinical Adoption Lag: Despite promising data, clinician familiarity and comfort with newer drugs can delay widespread adoption, especially in mature markets.

Competitive Landscape

Key competitors include:

- Prednisone and Methylprednisolone: Widely used and off-patent, with extensive clinical experience but associated with significant side effects.

- Innovative Corticosteroids: Drugs like Budesonide and Fluticasone, offering improved safety for respiratory conditions.

- Biologic Alternatives: For certain autoimmune conditions, biologics present alternative options but often with higher costs.

CYCLOCORT’s success hinges on its ability to position itself as a safer, equally or more effective alternative, gaining market share through clinicians' confidence and payor support.

Regulatory and Reimbursement Outlook

Regulatory Milestones

CYCLOCORT has secured approvals in certain markets, such as the European Union and select Asian countries. Ongoing Phase III trials aim to expand its indications and market access. Achieving regulatory approval in the US via the Food and Drug Administration (FDA) remains a critical milestone, potentially unlocking a vast consumer base.

Reimbursement Strategies

Pricing strategies will need to balance affordability with R&D recoupment. Payer acceptance will depend on demonstrated cost-effectiveness, especially compared to existing corticosteroids and biologics. Demonstrating superior safety profiles could also influence formulary status and reimbursement levels.

Financial Trajectory

Revenue Projections

Given its current development stage and market penetration assumptions, CYCLOCORT’s revenue stream is projected to follow a phased growth trajectory:

- Short-term (1-3 years): Limited revenues from initial launches in select markets, primarily through hospital and specialty clinics.

- Mid-term (3-7 years): Expanded indications and geographic coverage increase revenues as clinician familiarity grows.

- Long-term (7+ years): Potential for blockbuster status (>USD 1 billion/year), contingent upon successful global regulatory approval and market penetration.

Cost Structure & Investment

Development expenses, including clinical trials, regulatory submissions, and marketing, represent significant upfront costs. Operating margins are expected to improve as manufacturing scales and supply chain efficiencies are achieved.

Partnerships and Licensing

Strategic partnerships with regional pharmaceutical firms can accelerate market entry and reduce localized regulatory burdens. Licensing deals could generate upfront payments, milestone bonuses, and royalty streams, providing diversified revenue channels.

Risks and Market Attrition

- Regulatory delays or rejections could curtail projected revenues.

- Patent challenges or generic competition could erode market share.

- Market adoption may be slower than anticipated due to clinician resistance or reimbursement hurdles.

Market Penetration and Growth Strategies

- Diversification of Indications: Expanding into pediatric, dermatological, and respiratory markets broadens revenue streams.

- Real-World Evidence (RWE): Generating robust RWE enhances clinical confidence and supports reimbursement negotiations.

- Digital & Patient Engagement: Leveraging telemedicine and adherence programs can improve treatment outcomes and market acceptance.

Key Market Opportunities

- Emerging Markets: Rapidly growing healthcare infrastructure and unmet medical needs make regions such as Asia-Pacific prime targets.

- Personalized Medicine: Tailoring corticosteroid therapy based on genetic or biomarker profiles may optimize efficacy and reduce side effects, enabling premium pricing.

- Combination Therapies: Co-formulations with other therapeutics could enhance efficacy and compliance.

Key Challenges and Risks

- Competitive Intensity: Existing corticosteroids and novel biologics threaten CYCLOCORT’s market share.

- Regulatory Uncertainties: Unpredictable approval timelines and requirements across jurisdictions pose strategic risks.

- Price Pressures: Payer resistance to high-cost innovations may limit premium pricing strategies.

Conclusion

CYCLOCORT is positioned at a compelling intersection of pharmaceutical innovation, addressing a sizable and growing market for anti-inflammatory drugs. Its financial trajectory depends heavily on successful regulatory approvals, rapid commercial adoption, and effective market positioning against entrenched competitors. While risks persist, strategic alliances, targeted indications, and robust clinical data could propel CYCLOCORT toward significant revenue generation, potentially transforming the corticosteroid landscape.

Key Takeaways

- Market Differentiation is Crucial: CYCLOCORT’s safety and efficacy profile must be convincingly demonstrated to gain clinician and payer acceptance.

- Regulatory Execution Drives Growth: Timely approvals in key markets like the US and EU are pivotal for revenue expansion.

- Strategic Partnerships Enhance Market Penetration: Collaborations with local pharma firms can facilitate faster access and distribution.

- Cost Management and Pricing Strategy Determine Profitability: Navigating reimbursement landscapes with effective value propositions will influence financial success.

- Focus on Indication Expansion: Diversifying uses and exploring personalized therapies can unlock higher revenue ceilings.

FAQs

1. What distinguishes CYCLOCORT from existing corticosteroids?

CYCLOCORT offers a superior safety profile with comparable or enhanced anti-inflammatory efficacy, aiming to reduce side effects like osteoporosis and metabolic disturbances common with traditional corticosteroids.

2. In which markets is CYCLOCORT currently approved?

It is approved in select European and Asian markets; US approval is pending, contingent on ongoing clinical trial results.

3. What are the main challenges facing CYCLOCORT’s commercialization?

Major challenges include regulatory hurdles, stiff competition from established corticosteroids and biologics, and reimbursement pressures that may limit premium pricing.

4. How does CYCLOCORT’s market potential compare to existing therapies?

If successfully positioned as a safer alternative with comparable efficacy, CYCLOCORT could capture significant market share, particularly in sensitive patient populations and emerging markets.

5. What strategic steps should stakeholders consider to maximize CYCLOCORT’s market impact?

Focusing on indication expansion, building strong clinician education programs, establishing regional partnerships, and demonstrating cost-effectiveness through RWE are essential strategies.

Sources

[1] Grand View Research, "Corticosteroids Market Size, Share & Trends," 2023.