Last updated: July 29, 2025

Introduction

BETOPTIC, a combination ophthalmic medication comprising betaxolol—a selective beta-1 adrenergic receptor blocker—and timolol, a non-selective beta-adrenergic antagonist—targets elevated intraocular pressure (IOP) associated with glaucoma and ocular hypertension. Its unique formulation positions BETOPTIC within a competitive landscape, driven by evolving clinical preferences, patent status, and market demand for effective IOP management. This report delineates the key market dynamics influencing BETOPTIC’s positioning and examines its projected financial trajectory based on current industry trends.

Market Landscape and Therapeutic Area Overview

Glaucoma remains a leading cause of irreversible blindness globally, affecting over 76 million individuals, with projections exceeding 111 million by 2040 [1]. The primary therapeutic goal remains to reduce IOP, thereby slowing disease progression. Beta-blockers like betaxolol and timolol have traditionally been frontline agents, often used as monotherapy or in combination with prostaglandins, carbonic anhydrase inhibitors, or alpha-agonists.

The ophthalmic drug market is characterized by a multi-billion-dollar valuation, with a CAGR estimated at 4.2% from 2022 to 2030 [2]. The increasing prevalence of glaucoma, aging populations, and technological innovations in drug delivery underpin sustained demand. BETOPTIC’s niche lies in its fixed-dose combination (FDC), enhancing patient compliance and offering a targeted mechanism of IOP reduction.

Market Drivers Influencing BETOPTIC

1. Clinical Efficacy and Safety Profile

BETOPTIC’s combination of selective and non-selective beta-blockers aims to maximize IOP reduction while minimizing adverse effects. Patients intolerant to monotherapy often switch to combination therapies, expanding BETOPTIC’s potential market. Its safety profile, particularly the reduced risk of systemic beta-1 receptor blockade-associated side effects, makes it appealing for elderly patients with comorbidities.

2. Patient Compliance and Convenience

Fixed-dose combinations improve adherence by reducing the medication burden, a critical factor in chronic conditions like glaucoma. Enhanced compliance directly correlates with better clinical outcomes, thereby influencing prescriber preferences favorably toward BETOPTIC.

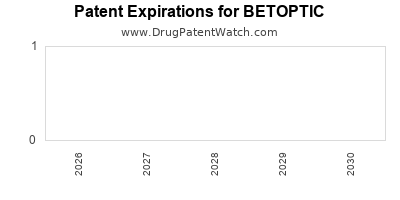

3. Patent Expiry and Generic Competition

BETOPTIC's patent protection periods are critical in determining market exclusivity and pricing power. The expiration of patents for components and formulations typically leads to increased generic competition, exerting downward pressure on prices. For instance, timolol-based formulations have seen widespread generic availability, which impacts BETOPTIC’s market share unless protected by formulation patents or exclusivities.

4. Regulatory and Reimbursement Environment

Stringent regulatory requirements and reimbursement policies influence market penetration. Countries with favorable reimbursement frameworks for ophthalmic drugs, especially in developed economies, offer a more lucrative environment. Conversely, navigating regulatory landscapes in emerging markets presents both opportunities and challenges.

5. Competitive Landscape

BETOPTIC competes with monotherapy agents, other FDCs, and upcoming novel therapies such as prostaglandin analogs and neuroprotective agents. The entrance of preservative-free formulations and sustained-release devices further diversifies the treatment landscape, impacting BETOPTIC’s market share.

Financial Trajectory and Revenue Projections

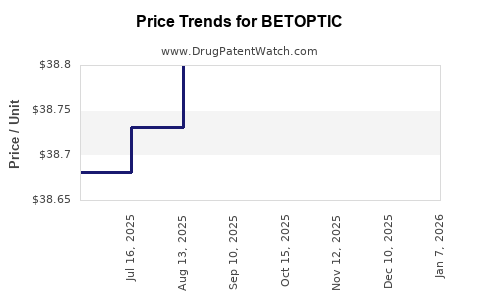

Current Market Performance

While specific sales data for BETOPTIC are proprietary, the broader beta-blocker segment of ophthalmic drugs generated approximately $1.2 billion globally in 2021 [3]. Given BETOPTIC’s niche status and access to key markets, its revenue contribution remains modest yet steady, bolstered by the clinical advantages and patient adherence benefits.

