Last updated: July 27, 2025

Introduction

Cortisporin, a combination ophthalmic and otic medication primarily composed of hydrocortisone, polymyxin B, and neomycin, has long been utilized in the treatment of bacterial infections and inflammation of the eye and ear. As a registered prescription drug, it operates within a complex market influenced by regulatory environments, technological advancements, and evolving medical practices. This analysis explores the key market dynamics and the projected financial trajectory of Cortisporin, offering strategic insights tailored for industry stakeholders.

Regulatory Landscape and Approval Status

Cortisporin’s positioning in the pharmaceutical ecosystem hinges heavily on regulatory decisions. Approved by the U.S. Food and Drug Administration (FDA) initially in the mid-20th century, the formulation’s patent protections have long since expired, rendering it a generic medication. This status affects its market exclusivity, pricing strategies, and competitive stature.

Recent regulatory trends, including increased scrutiny of combination drugs and antibiotic stewardship initiatives, influence Cortisporin’s market access. Legislative efforts to curb antibiotic resistance have prompted considerations for alternative therapies, potentially impacting demand. Moreover, global regulatory variances, especially in emerging markets, contribute to a patchwork of approval statuses, affecting distribution and sales volume.

Market Drivers

Increasing Incidence of Ear and Eye Infections

Growing prevalence of bacterial ear and ocular infections, often associated with urban living, climate change, and aging populations, propels demand for effective topical treatments such as Cortisporin. According to the CDC, ear infections affect nearly 6% of children annually in the United States, driving pediatric prescriptions [1]. Similarly, ocular infections from contact lens misuse are rising, bolstering the medication’s relevance.

Advancements in Drug Delivery and Formulation

Innovations in topical delivery mechanisms, including sustained-release formulations, improve therapeutic outcomes and patient compliance, indirectly supporting Cortisporin’s market stability. The development of preservative-free formulations also caters to sensitive populations, expanding scope.

Competitive Landscape and Genericization

The entrance of generic manufacturers post-patent expiration has significantly lowered Cortisporin’s prices, expanding access but eroding profit margins for brand producers. Several competitors now offer similar combination therapies, increasing market fragmentation. The presence of alternative agents with broader spectrums or fewer side effects shapes the competitive environment.

Antibiotic Stewardship and Resistance Concerns

Global efforts to combat antibiotic resistance influence prescribing patterns. Healthcare providers increasingly favor targeted therapy and may reserve combination antibiotics like Cortisporin for severe cases, potentially limiting its use. Such policies could result in a plateau or decline in demand, especially where newer, resistance-mitigating treatments emerge.

Market Penetration in Developing Countries

Emerging markets represent high-growth opportunities driven by expanding healthcare infrastructure and increasing penetrance of Western medicines. However, price sensitivity, regulatory hurdles, and local competition pose challenges. Companies that strategically price and localize formulations are positioned to capitalize on these dynamics.

Financial Trajectory Analysis

Revenue Streams and Pricing Strategies

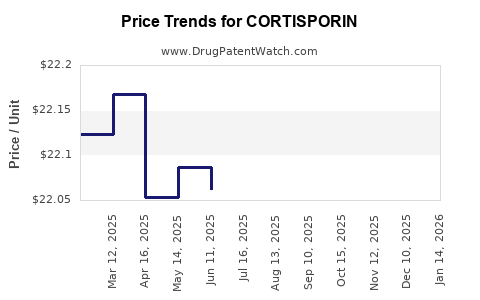

As a generic, Cortisporin’s revenue relies heavily on volume sales rather than premium pricing. Suppliers operating in mature markets see declining or plateaued revenues due to generic competition, unless they secure differentiated formulations or bundle with services.

In emerging markets, price elasticity allows for higher margins, especially where local providers seek affordable yet effective treatments. However, prices are often constrained by local regulatory limits and insurance reimbursement policies.

Profit Margins and Cost Structures

Manufacturers face compressed profit margins due to aggressive price competition among generics. Production costs have decreased with technological innovations, but marketing, distribution, and compliance expenses remain significant. Companies investing in R&D for alternative formulations or delivery methods may offset margin pressures.

