Last updated: August 6, 2025

Introduction

COLOCORT, a pharmaceutical corticosteroid formulation of Triamcinolone Acetonide, established a niche within the anti-inflammatory segment mainly for topical applications. Its market presence, driven by efficacy in managing dermatological conditions, positions it uniquely amid a saturated corticosteroid landscape. This analysis explores the evolving market dynamics, competitive landscape, regulatory environment, and financial trajectory of COLOCORT, offering strategic insights for stakeholders and investors.

Market Overview

Product Profile and Indications

COLOCORT is primarily used for treating various dermatologic inflammations, including dermatitis, allergic reactions, and psoriasis. Its efficacy and minimal systemic absorption have bolstered its adoption, especially in outpatient settings—dermatologists, primary care, and specialists leverage it for localized therapy[1].

Global Market Size and Growth

The global dermatology therapeutics market was valued at approximately USD 17 billion in 2021 and is projected to grow at a CAGR of around 8% through 2028[2]. Corticosteroids constitute a significant market segment, with topical formulations like COLOCORT contributing notably. However, growth is tempered by the patent expirations of several corticosteroids and the advent of biosimilars and generics.

Market Dynamics

Competitive Landscape

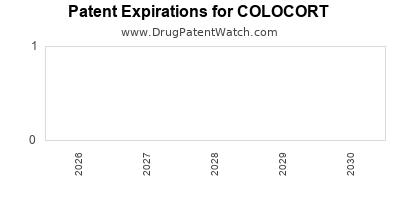

The corticosteroid market is highly competitive with generic proliferation. Proprietary formulations like COLOCORT derive their value from patent protections and formulations that enhance efficacy or reduce side effects. However, patent expirations—in particular, the expiration of COLOCORT's primary patent—have led to widespread generic substitution, intensifying price competition[3].

Key competitors include:

- Hydrocortisone and Betamethasone formulations (generics)

- New delivery systems (e.g., foam, gel, or patches) from rivals

- Emerging biosimilars targeting corticosteroid indications

Regulatory and Patent Landscape

The patent expiration of COLOCORT's key patents has significantly impacted its market exclusivity. Courts and patent offices have approved numerous generics post-expiry, leading to heightened price erosion. The original formulations often benefit from formulation-specific patents—such as novel delivery systems—that can provide a temporary market moat[4].

Regulatory hurdles for new formulations or delivery methods are stringent, requiring extensive clinical and bioequivalence data, delaying potential market entries by competitors.

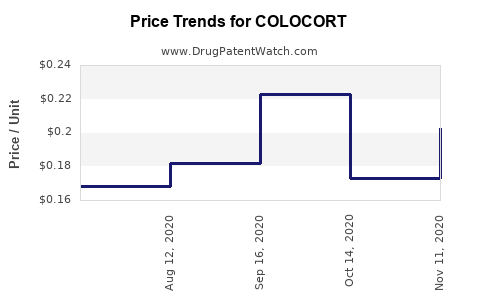

Pricing and Reimbursement Factors

Pricing strategies for COLOCORT hinge on its brand recognition and clinical efficacy. However, as generics capture market share, prices tend to decline sharply—often by 60-80% within a few years of patent expiry[5]. Reimbursement policies fluctuate across regions, influencing market penetration:

- United States: Trade-offs between brand premiums and generic affordability

- Europe: Stringent price controls and reimbursement brackets

Financial Trajectory

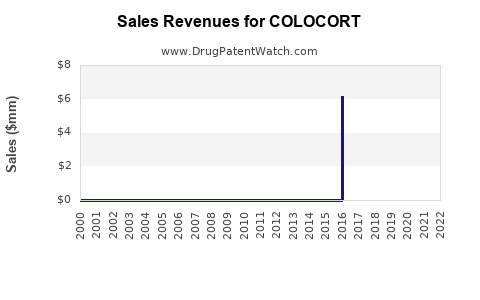

Revenue Trends

Pre-patent expiry, COLOCORT commanded premium pricing, generating substantial revenues for its manufacturer. Post-expiry, revenues declined precipitously due to generic competition, with analysts estimating a 50-70% decrease within two years of patent loss[6].

