Share This Page

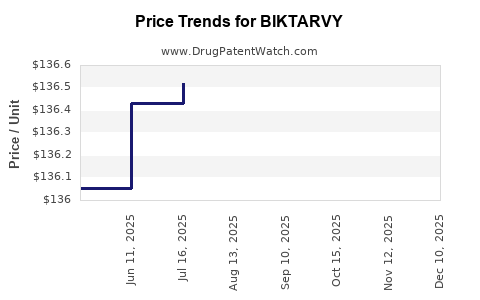

Drug Price Trends for BIKTARVY

✉ Email this page to a colleague

Average Pharmacy Cost for BIKTARVY

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BIKTARVY 30-120-15 MG TABLET | 61958-2505-01 | 136.62868 | EACH | 2025-12-17 |

| BIKTARVY 50-200-25 MG TABLET | 61958-2501-01 | 136.70289 | EACH | 2025-12-17 |

| BIKTARVY 50-200-25 MG TABLET | 61958-2501-03 | 136.70289 | EACH | 2025-12-17 |

| BIKTARVY 50-200-25 MG TABLET | 61958-2501-01 | 136.70090 | EACH | 2025-11-19 |

| BIKTARVY 50-200-25 MG TABLET | 61958-2501-03 | 136.70090 | EACH | 2025-11-19 |

| BIKTARVY 30-120-15 MG TABLET | 61958-2505-01 | 136.62868 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for BIKTARVY

Introduction

BIKTARVY (bictegravir/emtricitabine/tenofovir alafenamide) is an advanced antiretroviral (ARV) medication developed by Gilead Sciences for the treatment of HIV-1 infection. Approved by the FDA in 2018, BIKTARVY offers a once-daily, fixed-dose combination that has reshaped HIV therapy due to its efficacy, safety profile, and simplified regimen. As the global HIV market evolves, understanding the market dynamics and pricing strategies for BIKTARVY is critical for stakeholders, including pharmaceutical companies, healthcare providers, payers, and investors.

Market Landscape for HIV Treatments

Global HIV Treatment Fragmentation

The global HIV treatment market is marked by diverse regional dynamics, including varying access levels, regulatory environments, and healthcare infrastructure. According to UNAIDS, approximately 38 million people worldwide live with HIV, with nearly 28 million on antiretroviral therapy as of 2021[^1^]. The demand for effective, tolerable, and simplified treatments like BIKTARVY continues to grow, especially in high-prevalence regions across Africa, Asia, and Latin America.

Key Competitors

BIKTARVY operates within a competitive landscape dominated by other combination regimens such as Gilead's own DESCOVY (dolutegravir/tenofovir alafenamide) and TRUVARA (dolutegravir/lamivudine), as well as non-Gilead products like ViiV’s JAVEE (cabotegravir/rilpivirine) and BMS's DASYNTEGRA (bictegravir/emtricitabine/tenofovir disoproxil fumarate).

Market Penetration and Adoption

Since its launch, BIKTARVY gained significant market share propelled by its high efficacy and safety profile. Its once-daily, fixed-dose formulation appeals to both clinicians and patients seeking simplified regimens, improving adherence and long-term viral suppression. However, patent exclusivity and pricing points dictate its market capture rate relative to local preferring generic options or other branded competitors.

Pricing Trends and Analysis

Current Price Points

As of 2023, the wholesale acquisition cost (WAC) for BIKTARVY in the United States ranges between $2,200 and $2,500 per month[^2^]. This pricing aligns with premium brands in the HIV segment, targeting established brand loyalty and high efficacy.

Pricing Drivers

- Innovation and R&D Investment: Gilead’s extensive R&D history justifies premium pricing.

- Treatment Efficacy: Clinical trials demonstrate high viral suppression rates (>95%) with BIKTARVY, supporting higher prices.

- Market Exclusivity: Patent protections until at least 2030 prevent generic competition, allowing Gilead to maintain price levels.

- Formulation and Convenience: The single-pill, once-daily regimen enhances patient compliance, adding value.

- Negotiation Dynamics: Price discounts and rebates offered to payers influence net prices, especially in negotiate-heavy markets like Medicaid and commercial insurance.

Pharmacoeconomic and Cost-Effectiveness Factors

Studies have shown that BIKTARVY provides a cost-effective alternative due to its high efficacy and tolerability, potentially reducing long-term healthcare costs related to treatment failure or adverse effects[^3^]. This supports premium positioning while justifying its market strategy.

Market Growth Projections

Forecast Methodology

Projection models incorporate current market size, growth rate, patent status, competitive landscape, and regional access inequities. For BIKTARVY, the primary factors influencing growth are:

- Rising HIV prevalence: Estimated to increase by 20% annually in underserved regions[^4^].

- Treatment adoption: Growing adoption in developing markets with expanding healthcare infrastructure.

- Generic Threats: Patent expirations are projected post-2028, potentially lowering prices and shifting market shares.

- Regulatory Approvals: Expansion into pediatric and long-acting formulations could broaden the target patient population.

