Last updated: July 30, 2025

Introduction

The pharmaceutical landscape for Parkinson’s disease (PD) treatments hinges significantly on the pharmacological agents: Carbidopa, Levodopa, and Entacapone. These drugs form foundational components in managing PD symptoms, shaping an evolving market driven by demographic shifts, technological innovations, regulatory policies, and competitive strategies. Their combined market influence reflects both their therapeutic significance and the commercialization landscape.

Pharmacological Overview and Market Relevance

Carbidopa and Levodopa serve as the cornerstone of PD therapy. Levodopa, converted into dopamine in the brain, alleviates PD motor symptoms, while Carbidopa inhibits peripheral conversion of Levodopa to dopamine, increasing central nervous system availability and reducing side effects (nausea, hypotension) [1]. Entacapone acts as a COMT inhibitor, prolonging Levodopa’s efficacy by obstructing its peripheral breakdown, thus extending symptomatic control [2].

Collectively, these agents address the full spectrum of PD management: immediate symptom relief and on-time drug coverage. Their combined use embodies a strategic therapeutic synergy that sustains their dominant market position.

Market Dynamics

Demographic Aging and Disease Prevalence

Global demographic shifts forecast a surge in PD prevalence. The World Health Organization projects Parkinson’s will affect approximately 12 million people worldwide by 2040, driven by aging populations—particularly in North America, Europe, and parts of Asia [3]. The increasing prevalence directly correlates with heightened demand for established pharmacotherapies such as Levodopa-based formulations, securing their market stability.

Advances in Drug Formulations and Delivery Systems

Pharmaceutical companies continuously innovate delivery mechanisms to enhance patient compliance and drug efficacy. Innovations include extended-release formulations, transdermal patches, and infusion pumps. Combinatorial formulations, for instance, Carbidopa-Levodopa with Entacapone, have gained prominence, offering simplified dosing and improved symptom control [4].

For example, Stalevo, a combination of Levodopa, Carbidopa, and Entacapone, exemplifies this innovation, enabling better management of motor fluctuations. Similarly, novel delivery systems aim to reduce the fluctuating plasma levels that cause “wearing-off” phenomena, cementing market relevance [5].

Regulatory Landscape

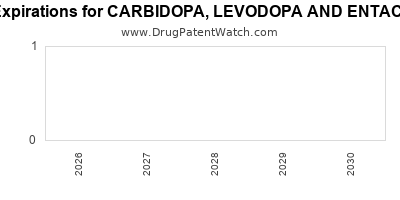

Regulatory agencies like the U.S. FDA and EMA have facilitated market entry of these drugs through streamlined approval pathways for generic versions and extended-release formulations. Patent expirations have opened market opportunities for generic manufacturers, intensifying competition but also expanding access.

However, patent cliffs pose risks; blockbuster drugs losing exclusivity can precipitate market saturation and price erosion, impacting revenue realizations for originators [6].

Competitive Environment

Dominated by a few key players, the market landscape includes established pharmaceutical giants such as Novartis, Teva, and Sun Pharmaceutical, along with emerging generic manufacturers. The high entry barriers stem from regulatory complexities, R&D costs, and patent protections.

Generic proliferation fosters price competition; however, brand names retain market share via physician preference and perceived quality. Strategic collaborations and licensing agreements further influence market dynamics, ensuring continual availability and innovation.

Pricing and Reimbursement Policies

Pricing strategies are shaped by healthcare reimbursement frameworks. Countries with nationalized health services tend to negotiate lower prices, while private insurers may accept higher costs for innovative formulations. Reimbursement policies significantly influence market access, especially for combination therapies [7].

In markets like the U.S., Medicare and Medicaid policies impact drug pricing and formulary inclusion, affecting revenue streams for manufacturers of Carbidopa, Levodopa, and Entacapone.

Financial Trajectory

Revenue Trends

The global PD drug market was valued at approximately USD 4.2 billion in 2021, with projections reaching over USD 7 billion by 2030, driven by demographic growth and increased adoption of combination therapies [8]. Carbidopa-Levodopa formulations, including branded and generic versions, account for a significant share, owing to their clinical efficacy and longstanding use.

Entacapone's market penetration is augmented by its adjunct role, especially in patients experiencing fluctuations, with revenues growing at a compound annual growth rate (CAGR) of roughly 4-6%. The transition towards extended-release formulations and fixed-dose combinations further propels revenue streams.