Market Share and Growth Projections

Overall, Cortisporin’s global market share is expected to decline gradually, influenced by rising generic competition and antibiotic stewardship policies. Nonetheless, strategic positioning in niche markets, such as pediatric or resistant infection segments, could sustain revenue streams.

Projections suggest a compound annual growth rate (CAGR) between -2% and 1% over the next five years in developed markets. Conversely, high-growth emerging markets could see a CAGR of 4-6%, driven by healthcare infrastructure expansion and unmet needs.

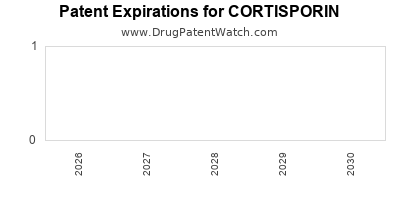

Impact of Regulatory and Patent Policies

The absence of patent protection limits exclusivity but opens opportunities for market expansion through strategic partnerships, regulatory approvals in new jurisdictions, and formulation innovations.

Future Outlook and Strategic Considerations

In the short term, Cortisporin faces stagnation in several mature markets due to commoditization. Long-term growth hinges on diversification into new indications, formulation innovations, and geographic expansion.

Emerging trends such as personalized medicine, microbiome considerations, and antibiotic alternatives could impact the drug’s positioning. Companies investing in R&D to develop novel derivatives or combination therapies with reduced resistance potential may unlock new revenue streams.

Furthermore, blockchain-enabled supply chain transparency and digital marketing strategies could enhance market penetration, especially in underpenetrated regions.

Key Takeaways

-

Market Saturation and Competition: The expiration of patents has shifted Cortisporin from a branded drug to a commoditized generic, resulting in reduced profit margins but increased accessibility.

-

Regulatory and Stewardship Influences: Evolving policies aimed at antibiotic stewardship might limit Cortisporin’s use, particularly for mild infections, affecting sales volume.

-

Growth Opportunities in Emerging Markets: Expansion through localized formulations and strategic licensing in developing countries offers potential for revenue growth, counterbalancing declines in mature markets.

-

Innovative Formulation Development: Investing in novel delivery systems and combination formulations may create competitive advantages and open new therapeutic niches.

-

Long-term Viability Challenges: Resistance concerns and shifting treatment paradigms necessitate diversification strategies and R&D to sustain future growth.

FAQs

Q1: How does the patent expiration of Cortisporin impact its market performance?

A: Patent expiration leads to generic competition, typically reducing prices and profit margins while increasing accessibility. It results in market saturation, requiring companies to innovate or diversify to maintain profitability.

Q2: What are the main regulatory challenges facing Cortisporin in global markets?

A: Regulatory challenges include approval variances across countries, restrictions on antibiotic use to combat resistance, and adherence to local safety standards, all influencing market entry and growth.

Q3: How does antibiotic stewardship influence Cortisporin’s future demand?

A: Stewardship initiatives promote judicious antibiotic use, potentially limiting prescriptions for broad-spectrum agents like Cortisporin. This can lead to decreased demand, especially for mild or self-limiting infections.

Q4: Are there opportunities for innovation within the Cortisporin product line?

A: Yes, opportunities include developing preservative-free formulations, sustained-release mechanisms, and combination therapies with reduced resistance potential, which could differentiate products and open new markets.

Q5: What role do emerging markets play in the long-term financial outlook for Cortisporin?

A: Emerging markets offer growth prospects due to expanding healthcare infrastructure, increasing disease prevalence, and demand for affordable medications. Strategic entry and localization can significantly enhance revenues in these regions.

Sources:

- Centers for Disease Control and Prevention (CDC). Ear infections prevalence.

- Global Antibiotic Resistance Partnership. Policy impacts on antibiotic use.

- IMS Health. Pharmaceutical market trends in emerging markets.

- U.S. FDA. Regulatory policies on antibiotics.

- Pharmaceutical Market Reports. Generic drug market analysis.