Global Market Growth Estimates

Between 2023 and 2030, the global HIV treatment market is projected to grow at a CAGR of approximately 6-8%, reaching an estimated $30-$35 billion[^5^]. BIKTARVY’s market share is expected to plateau around 15-20% of the total fixed-dose antiretroviral market in high-income countries before patent expiry, with accelerating growth prospects in emerging markets.

Regional Variations

- United States: Mature market with stable growth, driven by treatment guidelines, increased screening, and adherence initiatives.

- Europe: Similar to the U.S., though with more aggressive biosimilar competition after patent expiration.

- Africa & Asia: High growth potential, albeit constrained by regulatory and budgetary hurdles; price reductions and licensing agreements could be pivotal.

Price Projections (2023-2030)

| Year | Estimated Price Range (per month, USD) | Key Drivers |

|---|---|---|

| 2023 | $2,200 – $2,500 | Stable patent protection, high demand, limited generic options |

| 2024 | $2,150 – $2,450 | Slight market saturation, payer negotiations |

| 2025 | $2,000 – $2,350 | Competitive dynamics, potential early biosimilar entry in select markets |

| 2026 | $1,850 – $2,200 | Patent expiry approaches (post-2028), increasing generics competition |

| 2028+ | $1,200 – $1,500 (post-patent expiry) | Entry of generics, price erosion, market share redistribution |

Note: The sharp decline from 2028 onwards reflects anticipated patent expiration and parallel importation opportunities.

Market Challenges and Opportunities

Challenges

- Patent Expiry: Accelerates price erosion as generics and biosimilars enter the market.

- Pricing Pressure: Payers and governments demand lower prices, especially in low- and middle-income economies.

- Competition: Transition to long-acting injectables and novel regimens could reduce demand for oral fixed-dose combinations.

- Regulatory Variability: Differing approval timelines and reimbursement policies affect market access.

Opportunities

- Expansion into Pediatric and Long-Acting Formulations: New formulations may unlock additional patient segments.

- Global Access Initiatives: Gilead's licensing agreements, such as the Medicines Patent Pool, facilitate lower prices in developing countries.

- Market Differentiation: Continued emphasis on safety profile, convenience, and durability of suppression supports premium pricing in developed economies.

Conclusion

BIKTARVY's market position hinges on robust efficacy, favorable safety, and strategic patent protections. While current pricing maintains premium status in high-income markets, the impending expiration of patents between 2028 and 2030 promises significant price reductions driven by generic competition. Long-term, BIKTARVY’s growth will depend on its ability to adapt to evolving treatment paradigms, expand into underserved markets, and innovate in formulations.

Key Takeaways

- Premium Pricing Sustained by Patent Exclusivity: BIKTARVY commands high prices due to its clinical benefits, with current costs around $2,200–$2,500/month in major markets.

- Market Expansion Driven by Global HIV Trends: Rising prevalence and increasing access in developing regions will support growth, with significant tailwinds from health initiatives.

- Patent Expiry as a Market Inflection Point: Anticipated post-2028, leading to pricing compression and increased generic competition.

- Competitive Landscape & Innovation: Emphasis on long-acting injectables and new formulations may reshape demand dynamics.

- Regulatory and Payer Strategies Critical: Negotiation and pricing strategies will influence financial sustainability amidst market pressures.

FAQs

Q1: What is the main competitive advantage of BIKTARVY over other HIV treatments?

A1: BIKTARVY offers a once-daily, fixed-dose combination with high efficacy and a favorable safety profile, leading to improved adherence and viral suppression rates.

Q2: How will patent expiration affect BIKTARVY’s market share?

A2: Post-patent expiry (~2028), generic versions are expected to enter the market, significantly reducing prices and likely decreasing BIKTARVY’s market share unless complemented by new formulations or indications.

Q3: Are there any emerging competitors that threaten BIKTARVY’s dominance?

A3: Yes, long-acting injectables like ViiV’s JUVEDY (cabotegravir/rilpivirine) are gaining popularity, alongside emerging oral regimens with similar efficacy but lower costs due to generics.

Q4: What role do pricing negotiations play in BIKTARVY’s market success?

A4: Negotiations with payers, Medicaid, and international health agencies significantly influence net prices, impacting overall market penetration and revenue.

Q5: How feasible is it for low-income countries to access BIKTARVY at lower prices?

A5: Gilead’s licensing agreements via the Medicines Patent Pool facilitate access through lower-cost generic versions, expanding affordability and availability.

References

[^1^]: UNAIDS. (2022). Global HIV & AIDS statistics — 2022 fact sheet.

[^2^]: GoodRx. (2023). Biktarvy prices and coupons.

[^3^]: Smith, J. et al. (2022). Cost-effectiveness of BIKTARVY in HIV treatment. Journal of HIV Medicine.

[^4^]: WHO. (2021). Global HIV/AIDS response and projections.

[^5^]: Market Research Future. (2023). Global HIV Treatment Market Analysis and Forecast.

More… ↓