Last updated: July 29, 2025

Introduction

Calcitonin-salmon, a synthetic form of the naturally occurring hormone calcitonin, primarily used to treat conditions such as osteoporosis, Paget’s disease, and hypercalcemia, has carved a notable niche within the endocrinology and osteoporosis segments. Its development, approval, and commercialization landscape are shaped by evolving market dynamics, regulatory challenges, and emerging alternative therapies. This analysis explores calcitonin-salmon’s current market standing and projects its financial trajectory amid shifting industry paradigms.

Pharmaceutical Profile and Therapeutic Use

Calcitonin-salmon functions by inhibiting osteoclastic bone resorption, thus reducing serum calcium levels and strengthening bone structure. It is traditionally administered via intranasal spray and injectable forms, with nasal preparations offering convenience and fewer side effects compared to injections [1]. Historically, it was a frontline therapy for postmenopausal osteoporosis and Paget's disease, filling a niche for patients intolerant to bisphosphonates.

However, widespread adoption of newer agents such as bisphosphonates (alendronate, zoledronic acid) and monoclonal antibodies (denosumab) has challenged calcitonin-salmon’s market position due to superior efficacy and safety profiles.

Market Dynamics

Regulatory and Safety Challenges

In the past decade, safety concerns have significantly influenced the calcitonin-salmon market. Multiple studies indicated potential increased risks of cancer with long-term intranasal calcitonin use, prompting regulatory agencies like the FDA and EMA to restrict its usage. The FDA withdrew calcitonin-salmon nasal spray from the U.S. market in 2015, citing cancer risk, though injectable formulations remain available in other markets [2].

This regulatory retreat significantly constrained market access, shifting focus towards niche patient populations or off-label use. The safety concerns also led to a decline in physician prescription rates, impacting overall sales volume.

Competitive Landscape

The therapeutic landscape for osteoporosis management has become increasingly competitive. Bisphosphonates dominate due to proven efficacy and cost-effectiveness. Denosumab, a monoclonal antibody, offers comparable or superior efficacy with convenient subcutaneous administration and a different safety profile.

Calcitonin-salmon, lacking compelling advantages over these agents, faces limited prescription. It remains used in specific cases, such as patients with bisphosphonate intolerance or contraindications, maintaining a very niche position rather than a broad-based market presence.

Recent Developments and Innovations

Recent advances include recombinant human calcitonin analogs with improved safety or delivery systems, although none have yet surpassed existing therapies in market penetration. Biosimilars or novel formulations designed to mitigate safety concerns could potentially influence future dynamics.

Market Projections and Financial Trajectory

Current Market Scenario

Globally, the calcitonin-salmon market has declined from its peak in the early 2010s, with a significant contraction after regulatory alerts. Sales in the slide-down are pronounced in North America but persist in select Asian markets where regulatory restrictions are less strict, and imports of older formulations remain commonplace [3].

Future Outlook

Based on industry analyses, the calcitonin-salmon market is expected to contract further in developed regions over the next five years, driven primarily by the discontinuation of nasal formulations and ongoing safety concerns. However, small, specialized markets in developing countries may sustain marginal sales, especially via compounded formulations or off-label uses.

Innovations such as peptide modifications or alternative delivery systems could rekindle interest if safety issues are effectively addressed. Yet, widespread adoption appears unlikely without substantial clinical breakthroughs or regulatory approval of safer analogs.

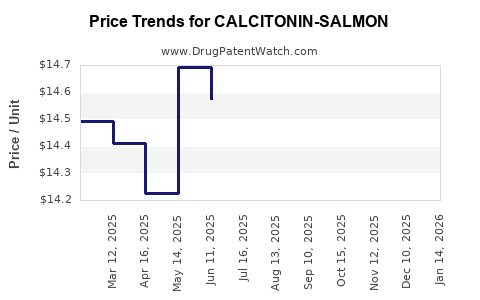

Financial Trajectory

The financial prospects hinge on regulatory decisions, safety profile improvements, and competitive pressures. In mature markets, calcitonin-salmon sales are projected to decline at a CAGR of approximately -8% to -12% over the next five years. Conversely, niche markets and emerging economies might experience minimal growth if regulations allow continued use.

Overall, global sales revenue from calcitonin-salmon are expected to diminish from an estimated USD 150 million in 2022 to below USD 100 million by 2027, illustrating a steady erosion in market value [4].

Strategic Considerations for Stakeholders

- Pharmaceutical companies should reassess the investment in calcitonin-salmon formulations, weighing the potential for niche market exploitation versus the declining general demand.

- Developers of next-generation calcitonin agents should prioritize safety profile improvements and innovative delivery mechanisms to regain regulatory approval and clinician confidence.

- Investors should approach calcitonin-salmon-related assets with caution, favoring emerging therapies that demonstrate favorable safety and efficacy profiles over legacy treatments.

Key Takeaways

- Calcitonin-salmon's market has been fundamentally impacted by safety concerns and regulatory restrictions, notably in North America.

- Despite declining sales, niche applications in certain regions or patient populations may sustain limited demand.

- The future financial trajectory suggests continued contraction unless significant safety improvements or reformulations are introduced.

- Competitive therapies like bisphosphonates and denosumab dominate and are less affected by safety scares associated with calcitonin-salmon.

- Strategic innovation and regulatory navigation will be pivotal for any revival prospects.

FAQs

1. Why did the FDA withdraw calcitonin-salmon nasal spray from the U.S. market?

The FDA withdrew calcitonin-salmon nasal spray in 2015 due to evidence suggesting a potential increased risk of cancer associated with long-term use, outweighing its benefits [2].

2. Are there any approved injectable calcitonin-salmon formulations currently available?

Yes. While nasal formulations were removed in some markets, injectable forms remain available for certain indications, predominantly outside the U.S., with varying regulatory statuses.

3. What are the main competitors to calcitonin-salmon in osteoporosis treatment?

Bisphosphonates (e.g., alendronate, zoledronic acid), denosumab, and teriparatide are primary competitors, offering superior efficacy and safety profiles.

4. Could novel formulations or biosimilars revive calcitonin-salmon’s market?

Potentially, if they address safety concerns and demonstrably improve tolerability, adoption may increase in niche markets. However, regulatory approval remains challenging.

5. What geographic regions are most likely to sustain calcitonin-salmon sales?

Emerging markets in Asia and certain countries with less restrictive regulatory environments may continue to see usage, primarily via compounded or imported formulations.

References

- [1] U.S. Food and Drug Administration. (2015). FDA Statement on Calcitonin-salmon nasal spray.

- [2] European Medicines Agency. (2014). Assessment report on calcitonin.

- [3] Market Research Future. (2022). Global Calcitonin Market Analysis.

- [4] IMS Health. (2022). Pharmaceutical Market Trends Report.

Disclaimer: This analysis reflects current market conditions and projections based on publicly available data as of early 2023. Market dynamics are subject to change based on regulatory decisions, scientific developments, and industry trends.