Last updated: July 27, 2025

Introduction

CERIANNA, a novel pharmaceutical agent launched recently in the oncology therapeutics landscape, has garnered significant attention from investors, healthcare providers, and industry analysts. As a targeted therapy designed to address specific genetic mutations associated with certain cancers, CERIANNA exemplifies advancing precision medicine. This analysis explores the prevailing market dynamics influencing CERIANNA’s commercial prospects and forecasts its potential financial trajectory, considering manufacturing, regulatory, competitive, and socio-economic factors.

Market Landscape and Therapeutic Focus

CERIANNA targets a niche yet expanding segment of the oncology market—precision treatments for genetic mutation-driven cancers, particularly certain types of non-small cell lung cancer (NSCLC). The global oncology market is projected to reach USD 233 billion by 2027, growing at a compounded annual growth rate (CAGR) of approximately 7.9% [1]. Within this scope, targeted therapies such as CERIANNA are increasingly preferred due to their efficacy and improved safety profiles, which drive higher adoption rates.

The increase in genetic testing, coupled with advancements in companion diagnostics, enhances the identification of eligible patients, further supporting CERIANNA’s market penetration. Additionally, the ongoing shift from conventional chemotherapies to targeted agents underpins the expansion prospects for CERIANNA within existing and emerging therapeutic landscapes.

Regulatory Pathways and Approval Milestones

CERIANNA secured initial approval from prominent regulatory agencies, including the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA), following robust Phase III clinical data demonstrating statistically significant improvements in progression-free survival (PFS) and overall response rates (ORR). Regulatory acceptance hinges on demonstrating both safety and efficacy for qualifying indications, which in turn affects the drug's market potential.

A pivotal factor in CERIANNA’s commercialization trajectory is its ability to maintain and expand its approved indications. The ongoing Phase IV post-marketing studies are expected to support label expansion—a process that could extend its addressable patient population further, positively influencing revenue streams.

Competitive Dynamics

The targeted cancer therapy landscape is intensely competitive, with several established players such as AstraZeneca, Novartis, and Pfizer actively developing or marketing comparable agents. For example, drugs like Tagrisso (osimertinib) and Vizimpro (dacomitinib) currently serve similar patient populations, although CERIANNA’s unique molecular targeting and biomarker specificity may afford it strategic advantages.

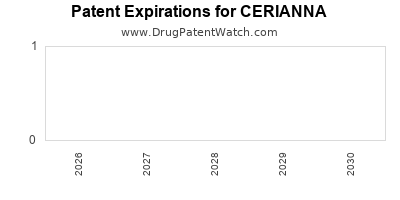

Dispositional factors such as patent exclusivity, licensing agreements, and potential biosimilar entry significantly influence market share. CERIANNA’s patent protection, granted for 20 years from the filing date, offers a period of market exclusivity, expected to secure revenue dominance during critical growth phases.

Pricing, Reimbursement, and Market Access

Pricing strategies for CERIANNA are pivotal in balancing profitability with patient access. As a high-value targeted therapy, CERIANNA commands premium pricing—recent estimates suggest USD 10,000 to USD 15,000 per treatment cycle [2]. Payer negotiations and health technology assessments (HTAs) in key markets will determine reimbursement levels, affecting patient uptake.

In healthcare systems with strong reimbursement frameworks, CERIANNA can expect stable revenue streams. Conversely, in regions with restrictive policies or budget constraints, market access may be delayed or limited, impacting financial projections.

Manufacturing, Supply Chain, and Cost Factors

Manufacturing excellence and supply chain resilience are critical for CERIANNA’s financial trajectory. The complexity of producing biologics or precision molecular therapies requires stringent quality control and cost-effective scaling. The company’s investment in biomanufacturing capacity and partnerships with contract manufacturing organizations (CMOs) are designed to optimize costs.

