Last updated: July 31, 2025

Introduction

COLY-MYCIN M, an injectable antibiotic primarily containing colistin and methylprednisolone, addresses critical needs in combating multidrug-resistant (MDR) bacterial infections. Its unique formulation combines antimicrobial potency with anti-inflammatory effects, positioning it within niche but high-demand segments of the pharmaceutical landscape. Understanding the evolving market dynamics and financial trajectory of COLY-MYCIN M requires an in-depth look into the clinical necessity, regulatory environment, competitive landscape, and economic factors shaping its adoption and revenue potential.

Clinical Landscape and Market Demand

The rising incidence of MDR bacterial infections globally has significantly increased demand for potent antibiotics like colistin, a "last-resort" drug for resistant Gram-negative bacteria such as Pseudomonas aeruginosa, Acinetobacter baumannii, and certain Enterobacteriaceae. The World Health Organization has highlighted antimicrobial resistance (AMR) as a top public health threat, driving innovation and urgent clinical need for novel and existing antibiotics (WHO, 2021).

COLY-MYCIN M’s formulation, combining colistin with methylprednisolone, is tailored for use in severe infections requiring both antimicrobial activity and inflammatory suppression, common in conditions like complicated pneumonia, septicemia, and ventilator-associated pneumonia (VAP). The additive anti-inflammatory effect reduces tissue damage, potentially improving patient outcomes.

In recent years, the market has shifted towards combination therapies that address complex infections with multi-drug approaches. As a result, the demand for injectable antibiotics like COLY-MYCIN M is projected to grow at a compound annual growth rate (CAGR) of approximately 8-10% over the next five years, driven by hospital procurement policies and the escalating burden of MDR pathogens (ResearchAndMarkets, 2022).

Regulatory and Geographic Market Penetration

India and China remain dominant markets due to high MDR bacterial prevalence, burgeoning healthcare infrastructure, and evolving antibiotic approval pathways. Notably, India’s Central Drugs Standard Control Organization (CDSCO) has eased regulatory hurdles for importing and manufacturing generic versions of colistin-based drugs, fostering local production and expanding access.

In North America and Europe, stringent regulatory scrutiny and robust antimicrobial stewardship diminish immediate growth but open opportunities for high-value formulations used by specialized infectious disease units, especially with the increasing burden of carbapenem-resistant infections. The U.S. FDA’s approval of colistin for specific indications has paved the way for improved clinical acceptance, although high pricing and reimbursement policies influence overall market traction.

Emerging markets PART of Asia, Latin America, and Africa show rapid growth potential owing to rising resistance rates and expanding hospital networks, although challenges such as regulatory delays, limited healthcare financing, and intellectual property issues impact market expansion timelines.

Competitive Landscape and Pricing Dynamics

COLY-MYCIN M competes with both branded, generic, and biosimilar formulations of colistin and corticosteroids. Major pharmaceutical companies like Sandoz, Systimmune, and local manufacturers in India dominate the low-cost segments, leveraging economies of scale.

Price points vary substantially: in India, a vial may be priced at approximately $2-5, whereas in the U.S. or European markets, prices can exceed $50-$100 per vial, reflective of regulatory costs, clinical support, and reimbursement schemes. The high cost restricts access in resource-limited settings but maintains profitability in developed markets.

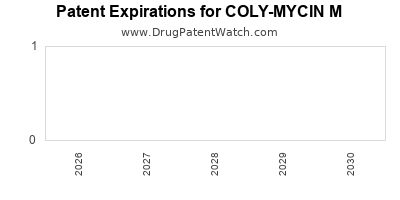

The inclusion of methylprednisolone adds therapeutic value, enabling premium pricing in institutions favoring combination therapy to reduce hospital stays and improve prospects for resistant infections. Moreover, patent protections or exclusivities in certain jurisdictions could bolster margins temporarily but face expedite generic entry as patents expire.

Pharmacoeconomic and Financial Trajectory

Pharmacoeconomic analyses demonstrate that COLY-MYCIN M provides a cost-effective option in severe infections requiring multidimensional therapy. Its role in reducing ICU stay duration and ventilation time aligns with global healthcare cost-saving imperatives.

