BIKTARVY Drug Patent Profile

✉ Email this page to a colleague

Which patents cover Biktarvy, and what generic alternatives are available?

Biktarvy is a drug marketed by Gilead Sciences Inc and is included in one NDA. There are nine patents protecting this drug and two Paragraph IV challenges.

This drug has three hundred and seventy-six patent family members in fifty-five countries.

The generic ingredient in BIKTARVY is bictegravir sodium; emtricitabine; tenofovir alafenamide fumarate. Two suppliers are listed for this compound. Additional details are available on the bictegravir sodium; emtricitabine; tenofovir alafenamide fumarate profile page.

DrugPatentWatch® Generic Entry Outlook for Biktarvy

Biktarvy was eligible for patent challenges on February 7, 2022.

By analyzing the patents and regulatory protections it appears that the earliest date

for generic entry will be November 8, 2036. This may change due to patent challenges or generic licensing.

There have been sixteen patent litigation cases involving the patents protecting this drug, indicating strong interest in generic launch. Recent data indicate that 63% of patent challenges are decided in favor of the generic patent challenger and that 54% of successful patent challengers promptly launch generic drugs.

Indicators of Generic Entry

AI Deep Research

Questions you can ask:

- What is the 5 year forecast for BIKTARVY?

- What are the global sales for BIKTARVY?

- What is Average Wholesale Price for BIKTARVY?

Summary for BIKTARVY

| International Patents: | 376 |

| US Patents: | 9 |

| Applicants: | 1 |

| NDAs: | 1 |

| Finished Product Suppliers / Packagers: | 2 |

| Clinical Trials: | 44 |

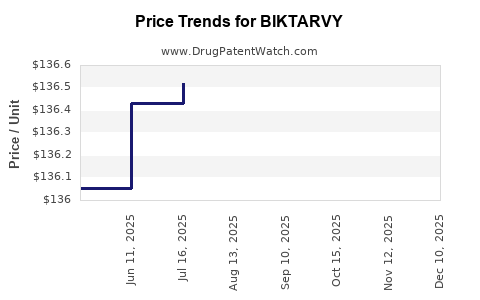

| Drug Prices: | Drug price information for BIKTARVY |

| Patent Litigation and PTAB cases: | See patent lawsuits and PTAB cases for BIKTARVY |

| What excipients (inactive ingredients) are in BIKTARVY? | BIKTARVY excipients list |

| DailyMed Link: | BIKTARVY at DailyMed |

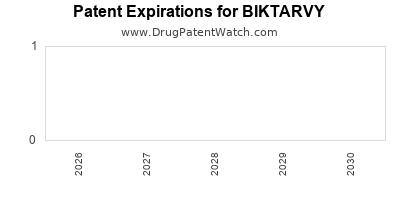

DrugPatentWatch® Estimated Loss of Exclusivity (LOE) Date for BIKTARVY

Generic Entry Date for BIKTARVY*:

Constraining patent/regulatory exclusivity:

NDA:

Dosage:

TABLET;ORAL |

*The generic entry opportunity date is the latter of the last compound-claiming patent and the last regulatory exclusivity protection. Many factors can influence early or later generic entry. This date is provided as a rough estimate of generic entry potential and should not be used as an independent source.

Recent Clinical Trials for BIKTARVY

Identify potential brand extensions & 505(b)(2) entrants

| Sponsor | Phase |

|---|---|

| Gilead Sciences | NA |

| Brigham and Women's Hospital | NA |

| Trutag Technologies | NA |

Pharmacology for BIKTARVY

Paragraph IV (Patent) Challenges for BIKTARVY

| Tradename | Dosage | Ingredient | Strength | NDA | ANDAs Submitted | Submissiondate |

|---|---|---|---|---|---|---|

| BIKTARVY | Tablets | bictegravir sodium; emtricitabine; tenofovir alafenamide fumarate | 30 mg/120 mg/ 15 mg | 210251 | 1 | 2023-09-28 |

| BIKTARVY | Tablets | bictegravir sodium; emtricitabine; tenofovir alafenamide fumarate | 50 mg/200 mg/ 25 mg | 210251 | 3 | 2022-02-07 |

US Patents and Regulatory Information for BIKTARVY

BIKTARVY is protected by nine US patents and five FDA Regulatory Exclusivities.

