Last updated: December 6, 2025

Executive Summary

Conjugated estrogens, primarily used for hormone replacement therapy (HRT), present a complex market landscape driven by demographic trends, regulatory policies, and evolving treatment paradigms. This analysis delineates the current market size, growth prospects, competitive structure, regulatory environment, and key financial indicators, providing a comprehensive outlook. The global conjugated estrogens market is projected to grow steadily, driven by increasing aging populations, rising awareness of menopause management, and strategic brand positioning. However, challenges such as safety concerns, patent expiries, and generic competition continually influence its financial performance.

What Are Conjugated Estrogens and Why Are They Market-Relevant?

Conjugated estrogens (CE), derived predominantly from the urine of pregnant mares, are a class of estrogenic compounds used in hormone therapy for menopausal women, osteoporosis prevention, and other estrogen-deficiency conditions. Commonly administered orally, transdermally, or via injections, CE formulations include brands like Premarin and generics.

Market relevance Factors:

- First-line therapy for menopause symptoms

- Used in hormone replacement therapy (HRT)

- Approved for estrogen deficiency treatment

- Underlying demand from aging global populations

Current Market Size and Growth Trajectory

Global Market Value (2023)

| Region |

Market Size (USD billion) |

CAGR (2023–2028) |

Notes |

| North America |

1.8 |

3.2% |

Largest regional share, driven by aging demographics and high healthcare expenditure |

| Europe |

1.2 |

2.8% |

Mature market, influenced by regulatory changes and patent expirations |

| Asia-Pacific |

0.9 |

6.0% |

Fastest-growing—boosted by rising awareness and healthcare infrastructure |

| Rest of World |

0.3 |

4.5% |

Emerging markets showing increasing demand |

Total Global Market (2023): Approximately USD 4.2 billion

Projected 5-year growth: Compound annual growth rate (CAGR) of 3–5%, with an accelerated growth rate in Asian markets.

Market Drivers

| Driver Category |

Specific Factors |

| Demographic Trends |

Increasing menopause rates among women aged 45–65 |

| Healthcare Policies |

Rising approval and reimbursement for HRT products |

| Innovation |

Development of bioidentical estrogens and combination therapies |

| Awareness Campaigns |

Focus on osteoporosis and postmenopausal health |

Market Restraints

| Restraint Type |

Description |

| Safety Concerns |

Risk of breast cancer, cardiovascular events, and stroke |

| Regulatory Hurdles |

Stringent approval processes, evolving guidelines |

| Patent Expiry |

Loss of exclusivity leading to price erosion |

| Competition |

Increased availability of generics and biosimilars |

Market Structure and Competitive Landscape

Major Players and Market Share

| Company |

Product Portfolio |

Estimated Market Share |

Key Strategies |

| Pfizer |

Premarin, new estrogen therapies |

35% |

Portfolio diversification, patent litigation |

| Novartis |

Estradiol-based products, biosimilars |

20% |

R&D, biosimilar entry |

| Teva |

Generic conjugated estrogens |

15% |

Cost leadership, expanding generics |

| Others |

Various regional brands |

30% |

Niche marketing, OTC formulations |

Market Entry Barriers

- Stringent regulatory approval processes

- High R&D costs for biosimilar development

- Existing patent protections

- Economies of scale required for manufacturing

Regulatory Environment Influencing Financial Trajectory

Key Regulatory Policies

| Region |

Policy Focus |

Impact on Market |

Implementation Date |

| US |

FDA guidelines on HRT safety |

Heightened safety monitoring, cautious approval |

2017–present |

| EU |

EMA phase-out target for conjugated estrogens |

Decreased approvals, market shift to bioidentical estrogen |

2020–2022 |

| Asia-Pacific |

Increasing inclusion in national formularies |

Market expansion, accelerated approvals |

2010–present |

FDA and EMA Approvals

- Post-2017, FDA mandated Boxed Warnings on associated risks, impacting sales.

- EMA adopted more stringent evidence requirements, slowing new product launches.

- These policies have driven a shift towards safer, bioidentical formulations.

