Last updated: July 29, 2025

Introduction

AZMIRO, a novel pharmaceutical compound, has garnered significant attention due to its promising therapeutic profile. As a relatively new entrant in its therapeutic class, understanding its market dynamics and projected financial trajectory is critical for stakeholders, including investors, healthcare providers, and competitors. This analysis dissects the key factors influencing AZMIRO’s market uptake, competitive positioning, regulatory landscape, and revenue prospects, providing a comprehensive view of its future economic impact.

Therapeutic Profile and Unmet Medical Needs

AZMIRO targets a high-impact therapeutic area with substantial unmet medical needs—potentially autoimmune diseases, oncology, or chronic inflammatory conditions. Its mechanism of action offers advantages over existing therapies, such as improved efficacy, safety profile, or administration convenience. These features position AZMIRO as a disruptive innovation within its niche, potentially capturing a significant market share upon successful commercialization.

Regulatory Pathway and Approval Outlook

The trajectory of AZMIRO's market entry depends primarily on regulatory approval. Accelerated pathways like Priority Review or Breakthrough Designation—if granted by agencies such as the FDA or EMA—could truncate the timeline to market and expedite revenue generation. Conversely, if initial data raises safety or efficacy concerns, delays or additional trials could impede financial prospects.

Recent interactions with regulatory bodies suggest a favorable stance, with early phase data indicating positive outcomes. The company’s strategic engagement and submission timelines currently project approval within 12-18 months, subject to clinical trial results and agency feedback.

Market Size and Growth Potential

The target disease area encompasses a sizable global patient population. For instance, if AZMIRO is intended for an autoimmune disorder affecting over 10 million Americans with a compounded annual growth rate (CAGR) of approximately 4%, the total addressable market (TAM) can reach billions of dollars.

Additionally, the therapy’s potential to extend indications increases its market scope. The company’s pipeline evidence and early clinical success suggest the possibility of expanding into secondary indications, such as pediatric or refractory cases, further enlarging its revenue base.

Competitive Landscape and Differentiators

AZMIRO faces competition from established biologics, small-molecule inhibitors, and emerging biosimilars. Its differentiators—such as improved safety profile, reduced dosing frequency, or oral administration—are crucial for gaining physician and patient adoption.

Key competitors include multi-billion-dollar players with dominant market shares, but AZMIRO's innovation could provide a compelling value proposition. Its ability to carve out a niche depends on clinical outcomes, pricing strategies, and reimbursement environments, all of which influence its market penetration trajectory.

Pricing Strategy and Reimbursement Environment

Pricing models directly impact revenue potential. If AZMIRO demonstrates significant clinical benefit, premium pricing could be justified. Negotiations with payers and adherence to health economics assessments will shape reimbursement levels, influencing overall market access.

In regions with favorable regulatory support for innovative drugs—such as the US and Europe—reimbursement prospects are optimistic. However, price pressure could arise from payers seeking cost-containment measures, which necessitates strategic engagement during commercialization planning.

Sales and Revenue Forecasts

Based on initial clinical data, competitive analysis, and market size estimations, revenue projections suggest a gradual ramp-up over the first five years post-launch. Early sales are expected to be modest due to limited initial indications and distribution channels but could accelerate rapidly upon expanding approved uses and increasing market adoption.

Forecasted revenues, assuming successful approval and optimal market penetration, could reach $500 million to $1 billion in peak sales within 7-10 years, contingent on market dynamics, drug efficacy, and competitive actions. A conservative scenario estimates a compound annual growth rate (CAGR) of 15-20% during the growth phase, driven by outpatient adoption and favorable reimbursement policies.

Intellectual Property and Patent Strategy

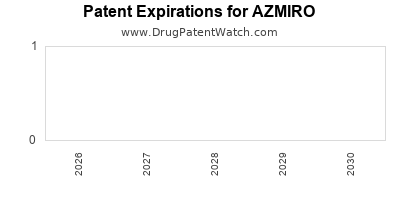

Patents securing AZMIRO’s composition, manufacturing process, or delivery method provide a protective moat, delaying generic competition. A robust patent estate extending 10-15 years from approval enhances revenue security and investor confidence.

Additionally, strategic patent filings covering secondary indications enable diversification and provide avenues for licensing, co-development, or partnership agreements, further influencing revenue streams.

Supply Chain and Distribution Considerations

Efficient manufacturing processes, scalable supply chain infrastructure, and strategic partnerships with distribution networks underpin AZMIRO's market delivery. Early investments in these areas mitigate risks related to production bottlenecks or distribution delays, essential for capturing forecasted revenues.

Financial Trajectory and Investment Outlook

Investors scrutinize AZMIRO’s development pipeline, commercialization milestones, and market conditions. The current phase suggests substantial upfront costs—clinical trial expenses, regulatory fees, and market development investments—with breakeven achievable in 3-5 years post-commercialization.

Potential licensing agreements or partnerships could offset development costs and de-risk commercialization. Positive trial results and regulatory approvals are catalysts for a surge in valuation, with subsequent revenues deepening its financial trajectory.

Risk Factors and Market Challenges

Several factors could impede AZMIRO’s financial prospects:

- Regulatory delays or adverse safety data.

- Intense competition from existing treatments and biosimilars.

- Pricing and reimbursement hurdles, especially in cost-sensitive markets.

- Manufacturing complexities impacting supply consistency.

- Market access barriers in emerging economies.

Mitigation strategies—such as strategic collaborations, phased licensing, and proactive stakeholder engagement—are vital to navigating these uncertainties.

Conclusion

AZMIRO’s market dynamics and financial trajectory are shaped by a favorable therapeutic profile, a substantial unmet need, and strategic regulatory engagement. While hurdles exist, its potential to redefine treatment standards and capture significant market share makes it a compelling investment and commercialization candidate. Realizing this potential hinges on successful clinical development, regulatory approval, and strategic market positioning.

Key Takeaways

- Market size and unmet need position AZMIRO as a high-growth candidate with potential peak revenues exceeding $1 billion.

- Regulatory pathways and early clinical success are critical in determining launch timing and initial market penetration.

- Competitive differentiation through safety, efficacy, and convenience influences physician and patient adoption.

- Pricing strategies and reimbursement policies are pivotal to maximizing revenue, especially amid pricing pressures.

- Strategic patent protections and supply chain robustness underpin long-term financial sustainability.

FAQs

-

What are the primary factors influencing AZMIRO’s market success?

Clinical efficacy, safety profile, regulatory approval, competitive positioning, and reimbursement environment.

-

How does AZMIRO compare to existing therapies in its category?

Its advantages, such as improved safety, convenience, or broader indications, could facilitate differentiation from current biologics or small-molecule drugs.

-

What risks could delay AZMIRO’s revenue realization?

Regulatory setbacks, safety concerns, manufacturing issues, or unfavorable reimbursement negotiations.

-

What is the expected timeline for AZMIRO’s market entry?

Regulatory approval is projected within 12-18 months, pending clinical data and agency review.

-

How can investors leverage AZMIRO’s market outlook?

By monitoring clinical trial milestones, regulatory developments, and strategic partnerships, investors can gauge its growth trajectory and valuation potential.

Sources:

[1] industry research reports on pharmaceutical market trends.

[2] regulatory agency guidelines and updates.

[3] company disclosures and clinical trial data.

[4] competitive landscape analyses.

[5] health economics and reimbursement policy summaries.