COPIKTRA Drug Patent Profile

✉ Email this page to a colleague

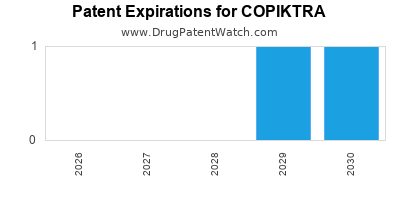

When do Copiktra patents expire, and what generic alternatives are available?

Copiktra is a drug marketed by Secura and is included in one NDA. There are six patents protecting this drug.

This drug has two hundred and twenty-seven patent family members in thirty-nine countries.

The generic ingredient in COPIKTRA is duvelisib. One supplier is listed for this compound. Additional details are available on the duvelisib profile page.

DrugPatentWatch® Generic Entry Outlook for Copiktra

Copiktra was eligible for patent challenges on September 24, 2022.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be May 17, 2032. This may change due to patent challenges or generic licensing.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for COPIKTRA?

- What are the global sales for COPIKTRA?

- What is Average Wholesale Price for COPIKTRA?

Summary for COPIKTRA

| International Patents: | 227 |

| US Patents: | 6 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 1 |

| Raw Ingredient (Bulk) Api Vendors: | 69 |

| Clinical Trials: | 12 |

| Drug Prices: | Drug price information for COPIKTRA |

| What excipients (inactive ingredients) are in COPIKTRA? | COPIKTRA excipients list |

| DailyMed Link: | COPIKTRA at DailyMed |

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for COPIKTRA

Generic Entry Date for COPIKTRA*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

CAPSULE;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for COPIKTRA

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| CSPC ZhongQi Pharmaceutical Technology Co., Ltd. | Phase 1/Phase 2 |

| Secura Bio, Inc. | Early Phase 1 |

| National Cancer Institute (NCI) | Early Phase 1 |

US Patents and Regulatory Information for COPIKTRA

COPIKTRA is protected by eight US patents and one FDA Regulatory Exclusivity.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of COPIKTRA is ⤷ Get Started Free.

This potential generic entry date is based on patent RE46621.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | TE | Type | RLD | RS | Patent No. | Patent Expiration | Product | Substance | Delist Req. | Exclusivity Expiration |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Secura | COPIKTRA | duvelisib | CAPSULE;ORAL | 211155-001 | Sep 24, 2018 | RX | Yes | No | 9,840,505 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Secura | COPIKTRA | duvelisib | CAPSULE;ORAL | 211155-002 | Sep 24, 2018 | RX | Yes | No | ⤷ Get Started Free | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Secura | COPIKTRA | duvelisib | CAPSULE;ORAL | 211155-001 | Sep 24, 2018 | RX | Yes | No | RE46621 | ⤷ Get Started Free | Y | Y | ⤷ Get Started Free | ||

| Secura | COPIKTRA | duvelisib | CAPSULE;ORAL | 211155-001 | Sep 24, 2018 | RX | Yes | No | 12,213,983 | ⤷ Get Started Free | ⤷ Get Started Free | ||||

| Secura | COPIKTRA | duvelisib | CAPSULE;ORAL | 211155-001 | Sep 24, 2018 | RX | Yes | No | 8,193,182 | ⤷ Get Started Free | Y | ⤷ Get Started Free | |||

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >TE | >Type | >RLD | >RS | >Patent No. | >Patent Expiration | >Product | >Substance | >Delist Req. | >Exclusivity Expiration |

EU/EMA Drug Approvals for COPIKTRA

| Company | Drugname | Inn | Product Number / Indication | Status | Generic | Biosimilar | Orphan | Marketing Authorisation | Marketing Refusal |

|---|---|---|---|---|---|---|---|---|---|

| Secura Bio Limited | Copiktra | duvelisib | EMEA/H/C/005381Copiktra monotherapy is indicated for the treatment of adult patients with: Relapsed or refractory chronic lymphocytic leukaemia (CLL) after at least two prior therapies. Follicular lymphoma (FL) that is refractory to at least two prior systemic therapies. | Authorised | no | no | no | 2021-05-19 | |

| >Company | >Drugname | >Inn | >Product Number / Indication | >Status | >Generic | >Biosimilar | >Orphan | >Marketing Authorisation | >Marketing Refusal |

International Patents for COPIKTRA

When does loss-of-exclusivity occur for COPIKTRA?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 4824

Patent: PROCESOS PARA PREPARAR ISOQUINOLINONAS Y FORMAS SOLIDAS DE ISOQUINOLINONAS

Estimated Expiration: ⤷ Get Started Free

Patent: 7467

Patent: PROCESOS PARA PREPARAR ISOQUINOLINONAS Y FORMAS SÓLIDAS DE ISOQUINOLINONAS

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 12205669

Patent: Processes for preparing isoquinolinones and solid forms of isoquinolinones