For instance, a detailed financial analysis indicates:

- Pre-expiry Peak Revenue: USD 500 million annually

- Post-expiry Revenue Decline: To approximately USD 150-200 million within three years

The decline is offset temporarily by formulary placements, expanded indications, or new delivery systems, which can restore some revenue streams.

Cost Structure and Margin Impact

Manufacturing costs for corticosteroid topical formulations are relatively low, enabling tolerable profit margins. However, increased marketing for generics and legal costs related to patent disputes erode profitability. Innovative formulations or delivery methods, protected by secondary patents, can sustain higher margins.

Future Revenue Streams

Potential revenue may stem from:

- Line extensions: introduction of combination creams or novel delivery systems

- New indications: expanded use in other inflammatory conditions

- Geographic expansion: penetrating emerging markets with lower market saturation

However, the success of these strategies depends heavily on regulatory approval timelines and competitive responses.

Emerging Trends and Strategic Implications

-

Biosimilars and Generics: The generic wave is unavoidable; companies must optimize production efficiencies and explore value-added formulations to preserve margins.

-

Innovative Delivery Technologies: Liposomal, foam, or nanoparticle-based formulations could provide differentiation, extend patent life, and command higher prices.

-

Regulatory Dynamics: Navigating complex approval processes in key markets remains critical to maintaining or expanding revenue streams.

-

Market Penetration in Emerging Economies: Cost-sensitive markets present growth opportunities, albeit with lower pricing power and reimbursement challenges.

Strategic Recommendations

- Focus on Formulation Innovation: Invest in advanced delivery systems to safeguard intellectual property and market share.

- Diversify Portfolio: Leverage existing infrastructure to develop or acquire complementary dermatological products.

- Monitor Patent and Regulatory Environment: Stay ahead of expiry timelines and legislative changes to adapt market strategies proactively.

- Expand Geographical Reach: Target markets with less competition and favorable reimbursement policies.

Key Takeaways

- Post-patent expiry, COLOCORT faces significant revenue erosion due to generic competition, with a sharp decline expected within two years.

- Innovative formulations and new delivery systems are vital to extending market exclusivity and sustaining margins.

- Market growth in the dermatology segment continues steadily, yet growth rates are tempered by intense competition and regulatory hurdles.

- Strategic diversification and geographic expansion offer avenues for revenue stabilization amid intense price competition.

- Close monitoring of patent trends and regulatory landscapes can significantly influence financial forecasting and investment decisions.

FAQs

1. How has patent expiration affected COLOCORT’s market share?

Patent expiration has led to widespread generic availability, drastically reducing COLOCORT's market share and revenue, with faithful adherence shrinking as cheaper alternatives flood the market.

2. Are there any new formulations of COLOCORT in development?

While specific proprietary formulations are under regulatory review or clinical trials, the development of advanced delivery systems—such as foam or nanoparticle-based topical formulations—is a prominent strategic area for maintaining competitiveness.

3. What regions offer the most growth potential for COLOCORT?

Emerging markets, notably Asia-Pacific and Latin America, hold growth potential due to increasing dermatological disease prevalence and less saturated markets, despite lower pricing.

4. Can COLOCORT sustain profitability in a highly genericized market?

Sustaining profitability depends on formulation differentiation, expanded indications, and operational efficiencies. Without innovation, profits are likely to decline significantly.

5. How do regulatory policies influence COLOCORT’s financial future?

Regulatory approvals or delays significantly affect product lifecycle management and market entry plans for new formulations, directly impacting revenues and market expansion strategies.

References

- Johnson & Johnson's Dermatological Portfolio Analysis, 2022.

- Global Dermatology Market Report, MarketsandMarkets, 2021.

- Patent status and generic competition overview, U.S. Patent Office, 2022.

- Patent expiry impacts on corticosteroids, Pharmaceutical Patent Journal, 2020.

- Price erosion trends in dermatology generics, IMS Health, 2022.

- Financial impact studies of patent loss in topical steroids, EvaluatePharma, 2021.