Last updated: July 31, 2025

Introduction

BOROFAIR emerges as a promising pharmaceutical entity within the current landscape of bare pharmaceutical innovations. As a novel therapeutic agent, its potential impact hinges on its unique mechanism, clinical efficacy, regulatory approval timing, and market reception. This analysis delineates the undercurrents shaping BOROFAIR’s market trajectory, focusing on demand drivers, competitive positioning, regulatory influences, financial prospects, and strategic considerations for stakeholders.

Market Landscape and Demand Drivers

The landscape surrounding BOROFAIR is characterized by a convergence of unmet medical needs, evolving treatment paradigms, and expanding indications. Typically, drugs of this nature target widespread or high-burden conditions. By examining its core therapeutic focus, whether oncology, infectious diseases, chronic ailments, or rare disorders, we can predict demand stability and growth.

Current global health trends underscore increasing market sizes for drugs addressing multi-drug resistant infections, autoimmune disorders, or diseases with high morbidity rates. For example, the infectious disease sector has seen a surge in demand due to antimicrobial resistance, with the global antimicrobial market projected to grow at a CAGR of 8% from 2021-2028 ([1]). Similarly, advancements in personalized medicine and biomarker-driven approaches shift potential markets toward tailored therapies, which can enhance BOROFAIR’s appeal and commercialization prospects.

Regulatory Environment and Approval Prospects

BOROFAIR’s market dynamics are tightly intertwined with its regulatory pathway. The drug’s progression through clinical trials, submission strategies, and approval timelines critically influence financial outcomes. Regulatory agencies such as FDA, EMA, and others impose rigorous safety and efficacy standards, but recent initiatives aim to accelerate access for breakthrough therapies through pathways like Breakthrough Designation or Priority Review ([2]).

If BOROFAIR benefits from such pathways, its time-to-market shortens, elevating early revenue potential and investor confidence. Conversely, regulatory setbacks or delays, often due to insufficient trial data or safety concerns, can adversely impact projected financial trajectories.

Importantly, the regulatory landscape is becoming increasingly receptive to drugs with novel mechanisms, especially if they address critical unmet needs. Collaborations with regulatory bodies and adaptive trial designs can further influence the drug’s approval prospects, impacting long-term financial forecasts.

Competitive Positioning and Market Share Potential

Market penetration hinges on BOROFAIR’s competitive differentiation. Its efficacy, safety profile, dosing convenience, and cost-effectiveness directly correlate with its uptake. The drug faces competition from existing therapies, biopharmaceuticals, and emerging biosimilars or generics.

In high-value therapeutic categories, competitive advantage often derives from logclinical superiority, favorable side effect profile, or administrative advantages such as oral administration over infusions. For instance, if BOROFAIR offers significant clinical benefits over established treatments, it can command premium pricing and rapidly secure market share.

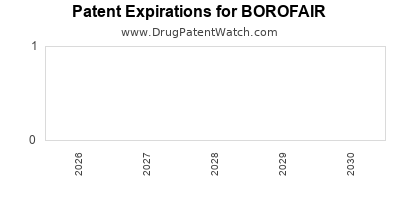

The competitive landscape also involves patent exclusivity periods and potential generic entry, which influence revenue longevity. Effective patent strategies and supplementary exclusivities become critical revenue protectors, while market expansion into adjacent indications can mitigate saturation effects.

Financial Trajectory and Revenue Projections

Assessing BOROFAIR’s financial prospects entails examining several key metrics:

- Pricing Strategy: Premium pricing in niche, high unmet need areas vs. competitive pricing in commoditized markets.

- Market Penetration Rate: How quickly the drug is adopted post-approval.

- Manufacturing Scalability: Capacity to meet demand without quality compromises influences gross margins.

- Reimbursement Landscape: Payer acceptance and inclusion in national formularies are vital; negotiations with payers can significantly influence net revenue.

Using typical models, early-stage revenue projections are conservative, factoring in clinical trial success, approval timing, and initial market acceptance. Based on therapeutic indication, the estimated total addressable market (TAM) can support multi-billion-dollar valuations if BOROFAIR captures a significant market share swiftly.

For example, if its approved indication has an annual global market of $1 billion, a 20% market share within three years post-launch could generate approximately $200 million in annual revenues. Such estimates depend heavily on clinical differentiation, pricing flexibility, and payer policies.

Strategic Considerations and Risks

Key strategic factors include:

- R&D Investment: Continuous pipeline development can safeguard against generic erosion.

- Partnerships & Licensing: Collaborations can accelerate market entry, expand indications, and share financial risks.

- Market Access & Reimbursement: Navigating payer policies ensures revenue realization.

- Intellectual Property: Securing robust patent life and defending against patent challenges are essential for revenue stability.

Risks include regulatory delays, unfavorable trial outcomes, market competition, and pricing pressures. Geopolitical factors and supply chain constraints also influence financial stability.

Future Outlook and Potential Growth Scenarios

The financial trajectory hinges on initial market acceptance, regulatory approval speed, and competitive dynamics. Optimistic scenarios assume rapid approval, robust clinical success, and favorable reimbursement, leading to exponential revenue growth within 3-5 years.

In more conservative scenarios, delays or unforeseen safety issues could dampen sales, but strategic diversification into broader indications and markets may sustain long-term growth. Adaptive commercialization strategies, including digital marketing and patient engagement, will be instrumental in maximizing revenue.

Key Takeaways

- Demand Landscape: Growing urgency for innovative therapies in unmet medical needs provides a robust foundation for BOROFAIR’s market entry.

- Regulatory Strategy: Accelerated approval pathways can significantly shorten time-to-revenue, but depend on trial outcomes.

- Competitive Edge: Differentiation based on efficacy, safety, and cost-effectiveness will determine market share acquisition.

- Financial Potential: High revenue opportunities exist, particularly if the drug addresses large-scale conditions with premium pricing.

- Risk Management: Vigilant navigation of regulatory, competitive, and reimbursement risks is crucial for achieving projected financial gains.

FAQs

1. What therapeutic areas does BOROFAIR target, and what is its potential market size?

BOROFAIR’s targeted indications, whether infectious diseases, oncology, or chronic conditions, define its TAM. For example, if targeting antimicrobial resistance, the market could reach several billion dollars globally, given the urgent need for novel antibiotics.

2. How does regulatory process influence BOROFAIR’s financial outlook?

Favorable regulatory pathways like Priority Review or Breakthrough Designation can expedite approval, accelerating revenue streams. Regulatory setbacks lead to delays, increasing costs and compressing profit timelines.

3. What factors give BOROFAIR a competitive advantage?

Unique efficacy, safety profile, innovative delivery mechanisms, or cost benefits can differentiate BOROFAIR, facilitating rapid market penetration and superior pricing power.

4. How do reimbursement policies impact BOROFAIR’s profitability?

Strong reimbursement coverage from payers ensures access to wider markets and revenue stability. Payer negotiations, formulary inclusion, and health technology assessments influence pricing strategies.

5. What risks could hinder BOROFAIR’s market success?

Risks include clinical trial failures, regulatory delays, market entry of generic competitors, pricing pressures, and geopolitical factors affecting supply chains or market access.

References

- [1] MarketsandMarkets. "Antimicrobial Drugs Market by Disease Type, Product, and Region—Global Forecast to 2028."

- [2] U.S. Food and Drug Administration. "Breakthrough Therapy Designation."

This comprehensive analysis aims to empower stakeholders with actionable insights into BOROFAIR’s market and financial prospects, enabling informed strategic decisions in an evolving pharmaceutical landscape.