Estimated Expiration: ⤷ Get Started Free

Patent: 15258280

Patent: PROCESSES FOR PREPARING ISOQUINOLINONES AND SOLID FORMS OF ISOQUINOLINONES

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2013017670

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 24197

Patent: PROCEDES DE PREPARATION D'ISOQUINOLINONES ET DE FORMES SOLIDES D'ISOQUINOLINONES (PROCESSES FOR PREPARING ISOQUINOLINONES AND SOLID FORMS OF ISOQUINOLINONES)

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 13002007

Patent: Compuesto polimorfo (s)-3-(1-(9h-purin-6-ilamino)etil)-8-cloro-2-fenilisoquinolin-1-(2h)-ona de formas b-j, amorfa, sal, solvato o hidrato del mismo; mezclas de estos compuestos; metodo para preparar el polimorfo de forma c; composicion farmaceutica; metodo de tratamiento; uso para el tratamiento de un trastorno mediado por pi3k.

Estimated Expiration: ⤷ Get Started Free

China

Patent: 3648499

Patent: Processes for preparing isoquinolinones and solid forms of isoquinolinones

Estimated Expiration: ⤷ Get Started Free

Denmark

Patent: 63309

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 63309

Patent: PROCÉDÉS DE PRÉPARATION D'ISOQUINOLINONES ET DE FORMES SOLIDES D'ISOQUINOLINONES (PROCESSES FOR PREPARING ISOQUINOLINONES AND SOLID FORMS OF ISOQUINOLINONES)

Estimated Expiration: ⤷ Get Started Free

Patent: 38722

Patent: FORMES SOLIDES D'ISOQUINOLINONES (SOLID FORMS OF ISOQUINOLINONES)

Estimated Expiration: ⤷ Get Started Free

Patent: 81574

Patent: COMPOSITION POUR ADMINISTRATION ORALE À UTILISER DANS LE TRAITEMENT DU CANCER, D'UNE MALADIE INFLAMMATOIRE OU D'UNE MALADIE AUTO-IMMUNE (A COMPOSITION FOR ORAL ADMINISTRATION FOR USE IN THE TREATMENT OF CANCER, AN INFLAMMATORY DISEASE OR AN AUTO-IMMUNE DISEASE)

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 45110

Patent: 異喹啉酮的固體形式 (SOLID FORMS OF ISOQUINOLINONES)

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 7387

Patent: תהליכים להכנת איזוקווינולינונים וצורת מוצקות של איזוקווינולינונים (Processes for preparing isoquinolinones and solid forms of isoquinolinones)

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 54672

Estimated Expiration: ⤷ Get Started Free

Patent: 14501790

Estimated Expiration: ⤷ Get Started Free

Patent: 17061547

Patent: イソキノリノンの調製方法及びイソキノリノンの固体形態 (PROCESSES FOR PREPARING ISOQUINOLINONES AND SOLID FORMS OF ISOQUINOLINONES)

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 7708

Patent: PROCESO PARA PREPARAR ISOQUINOLINONAS Y FORMAS SOLIDAS DE ISOQUINOLINONAS. (PROCESSES FOR PREPARING ISOQUINOLINONES AND SOLID FORMS OF ISOQUINOLINONES.)

Estimated Expiration: ⤷ Get Started Free

Patent: 13008065

Patent: PROCESO PARA PREPARAR ISOQUINOLINONAS Y FORMAS SOLIDAS DE ISOQUINOLINONAS. (PROCESSES FOR PREPARING ISOQUINOLINONES AND SOLID FORMS OF ISOQUINOLINONES.)

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 2909

Patent: Processes for preparing isoquinolinones and solid forms of isoquinolinones

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 141303

Patent: PROCEDIMIENTO PARA PREPARAR ISOQUINOLINONAS Y FORMAS SOLIDAS DE ISOQUINOLINONAS

Estimated Expiration: ⤷ Get Started Free

Patent: 180318

Patent: PROCEDIMIENTO PARA PREPARAR ISOQUINOLINONAS Y FORMAS SOLIDAS DE ISOQUINOLINONAS

Estimated Expiration: ⤷ Get Started Free

Philippines

Patent: 018500960

Patent: PROCESSES FOR PREPARING ISOQUINOLINONES AND SOLID FORMS OF ISOQUINOLINONES

Estimated Expiration: ⤷ Get Started Free

Russian Federation

Patent: 26883

Patent: СПОСОБЫ ПОЛУЧЕНИЯ ИЗОХИНОЛИНОНОВ И ТВЕРДЫЕ ФОРМЫ ИЗОХИНОЛИНОНОВ (METHODS OF PRODUCTION ISOQUINOLINONES AND SOLID FORMS ISOQUINOLINONES)

