Last updated: July 27, 2025

Introduction

BENADRYL, a widely recognized antihistamine primarily containing diphenhydramine, has long served as an over-the-counter treatment for allergy symptoms, motion sickness, and insomnia. Its deep-rooted presence in consumer healthcare underscores its significance in the pharmacological landscape. Analyzing its market dynamics and financial trajectory involves understanding product positioning, competitive forces, regulatory landscape, and evolving consumer behavior.

Historical Market Presence

Since its introduction in the 1940s, BENADRYL has cemented its role in OTC allergy relief. As a first-generation antihistamine, its efficacy in alleviating allergic rhinitis, conjunctivitis, and cold symptoms has driven consistent demand. The longstanding consumer familiarity and brand recognition contribute to its continued market share, despite emergence of newer, second-generation antihistamines with fewer sedative effects [1].

Market Size and Segmentation

The global antihistamine market exceeded USD 5 billion in 2022, with OTC products like BENADRYL constituting a significant segment. North America, especially the United States, remains the dominant market owing to high consumer awareness and well-established OTC regulatory frameworks. The pet care sector also presents a niche extension for diphenhydramine, reflecting potential diversification avenues.

Within the allergy relief category, BENADRYL’s key consumers include individuals seeking rapid symptom relief, the elderly (due to its sedative properties), and segments preferring generic formulations. The market segmentation is influenced by age demographics, severity of allergic conditions, and consumer preferences for sedative versus non-sedative options.

Market Drivers

Several factors underpin the ongoing demand for BENADRYL:

- Consumer Awareness and Brand Loyalty: BENADRYL’s long-standing presence fosters trust, particularly among older consumers familiar with its efficacy.

- Broad Indication Spectrum: Efficacy in allergy relief, sleep aid, and motion sickness broadens its usage.

- Regulatory Accessibility: Approved as an OTC product in multiple jurisdictions, facilitating easy consumer access.

- Pricing Strategy: Competitive pricing and availability in various formulations (tablets, liquids, topical) enhance consumer reach.

Market Restraints

However, the drug faces challenges:

- Preference for Second-Generation Antihistamines: Drugs like loratadine and cetirizine provide allergy relief without sedation, reducing BENADRYL's appeal.

- Sedative Side Effects: Potential for drowsiness limits use during daytime activities.

- Regulatory Changes: Potential restrictions on OTC sales or labeling modifications could impact market penetration.

Competitive Landscape

FDA-approved second-generation antihistamines have gained prominence, decreasing reliance on older sedating agents like BENADRYL. Major competitors include:

- Claritin (loratadine): Non-sedating, popular for daily allergy management.

- Zyrtec (cetirizine): Offers rapid relief with fewer sedative effects.

- Allegra (fexofenadine): Noted for minimal central nervous system penetration.

Generic diphenhydramine products also compete aggressively on price, eroding market share for branded BENADRYL. Pharmaceutical giants such as Johnson & Johnson (the original manufacturer) and other generic manufacturers have strategies centered on pricing and formulation diversity to sustain their market presence.

Regulatory and Legal Environment

Regulatory agencies like the FDA govern OTC status and labeling—any changes, especially concerning sedative warnings or contraindications, could influence sales trajectory. Additionally, growing scrutiny over sedative misuse and adverse effects necessitates vigilant compliance and possibly reformulation.

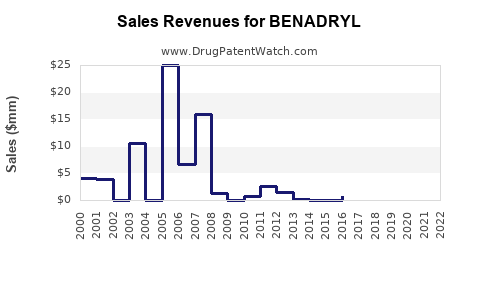

Financial Trajectory and Revenue Outlook

Historically, BENADRYL has generated consistent revenues due to its entrenched market position. Estimated global OTC diphenhydramine sales hovered around USD 1 billion in 2021, with BENADRYL contributing a substantial portion. However, the following factors influence future financial performance:

- Market Saturation: High brand familiarity limits innovative growth unless repositioned.

- Competition from Non-Sedating Antihistamines: Erosion of market share could diminish revenues.

- Consumer Trends: Increasing preference for non-sedating, long-acting relief options may curtail demand.

- Regulatory Developments: Potential label restrictions could alter sales volumes or formulations.

Major manufacturers are pursuing diversified revenue strategies: some developing combination products (e.g., antihistamine plus decongestant), while others leverage branding to maintain premium positioning in specific markets.

Future Growth Prospects

While growth in developed markets may plateau, emerging markets represent potential expansion areas owing to rising allergy incidences and increasing OTC healthcare spending. Additionally, the medicinal use of diphenhydramine in dermatological or sleep aid formulations indicates potential niche growth avenues.

Market Dynamics Summary

- Stable core demand driven by consumer familiarity and broad indication spectrum.

- Growing competition from non-sedating antihistamines diminishes market share.

- Regulatory and safety concerns may influence product formulations and labeling.

- Consumer shift towards newer agents impacts long-term financial prospects.

- Diversification and innovation opportunities are critical for maintaining revenue streams.

Financial Trajectory Summary

- Current revenues remain significant but face headwinds from generic commoditization and competition.

- Profit margins could be pressured by price erosion, particularly for generic formulations.

- Strategic branding and formulations offering sleep aid or combination products could sustain or enhance revenues.

- Emerging markets offer growth opportunities, contingent on regulatory pathways and market penetration strategies.

- Regulatory risks necessitate ongoing compliance, influencing future sales and profitability.

Key Takeaways

- Market Positioning: BENADRYL’s strength lies in brand loyalty and broad indication spectrum but faces significant competition from newer, non-sedating antihistamines.

- Revenue Outlook: While historically stable, revenues could decline if consumer preferences shift and regulatory environments tighten.

- Competitive Strategies: Manufacturers must innovate through combination therapies, reformulations, and market expansion to sustain financial performance.

- Regulatory Environment: Vigilant compliance and proactive engagement with regulatory bodies are essential to mitigate potential restrictions.

- Emerging Markets: Growth potential exists outside developed economies, offering avenues for revenue diversification.

FAQs

1. How is BENADRYL positioned against newer antihistamines?

BENADRYL’s sedative properties and familiarity maintain demand, especially for sleep aid applications. However, non-sedating alternatives like loratadine and cetirizine are preferred for daytime allergy relief, which impacts BENADRYL’s market share in allergy-specific segments.

2. What are the key factors influencing BENADRYL’s future revenues?

Market competition, consumer preferences, regulatory changes, and product diversification strategies primarily drive future financial outcomes. The shift toward non-sedating options and potential regulatory restrictions are critical considerations.

3. Are there opportunities for BENADRYL in emerging markets?

Yes. Rising allergy prevalence, expanding OTC markets, and consumer healthcare spending growth in regions like Asia and Latin America provide promising opportunities. Success depends on regulatory approval processes and local market strategies.

4. How might regulatory changes affect BENADRYL's market?

Enhanced safety warnings, age restrictions, or reclassification as prescription-only could significantly diminish sales volumes. Conversely, proactive reformulations emphasizing safety could mitigate adverse impacts.

5. What strategies can manufacturers employ to sustain BENADRYL’s market relevance?

Developing combination therapies, exploring new formulations (e.g., non-sedating variants), targeting niche markets like sleep aids, and expanding into emerging markets are pivotal strategies for maintaining competitiveness and financial stability.

Sources

[1] IBISWorld. "Antihistamines Market Report," 2022.