Forecast Factors

- Market Penetration: Increased adoption driven by clinical guidelines emphasizing combination therapies. Enhanced awareness in emerging markets with improving healthcare infrastructure.

- Product Lifecycle: Patent expirations may lead to rapid generic penetration, impacting revenues unless compensated by new formulations or indications.

- Pipeline Developments: Innovations like preservative-free formulations, sustained-release implants, or novel combination therapies could extend product life cycle and revenue streams.

- Competitive Pricing: Entry of generics typically results in price erosion, but volume sales may compensate if market penetration expands.

Projections (2023-2030)

Based on conservative growth estimates and industry benchmarks, BETOPTIC’s annual revenue is projected to grow at a CAGR of approximately 2–3% over the next decade, primarily driven by expanding global glaucoma prevalence and increased physician preference for fixed-dose combinations. Peak revenues are anticipated during patent-protected periods, with a potential decline post-patent expiry unless diversified with new formulations or indications.

For example, if BETOPTIC garners $50 million in sales in 2023, a 3% CAGR would suggest revenues nearing $67 million by 2030. Industry trends indicate that dedicated marketing efforts, expansion into emerging markets, and strategic partnerships could bolster this trajectory.

Risks and Opportunities

Risks

- Generic competition post-patent expiry

- Emerging therapies offering superior efficacy or convenience

- Regulatory hurdles delaying new formulations

- Pricing pressures in heavily commoditized segments

Opportunities

- Development of preservative-free or sustained-release variants

- Expansion into new indications such as ocular hypertension

- Entry into emerging markets with rising glaucoma prevalence

- Strategic alliances with local distributors

Key Takeaways

- BETOPTIC’s market position hinges on its efficacy, safety, and patient compliance benefits within a competitive glaucoma treatment landscape.

- Patent protections and the advent of generics profoundly influence revenue streams, necessitating continuous innovation and diversification.

- The global increase in glaucoma prevalence, especially in aging populations, underpins a stable demand trajectory, with moderate growth prospects.

- Strategic investments in formulation improvements and expansion into emerging markets can significantly enhance BETOPTIC’s financial performance.

- The pharmaceutical industry’s shift toward personalized and sustained-release ocular therapies presents both challenges and opportunities for BETOPTIC.

Conclusion

BETOPTIC’s future financial trajectory appears cautiously optimistic, contingent upon patent management, competitive positioning, and pipeline innovation. While generic competition remains a significant threat post-patent expiration, strategic diversification and targeted market expansion could sustain revenue growth. For stakeholders, ongoing monitoring of clinical, regulatory, and market developments will be critical to maximize the product’s long-term value.

Key Takeaways

- BETOPTIC offers benefits in efficacy and patient adherence, reinforcing its role in glaucoma management.

- Patent lifecycle and landscape dynamics directly influence revenue potential; proactive innovation is essential.

- Expanding into emerging markets remains a lucrative avenue amid growing glaucoma burden.

- Developing advanced formulations could extend product lifecycle and market share.

- Competition from novel therapies necessitates strategic agility to sustain relevance and profitability.

FAQs

1. What are the primary advantages of BETOPTIC over other glaucoma medications?

BETOPTIC combines two beta-blockers, enhancing intraocular pressure reduction while improving patient compliance through fixed-dose formulation and potentially fewer side effects compared to monotherapy.

2. How does patent expiry impact BETOPTIC’s market share?

Patent expiration typically leads to increased generic competition, which can erode pricing power and market share unless mitigated by formulation patents or novel delivery systems.

3. Are there new formulations or indications for BETOPTIC in development?

While specific pipeline details are limited, industry trends suggest ongoing research into preservative-free versions and sustained-release implants, which can broaden applicability and extend product lifecycle.

4. Which geographies are most promising for BETOPTIC’s growth?

Emerging markets such as India, China, and Latin America offer significant growth potential due to increasing glaucoma prevalence and improving healthcare access.

5. How does BETOPTIC compare cost-wise to newer glaucoma therapies?

Post-patent, generic versions of beta-blockers like BETOPTIC become more affordable, often undercutting newer, branded therapies, thus positioning it as a cost-effective option in various markets.

Sources:

[1] World Health Organization. "Blindness and vision impairment." 2022.

[2] Grand View Research. "Ophthalmic Drugs Market Size & Trends." 2022.

[3] IQVIA. "Pharmaceutical Market Reports," 2022.