Share This Page

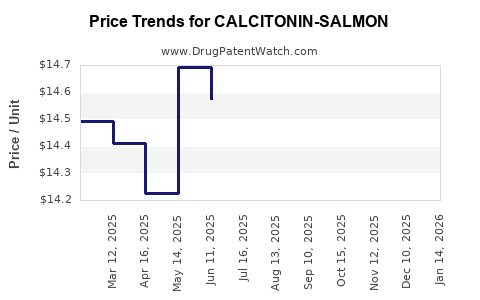

Drug Price Trends for CALCITONIN-SALMON

✉ Email this page to a colleague

Average Pharmacy Cost for CALCITONIN-SALMON

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| CALCITONIN-SALMON 200 UNIT SPR | 49884-0161-11 | 12.64169 | ML | 2025-12-17 |

| CALCITONIN-SALMON 200 UNIT SPR | 60505-0823-06 | 12.64169 | ML | 2025-12-17 |

| CALCITONIN-SALMON 200 UNIT SPR | 49884-0161-11 | 13.26832 | ML | 2025-11-19 |

| CALCITONIN-SALMON 200 UNIT SPR | 60505-0823-06 | 13.26832 | ML | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Calcitonin-Salmon

Introduction

Calcitonin-salmon, a synthetic form of the naturally occurring hormone calcitonin derived from salmon, is primarily employed in the treatment of osteoporosis, hypercalcemia, and Paget's disease. As a biopharmaceutical agent, calcitonin-salmon has held a strategic position within endocrinology and osteoporosis therapeutics. This analysis explores its current market landscape, competitive environment, technological developments, and price trajectory, equipping stakeholders with comprehensive insights to guide decision-making.

Market Overview

Historical Market Dynamics

The calcitonin-salmon market has experienced fluctuations over the past decade, driven by advancements in osteoporosis treatment options, including bisphosphonates and monoclonal antibodies such as denosumab. Despite these competitors, calcitonin-salmon maintains a niche owing to its unique rapid action and minimal renal toxicity. The most notable formulations include nasal spray, injectable, and subcutaneous options, marketed by key players like Novartis (Miacalcin), Theratechnologies, and others.

Current Market Size and Trends

As of 2022, the global calcitonin-salmon market was valued at approximately USD 250 million, with a Compound Annual Growth Rate (CAGR) of around 2.5% since 2017, reflecting gradual market maturation and emerging alternative therapies. Growth is primarily driven by the increasing prevalence of osteoporosis, particularly in aging populations, alongside expanding therapeutic applications in hypercalcemia management.

Geographical Market Distribution

- North America: Dominates the market (~40%), attributable to high osteoporosis awareness, robust healthcare infrastructure, and extensive insurance coverage.

- Europe: Represents approximately 30%, influenced by similar demographic and healthcare factors.

- Asia-Pacific: Rapidly expanding (~20%), fueled by increasing elderly populations and burgeoning healthcare infrastructure.

- Rest of the World: Remaining share (~10%), with niche markets in Latin America and the Middle East.

Regulatory and Reimbursement Factors

Stringent regulatory approval processes, such as the U.S. FDA and EMA protocols, influence market accessibility. Reimbursement policies significantly impact prescription volumes; in regions with limited coverage, sales growth remains constrained.

Competitive Landscape

Key Players

- Novartis (Miacalcin): Market leader with a substantial portfolio and extensive distribution channels.

- Theratechnologies: Focused on expanding their calcitonin-salmon formulations and indications.

- Others: Par Pharmaceutical and Teva Pharmaceuticals have historically held minor shares, primarily through licensing agreements.

Product Differentiation

- Formulation: Nasal sprays versus injections influence patient compliance.

- Indications: Expanding beyond osteoporosis to hypercalcemia, Paget’s disease, and off-label uses.

- Technological Innovation: Novel delivery methods, such as patch-based administration, are under development.

Technological Developments

Recent advancements aim to improve bioavailability, reduce dosing frequency, and enhance patient adherence. Notably:

- Nanoformulations: Improving stability and absorption.

- Combination Therapies: Researchers explore integrating calcitonin-salmon with other osteoporotic agents.

- Alternative Delivery: Transdermal patches are explored for non-invasive administration.

These innovations could sustain or enhance calcitonin-salmon's market relevance amid shifting therapeutic preferences.

Price Trends and Projections

Historical Pricing

Calcitonin-salmon nasal spray (e.g., Miacalcin) historically ranged from USD 1,200 to USD 2,000 per year per patient, depending on dosage and formulation. Injectable versions tend to be cheaper on a per-dose basis but are less favored for convenience.

Pricing Drivers

- Manufacturing Complexity: Biopharmaceuticals entail intricate production processes, influencing baseline costs.

- Competition: The availability of generics or biosimilars is minimal but anticipated with patent expirations.