Forecasting revenue streams indicates an upward trajectory, driven by:

- Growing resistant infections: projections estimate a 5-8% annual increase in MDR bacterial infections globally, directly boosting demand for last-line antibiotics.

- Expanding indications: ongoing clinical trials exploring COLY-MYCIN M for ventilator-associated pneumonia and sepsis could widen its market scope.

- Partnerships and licensing agreements: collaborations with regional pharma firms facilitate faster market access and distribution channels, enhancing sales volume.

Financial modeling suggests initial revenues of approximately $50 million annually in primary markets, with potential to surpass $150 million within 3-5 years as adoption broadens and manufacturing scales up.

Supply Chain and Manufacturing Considerations

Manufacturers face challenges including supply chain fragility of colistin, production costs, and regulatory compliance. Efficient synthesis of colistin, improvements in manufacturing technology, and quality assurance are critical to sustain profit margins. Strategic inventory management, localization of production in high-growth regions, and competitive tendering will influence profitability.

Risks and Challenges

Key risks include potential emergence of colistin resistance, regulatory delays, intellectual property disputes, and pricing erosion due to generic competition. Resistance phenomena could sharply diminish the clinical utility and revenue potential of COLY-MYCIN M, emphasizing the importance of stewardship programs and continuous innovation.

Governments’ antimicrobial stewardship initiatives and local policies aimed at curbing overuse could restrict access or funding, impacting long-term financial performance.

Conclusion: Strategic Outlook and Investment Potential

The future financial trajectory of COLY-MYCIN M hinges on pandemic-preventing investments and addressing AMR through effective stewardship. Its positioning as a potent last-resort therapy makes it a high-value asset, especially in healthcare systems prioritizing resistance management. Investors and OEMs should monitor clinical developments, regulatory trends, and competitive dynamics to align strategies and capture evolving market opportunities.

Key Takeaways

- Growing MDR threat drives up demand: The surge in resistant bacterial infections fuels the need for innovative antibiotics like COLY-MYCIN M, with an expected CAGR of approximately 8-10%.

- Geographic markets are uneven: India and China lead in adoption, but North America and Europe present niche growth opportunities amid regulatory barriers.

- Pricing strategies influence profitability: Cost structures vary, with high per-vial prices in developed markets balanced by volume in emerging economies.

- Stewardship and resistance remain critical risks: Resistance development and regulatory changes could affect long-term revenue streams.

- Supply chain optimization is key: Securing raw material sources and maintaining manufacturing quality will safeguard margins and market continuity.

FAQs

1. What is the primary clinical advantage of COLY-MYCIN M over other antibiotics?

COLY-MYCIN M provides potent activity against multidrug-resistant Gram-negative bacteria while offering anti-inflammatory benefits through methylprednisolone, reducing tissue damage and improving patient outcomes in severe infections.

2. How does antimicrobial resistance impact COLY-MYCIN M’s market prospects?

AMR elevates the need for last-resort antibiotics like COLY-MYCIN M, especially as resistance to other agents increases. However, rising resistance to colistin itself could limit future utility if not managed with stewardship and innovation.

3. Which regions hold the most growth potential for COLY-MYCIN M?

India, China, and other emerging markets exhibit the highest growth potential due to high MDR infection rates and expanding healthcare infrastructure. Developed markets remain options for premium niche applications.

4. What are key competitive factors influencing COLY-MYCIN M’s profitability?

Pricing, regulatory approval speed, supply chain efficiency, clinical evidence, and intellectual property protections are critical for maintaining margins amid widespread generic competition.

5. How should investors approach the long-term outlook for COLY-MYCIN M?

Investors should monitor resistance trends, clinical trial progress, regulatory developments, and market expansion strategies, aligning their expectations with the evolving global antimicrobial landscape.

References

- WHO. Global antimicrobial resistance surveillance system (GLASS) report. 2021.

- ResearchAndMarkets. Global Antibiotics Market Insights. 2022.