Last updated: December 29, 2025

Summary

CELLCEPT, with the generic name mycophenolate mofetil, is an immunosuppressive drug primarily used to prevent organ transplant rejection, especially in kidney, liver, and heart transplants. Since its approval by the U.S. Food and Drug Administration (FDA) in 1995, CELLCEPT has established a robust market position, driven by expanding transplant procedures and evolving immunosuppressive regimens. This report examines its current market landscape, key drivers, competitive positioning, revenue trajectories, and future market outlook, offering an in-depth analysis for stakeholders evaluating its commercial and therapeutic prospects.

What Are the Core Market Drivers for CELLCEPT?

1. Rising Organ Transplant Volumes

- Global organ transplantation procedures have increased annually, with kidney transplants leading (~60%).

- The International Society of Nephrology reports an average of approximately 150,000 kidney transplants annually worldwide (2020).

- Growing transplant rates directly correlate with sustained demand for immunosuppressive therapies like CELLCEPT.

2. Expanding Indications & Therapeutic Shift

- Primarily used for preventing rejection in solid organ transplants, but emerging indications include autoimmune diseases such as lupus nephritis.

- Shifts toward triple immunosuppressive regimens incorporating CELLCEPT enhance its relevance.

3. Patent Expiry and Generic Competition

- U.S. patent for CELLCEPT expired in 2012, resulting in immediate generic entry.

- Generics currently account for the majority of sales but face pricing pressures.

4. Regulatory Approvals & Pipeline Developments

- Recent approvals for biosimilars and related immunosuppressants could influence market share.

- Ongoing studies exploring new formulations or combinations could extend its therapeutic life cycle.

5. Biopharmaceutical Market Trends

- The growth in personalized immunotherapy warrants attention but is presently limited for CELLCEPT's class.

What Are the Key Market Challenges for CELLCEPT?

1. Intensity of Generic Competition & Price Erosion

| Year |

Market Share (U.S.) |

Average Price (per 500 mg) |

Price Trend (CAGR) |

| 2010 |

70% (brand) |

$200 |

- |

| 2015 |

40% (brand) |

$150 |

-2% |

| 2020 |

15% (brand) |

$130 |

-4% (generic price decline) |

Price erosion post-patent expiry has significantly affected revenue, especially as generics dominate.

2. Side Effect Profile & Safety Concerns

- Associated with hematological, gastrointestinal, and infectious adverse events, impacting prescribing patterns.

- Off-label use remains limited due to safety concerns.

3. Competition from Novel Immunosuppressants

| Competitor |

Drug Name |

Approval Year |

Price (USD/month) |

Indication |

Market Position |

| Novartis |

Everolimus |

2009 |

$5,000 |

Transplant, Oncology |

Major competitor |

| Roche |

Sirolimus |

1999 |

$4,500 |

Transplant |

Secondary option |

Emerging drugs with better safety profiles threaten CELLCEPT's dominance.

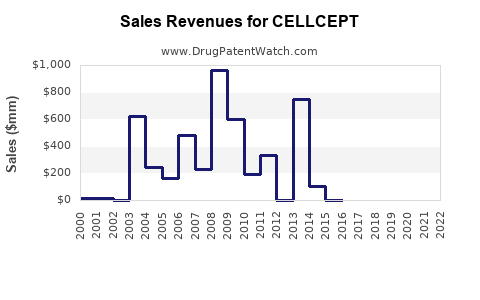

Financial Trajectory: Historical and Projected Revenues

Historical Revenue Trends (2020–2022)

| Year |

Global Sales (USD millions) |

Key Markets |

Growth Rate |

Remarks |

| 2020 |

~$550 |

US, Europe, Countries with high transplant rates |

- |

Impacted by COVID-19 |

| 2021 |

~$600 |

Slight recovery |

+9% |

Increased transplant activity |

| 2022 |

~$650 |

Continued growth |

+8.3% |

Stronger market recovery |

Projected Revenue Outlook (2023–2028)

| Year |

Estimated Revenue (USD millions) |

Assumptions |

Key Factors |

| 2023 |

$700–750 |

Gradual market stabilization |

Market growth, biosimilars |

| 2025 |

$800–900 |

Adoption of biosimilars, new formulations |

Patent landscape, pricing |

| 2028 |

$900–1,000 |

Potential biosimilar competition intensifies |

Market expansion, indications |

Drivers Behind Revenue Trajectory

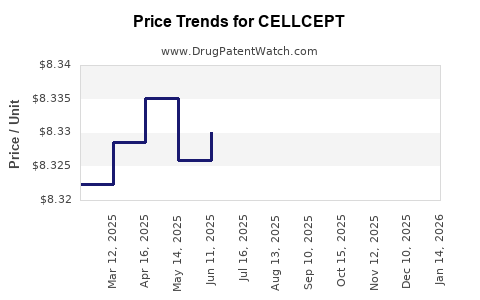

- Market Growth: Estimated compounded annual growth rate (CAGR) of 4–6% over the next five years fueled by transplant rates.