Based on analysis by DrugPatentWatch, the earliest date for a generic version of BIKTARVY is ⤷ Get Started Free.

This potential generic entry date is based on patent 10,548,846.

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

Expired US Patents for BIKTARVY

| Applicant | Tradename | Generic Name | Dosage | NDA | Approval Date | Patent No. | Patent Expiration |

|---|---|---|---|---|---|---|---|

| Gilead Sciences Inc | BIKTARVY | bictegravir sodium; emtricitabine; tenofovir alafenamide fumarate | TABLET;ORAL | 210251-002 | Oct 7, 2021 | 7,803,788 | ⤷ Get Started Free |

| Gilead Sciences Inc | BIKTARVY | bictegravir sodium; emtricitabine; tenofovir alafenamide fumarate | TABLET;ORAL | 210251-001 | Feb 7, 2018 | 6,642,245 | ⤷ Get Started Free |

| Gilead Sciences Inc | BIKTARVY | bictegravir sodium; emtricitabine; tenofovir alafenamide fumarate | TABLET;ORAL | 210251-001 | Feb 7, 2018 | 7,803,788 | ⤷ Get Started Free |

| Gilead Sciences Inc | BIKTARVY | bictegravir sodium; emtricitabine; tenofovir alafenamide fumarate | TABLET;ORAL | 210251-001 | Feb 7, 2018 | 6,703,396 | ⤷ Get Started Free |

| >Applicant | >Tradename | >Generic Name | >Dosage | >NDA | >Approval Date | >Patent No. | >Patent Expiration |

International Patents for BIKTARVY

When does loss-of-exclusivity occur for BIKTARVY?

Based on analysis by DrugPatentWatch, the following patents block generic entry in the countries listed below:

Argentina

Patent: 6645

Estimated Expiration: ⤷ Get Started Free

Australia

Patent: 16354007

Estimated Expiration: ⤷ Get Started Free

Patent: 20200995

Estimated Expiration: ⤷ Get Started Free

Brazil

Patent: 2016026127

Estimated Expiration: ⤷ Get Started Free

Canada

Patent: 48021

Estimated Expiration: ⤷ Get Started Free

Chile

Patent: 18001199

Estimated Expiration: ⤷ Get Started Free

China

Patent: 8348473

Estimated Expiration: ⤷ Get Started Free

Patent: 3546052

Estimated Expiration: ⤷ Get Started Free

Colombia

Patent: 18004776

Estimated Expiration: ⤷ Get Started Free

Costa Rica

Patent: 180253

Estimated Expiration: ⤷ Get Started Free

Cuba

Patent: 180036

Estimated Expiration: ⤷ Get Started Free

Ecuador

Patent: 18033723

Estimated Expiration: ⤷ Get Started Free

El Salvador

Patent: 18005682

Patent: COMPOSICIONES TERAPEUTICAS PARA EL TRATAMIENTO DEL VIRUS DE INMUNODEFICIENCIA HUMANA

Estimated Expiration: ⤷ Get Started Free

Eurasian Patent Organization

Patent: 1890654

Estimated Expiration: ⤷ Get Started Free

European Patent Office

Patent: 46995

Estimated Expiration: ⤷ Get Started Free

Patent: 32415

Estimated Expiration: ⤷ Get Started Free

Hong Kong

Patent: 56093

Estimated Expiration: ⤷ Get Started Free

Patent: 56903

Estimated Expiration: ⤷ Get Started Free

Israel

Patent: 8459

Estimated Expiration: ⤷ Get Started Free

Japan

Patent: 21933

Estimated Expiration: ⤷ Get Started Free

Patent: 18532811

Estimated Expiration: ⤷ Get Started Free

Mexico

Patent: 18005729

Patent: COMPOSICIONES TERAPEUTICAS PARA TRATAMIENTO DEL VIRUS DE INMUNODEFICIENCIA HUMANA. (THERAPEUTIC COMPOSITIONS FOR TREATMENT OF HUMAN IMMUNODEFICIENCY VIRUS.)