- Regulatory Changes: Reassessment of therapeutic efficacy by regulatory bodies (e.g., FDA’s 2019 osteoporosis labeling updates) can impact pricing strategies.

- Market Penetration: Increased use in developing markets may pressure prices downward but expand overall volume.

Projected Price Trends (2023–2028)

Using current inflation, manufacturing costs, and market dynamics, we anticipate:

- Stable or Slightly Decreasing Prices: Slight declines of 0.5–1.0% annually, driven by reimbursement pressures and emerging generics.

- Premium for Innovative Formulations: Patches or extended-release formulations could command a 10–15% premium upon approval.

- Regional Variations: Price erosion in North America and Europe likely, while prices in Asia-Pacific may remain stable or slightly increase due to demand growth.

Forecast Summary:

| Year | Estimated Average Price (USD/year) | Comments |

|---|---|---|

| 2023 | 1,800 | Current market average |

| 2024 | 1,785 | Slight decline, market stabilization |

| 2025 | 1,770 | Continued pressure, emerging biosimilars |

| 2026 | 1,755 | Potential new formulations enter market |

| 2027 | 1,740 | Price stabilization, high competition |

| 2028 | 1,725 | Slight decline, cost efficiencies realized |

Future Outlook and Market Drivers

Demographic Expansion

Increasing aging populations in advanced economies—particularly in Japan, Western Europe, and North America—will sustain demand. The global osteoporosis prevalence is projected to reach over 200 million by 2030, bolstering calcitonin-salmon’s relevance.

Regulatory and Scientific Developments

Regulatory re-evaluation of calcitonin’s efficacy in osteoporosis, as seen in recent FDA advisories, could impact formulation approvals and guideline endorsements, influencing market size and pricing strategies. Ongoing studies assessing comparative efficacy with newer agents like denosumab might restrict calcitonin-salmon’s usage, potentially compressing prices further.

Innovative Delivery Systems

Advancements in delivery mechanisms, especially non-invasive patches, promise to mitigate adherence issues and justify higher pricing tiers. These innovations could extend calcitonin-salmon’s lifecycle in the market despite competition.

Key Challenges

- Efficacy Perception: Recent meta-analyses question calcitonin-salmon’s analgesic and anti-osteoporotic potency relative to newer agents.

- Market Competition: The rise of monoclonal antibodies and bisphosphonates, especially in osteoporosis management, diminishes calcitonin-salmon’s market share.

- Generic and Biosimilar Threats: Patent cliffs and biosimilar development may pressure prices downward.

Conclusion

Calcitonin-salmon remains a niche yet stable player within the osteoporosis treatment landscape. Market size growth is moderate, influenced by demographic trends and incremental technological innovation. Price projections suggest gradual declines, with potential for premiumization if novel delivery systems or new indications gain regulatory approval. Stakeholders should monitor regulatory updates and technological advances to adjust market strategies accordingly.

Key Takeaways

- The global calcitonin-salmon market is valued around USD 250 million, with modest growth projections (~2.5% CAGR).

- Price erosion of approximately 0.5–1.0% annually is anticipated, driven by competition and generic threats.

- Innovator companies exploring non-invasive formulations and expanded indications could command higher prices.

- Demographics and regulatory positioning will remain critical market drivers over the next five years.

- Stakeholders should consider technological innovation, regulatory landscape shifts, and competitive dynamics in strategic planning.

FAQs

1. What factors influence the pricing of calcitonin-salmon?

Pricing is affected by manufacturing complexity, regulatory approvals, competition from generics or biosimilars, regional reimbursement policies, and technological innovations in delivery systems.

2. Will biosimilars impact the calcitonin-salmon market?

Potentially. Although biosimilars are in early development stages, their entry could lead to significant price reductions and market share shifts within 5-7 years.

3. How does technological innovation affect future price projections?

Innovations such as transdermal patches or extended-release formulations can justify premium pricing, improve adherence, and extend market relevance, potentially stabilizing or increasing prices.

4. Which regions present the most growth opportunities?

Asia-Pacific and Latin America offer growth potential due to increasing aging populations and expanding healthcare infrastructure, albeit with regional price dynamics distinct from Western markets.

5. How might regulatory changes influence the calcitonin-salmon market?

Regulatory re-evaluations of efficacy and safety profiles, such as recent FDA advisories, could restrict indications or approval statuses, affecting both market size and pricing.

References

[1] MarketWatch, “Calcitonin Market Size, Share & Trends Analysis Report,” 2022.

[2] Grand View Research, “Osteoporosis Drugs Market Analysis,” 2022.

[3] FDA Regulatory Updates, 2019.

[4] IQVIA Price & Market Data, 2022.

[5] Global Biodemographics Report, United Nations, 2021.

More… ↓