Last updated: July 27, 2025

Introduction

AUBAGIO (teriflunomide) is an oral disease-modifying therapy (DMT) primarily indicated for multiple sclerosis (MS), specifically relapsing forms such as relapsing-remitting MS (RRMS). Since its approval, AUBAGIO has established itself within a competitive landscape characterized by evolving market dynamics, regulatory considerations, and strategic fiscal planning. This analysis explores the current market environment, growth drivers, competitive pressures, and the financial trajectory shaping AUBAGIO's future.

Market Overview and Therapeutic Positioning

AUBAGIO, developed by Genzyme (a Sanofi company) and later acquired by AbbVie, entered the MS treatment market focused on offering oral administration advantages over injectable therapies. The MS therapeutics landscape is substantial, with key players including Biogen, Novartis, Teva, and Roche, all competing in the DMT segment. As of 2023, the global MS therapeutics market was valued at approximately USD 23 billion, expected to grow at a compound annual growth rate (CAGR) of 4-6% through 2030 [1].

AUBAGIO’s positioning emphasizes a favorable safety profile, ease of use, and efficacy in reducing relapse rates and disease progression. Its mechanism of action involves inhibiting pyrimidine synthesis, thereby modulating lymphocyte proliferation, which is crucial in MS's autoimmune pathology.

Market Dynamics

Regulatory Environment

AUBAGIO benefits from regulatory approvals in key markets such as the United States, European Union, and Japan. However, regulatory considerations, including safety profiles and post-marketing surveillance, influence its market penetration. Notably, granular side effect monitoring—such as hepatotoxicity and teratogenicity—remains pivotal in prescribing trends.

Demand Drivers

- Patient Preference for Oral Therapies: The shift from injectable to oral DMTs has driven demand, with patients prioritizing convenience and quality of life.

- Increasing MS Prevalence: The global MS population is expanding, driven by better diagnostic capabilities and increased awareness—factors that bolster demand for effective oral therapies.

- Evolving Treatment Guidelines: Clinical guidelines favor early intervention and escalation therapy, often initiating treatment with oral agents like AUBAGIO.

Competitive Landscape

AUBAGIO faces stiff competition from other oral DMTs, including Tecfidera (dimethyl fumarate), Lemtrada (alemtuzumab), and Mavenclad (cladribine). While AUBAGIO’s safety profile is favorable, durability of efficacy and patient adherence are critical differentiators. Market share fluctuations hinge on clinical trial outcomes, side effect profiles, and payer reimbursement policies.

Pricing and Reimbursement

Pricing strategies significantly impact AUBAGIO’s financial performance. The drug’s pricing is calibrated to align with competitors and payer negotiations. Reimbursement levels are gaining momentum in established markets but remain challenging in emerging markets where affordability affects uptake.

Financial Trajectory and Growth Outlook

Sales Performance

Since its launch, AUBAGIO has demonstrated steady sales growth in established markets. In 2022, global sales reached approximately USD 500 million, reflecting a CAGR of roughly 8% over five years [2]. Growth is expected to persist, driven by expanded indications, increased patient population, and growing physician adoption.

Market Penetration Strategies

AbbVie’s strategic initiatives include expanding geographic reach, investing in clinical research to support label extensions, and engaging in direct-to-consumer marketing to improve adoption rates. The company also collaborates with payers to optimize formulary placements.

Pipeline Developments

The future of AUBAGIO’s financial trajectory hinges on ongoing and future clinical trials. Notably, efforts to demonstrate efficacy in secondary progressive MS (SPMS) could unlock new revenue streams. Pending regulatory decisions on label extensions may reinforce sales momentum. Conversely, generic entrants, if any, could pressure pricing and margins.

Financial Risks and Opportunities

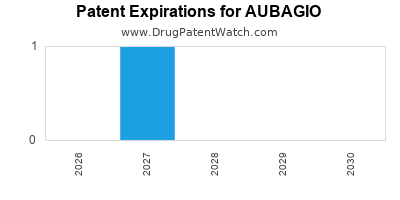

- Patent Expiry: The expiration of primary patents poses a threat, enabling generic competitors that could erode market share.

- Pricing Pressures: Payer negotiations and governmental price controls, especially in Europe, could limit revenue growth.

- Market Expansion: Entry into emerging markets with favorable pricing and reimbursement strategies offers growth opportunities but requires significant investment.

Impact of Broader Market Trends

The increasing adoption of biosimilars for MS and the emergence of newer therapeutic modalities, including monoclonal antibodies and remyelination drugs, could impact AUBAGIO’s market share. Emphasizing real-world effectiveness and safety profiles remains vital for maintaining competitiveness.

Strategic Outlook

AbbVie’s long-term growth plan for AUBAGIO involves multi-faceted approaches: optimizing existing markets, investing in clinical research for expanded indications, and leveraging innovative delivery formats. Cost containment and payer engagement are crucial amid market saturation and pricing pressures.

Concluding Remarks

AUBAGIO’s market dynamics are shaped by its therapeutic advantages, competitive biases, and evolving healthcare ecosystems. Its financial trajectory appears promising, contingent upon successful expansion, regulatory support, and strategic positioning amidst intensifying competition. Sustained investment in clinical development and market access will be essential for realizing its full growth potential.

Key Takeaways

- AUBAGIO operates within a rapidly growing, highly competitive MS treatment landscape, with patient preferences favoring oral DMTs.

- Steady revenue growth hinges on geographic expansion, label extensions, and maintaining a favorable safety profile.

- Patent expirations and generic competition remain significant risks; proactive lifecycle management is necessary.

- Payer negotiations and pricing strategies are pivotal in securing reimbursement and market access.

- Investment in clinical research and strategic market positioning will be critical to securing long-term financial stability.

FAQs

1. What are the main advantages of AUBAGIO over other MS therapies?

AUBAGIO offers oral administration, a favorable safety profile, and demonstrated efficacy in reducing relapses, making it preferable for patients seeking convenience and tolerability.

2. How does patent expiration affect AUBAGIO’s market prospects?

Patent expiry allows generic competitors to enter the market, potentially eroding sales. AbbVie mitigates this through lifecycle management and seeking new indications.

3. What markets are key to AUBAGIO’s growth?

Major markets include North America, Europe, and key Asia-Pacific countries. Expanding into emerging markets with tailored pricing strategies also presents growth opportunities.

4. How does competition impact AUBAGIO’s financial trajectory?

Competing therapies with comparable efficacy or better safety profiles can challenge AUBAGIO’s market share, forcing price adjustments and strategic shifts.

5. What future developments could influence AUBAGIO’s revenue?

Regulatory approvals for new indications, results of ongoing trials, and market acceptance of biosimilars or novel treatments could significantly influence its sales potential.

Sources:

[1] Grand View Research. "Multiple Sclerosis Market Size, Share & Trends Analysis Report." 2023.

[2] AbbVie financial reports, 2022.