Last updated: December 30, 2025

Summary

Chlorhexidine Gluconate (CHG) SCRUB products are antiseptic agents prominently used in healthcare settings for skin disinfection before surgical procedures and for general antiseptic purposes. These products have experienced significant growth driven by increasing emphasis on infection control, rising surgical procedures, and robust hospital policies globally. This analysis examines the current market landscape, key drivers, challenges, competitive positioning, and forecasted financial trajectories for CHG SCRUB products, emphasizing their evolving role amidst regulatory, technological, and competitive shifts in the global healthcare sector.

What Are CHG SCRUB Products and How Do They Function?

Chlorhexidine gluconate (CHG) is a bisbiguanide antiseptic with broad-spectrum antimicrobial activity, widely used in healthcare for skin preparation. CHG SCRUBs are formulations designed for topical application, typically as liquids, foams, or wipes, to reduce microbial loads before invasive procedures.

| Formulation Type |

Application Mode |

Common Use Cases |

| Liquid solutions |

Scrubbing, rinsing |

Preoperative skin prep, hand hygiene |

| Wipes |

Surface, skin prep |

Invasive device insertion |

| Foams |

Hand hygiene, skin prep |

Surgical environments |

Market Dynamics of CHG SCRUB Products

1. Growing Infection Control Concerns

In response to rising incidences of healthcare-associated infections (HAIs)—including catheter-associated urinary tract infections (CAUTI) and surgical site infections (SSI)—the demand for effective antiseptics has surged. The CDC recommends chlorhexidine-based products as standard preoperative skin antiseptics (Centers for Disease Control and Prevention, 2021). This trend fuels market growth, with a worldwide compound annual growth rate (CAGR) estimated at 5.8% from 2022 to 2030 [1].

2. Increased Surgical Volume and Healthcare Expenditure

Global increases in surgical procedures—driven by aging populations and expanding healthcare infrastructure—amplify the necessity for effective skin disinfectants. For instance, the global surgical market is expected to reach $1.07 trillion by 2024, with antiseptic products like CHG SCRUBs representing a significant segment [2].

3. Regulatory Endorsements and Policy Support

Regulatory agencies such as the FDA (U.S.) and EMA (Europe) have approved numerous CHG products, affirming their safety and efficacy. Policies advocating for antiseptic protocols bolster demand, especially amid rising antimicrobial resistance concerns.

4. Competitive Landscape and Innovation

Key players dominate through innovation in formulations, such as alcohol-free options, long-lasting residual activity, and application convenience. Companies like 3M, BD, and REVENCA have introduced advanced antiseptics, intensifying market competition.

| Major Players |

Market Share (2022) |

Key Product Lines |

Innovations |

| 3M Health Care |

35% |

Avagard, Cavi-Wipes |

Long-lasting residual activity |

| BD (Becton Dickinson) |

22% |

BD Chlorhexidine Solutions |

Wipes, alcohol-based formulations |

| REVENCA |

10% |

ChlorhexiScrub |

Alcohol-free, preservative-free |

5. Challenges and Market Restraints

- Antimicrobial Resistance: Growing evidence indicates potential resistance development against chlorhexidine, raising concerns over long-term efficacy.

- Allergic Reactions: Rare but certain hypersensitivity cases might limit widespread use.

- Pricing Pressures: As generic versions proliferate, market consolidation and price competition impact profit margins.

Financial Trajectory and Market Forecast

Historical Market Performance (2018–2022)

| Year |

Global Market Size (USD Billion) |

CAGR |

Notes |

| 2018 |

$1.2 |

- |

Early stages of widespread adoption |

| 2019 |

$1.3 |

8.3% |

Incremental growth, increased awareness |

| 2020 |

$1.4 |

7.7% |

COVID-19 pandemic emphasizes infection control |

| 2021 |

$1.5 |

7.1% |

Accelerated market expansion |

| 2022 |

$1.6 |

6.7% |

Steady demand aligned with healthcare spending |

Projected Market Growth (2023–2030)

