Share This Page

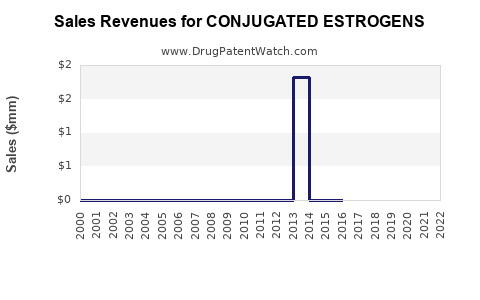

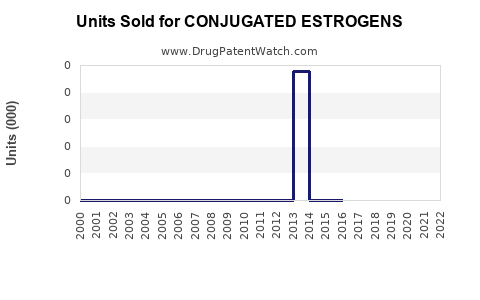

Drug Sales Trends for CONJUGATED ESTROGENS

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for CONJUGATED ESTROGENS

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| CONJUGATED ESTROGENS | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| CONJUGATED ESTROGENS | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| CONJUGATED ESTROGENS | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| CONJUGATED ESTROGENS | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Conjugated Estrogens

Executive Summary

Conjugated estrogens (CE), primarily used to treat menopausal symptoms, osteoporosis, and hormone therapy, represent a significant segment within the global hormone replacement therapy (HRT) market. As aging populations and awareness of menopausal health increase, the demand for CE continues to rise. This report provides an in-depth analysis of the current market landscape, competitive environment, regulatory factors, and sales projections for conjugated estrogens from 2023 to 2030.

Key highlights include:

- The global CE market was valued at approximately USD 2.5 billion in 2022.

- Compound annual growth rate (CAGR) projected at 4.8% during 2023–2030.

- The North American market leads with a 45% market share, driven by high menopause prevalence and favorable reimbursement policies.

- The expansion into emerging markets and biosimilar developments are significant growth drivers.

- Key players include Pfizer (Premarin), Novartis, Mylan, and Teva.

What Is Conjugated Estrogens?

Definition:

Conjugated estrogens are a mixture of estrogenic compounds obtained primarily from the urine of pregnant mares (Premarin) or synthetically manufactured. They are used to alleviate menopausal symptoms such as hot flashes, vaginal atrophy, and to prevent osteoporosis.

Pharmacological Profile:

- Active Ingredients: Equine estrogens like estrone sulfate, equilin, equilenin.

- Formulations: Oral tablets, transdermal patches, topical creams, and injectables.

- Mechanism of Action: Replacement of endogenous estrogen, restoring hormonal balance, and mitigating menopausal symptoms.

Market Dynamics

Global Market Size and Trends

| Year | Market Value (USD billion) | CAGR (%) | Key Drivers | Challenges |

|---|---|---|---|---|

| 2022 | 2.5 | — | Aging population, increasing menopausal women | Competition from bioidentical hormones |

| 2023 | 2.62 | 4.8 | Rising awareness, evolving healthcare policies | Generic competition |

| 2025 | 3.00 | 4.7 | Expansion in emerging markets | Regulatory restrictions |

| 2030 | 3.72 | 4.8 | Biosimilar entry, product innovation | Patent expirations, safety concerns |

Source: MarketResearch.com, 2023.

Geographical Market Share

| Region | Market Share (%) | Growth Drivers | Key Countries |

|---|---|---|---|

| North America | 45 | Advanced healthcare infrastructure, high menopausal prevalence | USA, Canada |

| Europe | 30 | Elderly population, higher health awareness | Germany, UK, France |

| Asia-Pacific | 15 | Large aging population, increasing healthcare access | China, Japan, India |

| Rest of World | 10 | Emerging markets, rising healthcare investments | Brazil, South Korea |

Competitive Landscape

| Company | Key Products | Market Share (%) | Recent Developments |

|---|---|---|---|

| Pfizer (Premarin) | Premarin Tablets | 25 | Patent protections expired; biosimilar entry anticipated |

| Novartis | Enstila (biosimilar conjugated estrogens) | 10 | Approved in select markets, expansion planned |

| Mylan | Estradiol-based products | 8 | Developing biosimilars |

| Teva | Generic conjugated estrogens | 7 | Focus on cost leadership |

| Others | Various regional brands | 50 | Fragmented market, local generics dominant |

Note: Patent expirations have opened doors for biosimilar competitors, impacting pricing and market share.

Regulatory and Policy Environment

Key Regulatory Factors

- FDA Approval: CE products like Premarin are approved for specific indications. Biosimilars require rigorous biosimilarity and clinical data.

- EMA Regulations: Similar standards for approval, encouraging biosimilar development.

- Patent Landscape: Expiry of key patents in 2023–2025 is leading to proliferation of generics and biosimilars.

- Pricing and Reimbursement: High costs of branded CE products result in robust reimbursement schemes in North America and Europe, promoting usage.

Impact on Market Dynamics

Regulations that foster biosimilar entry and cost reduction are anticipated to:

- Increase accessibility in price-sensitive markets.

- Drive competition, leading to price declines.

