Last updated: August 1, 2025

Introduction

CELLCEPT (mycophenolate mofetil) is a critical immunosuppressive medication primarily used to prevent organ rejection post-transplantation. As a cornerstone therapy in transplant medicine, specifically in kidney, heart, and liver transplants, CELLCEPT has secured a dominant position within the immunosuppressant market. This analysis examines the current market landscape, competitive positioning, regulatory dynamics, and future price projections for CELLCEPT over the next five years, offering strategic insights for industry stakeholders.

Market Overview

Global Market Size and Growth

The global immunosuppressant market was valued at approximately USD 9.5 billion in 2022 and is projected to reach USD 13.8 billion by 2030, growing at a CAGR of 4.9% [1]. CELLCEPT commands a substantial share within this segment, driven by its efficacy, established clinical profile, and widespread adoption in transplant centers. The rising incidence of organ transplants, along with improvements in transplant procedures and post-transplant care, underpins sustained demand.

Key Indications and Patient Demographics

Mycophenolate mofetil is primarily indicated for prophylaxis of organ rejection in kidney, heart, and liver transplants. The global transplant volume has been increasing steadily, with over 144,000 organ transplants performed worldwide in 2022 [2]. The expanding transplant recipient population, coupled with improvements in survival rates, boosts long-term demand for immunosuppressant therapies like CELLCEPT.

Market Drivers

- Growing Transplant Procedures: Advances in surgical techniques and better recipient management contribute to increased transplant rates.

- Chronic Immunosuppression Needs: Patients require lifelong immunosuppression, ensuring steady demand.

- Patent Status and Market Exclusivity: As of 2023, the original formulation of CELLCEPT remains under patent in key markets, supporting pricing power.

Market Challenges

- Availability of Generics: Patent expirations typically lead to increased generic competition, which can suppress prices.

- Side Effect Profile: Adverse effects such as gastrointestinal disturbances and hematological issues necessitate careful management, limiting broader indications.

- Regulatory Scrutiny: Stringent pharmacovigilance requirements influence cost and market access strategies.

Competitive Landscape

Key Players

- Bristol-Myers Squibb: The original patent holder, with exclusive rights to sell CELLCEPT.

- Generic Manufacturers: Multiple companies, including Mylan and Sandoz, have introduced generic versions post-patent expiry, intensifying price competition.

Market Share Dynamics

While generics have gained ground, CELLCEPT maintains a premium segment due to brand recognition, perceived quality, and established clinical data. However, in many markets, generics account for over 60% of prescriptions, emphasizing cost competitiveness.

Global Market Penetration

North America remains the largest market, benefitting from high transplantation rates and favorable insurance coverage. Europe follows, driven by similar factors, with emerging markets in Asia-Pacific showing growth potential due to increasing healthcare infrastructure.

Regulatory Environment

Patent protections extend until 2023-2024 in various jurisdictions. Patent expirations in key markets often lead to influxes of generics, impacting pricing strategies. Regulatory pathways for biosimilars and generics are relatively streamlined, incentivizing competition but also requiring manufacturers to meet high-quality standards.

Price Dynamics and Outlook

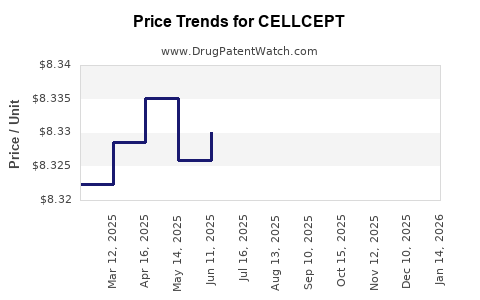

Historical Pricing Trends

In developed markets like the US, the average retail price of CELLCEPT around 2022 ranged from USD 500 to USD 800 per month per patient, depending on dosage and formulation [3]. Generic versions are priced approximately 40-60% lower, which exerts downward pressure on the originator’s price.

Projected Price Trends (2023–2028)

- Post-Patent Expiry Period: Expect significant price reductions for CELLCEPT branded formulations—estimates suggest a decline of 45-55% over five years as generics dominate the market.

- Market Segmentation: High-income countries will experience more pronounced price drops owing to competitive pressures, while emerging markets may see slower declines due to market entry barriers and affordability issues.

- Potential for Price Stabilization: In some geographies, manufacturers may adopt volume-based strategies or bundle offerings to maintain revenue streams amid declining per-unit prices.

Influencing Factors on Future Pricing

- Patent and Exclusivity Status: The expiration of patents will be the primary driver of price erosion.

- Market Entry of Biosimilars and Generics: The number and quality of competitors will determine the depth of price reductions.

- Regulatory Policies: Price regulation and reimbursement policies, especially in countries with nationalized healthcare systems, will influence pricing strategies.

- Manufacturing Costs: Cost efficiencies in manufacturing generics will further support price declines.

Strategic Implications

- Brand Loyalty and Clinical Data: Bristol-Myers Squibb's established position and robust clinical data provide a competitive edge, yet price sensitivity among payers may shift market shares over time.

- Investment in Biosimilar Development: The pipeline for biosimilars targeting immunosuppressants like CELLCEPT can influence long-term pricing and market dynamics.

- Emerging Markets: Growth in transplant procedures in Asia-Pacific offers an opportunity to capture market share with cost-effective generic formulations.

Key Takeaways

- The current market for CELLCEPT is characterized by high demand driven by increasing transplant procedures and chronic immunosuppressive therapy needs.

- Patent expiration beginning in 2023-2024 will catalyze a substantial shift toward generic competition, reducing average prices by approximately 45-55% over five years.

- The global landscape is segmented, with developed markets experiencing faster price declines compared to emerging markets, where affordability remains a challenge.

- Strategic pricing will be influenced by regulatory policies, market entry of biosimilars, and manufacturing efficiencies.

- Maintaining clinical differentiation and strong regulatory compliance will remain critical challenges and opportunities amid evolving market conditions.

Conclusion

CELLCEPT’s market outlook reflects a trajectory of moderate growth offset by significant pricing pressures stemming from patent expiries and generic proliferation. Manufacturers and investors should anticipate accelerated price declines post-2023, with opportunities arising from emerging markets, biosimilar developments, and strategic reimbursement negotiations. Sustained clinical superiority, coupled with competitive pricing, will be indispensable for maintaining market share and profitability.

FAQs

-

When does the patent for CELLCEPT expire, and how will it affect the market?

The patent for CELLCEPT in key markets is set to expire around 2023-2024. This will facilitate generic entry, leading to significant price reductions and increased competition.

-

How does generic competition impact the pricing of CELLCEPT?

Generic competition typically decreases the price of original-brand drugs by 40-60%, encouraging payers to favor more cost-effective alternatives while challenging brand manufacturer margins.

-

Are biosimilars a concern for CELLCEPT?

Currently, biosimilars are not directly applicable, as CELLCEPT is a small-molecule drug. However, the development of generic equivalents and new immunosuppressants will influence the market landscape.

-

What factors could mitigate the price decline of CELLCEPT?

Factors such as brand loyalty, clinical differentiation, limited alternative therapies, and regulatory barriers to generics can slow the rate of price erosion.

-

What are the future growth opportunities for CELLCEPT in emerging markets?

Growing transplantation rates, increasing healthcare infrastructure, and demand for affordable immunosuppressants present substantial expansion opportunities via low-cost generic options.

Sources:

[1] MarketsandMarkets, "Immunosuppressants Market," 2022.

[2] WHO Global Observatory on Transplantation, 2022.

[3] IQVIA, "Average Wholesale Prices of Immunosuppressive Agents," 2022.