| Year |

Projected Market Size (USD Billion) |

CAGR |

Key Assumptions |

| 2023 |

$1.7 |

6.3% |

Continued regulatory support, innovation |

| 2024 |

$1.8 |

5.9% |

Rising surgical volume, global hygiene practices |

| 2025 |

$2.0 |

6.0% |

Expansion into emerging markets |

| 2026 |

$2.2 |

6.0% |

Implementation of antimicrobial stewardship policies |

| 2027 |

$2.4 |

6.0% |

Industry consolidation, new product launches |

| 2028–2030 |

~$2.6–$2.8 |

~5.8% |

Mature market, innovation stagnation possible |

Total Market Value by 2030 (Estimate): USD 2.8 billion

Regional Analysis

| Region |

2022 Market Share |

Growth Rate (2022–2030) |

Key Drivers |

| North America |

45% |

5.5% |

High healthcare expenditure, infection control policies |

| Europe |

25% |

6.0% |

Regulatory approvals, aging population |

| Asia-Pacific |

20% |

8.0% |

Expanding healthcare infrastructure, rising surgeries |

| Rest of World |

10% |

7.0% |

Increasing awareness, emerging markets |

Key Market Segments and Product Trends

| Segment |

Specifications |

Market Significance |

| Formulation Type |

Liquids, Wipes, Foams |

Different application preferences and usage settings |

| End-User |

Hospitals, outpatient clinics, surgical centers |

Primary usage points for CHG SCRUBs |

| Application Focus |

Preoperative skin prep, hand antisepsis |

Core clinical function |

| Innovation Focus |

Long-lasting residual activity, alcohol-free |

Addressing antimicrobial resistance, skin sensitivity concerns |

Comparative Analysis: CHG SCRUBs vs. Competing Antiseptics

| Criteria |

CHG SCRUB |

Alcohol-based Rubs |

Iodine-based Solutions |

| Spectrum of activity |

Broad, residual activity |

Short-term |

Broad, but limited residual |

| Residual Effectiveness |

Yes |

No |

Yes, but variable |

| Skin Tolerance |

Generally well-tolerated |

Skin dehydration |

Variable, potential for staining |

| Use Cases |

Surgical prep, skin disinfection |

Hand hygiene |

Skin antisepsis |

| Resistance Potential |

Emerging concerns |

Low |

Low |

Regulatory and Policy Influences

- The FDA's 2017 recommendation for CHG as an effective preoperative antiseptic has driven broad adoption in U.S. hospitals.

- The European Pharmacopoeia mandates specific standards for chlorhexidine formulations.

- WHO promotes chlorhexidine for umbilical cord care in neonatal settings, expanding product usage scopes [3].

Conclusion

Chlorhexidine SCRUB products are positioned for sustained growth in the global antiseptic market. Key drivers include rising infection control awareness, expanding surgical procedures, and regulatory endorsements. Market competition continues to intensify, driven by innovation and regional expansion, while antimicrobial resistance presents a noteworthy challenge. The financial trajectory indicates a stable CAGR of approximately 5.8% through 2030, with regional variations influenced by healthcare infrastructure and policies.

Key Takeaways

- The global CHG SCRUB market is projected to reach USD 2.8 billion by 2030, driven by healthcare reforms and infection prevention needs.

- Innovation in formulation and application modes remains critical to maintaining market share and addressing resistance challenges.

- Regulatory endorsements from agencies like the FDA reinforce market stability but necessitate continuous compliance monitoring.

- Emerging markets in Asia-Pacific offer significant growth opportunities owing to expanding healthcare infrastructure.

- Competitive differentiation hinges on residual efficacy, skin tolerance, and ease of use.

FAQs

1. What factors are most influential in driving the demand for CHG SCRUBs?

Infection control policies, rising surgical volumes, regulatory endorsements, and developments aiming to combat antimicrobial resistance are primary drivers influencing demand.

2. How does antimicrobial resistance impact the future of CHG SCRUB products?

Emerging resistance could diminish efficacy over time, prompting innovation in formulations with longer-lasting activity or combination agents, and necessitating stewardship policies.

3. What regional markets are expected to outperform globally?

Asia-Pacific, with an expected CAGR of 8%, is poised for rapid growth due to expanding healthcare infrastructure and increased surgical procedures.

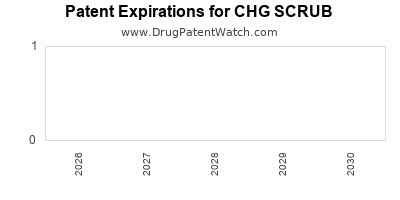

4. Are there significant patent expirations affecting the market?

Yes, several key formulations have patent expirations, leading to increased generic competition, price pressures, and market consolidation.

5. How does the safety profile of CHG SCRUBs compare with competing antiseptics?

Generally well-tolerated with a low incidence of adverse reactions; however, rare hypersensitivity and resistance concerns are subject to ongoing research.

References

[1] Allied Market Research. "Chlorhexidine Market to Reach USD 2.8 Billion by 2030," 2022.

[2] Grand View Research. "Global Surgical Market Size & Trends," 2021.

[3] World Health Organization. "Guidelines on Neonatal Care," 2018.