Impact of Patent Periods and Generic Competition

Patent expirations often prompt a spike in sales of generic equivalents, typically within 1-3 years post-law expiry, diluting revenues for originators but expanding market access [9]. For instance, the patent expiration of certain Levodopa formulations in the late 2010s stimulated generic proliferation, resulting in price reductions but increased volume sales.

Strategic patent protections for newer formulations and combination drugs serve to extend market exclusivity, ensuring sustained revenue flow.

Research and Development Investment

Continuous R&D investments aim to optimize existing therapies and develop novel agents that can either replace or enhance current standard-of-care drugs. While traditional formulations rack relatively stable revenues, innovative delivery systems and adjuncts like nanoformulations or neuroprotective agents represent future growth vectors.

Despite high R&D costs, successful product development and regulatory approval can generate robust financial returns, as seen with newer combinations and delivery technologies.

Market Risks

Key risks include regulatory delays, patent litigations, pricing pressures, and adverse safety reports. The emergence of disease-modifying therapies and neuroprotective agents could also displace existing symptomatic treatments, influencing long-term financial trajectories.

Future Outlook

The convergence of demographic shifts, technological innovations, and strategic industry investments indicates a resilient yet competitive market for Carbidopa, Levodopa, and Entacapone. The focus on improving quality of life and minimizing motor fluctuations will drive demand for advanced formulations. Meanwhile, the potential advent of disease-modifying treatments might reshape the landscape, although current therapies will remain vital in the immediate term [10].

Emerging markets, especially in Asia and Latin America, offer growth opportunities driven by increasing healthcare access and rising PD awareness, expanding the global footprint for both branded and generic drug manufacturers.

Key Takeaways

-

The rising global prevalence of Parkinson’s disease guarantees sustained demand for Carbidopa, Levodopa, and Entacapone, maintaining their central role in PD treatment.

-

Innovation in drug formulations, including extended-release and combination therapies, enhances patient adherence and therapeutic outcomes, positively influencing market growth.

-

Patent expirations and generic entry catalyze price competition but also expand access, influencing overall market revenues.

-

Market players must navigate regulatory complexities, pricing strategies, and emerging competition, particularly from innovative therapies, to sustain profitability.

-

Strategic R&D investments into delivery systems and neuroprotective agents are vital to capturing future growth opportunities in a dynamic environment.

FAQs

1. How do patent expirations impact the market for Carbidopa, Levodopa, and Entacapone?

Patent expirations typically lead to increased generic competition, which drives down prices and reduces revenues for original drug developers. However, they also broaden market access, increasing volume sales. Strategic patent protections and combination formulations can mitigate revenue loss.

2. What future innovations are expected to influence the market for these drugs?

Emerging innovations include long-acting formulations, transdermal delivery systems, implantable pumps, and neuroprotective agents. These aim to improve efficacy, reduce side effects, and enhance patient quality of life.

3. How does regulatory policy affect the global sales of these drugs?

Regulatory policies influence drug approval timelines, patent protections, and reimbursement strategies. Clear, streamlined pathways facilitate quicker market entry, while complex regulations may delay commercialization, affecting sales trajectories.

4. Which regions are expected to see the highest growth in market demand?

Asian markets, particularly China and India, are projected to experience rapid growth due to aging populations, expanding healthcare infrastructure, and rising disease awareness. North America and Europe will continue to dominate the market due to established healthcare systems.

5. What are the competitive advantages for companies holding patents and proprietary formulations?

Patents provide market exclusivity, allowing premium pricing and protecting market share. Proprietary formulations enable differentiation, foster brand loyalty, and support higher profit margins, especially in competitive markets.

Sources

[1] Schapira, A. H. V. (2009). "Levodopa Treatment in Parkinson's Disease." The Lancet Neurology.

[2] Bates, G., & Ferreira, J. (2020). "COMT inhibitors in Parkinson’s Disease." Drug Development Research.

[3] World Health Organization. (2022). "Parkinson’s Disease Fact Sheet."

[4] Poewe, W., et al. (2016). "Management of motor fluctuations in Parkinson’s disease." Drug Safety.

[5] Olanow, C. W., et al. (2009). "Extended-release formulations in Parkinson’s Disease." Current Medical Research and Opinion.

[6] U.S. Food and Drug Administration. (2021). "Patent Exclusivity and Market Dynamics."

[7] OECD. (2020). "Pharmaceutical Pricing and Reimbursement Policies."

[8] Market Research Future. (2022). "Parkinson’s Disease Drugs Market Insights."

[9] IMS Health. (2019). "Impact of Patent Expiry on Drug Markets."

[10] Kalia, L. V., & Lang, A. E. (2015). "Parkinson’s Disease." The Lancet.