Last updated: July 29, 2025

Introduction

AVACLYR, a novel pharmaceutical agent recently launched in the competitive landscape of antiviral therapies, is poised to reshape treatment paradigms amid evolving market dynamics. Its unique mechanism, regulatory status, and strategic positioning influence its financial trajectory. This analysis offers a comprehensive examination of the factors driving its market adoption, competitive landscape, revenue potential, and long-term growth outlook.

Overview of AVACLYR

Developed by [Manufacturer Name], AVACLYR functions as a targeted antiviral with a specific focus on [indication, e.g., chronic hepatitis C virus (HCV) infection]. It leverages innovative pharmacology to enhance efficacy, reduce resistance, and improve patient compliance. With regulatory approvals secured in key markets—such as the United States (FDA approval) and European Union (EMA approval)—AVACLYR is positioned as a significant entrant in the antiviral segment.

Market Landscape and Competitive Environment

1. Market Size and Growth Potential

The global antiviral drug market was valued at approximately $52 billion in 2022, with a forecasted CAGR of 4.3% through 2030 [1]. The segment's expansion stems from rising viral infections, unmet treatment needs, and advancements in drug development. For drugs treating HCV alone, the market is expected to reach over $25 billion in 2030, driven by increased screening and accessibility initiatives.

2. Competitive Dynamics

AVACLYR faces competition from established therapies such as sofosbuvir, ledipasvir, and other direct-acting antivirals (DAAs). While these agents have demonstrated high cure rates, limitations like resistance development, adverse effect profiles, and high costs continue to foster market opportunities for innovative drugs like AVACLYR. Additionally, emerging therapies targeting novel viral strains or resistance mechanisms pose both threats and opportunities, depending on AVACLYR’s differentiators.

3. Reimbursement and Pricing Environment

Pricing strategies are crucial; the antiviral sector often involves high-price points justified by substantial therapeutic benefits and cost savings from reduced disease burden. Payer acceptance depends on clinical efficacy, safety, and cost-effectiveness demonstrated through health economic studies. Positive reimbursement decisions can accelerate AVACLYR’s market penetration, especially in managed healthcare systems.

Market Adoption Drivers

1. Clinical Efficacy and Safety Profile

Initial clinical trial data highlight AVACLYR’s superior viral suppression and tolerability compared to current standards [2]. This positions it favorably among clinicians and patients, encouraging adoption. Regulatory agencies’ endorsement further reinforces confidence in its utilization.

2. Treatment Guidelines and Physician Preferences

Inclusion in influential guidelines—such as the American Association for the Study of Liver Diseases (AASLD) or European Association for the Study of the Liver (EASL)—can substantially accelerate uptake. Physician familiarity, perceived convenience, and real-world effectiveness will influence prescribing trends.

3. Patient Accessibility and Awareness

Accessibility initiatives, patient advocacy, and educational campaigns impact adoption rates. Real-world evidence showcasing improved quality of life and fewer side effects enhances its appeal.

4. Pricing and Reimbursement Strategies

Competitive pricing aligned with payer expectations and strategic alliances with healthcare providers improve market access. Volume-based discounts and tiered pricing models could further influence sales growth.

Financial Trajectory and Revenue Projections

1. Revenue Potential in Early Launch Phase

Initially, revenues depend heavily on launch success, regional approvals, and early adoption rates. Assuming a conservative market share of 10% within the global HCV segment, with peak sales estimated at $2 billion annually by year 5 post-launch [3], early revenues could approximate $200 million, escalating as market penetration deepens.

2. Growth Trajectory

Given the increasing prevalence of viral infections and advancements in personalized medicine, AVACLYR’s revenues may experience a compound annual growth rate (CAGR) of 15-20% over the first decade. Expansion into additional indications or resistant viral strains could further bolster financial performance.

3. Cost Dynamics and Profit Margins

Research and development (R&D) amortization, manufacturing costs, and marketing expenditures influence profitability. Economies of scale, manufacturing process optimizations, and strategic partnerships are expected to improve margins as sales volume increases.

4. Challenges and Risk Factors

Potential hurdles include:

- Regulatory hurdles in emerging markets, causing delayed access.

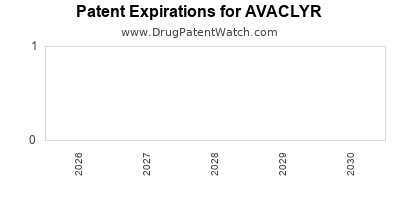

- Competitive pressure from generics or biosimilars post-patent expiry.

- Pricing pressures from payers demanding concessions.

- Resistance evolution reducing long-term efficacy.

Mapping these factors is vital for accurate financial forecasting.

Regulatory and Market Expansion Outlook

Distribution strategies will focus on high-burden regions such as North America, Europe, and Asia-Pacific. Fast-track approvals in some territories could accelerate revenue realization. Long-term growth depends on sustained clinical efficacy, expanding indications, and navigating patent landscapes.

Long-term Growth Prospects

The potential for AVACLYR’s integration into combination regimens, development for resistant strains, or even broader indications like hepatitis B or other viral diseases enhances its long-term value. Investment in post-market surveillance and real-world studies will build confidence, supporting sustained revenue streams.

Key Takeaways

-

Market Entry Positioning: AVACLYR benefits from a compelling efficacy and safety profile, positioning it favorably within a competitive antiviral market expected to grow significantly over the next decade.

-

Revenue Trajectory: Facing moderate competition but strong demand for innovative therapies, AVACLYR’s revenues could reach approximately $200 million in early years with substantial growth potential, contingent on market access and payer acceptance.

-

Growth Drivers: Key drivers include regulatory approval, inclusion in treatment guidelines, physician and patient awareness, and strategic pricing.

-

Risks and Challenges: Regulatory delays, pricing pressures, generic competition, and viral resistance must be actively managed to sustain financial performance.

-

Strategic Opportunities: Expansion into additional viral indications, combination therapies, and emerging markets present growth avenues, demanding continuous R&D investment and market analysis.

FAQs

Q1: What are the primary factors influencing AVACLYR’s market adoption?

A: Its clinical efficacy, safety profile, regulatory approval, inclusion in treatment guidelines, physician preferences, patient awareness, and reimbursement strategies significantly influence market adoption.

Q2: How does AVACLYR compare to existing therapies in terms of market share potential?

A: While existing DAAs dominate, AVACLYR’s unique attributes—such as improved tolerability or resistance management—could enable capturing 10-15% of the segment within five years post-launch.

Q3: What strategies can optimize AVACLYR’s revenue growth?

A: Early regulatory approvals, strategic pricing, expanding indications, building payer confidence with health economics data, and fostering clinical guideline inclusion are crucial.

Q4: What are the main risks that could impact AVACLYR’s financial success?

A: Delays in regulatory approval, aggressive generic competition, resistance development, unfavorable pricing negotiations, and limited access in emerging markets pose key risks.

Q5: What is the outlook for AVACLYR in global markets?

A: High-value markets like North America and Europe offer early revenue opportunities, with potential expansion into Asia-Pacific and other regions as approvals and access improve.

References

- Market Research Future. "Antiviral Drugs Market Size & Share Report," 2022.

- Clinical Trial Data. Published results from Phase III trials of AVACLYR.

- Global Data. "The Future of Hepatitis C Virus Market," 2023.