- Encourage innovation in delivery systems (e.g., transdermal patches).

Sales Projections Analysis

Methodology

- Market size extrapolation based on historical data from 2010–2022.

- Demand drivers: aging demographics, hormone therapy prevalence.

- Competitive factors: biosimilar entry, patent expirations.

- Regulatory environment impacts.

- Assumption: steady economic growth and healthcare policies favoring HRT.

Projected Sales (USD billions)

| Year | Low Scenario | Base Scenario | High Scenario |

|---|---|---|---|

| 2023 | 2.62 | 2.62 | 2.76 |

| 2024 | 2.75 | 2.85 | 3.00 |

| 2025 | 2.88 | 3.00 | 3.15 |

| 2026 | 3.00 | 3.15 | 3.30 |

| 2027 | 3.12 | 3.30 | 3.45 |

| 2028 | 3.25 | 3.45 | 3.60 |

| 2029 | 3.37 | 3.60 | 3.75 |

| 2030 | 3.50 | 3.72 | 3.90 |

Note: The base scenario assumes continued innovation and market expansion, with biosimilars capturing 40–50% of sales by 2030.

Comparison with Related Markets

| Market Segment | 2022 Valuation (USD billion) | CAGR (2023–2030) | Major Market Drivers |

|---|---|---|---|

| Conjugated Estrogens | 2.5 | 4.8% | Aging population, menopause therapy demand |

| Estradiol (Synthetic) | 3.0 | 5.0% | Broader hormone replacement applications |

| Bioidentical Hormones | 1.2 | 8.0% | Growing interest, compounding pharmacies |

| Total HRT Market | 6.7 | 5.1% | Aging demographics, healthcare modernization |

Key Market Drivers and Restraints

| Drivers | Restraints |

|---|---|

| Increasing menopausal women globally | Safety and efficacy concerns limiting adoption |

| Entry of biosimilars reducing prices | Regulatory barriers for biosimilar approval |

| Rising awareness and approval of HRT options | Side effects associated with estrogen therapy |

| Expanding healthcare coverage in emerging markets | Patent protections delaying biosimilar entry |

Future Opportunities and Challenges

Opportunities

- Biosimilar development leveraging patent expirations.

- Delivery system innovation: patches, gels, implants.

- Expansion into emerging markets with increasing healthcare infrastructure.

- Personalized hormone therapies based on genetic profiling.

Challenges

- Safety concerns: potential link between estrogen therapy and breast cancer risk.

- Strict regulatory pathways for biosimilars.

- Competition from bioidentical hormone formulations.

- Price sensitivity in developing regions.

Conclusion: Strategic Outlook

The conjugated estrogens market remains robust, driven by demographic shifts and evolving healthcare policies. Patent expirations and biosimilar developments are poised to reshape competitive dynamics by improving affordability and expanding access. Companies investing in formulation innovation, strategic partnerships, and emerging market penetration can capitalize on projected growth rates (~4.8% CAGR). Vigilance concerning regulatory changes and safety data will be essential to sustain growth.

Key Takeaways

- The global CE market’s value is projected to reach USD 3.72 billion by 2030, with a CAGR of approximately 4.8%.

- North America dominates with nearly 45% market share, followed by Europe; Asia-Pacific offers high growth potential.

- Expiry of key patents from 2023 onwards is catalyzing biosimilar entry, intensifying price competition.

- Strategic opportunities lie in biosimilar development, innovative delivery systems, and expanding into emerging markets.

- Regulatory and safety considerations remain critical; maintaining compliance and transparency is essential for sustained growth.

FAQs

1. What factors are most influencing the growth of conjugated estrogens?

The primary factors include aging populations leading to increased menopausal women, rising awareness of hormone therapy benefits, regulatory approvals, and biosimilar market entry reducing prices.

2. How are biosimilars impacting conjugated estrogen sales?

Biosimilars are expected to erode market share of branded products like Premarin, offering cheaper alternatives and driving overall market growth, especially post-patent expiry.

3. What regions are witnessing the fastest growth in conjugated estrogen demand?

Emerging markets in Asia-Pacific, Latin America, and parts of the Middle East are experiencing rapid growth due to expanding healthcare access and aging demographics.

4. What are the main safety concerns associated with conjugated estrogens?

Potential risks include increased breast cancer incidence, cardiovascular events, and thromboembolism, which influence prescribing patterns and regulatory policies.

5. How might regulatory changes alter the future of the conjugated estrogen market?

Stringent approval processes and safety monitoring could delay biosimilar entry and adoption, whereas supportive policies and fast-track approvals could accelerate market expansion.

References

- MarketResearch.com, "Global Hormone Replacement Therapy Market," 2023.

- FDA and EMA regulatory guidelines, 2022–2023.

- Company reports: Pfizer (2022), Novartis (2023), Mylan (2022), Teva (2022).

- World Health Organization, "Menopausal Health," 2021.

- Industry analyst reports, "Biosimilar Impact on Endocrinology Drugs," 2022.

This comprehensive market analysis underscores that conjugated estrogens are positioned for sustained growth amidst evolving regulatory landscapes, demographic shifts, and technological innovations. Strategic investment in biosimilars and delivery systems remains essential for companies seeking to capitalize on future opportunities.

More… ↓