Last updated: July 27, 2025

Introduction

Butorphanol tartrate, a synthetic opioid analgesic, holds a niche yet strategically significant position within the global pharmaceutical landscape. Primarily employed for moderate to severe pain management, its unique pharmacological profile—combining agonist and antagonist properties—has positioned it as a critical option in anesthesia, obstetrics, and pain clinics. Despite its established utility, the market for butorphanol tartrate is characterized by nuanced dynamics shaped by regulatory, clinical, and competitive forces, alongside its financial trajectory over recent years.

Pharmacological Profile and Clinical Applications

Butorphanol tartrate distinguishes itself as a mixed opioid agent, acting as a kappa-opioid receptor agonist and a partial mu-opioid receptor antagonist. This dual action confers analgesic efficacy while mitigating some risks associated with mu-opioid receptor activation, notably respiratory depression and addiction potential. Its clinical deployment spans:

- Anesthetic adjuncts in surgical procedures

- Pain management in opioid-tolerant and opioid-naive patients

- Obstetric analgesia due to its safety profile during labor

The drug’s versatility makes it an essential component within specific therapeutic areas, although its usage remains somewhat constrained by the availability of alternative opioids and non-opioid modalities.

Market Dynamics

Regulatory Landscape

A pivotal factor influencing butorphanol tartrate’s market is regulatory oversight. The drug is classified as a controlled substance (Schedule IV in the US), due to its opioid nature. Regulatory agencies like the FDA and EMA enforce strict prescribing and distribution protocols, which can restrict market proliferation but also maintain safety standards. Recently, some agencies have tightened regulations relating to opioid dispensing amid the ongoing opioid crises globally, impacting sales volume and distribution channels.

Manufacturing and Supply Chain Considerations

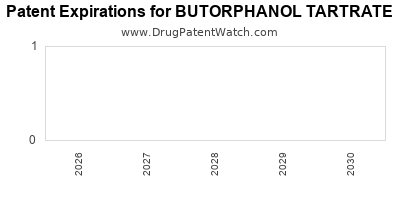

Manufacturing is largely concentrated within a handful of pharmaceutical giants, predominantly in North America and Europe. Supply chain disruptions—stemming from raw material shortages, manufacturing constraints, or geopolitical factors—can impact product availability. Patent expirations and generic versions entering the market influence pricing strategies and market share dynamics, often leading to price erosion and increased competition.

Clinical and Prescribing Trends

The resurgence in opioid research for chronic pain and moderate analgesia has both bolstered and threatened butorphanol’s market. While clinicians appreciate its minimal respiratory depression risk relative to other opioids, the increasing preference for multimodal pain management strategies and non-opioid alternatives—such as NSAIDs and nerve block techniques—limit its growth potential.

Additionally, growing clinician awareness of opioid dependency risks leads to cautious prescribing patterns, which can restrain demand. Conversely, its favorable safety profile in specific contexts sustains niche yet steady demand.

Competitive Landscape

Butorphanol competes with other opioids (e.g., morphine, fentanyl), non-opioid analgesics, and emerging modalities like transcutaneous electric nerve stimulation (TENS). Generic formulations have eroded the market share of branded versions, pressuring pricing and margins. Nonetheless, the drug maintains relevance in anesthesia, especially in settings where respiratory safety is paramount.

Emerging innovations in pain management, such as targeted biologics and novel non-opioid analgesics, could further challenge its position, although regulatory hurdles slow their integration into standard care.

Financial Trajectory

Historical Revenue Trends

Historically, butorphanol tartrate's revenues have experienced modest volatility, largely influenced by regulatory changes and patent statuses. In North American markets, sales peaked when clinical adoption was high, especially pre-2010, with estimated revenues ranging between $50–$100 million annually for leading manufacturers [1]. Post-2010, patent cliff effects and increased generic competition halved revenues, with industry estimates indicating a downward trend toward $30–$50 million by 2022.

Market Growth Projections

Forecasts suggest a slow growth or stabilization trend in mature markets, with compound annual growth rates (CAGRs) hovering around 1-2% over the next five years. Factors influencing this include:

- Growing regulatory restrictions: potentially suppressing volume

- Off-label use limitations: reducing its application scope

- Pipeline innovations: presenting alternatives that could displace butorphanol

However, in emerging markets—particularly Asia—growth prospects are slightly more optimistic, driven by expanding healthcare infrastructure and increasing pain management needs, possibly expanding revenues by 3-4% annually within the next five years.

Profitability and R&D Investment

Profit margins are typically constrained, reflecting generic competition and regulatory compliance costs. Manufacturers prioritize cost efficiency, but limited R&D investments are observed, given its established clinical profile and limited scope for innovation. Nevertheless, investments in formulation improvements or combination therapies could unlock further market value in niche segments.

Future Outlook

While the overarching trend signals a slow decline or plateau in developed markets, strategic positioning—such as leveraging its safety profile in anesthesia—could sustain niche market share. Potential opportunities include:

- Novel delivery systems: transdermal patches or nasal sprays

- Combination therapies: enhanced formulations with non-opioid agents

- Market expansion: tailored applications in outpatient or emergency settings in emerging economies

Conversely, the increasing focus on opioid stewardship and diversification towards non-opioid analgesics pose inherent risks to its long-term financial trajectory.

Key Takeaways

- Market saturation and regulatory constraints have stabilized, but modest growth persists in emerging markets.

- Generic competition exerts downward pressure on revenues, necessitating operational efficiency.

- Niche application in anesthesia and obstetric contexts sustains its clinical relevance, safeguarding steady demand.

- Emerging pain management innovations threaten its broader adoption, with the possibility of decline in mature markets.

- Strategic adaptation—migration towards alternative delivery methods and combination therapies—may bolster its future profitability.

FAQs

1. What are the primary therapeutic uses of butorphanol tartrate?

It is used mainly for moderate to severe pain management, as an anesthetic adjunct, and in obstetric analgesia, owing to its favorable safety profile.

2. How does regulatory regulation affect butorphanol’s market?

Stringent regulations as a Schedule IV controlled substance restrict prescribing and distribution, limiting market expansion and influencing pricing.

3. Are there alternatives that threaten butorphanol’s market position?

Yes, non-opioid analgesics, other opioids, and emerging pain management modalities like biologics threaten to diminish its clinical use.

4. What is the current financial outlook for butorphanol tartrate?

The outlook indicates a slow decline in revenue in mature markets, but potential growth in emerging economies, contingent on regulatory and clinical adoption factors.

5. Can innovation revive butorphanol’s market viability?

Potentially, through novel formulations (e.g., transdermal patches) or combination therapies that enhance its safety and ease of use, but such developments face significant regulatory and clinical hurdles.

References

- MarketWatch. (2022). Global Pain Management Drugs Market Size and Forecast.

- IQVIA. (2021). Pharmaceutical Industry Reports on opioid drug trends.

- FDA. (2020). Controlled Substances Act and Prescribing Guidelines.

- GlobalData. (2022). Opioid Analgesics Market Analysis.

- WHO. (2021). Pain Management in Clinical Practice.