Financial Metrics and Investment Trends

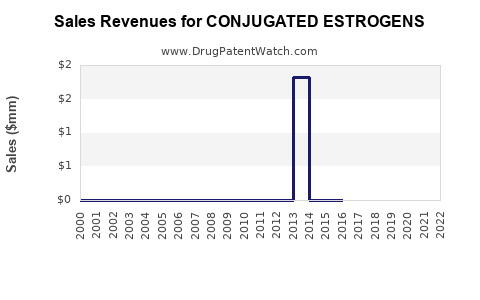

Revenue Trends (Last 5 Years)

| Year |

Global Revenue (USD billion) |

Year-over-Year Growth |

| 2018 |

3.4 |

- |

| 2019 |

3.6 |

5.9% |

| 2020 |

3.7 |

2.8% |

| 2021 |

4.0 |

8.1% |

| 2022 |

4.2 |

5.0% |

Profitability Metrics

| Metric |

2022 |

Notes |

| Gross Margin |

~45% |

Influenced by high generic competition |

| R&D Spending |

10–15% of revenue |

Focused on biosimilars and bioidentical hormone research |

| Operating Margin |

~20% |

Stabilized despite price erosion |

Investment Trends

- Increasing R&D investments in biosimilar and biosynthetic conjugated estrogen formulations.

- Mergers and acquisitions (M&A) to acquire pipeline assets.

- Public market offerings focusing on bioidentical hormone technology.

Market Opportunities and Risks

Opportunities

- Growing demand in emerging markets

- Development of safer, more effective formulations

- Expansion of combination therapies (e.g., estrogen with progestins)

- Personalized medicine and bio-identical estrogen products

Risks

- Regulatory reclassification of estrogen therapies as high-risk drugs

- Litigation related to safety profiles

- Patent cliffs leading to generic commoditization

- Competitive pressure from alternative hormone therapies

Comparison: Conjugated Estrogens vs. Other Estrogen Therapies

| Aspect |

Conjugated Estrogens |

Estradiol |

Bioidentical Estrogens |

Synthetic Alternatives |

| Source |

Urine of pregnant mares |

Synthesized in labs |

Plant-derived compounds |

Chemical synthesis |

| Safety Profile |

Controversial; risk concerns |

Similar, generally safer |

Considered safer, "natural" |

Varies; depends on formulation |

| Patent Status |

Limited, some formulations expiring |

Patent protected |

Often compounded, less regulated |

Patent protected, proprietary |

| Market Trends |

Mature, slow growth |

Growing, with new formulations |

Rising in niche markets |

Limited within estrogen class |

FAQs

1. What factors are driving the growth of conjugated estrogens globally?

Aging populations, increasing prevalence of menopausal symptoms, healthcare policy support, and innovation in formulations are the primary drivers. Emerging markets, notably in Asia-Pacific, are experiencing accelerated growth due to increased awareness and infrastructure.

2. How do safety concerns impact the financial performance of conjugated estrogens?

Safety warnings, especially regarding breast cancer and cardiovascular risks, have led to regulatory restrictions and reduced market share, impacting revenue streams. Companies actively invest in newer, safer formulations to mitigate these risks.

3. What is the future of conjugated estrogens in the face of generic competition?

Patent expiries have increased generic availability, exerting downward pressure on prices. Future growth hinges on developing bioidentical or improved formulations that meet safety standards and consumer preferences for 'natural' products.

4. How are regulatory policies shaping research and product development in this segment?

Regulatory agencies' emphasis on safety has led to more rigorous approval processes, influencing R&D priorities. Innovators focus on bioidentical hormones and combination therapies, aligning with tighter safety regulations.

5. Which regions represent the highest potential for market expansion?

Asia-Pacific presents the highest growth potential due to demographic shifts, increasing healthcare access, and evolving regulatory landscapes favoring hormone therapies. Latin America and Africa also offer emerging opportunities.

Key Takeaways

- Market stability amidst challenges: The conjugated estrogens market remains vital but is characterized by slow, steady growth influenced by demographic shifts and technological advancements.

- Demographic strengths: Aging populations globally benefit from HRT, supporting sustained demand.

- Regulatory and safety dynamics: Stringent policies and safety concerns necessitate innovation towards safer, bioidentical estrogen products.

- Competitive landscape: Dominated by large pharma with shifting market share due to patent expiries and generic competition.

- Opportunities: Emerging markets, biosimilars, and personalized medicine approaches offer substantial long-term growth avenues.

References

- Industry Reports, "Global Hormone Therapy Market," MarketsandMarkets, 2023.

- FDA, "Hormone Therapy Labeling," 2017.

- EMA Guidelines, "Estrogen and Progestogen Therapy," 2020.

- World Health Organization, "Menopause and Ageing," 2022.

- Company Annual Reports: Pfizer, Novartis, Teva, 2022–2023.