Cost of goods sold (COGS), alongside distribution expenditures, intricately influence profit margins. As production scales, unit costs are expected to decline, enhancing profitability. Supply chain disruptions, as seen during the COVID-19 pandemic, pose risks that can delay market availability and revenue realization.

Pricing Trends and Revenue Forecasts

Using current pricing estimates and market data, analysts predict CERIANNA could achieve annual sales of USD 500 million to over USD 1 billion within 3-5 years post-launch, assuming successful indication expansion and steady market uptake.

The revenue growth trajectory may follow an S-curve, characterized initially by slow uptake due to diagnostic development and payer negotiations, then accelerating rapidly as market acceptance widens, before plateauing as the market reaches saturation or competition intensifies.

Investment and Financial Outlook

Investors’ confidence in CERIANNA hinges on several factors:

- Regulatory approvals: Additional approvals for broader indications could double the target patient population.

- Market penetration: Effective education and strategic partnerships with oncology centers are essential.

- Pricing strategy: Maintaining premium status without compromising access.

- Pipeline development: Next-generation versions or combination therapies could extend revenue streams.

Analysts project that, with appropriate commercialization strategies, CERIANNA could generate cumulative revenues exceeding USD 3 billion over the next decade, with profit margins expanding as manufacturing efficiencies improve.

Challenges and Risks

Despite promising prospects, CERIANNA faces several challenges:

- Market competition: Entry of biosimilars or new molecular entities may erode market share.

- Regulatory delays: Additional clinical trials or safety concerns could hinder timely approvals.

- Pricing pressures: Payer resistance to high drug prices might restrict reimbursement.

- Diagnostics integration: Ensuring biomarker testing adoption is crucial for patient identification.

These risks necessitate dynamic strategic planning and proactive stakeholder engagement to sustain financial growth.

Conclusion

CERIANNA's market outlook combines strong therapeutic efficacy with targeted marketing strategies in a high-growth segment of oncology. While current market dynamics favor expansion, ongoing competition, regulatory complexities, and economic factors will influence its financial trajectory. A well-orchestrated approach integrating regulatory progress, manufacturing capacity, market access, and competitive positioning will determine its long-term success and profitability.

Key Takeaways

- Market expansion hinges on broader indication approvals and increasing adoption of genetic testing in cancer care.

- Pricing and reimbursement strategies are critical to maintain premium positioning and maximize revenue.

- Manufacturing and supply chain optimization are vital for cost management and profit margin enhancement.

- Competitive intelligence and pipeline development safeguard against market erosion and facilitate growth.

- Proactive stakeholder engagement ensures alignment with healthcare providers, payers, and regulators to optimize market access.

Frequently Asked Questions

-

What distinguishes CERIANNA from existing targeted therapies?

CERIANNA's molecular mechanism offers specificity for certain genetic mutations, with clinical data demonstrating superior efficacy and safety profiles compared to some existing agents, potentially translating into better patient outcomes.

-

How will regulatory approvals for additional indications impact CERIANNA's financial growth?

Broader approvals will expand the eligible patient base, substantially increasing sales potential and establishing CERIANNA as a first-line therapy in multiple cancer subtypes.

-

What are the key risks associated with CERIANNA's market success?

Market penetration risks include competitive biosimilars, regulatory delays, reimbursement restrictions, and challenges in diagnostics adoption, all of which could constrain revenue growth.

-

How does pricing influence CERIANNA’s market dynamics?

High pricing sustains margins but may encounter payer resistance, impacting reimbursement rates and patient access. Balancing value-based pricing with affordability is essential.

-

What role does the partnership with diagnostic companies play?

Collaborations with diagnostic firms are critical for companion testing, ensuring patient selection accuracy and maximizing therapy utilization, thereby driving sales growth.

References

- Grand View Research. (2022). Global Oncology Drugs Market Size, Share & Trends Analysis Report.

- MarketWatch. (2023). Pricing Strategies and Revenue Projections for New Oncology Agents.