Estimated Expiration: ⤷ Get Started Free

Patent: 13137424

Patent: СПОСОБЫ ПОЛУЧЕНИЯ ИЗОХИНОЛИНОНОВ И ТВЕРДЫЕ ФОРМЫ ИЗОХИНОЛИНОНОВ

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 1897

Patent: PROCESSES FOR PREPARING ISOQUINOLINONES AND SOLID FORMS OF ISOQUINOLINONES

Estimated Expiration: ⤷ Get Started Free

Patent: 201600179R

Patent: PROCESSES FOR PREPARING ISOQUINOLINONES AND SOLID FORMS OF ISOQUINOLINONES

Estimated Expiration: ⤷ Get Started Free

South Africa

Patent: 1305150

Patent: PROCESSES FOR PREPARING ISOQUINOLINONES AND SOLID FORMS OF ISOQUINOLINONES

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 1875720

Estimated Expiration: ⤷ Get Started Free

Patent: 140020249

Patent: PROCESSES FOR PREPARING ISOQUINOLINONES AND SOLID FORMS OF ISOQUINOLINONES

Estimated Expiration: ⤷ Get Started Free

Patent: 180080358

Patent: 이소퀴놀린온 및 이의 고체 형태의 제조 방법 (PROCESSES FOR PREPARING ISOQUINOLINONES AND SOLID FORMS OF ISOQUINOLINONES)

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 37113

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 46305

Estimated Expiration: ⤷ Get Started Free

Patent: 59956

Estimated Expiration: ⤷ Get Started Free

Patent: 74262

Estimated Expiration: ⤷ Get Started Free

Patent: 1247670

Patent: Processes for preparing isoquinolinones and solid forms of isoquinolinones

Estimated Expiration: ⤷ Get Started Free

Patent: 1700475

Patent: Processes for preparing isoquinolinones and solid forms of isoquinolinones

Estimated Expiration: ⤷ Get Started Free

Patent: 1906841

Patent: Processes for preparing isoquinolinones and solid forms of isoquinolinones

Estimated Expiration: ⤷ Get Started Free

Ukraine

Patent: 5767

Patent: СПОСОБИ ОТРИМАННЯ ІЗОХІНОЛІНОНІВ І ТВЕРДІ ФОРМИ ІЗОХІНОЛІНОНІВ (PROCESSES FOR PREPARING ISOQUINOLINONES AND SOLID FORMS OF ISOQUINOLINONES)

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering COPIKTRA around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| European Patent Office | 2914296 | ⤷ Get Started Free | |

| Taiwan | I659956 | ⤷ Get Started Free | |

| Mexico | 358640 | ⤷ Get Started Free | |

| Japan | 7088889 | ⤷ Get Started Free | |

| South Africa | 201005390 | CERTAIN CHEMICAL ENTITIES,COMPOSITIONS AND METHODS | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for COPIKTRA

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2456444 | 811 | Finland | ⤷ Get Started Free | |

| 2456444 | SPC/GB21/069 | United Kingdom | ⤷ Get Started Free | SPC/GB21/069 WAS ADDED TO THE JOURNAL 7041 INCORRECTLY IDENTIFYING THE INCORRECT MAXIMUM EXPIRY DATE ON WHICH THE SPC IS BASED. PLEASE SEE THE UPDATED JOURNAL ENTRY.; APPLICANT: INTELLIKINE, LLC; 10931 NORTH TORREY PINES ROAD, LA JOLLA CA 92037, UNITED STATES OF AMERICA; PRODUCT: DUVELISIB; PRODUCT TYPE: MEDICINAL; AUTHORISED:; EU/1/21/1542/001 21 MAY 2021 (NI); EU/1/21/1542/002 21 MAY 2021 (NI) ; FURTHER MA'S ON IPSUM; ; AUTHORISED EXTENSION:; PATENT NO: EP2456444; TITLE: ADENINE DERIVATIVE AS PI3K INHIBITOR; SPC NO: SPC/GB21/069; DATE GRANTED: 05 APRIL 2024; MAXIMUM PERIOD EXPIRES ON: 14 JULY 2035; CORRECTED DATA |

| 2456444 | C20210033 00435 | Estonia | ⤷ Get Started Free | PRODUCT NAME: DUVELISIIB;REG NO/DATE: EU/1/21/1542 21.05.2021 |

| 2456444 | 301140 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: DUVELISIB; REGISTRATION NO/DATE: EU/1/21/1542 20210521 |

| 2914296 | 47/2021 | Austria | ⤷ Get Started Free | PRODUCT NAME: DUVELISIB; REGISTRATION NO/DATE: EU/1/21/1542 (MITTEILUNG) 20210521 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for COPIKTRA (Duvelisib)

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.