Estimated Expiration: ⤷ Get Started Free

New Zealand

Patent: 1957

Patent: Therapeutic compositions for treatment of human immunodeficiency virus

Estimated Expiration: ⤷ Get Started Free

Peru

Patent: 181207

Patent: COMPOSICIONES TERAPEUTICAS PARA EL TRATAMIENTO DEL VIRUS DE INMUNODEFICIENCIA HUMANA

Estimated Expiration: ⤷ Get Started Free

Philippines

Patent: 018501001

Patent: THERAPEUTIC COMPOSITIONS FOR TREATMENT OF HUMAN IMMUNODEFICIENCY VIRUS

Estimated Expiration: ⤷ Get Started Free

Poland

Patent: 46995

Estimated Expiration: ⤷ Get Started Free

Portugal

Patent: 46995

Estimated Expiration: ⤷ Get Started Free

Singapore

Patent: 201802983T

Patent: THERAPEUTIC COMPOSITIONS FOR TREATMENT OF HUMAN IMMUNODEFICIENCY VIRUS

Estimated Expiration: ⤷ Get Started Free

Slovenia

Patent: 46995

Estimated Expiration: ⤷ Get Started Free

South Korea

Patent: 2153996

Estimated Expiration: ⤷ Get Started Free

Patent: 2606625

Estimated Expiration: ⤷ Get Started Free

Patent: 180067702

Patent: 인간 면역결핍 바이러스의 치료를 위한 치료 조성물

Estimated Expiration: ⤷ Get Started Free

Patent: 200106222

Patent: 인간 면역결핍 바이러스의 치료를 위한 치료 조성물 (Therapeutic Compositions for Treatment of Human Immunodeficiency Virus)

Estimated Expiration: ⤷ Get Started Free

Patent: 230015512

Patent: 인간 면역결핍 바이러스의 치료를 위한 치료 조성물 (Therapeutic Compositions for Treatment of Human Immunodeficiency Virus)

Estimated Expiration: ⤷ Get Started Free

Patent: 240095320

Patent: 인간 면역결핍 바이러스의 치료를 위한 치료 조성물 (Therapeutic Compositions for Treatment of Human Immunodeficiency Virus)

Estimated Expiration: ⤷ Get Started Free

Spain

Patent: 57560

Estimated Expiration: ⤷ Get Started Free

Taiwan

Patent: 37647

Estimated Expiration: ⤷ Get Started Free

Patent: 1726139

Patent: Therapeutic compositions for treatment of human immunodeficiency virus

Estimated Expiration: ⤷ Get Started Free

Patent: 2220660

Patent: Therapeutic compositions for treatment of human immunodeficiency virus

Estimated Expiration: ⤷ Get Started Free

Uruguay

Patent: 981

Patent: COMPOSICIONES TERAPÉUTICAS PARA EL TRATAMIENTO DEL VIRUS DE INMUNODEFICIENCIA HUMANA

Estimated Expiration: ⤷ Get Started Free

Generics may enter earlier, or later, based on new patent filings, patent extensions, patent invalidation, early generic licensing, generic entry preferences, and other factors.

See the table below for additional patents covering BIKTARVY around the world.

| Country | Patent Number | Title | Estimated Expiration |

|---|---|---|---|

| Japan | 2019218368 | ⤷ Get Started Free | |

| Japan | 2022095640 | ナトリウム(2R,5S,13AR)-7,9-ジオキソ-10-((2,4,6-トリフルオロベンジル)カルバモイル)-2,3,4,5,7,9,13,13A-オクタヒドロ-2,5-メタノピリド[1’,2’:4,5]ピラジノ[2,1-B][1,3]オキサゼピン-8-オレート | ⤷ Get Started Free |

| Japan | H06505725 | ⤷ Get Started Free | |

| Peru | 20181207 | COMPOSICIONES TERAPEUTICAS PARA EL TRATAMIENTO DEL VIRUS DE INMUNODEFICIENCIA HUMANA | ⤷ Get Started Free |