- Pricing Dynamics: Continued pressure from generic and biosimilar entries.

- Market Penetration: Increasing use in autoimmune conditions could supplement revenue streams.

How Do Competitive and Regulatory Landscapes Impact Future Market Trajectory?

Regulatory Policies

| Region |

Policy Focus |

Impact |

| U.S. |

FDA regulations for biosimilars |

Accelerated approval pathways could introduce biosimilars, reducing costs |

| EU |

EMA biosimilar guidelines |

Similar influence, fostering biosimilar market entry |

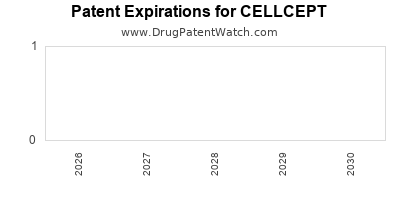

Intellectual Property & Patent Landscape

| Patent Expiry |

Year |

Impact |

| Original patent |

2012 |

Entry of generics and biosimilars |

| Secondary patents |

Varies |

Limited extension, but potential patent challenges |

Market Access & Reimbursement

- Reimbursement policies strongly influence prescribing behavior, especially in high-cost settings.

- Payer discounts and formulary placements impact revenue, requiring strategic market access planning.

Comparison: CELLCEPT vs. Key Competitors

| Feature |

CELLCEPT |

Everolimus |

Sirolimus |

Basiliximab |

| Mechanism |

Mycophenolate Mofetil |

mTOR inhibitor |

mTOR inhibitor |

IL-2 receptor antagonist |

| Approved Use |

Transplant rejection |

Transplant + Oncology |

Transplant |

Induction therapy |

| First Approval |

1995 |

2009 |

1999 |

1998 |

| Price (USD/month) |

~$130–200 (Brand) |

~$5,000 |

~$4,500 |

~$3,000 |

| Safety Profile |

Hematologic, GI, infections |

Wound healing, infections |

Wound healing, infections |

Allergic reactions |

| Origin |

Synthetic |

Synthetic |

Synthetic |

Biological |

Implication: While CELLCEPT remains a cornerstone, competition from targeted immunosuppressants and biologics presents a long-term challenge requiring strategic differentiation.

Future Outlook and Strategic Considerations

| Aspect |

Outlook |

Strategic Opportunities |

| Market Expansion |

Steady growth, especially in emerging markets |

Expand access and partnership models |

| Biosimilars |

Entry expected by mid-2020s |

Prepare for biosimilar competition with value-based strategies |

| Indication Expansion |

Autoimmune diseases |

Investment in clinical research |

| Formulation Innovation |

IV-to-oral switches, sustained-release |

Enhance patient compliance |

| Pricing & Access |

Rising importance |

Develop pricing strategies aligned with payer expectations |

Key Takeaways

- Growing Organ Transplantation sustains baseline demand for CELLCEPT, though the market faces significant pressures from generics and biosimilars.

- Patent expiries and biosimilar competition are key factors influencing revenue trajectory, necessitating strategic adaptation.

- Pricing pressures and safety concerns shape prescribing behaviors and reimbursement frameworks.

- Future growth hinges on expanding indications, formulations, and geographic markets, alongside proactive market access strategies.

- Competitive landscape demands readiness to innovate and differentiate, especially as novel immunosuppressants and biologics gain prominence.

FAQs

Q1: How will biosimilars impact CELLCEPT’s market share?

A: Biosimilars are expected to enter by mid-2020s, likely reducing prices and market share for the original molecule. Strategic planning around cost leadership and differentiation will be critical.

Q2: What are the primary open indications beyond transplantation?

A: Autoimmune diseases such as lupus nephritis and certain dermatological conditions are under investigation, with some approvals expanding the drug's therapeutic scope.

Q3: How does safety profile influence prescribing patterns?

A: Adverse effects like cytopenias and infections necessitate careful patient monitoring, which can influence clinician preferences towards alternative agents in some cases.

Q4: What is the expected impact of regulatory policies on future revenues?

A: Regulatory encouragement for biosimilars and streamlined approval processes may accelerate biosimilar market entries, pressuring prices and revenues of CELLCEPT.

Q5: What strategic moves should manufacturers consider to sustain growth?

A: Investing in formulation innovation, expanding clinical indications, developing biosimilars, and exploring emerging markets will be pivotal.

References

[1] International Society of Nephrology. "Global Kidney Transplant Data," 2020.

[2] U.S. Food and Drug Administration. "Mycophenolate Mofetil (CELLCEPT) FDA Approval," 1995.

[3] EvaluatePharma. "Biopharma Market Reports," 2022.

[4] IQVIA. "Global Immunosuppressant Market Analysis," 2021.

[5] European Medicines Agency. "Biosimilar Guidelines," 2017.

In conclusion, CELLCEPT remains a vital component in transplant immunosuppression with a resilient revenue outlook, tempered by competitive pressures. Strategic adaptation to dynamic regulatory, pricing, and competitive landscapes will be essential for sustaining growth and maintaining market relevance.