| Hungary | E036928 | ⤷ Get Started Free | |

| El Salvador | 2018005682 | COMPOSICIONES TERAPEUTICAS PARA EL TRATAMIENTO DEL VIRUS DE INMUNODEFICIENCIA HUMANA | ⤷ Get Started Free |

| Mexico | 357940 | COMPUESTOS DE CARBAMOILPIRIDONA POLICICLICOS Y SU USO FARMACEUTICO. (POLYCYCLIC-CARBAMOYLPYRIDONE COMPOUNDS AND THEIR PHARMACEUTICAL USE.) | ⤷ Get Started Free |

| >Country | >Patent Number | >Title | >Estimated Expiration |

Supplementary Protection Certificates for BIKTARVY

| Patent Number | Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|---|

| 2822954 | 330 16-2018 | Slovakia | ⤷ Get Started Free | PRODUCT NAME: BIKTEGRAVIR VO VSETKYCH FORMACH CHRANENYCH ZAKLADNYM PATENTOM; REGISTRATION NO/DATE: EU/1/18/1289 20180625 |

| 2822954 | 300947 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: BICTEGRAVIR OF EEN FARMACEUTISCH AANVAARDBAAR ZOUT DAARVAN, IN HET BIJZONDER BICTEGRAVIRNATRIUM; REGISTRATION NO/DATE: EU/1/18/1289 20180625 |

| 2822954 | LUC00083 | Luxembourg | ⤷ Get Started Free | PRODUCT NAME: BICTEGRAVIR OR A PHARMACEUTICALLY ACCEPTABLE SALT THEREOF, IN PARTICULAR BICTEGRAVIR SODIUM; AUTHORISATION NUMBER AND DATE: EU/1/18/1289 20180625 |

| 2822954 | 1890030-8 | Sweden | ⤷ Get Started Free | PRODUCT NAME: BICTEGRAVIR OR A PHARMACEUTICALLY ACCEPTABLE SALT THEREOF, IN PARTICULAR BICTEGRAVIR SODIUM; REG. NO/DATE: EU/1/18/1289 20180625 |

| 1301519 | CA 2016 00012 | Denmark | ⤷ Get Started Free | PRODUCT NAME: TENOFOVIRALAFENAMID ELLER ET SALT ELLER SOLVAT DERAF, I SAERDELESHED TENOFOVIRALAFENAMIDFUMARAT; REG. NO/DATE: EU/1/15/1061/001-002 20151123 |

| 1301519 | SPC/GB16/015 | United Kingdom | ⤷ Get Started Free | PRODUCT NAME: TENOFOVIR ALAFENAMIDE OR A SALT OR SOLVATE THEREOF, IN PARTICULAR TENOFOVIR ALAFENAMIDE FUMARATE; REGISTERED: UK EU/1/15/1061/001 20151123; UK EU/1/15/1061/002 20151123 |

| 0513200 | 300148 | Netherlands | ⤷ Get Started Free | 300148, 20110131, EXPIRES: 20160130 |

| >Patent Number | >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for BIKTARVY

More… ↓

Make Better Decisions: Try a trial or see plans & pricing

Drugs may be covered by multiple patents or regulatory protections. All trademarks and applicant names are the property of their respective owners or licensors. Although great care is taken in the proper and correct provision of this service, thinkBiotech LLC does not accept any responsibility for possible consequences of errors or omissions in the provided data. The data presented herein is for information purposes only. There is no warranty that the data contained herein is error free. We do not provide individual investment advice. This service is not registered with any financial regulatory agency. The information we publish is educational only and based on our opinions plus our models. By using DrugPatentWatch you acknowledge that we do not provide personalized recommendations or advice. thinkBiotech performs no independent verification of facts as provided by public sources nor are attempts made to provide legal or investing advice. Any reliance on data provided herein is done solely at the discretion of the user. Users of this service are advised to seek professional advice and independent confirmation before considering acting on any of the provided information. thinkBiotech LLC reserves the right to amend, extend or withdraw any part or all of the offered service without notice.